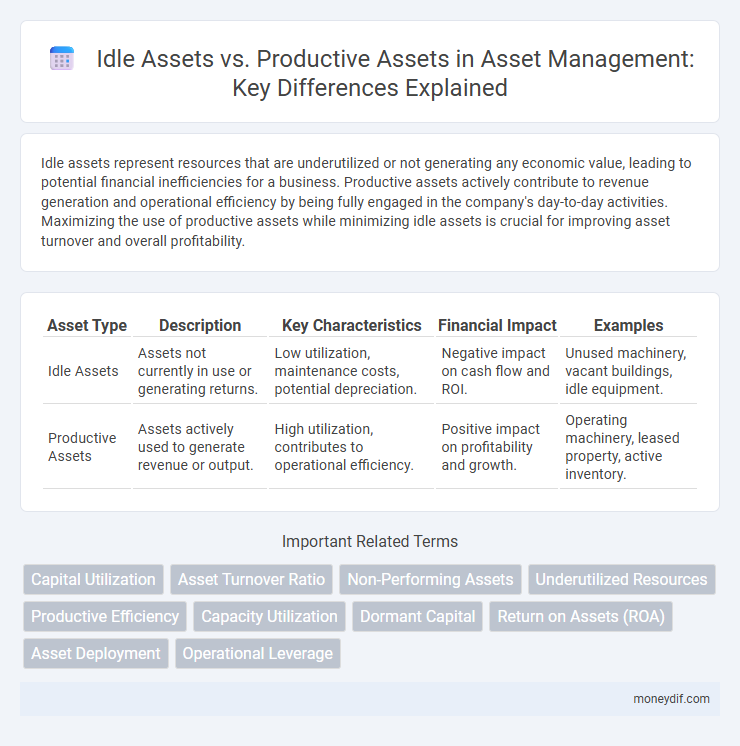

Idle assets represent resources that are underutilized or not generating any economic value, leading to potential financial inefficiencies for a business. Productive assets actively contribute to revenue generation and operational efficiency by being fully engaged in the company's day-to-day activities. Maximizing the use of productive assets while minimizing idle assets is crucial for improving asset turnover and overall profitability.

Table of Comparison

| Asset Type | Description | Key Characteristics | Financial Impact | Examples |

|---|---|---|---|---|

| Idle Assets | Assets not currently in use or generating returns. | Low utilization, maintenance costs, potential depreciation. | Negative impact on cash flow and ROI. | Unused machinery, vacant buildings, idle equipment. |

| Productive Assets | Assets actively used to generate revenue or output. | High utilization, contributes to operational efficiency. | Positive impact on profitability and growth. | Operating machinery, leased property, active inventory. |

Understanding Idle Assets and Productive Assets

Understanding idle assets involves recognizing resources or capital investments that remain unused or underutilized, leading to potential financial inefficiencies and increased holding costs. Productive assets, on the other hand, actively contribute to generating revenue, enhancing operational efficiency, and driving business growth by optimizing asset utilization. Differentiating between idle and productive assets is crucial for strategic asset management, ensuring optimal allocation and maximizing return on investment.

Key Differences Between Idle and Productive Assets

Idle assets refer to resources that are not currently in use or generating revenue, often leading to increased holding costs and decreased operational efficiency. Productive assets actively contribute to business operations by generating revenue, enhancing asset turnover, and improving return on investment (ROI). Key differences include utilization rate, impact on cash flow, and overall contribution to business profitability.

The Impact of Idle Assets on Financial Performance

Idle assets, which are resources not currently generating revenue, significantly decrease a company's return on assets (ROA) and overall profitability. Maintaining high levels of idle assets leads to increased carrying costs, depreciating asset value, and reduced operational efficiency. Optimizing asset utilization improves cash flow and enhances financial performance by converting dormant investments into productive assets.

Maximizing Asset Productivity for Growth

Maximizing asset productivity involves transforming idle assets into productive resources that generate consistent returns and drive business growth. Idle assets often represent untapped potential and increased carrying costs, while productive assets contribute directly to revenue through efficient utilization and optimization. Strategic asset management enhances operational efficiency, reduces waste, and supports sustained growth by aligning asset use with organizational goals.

Identifying and Reducing Idle Assets

Idle assets are resources that remain unused or underutilized, leading to unnecessary holding costs and reduced return on investment. Identifying these idle assets requires regular audits, utilization tracking, and performance analysis to distinguish non-productive items from productive assets actively contributing to operations. Reducing idle assets involves strategies such as asset redeployment, sale, or disposal, optimizing asset allocation and enhancing overall financial efficiency.

