Asset swaps involve exchanging fixed-rate asset cash flows for floating-rate payments, allowing investors to hedge interest rate risk while retaining ownership of the underlying asset. Total return swaps transfer both the credit risk and the market risk by exchanging total returns of an asset for a fixed or floating payment, enabling exposure without asset ownership. Understanding the key differences helps optimize strategies for risk management and return enhancement.

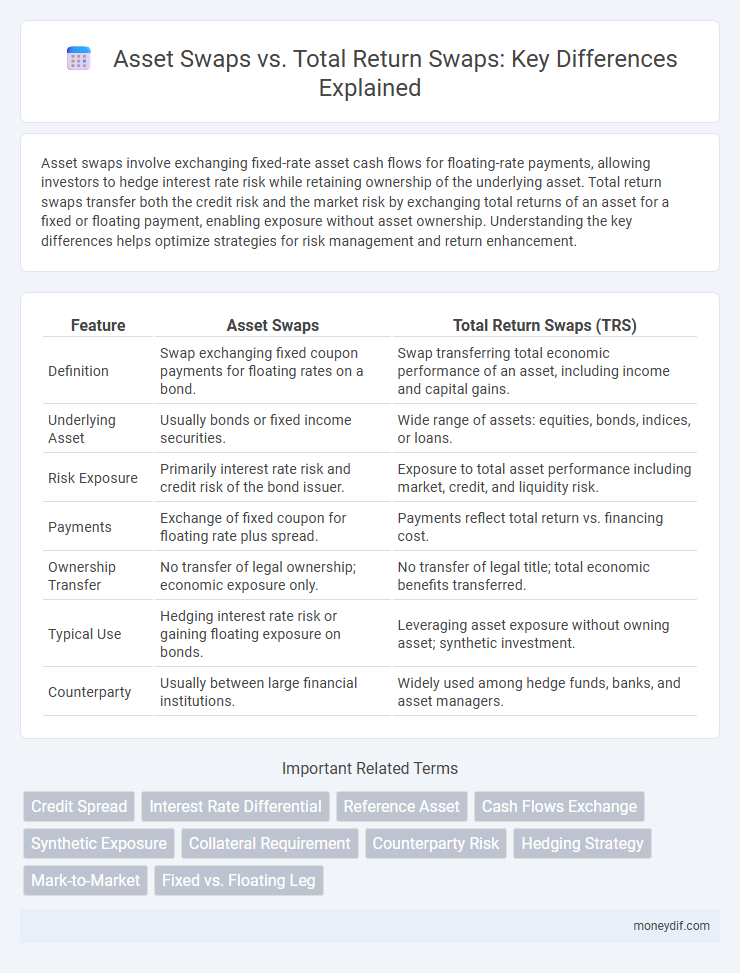

Table of Comparison

| Feature | Asset Swaps | Total Return Swaps (TRS) |

|---|---|---|

| Definition | Swap exchanging fixed coupon payments for floating rates on a bond. | Swap transferring total economic performance of an asset, including income and capital gains. |

| Underlying Asset | Usually bonds or fixed income securities. | Wide range of assets: equities, bonds, indices, or loans. |

| Risk Exposure | Primarily interest rate risk and credit risk of the bond issuer. | Exposure to total asset performance including market, credit, and liquidity risk. |

| Payments | Exchange of fixed coupon for floating rate plus spread. | Payments reflect total return vs. financing cost. |

| Ownership Transfer | No transfer of legal ownership; economic exposure only. | No transfer of legal title; total economic benefits transferred. |

| Typical Use | Hedging interest rate risk or gaining floating exposure on bonds. | Leveraging asset exposure without owning asset; synthetic investment. |

| Counterparty | Usually between large financial institutions. | Widely used among hedge funds, banks, and asset managers. |

Understanding Asset Swaps: Definition and Mechanism

Asset swaps involve exchanging the fixed cash flows of a bond for floating-rate payments, allowing investors to hedge interest rate risk or alter the asset's risk profile. This mechanism combines a bond with an interest rate swap, where the bondholder pays fixed coupon payments and receives floating-rate payments, typically linked to LIBOR or SOFR. Asset swaps enable market participants to tailor investment exposure by converting fixed income instruments into synthetic floating rate assets.

