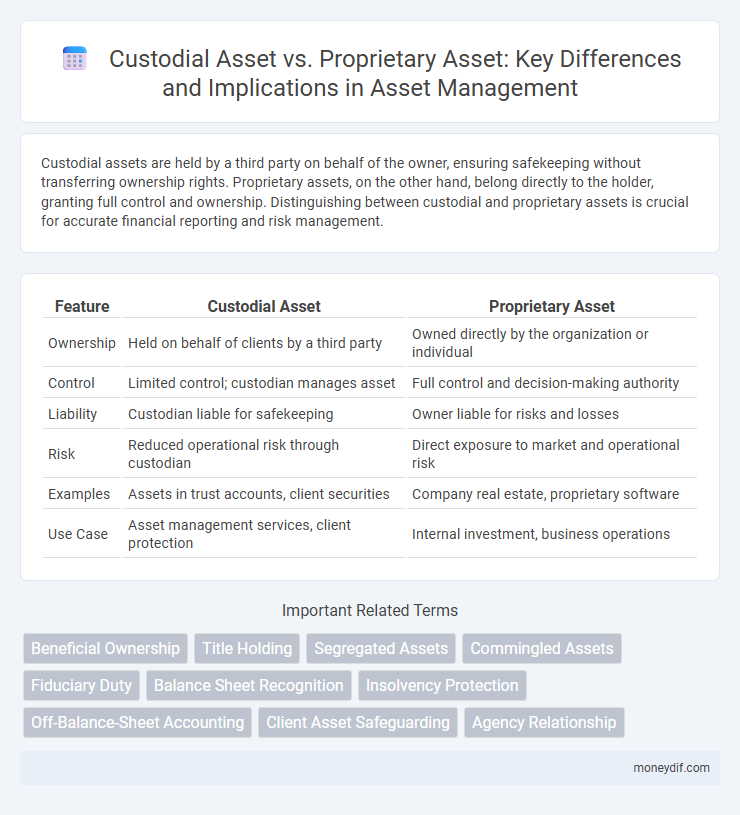

Custodial assets are held by a third party on behalf of the owner, ensuring safekeeping without transferring ownership rights. Proprietary assets, on the other hand, belong directly to the holder, granting full control and ownership. Distinguishing between custodial and proprietary assets is crucial for accurate financial reporting and risk management.

Table of Comparison

| Feature | Custodial Asset | Proprietary Asset |

|---|---|---|

| Ownership | Held on behalf of clients by a third party | Owned directly by the organization or individual |

| Control | Limited control; custodian manages asset | Full control and decision-making authority |

| Liability | Custodian liable for safekeeping | Owner liable for risks and losses |

| Risk | Reduced operational risk through custodian | Direct exposure to market and operational risk |

| Examples | Assets in trust accounts, client securities | Company real estate, proprietary software |

| Use Case | Asset management services, client protection | Internal investment, business operations |

Introduction to Custodial and Proprietary Assets

Custodial assets refer to funds or properties held by an entity on behalf of clients, without ownership rights, ensuring safekeeping and proper management. Proprietary assets are owned directly by the entity, recorded on the balance sheet, and include cash, investments, and physical property under the entity's control. Understanding the distinction between custodial and proprietary assets is essential for accurate financial reporting and risk management within investment and banking sectors.

Defining Custodial Assets

Custodial assets refer to property held by one party on behalf of another, where the custodian does not have ownership rights but manages or safeguards the assets according to specific terms. These assets are separated from the custodian's proprietary assets, which are owned outright and recorded on the custodian's balance sheet. Proper classification of custodial assets ensures clarity in financial reporting and regulatory compliance, highlighting the fiduciary responsibility involved.

What Are Proprietary Assets?

Proprietary assets refer to the resources or properties owned directly by a company, representing its exclusive rights and interests. Unlike custodial assets held temporarily on behalf of clients, proprietary assets include tangible and intangible items such as intellectual property, real estate, equipment, and financial investments. These assets contribute to the company's net worth and are reflected on its balance sheet as part of shareholders' equity.

Key Differences: Custodial vs Proprietary Assets

Custodial assets are held by a custodian on behalf of the owner, without transferring ownership rights, ensuring asset safekeeping and administrative handling. Proprietary assets belong directly to the owner or firm, reflecting ownership on the balance sheet and representing economic interest. The key difference lies in ownership; custodial assets do not appear as the custodian's property, whereas proprietary assets are recorded as owned by the entity managing them.

Ownership and Control Implications

Custodial assets are held by an institution on behalf of clients, where ownership remains with the clients while the institution exercises control for safekeeping and management purposes. Proprietary assets belong directly to the institution, granting both ownership and full control, which exposes the institution to risks and rewards associated with those assets. Understanding these distinctions is critical in regulatory compliance and risk management within financial and asset management sectors.

