Asset securitization involves pooling financial assets and issuing securities backed by those assets to raise capital, providing liquidity without selling the underlying assets. Asset monetization directly converts assets into cash through sales or leases, often impacting the company's balance sheet by reducing asset ownership. Both strategies enhance cash flow, but securitization retains asset ownership while monetization typically transfers it.

Table of Comparison

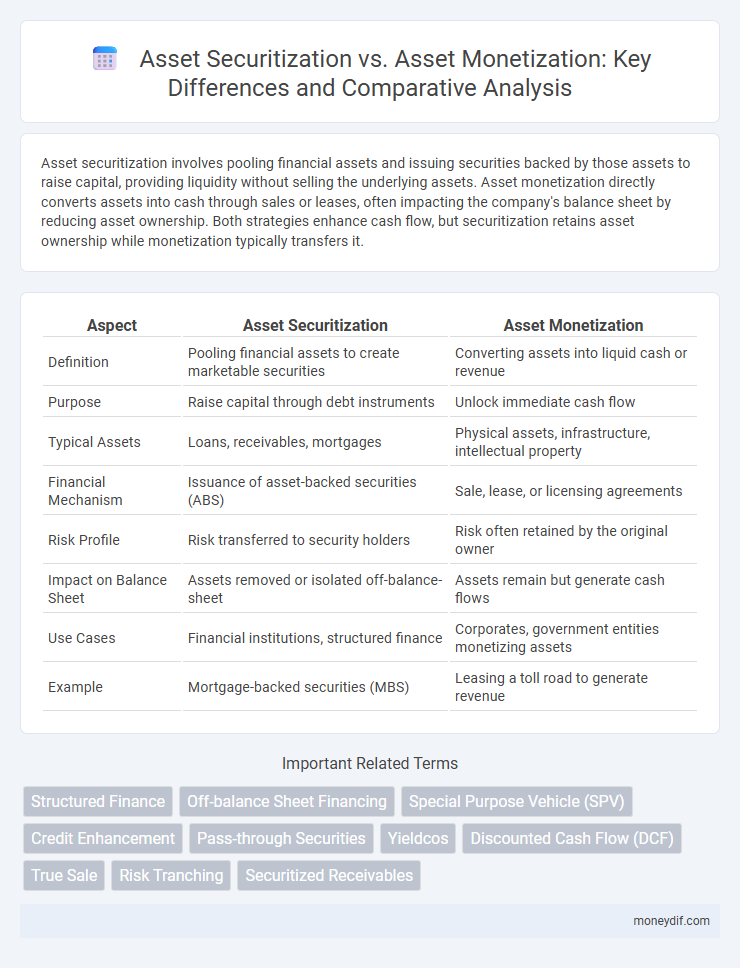

| Aspect | Asset Securitization | Asset Monetization |

|---|---|---|

| Definition | Pooling financial assets to create marketable securities | Converting assets into liquid cash or revenue |

| Purpose | Raise capital through debt instruments | Unlock immediate cash flow |

| Typical Assets | Loans, receivables, mortgages | Physical assets, infrastructure, intellectual property |

| Financial Mechanism | Issuance of asset-backed securities (ABS) | Sale, lease, or licensing agreements |

| Risk Profile | Risk transferred to security holders | Risk often retained by the original owner |

| Impact on Balance Sheet | Assets removed or isolated off-balance-sheet | Assets remain but generate cash flows |

| Use Cases | Financial institutions, structured finance | Corporates, government entities monetizing assets |

| Example | Mortgage-backed securities (MBS) | Leasing a toll road to generate revenue |

Introduction to Asset Securitization and Asset Monetization

Asset securitization involves pooling financial assets like loans or receivables to create tradable securities, providing liquidity and risk distribution for originators. Asset monetization converts non-liquid assets, such as intellectual property or real estate, into cash flows through methods like leasing or sales without transferring ownership. Understanding these mechanisms enables companies to optimize capital structure and enhance cash flow management effectively.

Defining Asset Securitization

Asset securitization involves pooling financial assets like loans or receivables and converting them into tradable securities, which are then sold to investors to raise capital. This process transfers asset risk from the originator to investors while enhancing liquidity by unlocking the value of otherwise illiquid assets. Compared to asset monetization, which directly generates cash from assets through sales or leases, securitization creates marketable financial instruments backed by underlying assets.

Understanding Asset Monetization

Asset monetization involves converting existing tangible or intangible assets into liquid capital without relinquishing ownership, enabling companies to generate cash flow while maintaining operational control. Unlike asset securitization, which packages assets into financial instruments to be sold to investors, asset monetization leverages assets directly through methods such as leasing, licensing, or sale-leaseback agreements. This strategy enhances liquidity, improves balance sheet strength, and supports growth initiatives by unlocking the dormant value of corporate assets.

Key Differences Between Asset Securitization and Monetization

Asset securitization involves pooling financial assets, such as loans or receivables, and issuing tradable securities backed by these assets, transferring risk to investors. Asset monetization converts physical or intangible assets directly into cash without creating securities, often through sales or leasing agreements. The key difference lies in securitization's focus on structured financing and risk distribution, while monetization emphasizes immediate liquidity from asset disposition.

