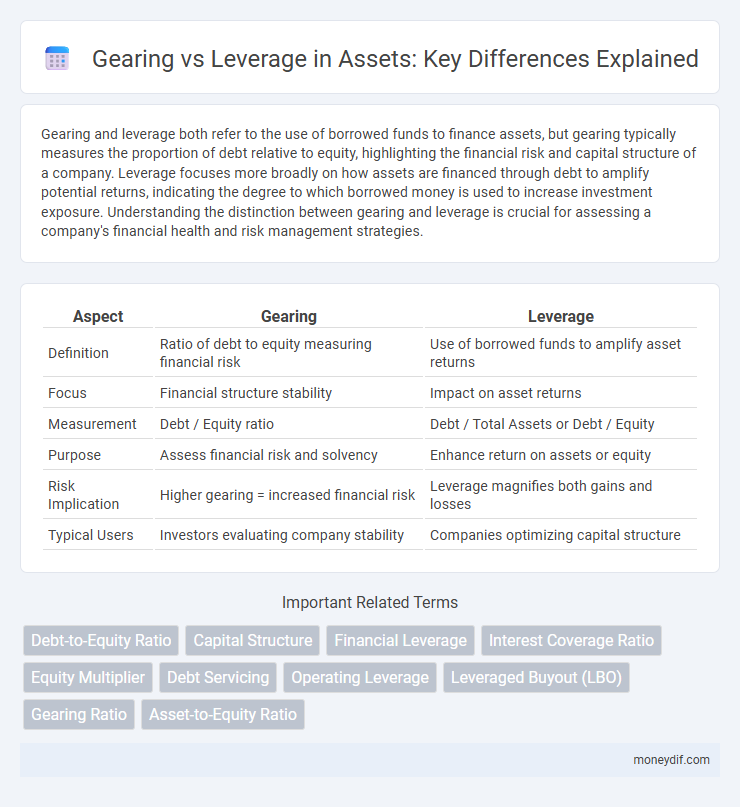

Gearing and leverage both refer to the use of borrowed funds to finance assets, but gearing typically measures the proportion of debt relative to equity, highlighting the financial risk and capital structure of a company. Leverage focuses more broadly on how assets are financed through debt to amplify potential returns, indicating the degree to which borrowed money is used to increase investment exposure. Understanding the distinction between gearing and leverage is crucial for assessing a company's financial health and risk management strategies.

Table of Comparison

| Aspect | Gearing | Leverage |

|---|---|---|

| Definition | Ratio of debt to equity measuring financial risk | Use of borrowed funds to amplify asset returns |

| Focus | Financial structure stability | Impact on asset returns |

| Measurement | Debt / Equity ratio | Debt / Total Assets or Debt / Equity |

| Purpose | Assess financial risk and solvency | Enhance return on assets or equity |

| Risk Implication | Higher gearing = increased financial risk | Leverage magnifies both gains and losses |

| Typical Users | Investors evaluating company stability | Companies optimizing capital structure |

Understanding Gearing and Leverage in Asset Management

Gearing in asset management measures the proportion of borrowed funds relative to equity, indicating financial risk and potential returns on assets. Leverage involves using various financial instruments or borrowed capital to increase an asset's potential return, amplifying both gains and losses. Understanding these concepts is crucial for optimizing asset performance while managing risk exposure effectively.

Key Differences Between Gearing and Leverage

Gearing measures the proportion of a company's borrowed funds to its equity, highlighting financial risk linked to debt levels, while leverage encompasses broader financial strategies that use various debt instruments to amplify investment returns. Gearing is often expressed as a ratio, such as debt-to-equity, specifically indicating how much of the asset financing comes from lenders versus shareholders. Leverage includes operational, financial, and combined leverage, reflecting the overall impact of debt on profitability, risk, and asset management efficiency.

Types of Gearing and Their Impact on Assets

Types of gearing, including operating gearing and financial gearing, influence asset performance and risk exposure differently. Operating gearing affects the proportion of fixed costs in operating expenses, impacting asset profitability during revenue fluctuations. Financial gearing involves the use of debt to finance assets, increasing potential returns but also elevating financial risk and asset volatility.

How Leverage Works in Asset Acquisition

Leverage in asset acquisition involves using borrowed capital to increase the potential return on investment, allowing buyers to control larger assets with less equity. By securing debt, investors can amplify their purchasing power, enhancing asset growth while managing risk through structured repayments. Effective leverage optimizes capital allocation, maximizing asset value while maintaining financial stability.

Advantages and Disadvantages of Gearing

Gearing measures a company's financial risk by comparing debt to equity, offering advantages such as amplifying returns on investment and providing tax benefits due to interest deductibility. However, high gearing increases financial vulnerability, raising the likelihood of insolvency during economic downturns and limiting operational flexibility. Managing an optimal gearing ratio is crucial for maintaining balance between growth opportunities and risk exposure in asset management.