Risk Factors in Custodial and Proprietary Assets

Custodial assets carry risks primarily associated with third-party mismanagement, fraud, or failure to segregate client funds properly, increasing vulnerability to loss or misuse. Proprietary assets expose the holder to direct market, credit, and operational risks, as these assets belong to the firm and reflect its financial health and exposure. Risk management strategies differ substantially, with custodial asset risks emphasizing regulatory compliance and safeguarding measures, while proprietary asset risks focus on asset valuation accuracy and liquidity management.

Regulatory Considerations and Compliance

Custodial assets are held by financial institutions on behalf of clients, requiring strict adherence to regulatory frameworks such as the SEC's custody rule and MiFID II to ensure transparency and safeguard client property. Proprietary assets belong directly to the institution, demanding compliance with capital adequacy requirements like Basel III to manage risk exposure and maintain financial stability. Regulatory considerations emphasize segregation of custodial assets from proprietary holdings to prevent misuse and ensure clear audit trails for effective compliance monitoring.

Use Cases: When to Choose Custodial or Proprietary

Custodial assets are ideal for use cases requiring enhanced security and regulatory compliance, such as third-party managed investment accounts or digital wallets, where asset ownership remains with the client but is held by a custodian. Proprietary assets are preferable when full control, direct management, and operational flexibility are necessary, like corporate-owned equipment or internally traded securities. Choosing between custodial and proprietary assets depends on factors such as risk tolerance, regulatory environment, and the need for operational control versus third-party safeguarding.

Advantages and Disadvantages of Each Asset Type

Custodial assets offer enhanced security and liquidity as they are held by a third party, reducing the risk of loss through theft or mismanagement, but they lack direct control and may incur higher fees. Proprietary assets provide full ownership and control, enabling more strategic flexibility and potential tax benefits, yet they require active management and carry risks of devaluation or misappropriation. Choosing between custodial and proprietary assets depends on the balance between security, control, and cost considerations tailored to the investor's goals.

Future Trends in Asset Custody and Proprietary Ownership

Future trends in asset custody emphasize enhancing security through blockchain technology and decentralized finance (DeFi) solutions, increasing transparency and reducing counterparty risks. Proprietary asset ownership is shifting towards tokenization, allowing fractional ownership and improved liquidity in traditionally illiquid markets like real estate and art. Integration of artificial intelligence in asset management platforms is optimizing decision-making processes and personalized investment strategies for both custodial and proprietary assets.

Important Terms

Beneficial Ownership

Beneficial ownership refers to the true owner of an asset, who enjoys the benefits and control, even if the asset is held in custody by a custodian. Custodial assets are legally owned by the custodian but managed for the benefit of the beneficial owner, whereas proprietary assets are owned outright by the beneficial owner without intermediary control.

Title Holding

Title holding indicates legal ownership of assets, distinguishing custodial assets held on behalf of clients from proprietary assets owned outright by the holder.

Segregated Assets

Segregated assets are custodial assets held separately from proprietary assets to protect client funds from the custodian's financial risks.

Commingled Assets

Commingled assets refer to pooled investments where custodial assets are held on behalf of clients without ownership claims, whereas proprietary assets represent the firm's own investments subject to its profit and loss.

Fiduciary Duty

Fiduciary duty requires custodians to manage custodial assets with the highest care and loyalty, ensuring these assets, held on behalf of clients, are not commingled with the custodian's proprietary assets, which belong to the firm itself. Clear separation between custodial and proprietary assets protects client interests and upholds legal obligations under fiduciary standards.

Balance Sheet Recognition

Balance Sheet recognition distinguishes custodial assets, which are held on behalf of clients and not recorded as company assets, from proprietary assets, which are owned and reflected on the company's balance sheet.

Insolvency Protection

Insolvency protection distinguishes custodial assets, which are held on behalf of clients and remain protected from creditors, from proprietary assets that belong to the firm and are subject to insolvency claims.

Off-Balance-Sheet Accounting

Off-Balance-Sheet Accounting excludes custodial assets, which are held on behalf of clients and not owned by the company, while proprietary assets are recorded on the balance sheet as company-owned resources.

Client Asset Safeguarding

Client asset safeguarding ensures strict separation between custodial assets, which are held on behalf of clients and remain their property, and proprietary assets owned by the firm, minimizing risks of misuse or insolvency-related losses. Regulatory frameworks like FCA rules mandate transparent record-keeping and segregation measures to protect custodial assets from claims against the firm's proprietary holdings.

Agency Relationship

An agency relationship arises when one party, the agent, manages assets on behalf of another party, the principal, distinguishing custodial assets--which are held and safeguarded without ownership--from proprietary assets, which the agent controls and owns. Proper delineation between custodial and proprietary assets is critical for regulatory compliance, risk management, and accurate financial reporting in asset management and fiduciary responsibilities.

Custodial Asset vs Proprietary Asset Infographic

moneydif.com

moneydif.com