Process Flow: Securitization vs Monetization

Asset securitization involves pooling financial assets and issuing tradable securities backed by these assets, typically structured through special purpose vehicles (SPVs) to isolate risk and enhance liquidity. Asset monetization converts non-performing or non-core assets directly into cash via sales, leases, or licensing agreements, focusing on unlocking immediate capital without transferring risk. The securitization process emphasizes risk distribution and market financing, while monetization prioritizes asset liquidation or revenue generation through operational mechanisms.

Benefits of Asset Securitization

Asset securitization enhances liquidity by converting illiquid assets into marketable securities, enabling firms to access immediate capital without increasing debt. It offers risk diversification by pooling various assets, which attracts a broader investor base and improves creditworthiness. Structured effectively, securitization can reduce capital costs and optimize balance sheets, fostering greater financial stability and growth opportunities.

Advantages of Asset Monetization

Asset monetization transforms underutilized or non-core assets into immediate cash flow, enhancing liquidity without increasing debt on the balance sheet. This process enables companies to unlock capital for reinvestment, driving growth and operational efficiency. Unlike asset securitization, asset monetization often involves fewer regulatory complexities and faster access to funds.

Risks and Challenges in Securitization and Monetization

Asset securitization involves pooling financial assets and issuing securities backed by those assets, exposing investors to credit risk, market volatility, and transparency challenges due to complex structured products. Asset monetization, which converts assets into cash typically through sales or leasing, faces risks such as asset devaluation, liquidity constraints, and potential operational disruptions impacting cash flow stability. Both approaches demand rigorous risk assessment and regulatory compliance to mitigate financial instability and preserve asset value.

Applications and Industry Use Cases

Asset securitization involves converting illiquid assets like mortgages, loans, or receivables into tradable securities, widely used in banking, real estate, and finance industries to improve liquidity and manage risk. Asset monetization focuses on generating revenue from existing assets, such as intellectual property or physical infrastructure, and is prevalent in sectors like telecommunications, energy, and government for maximizing asset value. Both approaches enable companies to unlock capital; securitization suits financial institutions optimizing balance sheets, while monetization benefits industries leveraging operational assets for cash flow.

Choosing the Right Strategy: Securitization or Monetization

Choosing the right strategy between asset securitization and asset monetization depends on the company's liquidity needs, risk tolerance, and long-term financial goals. Asset securitization converts illiquid assets into tradable securities, providing immediate capital while transferring risk to investors, ideal for firms seeking structured financing and risk management. Asset monetization involves directly generating cash from existing assets through sales or leases, offering flexibility and quicker access to funds but often at the expense of losing asset control.

Important Terms

Structured Finance

Structured finance uses asset securitization to pool and convert illiquid assets into marketable securities, whereas asset monetization transforms assets into direct cash flow without issuing securities.

Off-balance Sheet Financing

Off-balance sheet financing enables companies to improve liquidity by transferring assets through asset securitization, which pools receivables into securities, whereas asset monetization directly converts assets into cash without creating securities.

Special Purpose Vehicle (SPV)

A Special Purpose Vehicle (SPV) facilitates asset securitization by legally isolating financial assets to issue securities, whereas in asset monetization, it converts assets into cash or liquidity without necessarily issuing securities.

Credit Enhancement

Credit enhancement in asset securitization improves the credit quality of pooled assets to secure better funding terms, whereas asset monetization focuses on converting assets directly into cash without necessarily improving creditworthiness.

Pass-through Securities

Pass-through securities in asset securitization convert pooled financial assets into tradable instruments, enabling investors to receive principal and interest payments, whereas asset monetization involves converting assets directly into cash without issuing securities.

Yieldcos

Yieldcos facilitate asset securitization by bundling renewable energy projects into tradable financial instruments, providing stable cash flows and attracting investment. Unlike asset monetization, which involves converting assets into immediate cash through sales or leases, asset securitization via Yieldcos transforms future revenue streams into marketable securities, optimizing capital efficiency and risk distribution.

Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) valuation assesses future cash flows from asset securitization by converting pooled asset payments into securities, whereas asset monetization focuses on immediate liquidity through sale or lease agreements without relying on projected discounted earnings.

True Sale

True sale in asset securitization legally transfers assets to a special purpose vehicle, isolating them from the originator's balance sheet, unlike asset monetization which involves borrowing against assets without transferring ownership.

Risk Tranching

Risk tranching in asset securitization involves dividing pooled financial assets into different risk levels to attract diverse investors, whereas asset monetization converts assets directly into cash without layering risk exposure.

Securitized Receivables

Securitized receivables involve pooling financial assets like loans or receivables and issuing securities backed by these cash flows, enabling asset securitization to transform illiquid assets into marketable securities. Asset monetization, in contrast, typically refers to converting assets into immediate cash, often through sale or lease, without necessarily creating tradable securities.

Asset securitization vs Asset monetization Infographic

moneydif.com

moneydif.com