Total Return Swaps Explained: Structure and Purpose

Total Return Swaps (TRS) are financial derivatives enabling one party to receive the total return of an asset, including income and capital gains, while the other pays a regular fixed or floating rate. TRS structures separate ownership of the asset from economic exposure, allowing investors to gain synthetic exposure without purchasing the underlying asset. These swaps are primarily used for hedging, leverage, and risk management within asset management and trading strategies.

Key Differences Between Asset Swaps and Total Return Swaps

Asset swaps involve exchanging fixed cash flows from an underlying bond for floating rate payments, primarily used to hedge interest rate risk, while total return swaps transfer all risks and rewards of ownership, including price appreciation and credit risk. Asset swaps typically focus on individual securities with bond-specific cash flows, whereas total return swaps encompass a broader exposure, often referencing portfolios or indices. The key differentiation lies in risk transfer scope: asset swaps isolate interest rate exposure, total return swaps convey full economic exposure to the asset.

Advantages of Asset Swaps for Investors

Asset swaps offer investors the advantage of isolating and managing specific risks by exchanging fixed income cash flows for floating rates while retaining ownership of the underlying asset, which provides transparency and control over credit exposure. They enable customization of risk and return profiles without relinquishing the principal, supporting tailored investment strategies and potential capital appreciation. Asset swaps typically present lower counterparty risk compared to total return swaps, enhancing security for investors seeking stable cash flow adjustments.

Benefits of Using Total Return Swaps in Portfolios

Total return swaps offer significant benefits in portfolio management by providing exposure to asset returns without requiring ownership, enabling enhanced leverage and liquidity. They facilitate efficient risk management and customizable exposure to underlying assets, such as equities or bonds, while avoiding transaction costs and regulatory constraints. This flexibility allows investors to optimize diversification and tailor portfolio performance in dynamic market conditions.

Risks Associated with Asset and Total Return Swaps

Asset swaps expose investors to credit risk from the underlying bond issuer and interest rate risk from floating-rate payments, while total return swaps carry counterparty risk linked to the swap provider and market risk due to fluctuations in the asset's total return, including price appreciation and income. Both instruments may also involve liquidity risk, but total return swaps can amplify exposure through leverage, increasing potential losses if the underlying asset's value declines. Effective risk management requires thorough assessment of creditworthiness, market conditions, and counterparty stability to mitigate potential adverse impacts.

Use Cases: When to Choose Asset Swaps or Total Return Swaps

Asset swaps are ideal for investors seeking to isolate credit risk while managing interest rate exposure on fixed-income securities, enabling precise hedging of bond coupons against benchmark rates. Total return swaps suit investors aiming to gain synthetic exposure to an asset's total performance, including both income and capital gains, without owning the underlying asset outright. Choosing between asset swaps and total return swaps depends on whether the focus is on credit risk management or obtaining leveraged market exposure.

Impact on Portfolio Performance and Risk Management

Asset swaps enhance portfolio flexibility by allowing investors to convert fixed-rate bonds into floating-rate exposures, thereby optimizing interest rate risk management and improving yield stability. Total return swaps transfer both the income and capital appreciation of assets, enabling comprehensive exposure without direct ownership, which intensifies market risk but can amplify returns. Understanding the distinct impact of asset swaps versus total return swaps on portfolio performance is crucial for tailoring risk management strategies and achieving specific investment objectives.