Benefits of Converting Idle Assets to Productive Use

Converting idle assets into productive assets maximizes return on investment by generating continuous revenue streams and reducing holding costs. Productive asset utilization enhances operational efficiency and supports sustainable growth by optimizing resource allocation. This transformation mitigates financial risks associated with asset depreciation and obsolescence while improving cash flow and overall asset performance.

Asset Utilization Strategies for Businesses

Maximizing asset utilization involves shifting idle assets into productive use to enhance operational efficiency and increase return on investment. Implementing strategies such as regular asset audits, predictive maintenance, and leveraging technology for real-time asset tracking can transform underutilized resources into revenue-generating tools. Businesses that optimize asset deployment reduce holding costs and improve cash flow, driving sustainable growth and competitive advantage.

Assessing Asset Efficiency: Metrics and Tools

Assessing asset efficiency involves comparing idle assets, which remain unutilized, against productive assets actively contributing to output. Key metrics such as asset turnover ratio, return on assets (ROA), and utilization rates enable precise evaluation of asset performance. Tools like real-time asset management software and predictive analytics enhance monitoring, ensuring optimal allocation and minimizing idle asset costs.

Case Studies: Transforming Idle Assets

Case studies illustrate how companies convert idle assets into productive resources by leveraging technology and strategic asset management, significantly increasing return on investment. Implementing IoT sensors and predictive analytics enables real-time monitoring and utilization optimization, reducing asset downtime by up to 40%. These transformations boost operational efficiency and unlock hidden value from previously underutilized assets, driving sustainable growth.

Future Trends in Asset Optimization

Future trends in asset optimization emphasize the conversion of idle assets into productive assets through advanced data analytics and IoT integration. Predictive maintenance and real-time monitoring technologies enhance asset utilization rates while reducing downtime and operational costs. Artificial intelligence-driven platforms enable dynamic asset allocation, maximizing return on investment and operational efficiency.

Important Terms

Capital Utilization

Maximizing capital utilization requires reducing idle assets and increasing productive assets to enhance operational efficiency and return on investment.

Asset Turnover Ratio

The Asset Turnover Ratio measures a company's efficiency in using productive assets to generate revenue, highlighting the impact of idle assets that do not contribute to sales. A higher ratio indicates effective utilization of productive assets, while a substantial presence of idle assets lowers overall asset efficiency and profitability.

Non-Performing Assets

Non-Performing Assets (NPAs) represent loans or advances where the principal or interest is overdue for 90 days or more, directly impacting a bank's financial health by tying up idle assets that fail to generate income. Productive assets, in contrast, actively contribute to revenue generation and economic growth, making the efficient allocation and management of assets crucial for minimizing NPAs and maximizing financial performance.

Underutilized Resources

Underutilized resources often manifest through idle assets that remain unproductive, directly impacting operational efficiency and financial performance. Shifting focus from idle to productive assets enhances asset utilization rates and maximizes return on investment by leveraging existing resources effectively.

Productive Efficiency

Productive efficiency maximizes output by effectively utilizing productive assets while minimizing idle assets that do not contribute to value creation. Efficient allocation and management of resources ensure that productive assets operate at optimal capacity, reducing waste associated with underused or dormant assets.

Capacity Utilization

Capacity utilization measures the efficiency of productive assets by comparing actual output to the maximum potential output, highlighting the extent of idle assets within a facility. High capacity utilization indicates effective use of productive assets with minimal idle resources, directly impacting operational costs and profitability.

Dormant Capital

Dormant Capital refers to idle assets that are underutilized compared to productive assets generating active economic value and growth.

Return on Assets (ROA)

Return on Assets (ROA) improves when productive assets generate higher earnings compared to idle assets, which consume resources without contributing to profitability.

Asset Deployment

Asset deployment efficiency hinges on minimizing idle assets, which do not contribute to revenue generation, while maximizing productive assets that directly enhance operational output and profitability. An optimized asset allocation strategy focuses on reallocating resources from underutilized, idle assets to high-yield productive assets, driving improved return on investment (ROI) and operational efficiency.

Operational Leverage

Operational leverage increases when productive assets are maximized, reducing idle assets that do not contribute to fixed cost absorption or revenue generation.

Idle Assets vs Productive Assets Infographic

moneydif.com

moneydif.com