The Role of Leverage in Asset Portfolio Growth

Leverage amplifies asset portfolio growth by utilizing borrowed capital to increase the potential return on investment without requiring additional equity. Effective leverage management balances risk and reward, enabling investors to enhance asset acquisition and maximize portfolio value. Over-leveraging can magnify losses, making risk assessment and strategic gearing ratios critical for sustainable portfolio expansion.

Risks Associated with Gearing vs Leverage

Gearing and leverage both increase financial risk by magnifying potential losses relative to equity, but gearing specifically highlights the ratio of debt to equity, intensifying vulnerability to interest rate fluctuations and cash flow constraints. High gearing ratios can lead to increased default risk during economic downturns due to fixed debt obligations. Leverage risk extends beyond debt levels, encompassing the overall use of borrowed capital, which can amplify operational volatility and impact creditworthiness if not managed carefully.

Choosing Between Gearing and Leverage for Asset Optimization

Choosing between gearing and leverage for asset optimization requires assessing the balance between risk and return, with gearing focusing on debt-to-equity ratio and leverage emphasizing total debt usage relative to assets. Effective asset optimization involves selecting the appropriate level of gearing to maintain financial stability while leveraging debt strategically to maximize asset returns. Evaluating key financial ratios such as debt-to-equity, debt-to-asset, and interest coverage ensures informed decisions aligning with company goals and market conditions.

Gearing and Leverage: Effects on Asset Returns

Gearing measures the proportion of debt in a company's capital structure, directly influencing asset returns through amplified gains or losses based on borrowed funds. Leverage extends this concept by incorporating both debt and fixed costs to assess overall financial risk impacting asset profitability. Elevated gearing typically increases volatility in asset returns, while optimal leverage balances growth potential with risk management for sustainable asset performance.

Industry Examples: Gearing vs Leverage in Practice

In the manufacturing sector, companies like Caterpillar demonstrate high gearing through substantial debt financing to amplify capital for equipment expansion. Conversely, tech giants such as Apple exhibit leverage by optimizing both debt and equity to fuel innovation and market growth while maintaining manageable risk levels. These industry examples highlight how gearing and leverage strategies vary significantly, with gearing emphasizing debt proportion and leverage focusing on the overall use of assets to enhance returns.

Important Terms

Debt-to-Equity Ratio

The debt-to-equity ratio measures a company's financial leverage by comparing its total debt to shareholders' equity, indicating its gearing level and risk exposure.

Capital Structure

Capital structure balances gearing, the ratio of debt to equity, with financial leverage, which measures the impact of debt on return on equity.

Financial Leverage

Financial leverage measures a company's use of debt to finance assets, directly impacting its gearing ratio, which compares debt to equity to assess financial risk. Higher leverage intensifies potential returns and risks, making the distinction between operational leverage (fixed costs) and financial leverage (debt levels) crucial in evaluating overall gearing strategy and capital structure efficiency.

Interest Coverage Ratio

Interest Coverage Ratio measures a company's ability to meet interest payments on its debt, directly impacting its financial leverage and overall gearing structure. A higher Interest Coverage Ratio indicates lower financial risk by showcasing sufficient operating income relative to interest expenses, thus balancing the proportion of debt in the gearing ratio.

Equity Multiplier

The Equity Multiplier measures financial leverage by indicating the proportion of a company's assets financed through shareholders' equity, directly reflecting the degree of gearing. Higher equity multipliers correspond to increased leverage, signaling greater reliance on debt financing relative to equity.

Debt Servicing

Debt servicing efficiency improves as gearing ratios optimize capital structure, while leverage magnifies financial risk impacting the ability to meet debt obligations.

Operating Leverage

Operating leverage measures a company's fixed cost proportion affecting profit sensitivity to sales changes, while gearing ratio quantifies financial leverage by comparing debt to equity, both critical for assessing overall business risk.

Leveraged Buyout (LBO)

Leveraged Buyout (LBO) transactions typically involve high gearing levels, as substantial debt financing is used to acquire a target company, amplifying potential returns but also increasing financial risk. While gearing refers specifically to the ratio of debt to equity in a company's capital structure, leverage encompasses the broader use of various financial instruments or borrowed capital to boost investment capacity.

Gearing Ratio

Gearing ratio measures a company's financial leverage by comparing its debt to equity, indicating the proportion of borrowed funds used relative to shareholders' equity.

Asset-to-Equity Ratio

The Asset-to-Equity Ratio measures a company's financial leverage by comparing its total assets to shareholders' equity, indicating the extent of gearing and the reliance on debt financing.

Gearing vs Leverage Infographic

moneydif.com

moneydif.com