Regulatory Considerations for Asset and Total Return Swaps

Asset swaps and total return swaps are subject to distinct regulatory frameworks, with asset swaps often classified under derivative contracts requiring compliance with margin and reporting standards established by regulators such as the CFTC and ESMA. Total return swaps, due to their synthetic exposure to underlying assets, attract stricter capital and liquidity requirements under Basel III and Dodd-Frank regulations, emphasizing transparency and counterparty risk management. Understanding jurisdiction-specific regulatory mandates is crucial for issuers and investors to ensure compliance and optimize risk mitigation in both swap structures.

Future Trends in Asset and Total Return Swap Markets

Emerging trends in asset and total return swap markets highlight increased regulatory scrutiny and growing demand for customized risk management solutions across diverse asset classes. Technological advancements such as blockchain integration and AI-driven analytics enhance transparency and efficiency, driving innovation in swap structuring and execution. Market participants anticipate heightened adoption of eco-friendly and ESG-linked swaps, reflecting broader shifts toward sustainable finance in asset management.

Important Terms

Credit Spread

Credit spread in asset swaps reflects the differential between the bond's yield and the benchmark interest rate, allowing investors to isolate and trade credit risk separate from interest rate risk. Total return swaps encompass both credit risk and market risk by transferring the full economic performance of an asset, including income and capital gains, enabling comprehensive exposure beyond just the credit spread component.

Interest Rate Differential

Interest Rate Differential (IRD) plays a crucial role in pricing Asset Swaps and Total Return Swaps by affecting the net cash flows exchanged between counterparties, with Asset Swaps primarily focusing on converting fixed-rate bond payments into floating rates plus a spread. Total Return Swaps incorporate IRD by allowing one party to receive total economic performance, including coupon payments and capital gains or losses, while paying a floating rate benchmark, making IRD a key factor in evaluating relative value and hedging strategies.

Reference Asset

Reference assets in asset swaps serve as the underlying securities delivering fixed cash flows, while total return swaps transfer both the income and capital appreciation risks of the reference asset from one party to another.

Cash Flows Exchange

Cash Flows Exchange in Asset Swaps involves swapping fixed-rate payments for floating-rate payments on a bond, while in Total Return Swaps it includes exchanging the total economic performance, including income and capital gains or losses, of an asset for a fixed or floating cash flow.

Synthetic Exposure

Synthetic exposure enables investors to replicate asset performance through asset swaps by exchanging fixed income cash flows, whereas total return swaps provide comprehensive exposure by swapping total economic returns including income and capital gains.

Collateral Requirement

Collateral requirements for asset swaps are generally lower than total return swaps due to reduced exposure to credit and market risks.

Counterparty Risk

Counterparty risk in asset swaps primarily arises from the possibility that the fixed or floating rate payer defaults, impacting cash flow exchanges linked to bond coupons and swap spreads. In total return swaps, counterparty risk extends to include the entirety of the asset's market value fluctuations and income, making it more sensitive to credit events and market volatility of the underlying reference asset.

Hedging Strategy

Hedging strategies using asset swaps primarily focus on isolating and managing credit and interest rate risks by exchanging fixed cash flows for floating rates, whereas total return swaps allow investors to hedge or gain exposure to the total economic performance of an asset, including income and capital gains.

Mark-to-Market

Mark-to-Market valuation in Asset Swaps involves periodic adjustment of the swap's value based on current market prices of the underlying assets, whereas in Total Return Swaps, it reflects the total economic exposure including income and capital gains or losses on the reference asset.

Fixed vs. Floating Leg

Fixed legs in asset swaps typically involve predetermined interest payments tied to a reference bond's fixed coupon, whereas floating legs in total return swaps encompass variable cash flows linked to the total return of an underlying asset, including both income and capital appreciation. Asset swaps focus on interest rate risk management by exchanging fixed bond coupons for floating rates, while total return swaps transfer total market risk by swapping the full economic performance of an asset for a floating or fixed payment.

Asset Swaps vs Total Return Swaps Infographic

moneydif.com

moneydif.com