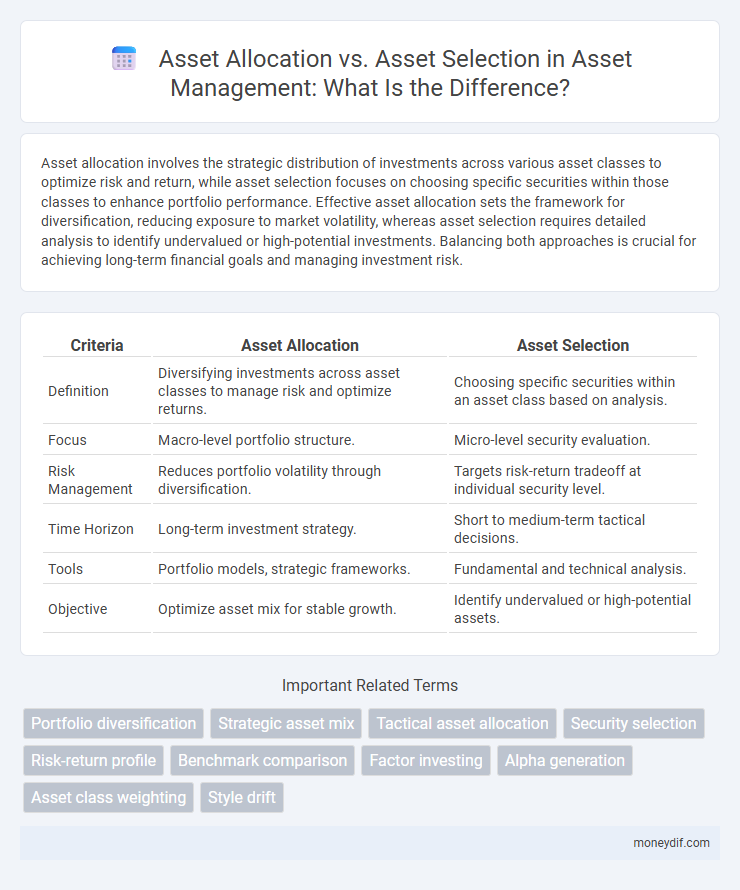

Asset allocation involves the strategic distribution of investments across various asset classes to optimize risk and return, while asset selection focuses on choosing specific securities within those classes to enhance portfolio performance. Effective asset allocation sets the framework for diversification, reducing exposure to market volatility, whereas asset selection requires detailed analysis to identify undervalued or high-potential investments. Balancing both approaches is crucial for achieving long-term financial goals and managing investment risk.

Table of Comparison

| Criteria | Asset Allocation | Asset Selection |

|---|---|---|

| Definition | Diversifying investments across asset classes to manage risk and optimize returns. | Choosing specific securities within an asset class based on analysis. |

| Focus | Macro-level portfolio structure. | Micro-level security evaluation. |

| Risk Management | Reduces portfolio volatility through diversification. | Targets risk-return tradeoff at individual security level. |

| Time Horizon | Long-term investment strategy. | Short to medium-term tactical decisions. |

| Tools | Portfolio models, strategic frameworks. | Fundamental and technical analysis. |

| Objective | Optimize asset mix for stable growth. | Identify undervalued or high-potential assets. |

Understanding Asset Allocation and Asset Selection

Asset allocation refers to the strategic distribution of investments across various asset classes such as stocks, bonds, and real estate to balance risk and return in a portfolio. Asset selection involves choosing specific securities within each asset class based on performance, valuation, and individual investment goals. Understanding the distinction helps investors optimize diversification while targeting assets that align with their risk tolerance and financial objectives.

Key Differences Between Asset Allocation and Asset Selection

Asset allocation involves strategically distributing investments across various asset classes such as stocks, bonds, and real estate to balance risk and return, while asset selection focuses on identifying specific securities within those asset classes. The primary difference lies in asset allocation's emphasis on the overall portfolio structure, whereas asset selection prioritizes choosing individual assets based on fundamental analysis and performance potential. Effective portfolio management integrates both processes to optimize diversification and maximize investment returns.

The Role of Asset Allocation in Portfolio Management

Asset allocation plays a critical role in portfolio management by determining the optimal distribution of investments across various asset classes such as equities, bonds, and cash to balance risk and return. It provides the strategic framework that underpins diversification, reducing portfolio volatility and enhancing long-term growth potential. In contrast, asset selection focuses on choosing specific securities within an asset class, but the overall success heavily depends on the initial asset allocation strategy.

The Importance of Asset Selection for Investment Performance

Asset selection directly impacts investment performance by determining the specific securities chosen within each asset class, influencing risk and return outcomes more precisely than broad asset allocation. While asset allocation sets the strategic framework across equities, bonds, and alternatives, effective asset selection exploits market inefficiencies and identifies high-potential investments. Skilled asset selection enhances portfolio alpha and mitigates downside risk, proving critical for achieving superior long-term returns.

Risk Management: Allocation vs. Selection

Effective risk management in asset allocation involves diversifying investments across various asset classes to minimize exposure to any single risk factor. In contrast, asset selection emphasizes choosing individual securities within an asset class to optimize returns while controlling specific security risk. Balancing allocation strategies with rigorous selection processes enhances portfolio resilience against market volatility.

Strategic vs. Tactical Approaches

Asset allocation strategically determines the long-term distribution of investments across asset classes to optimize portfolio risk and return, while tactical asset selection involves short-term adjustments to capitalize on market opportunities or mitigate risks. Strategic asset allocation relies heavily on an investor's risk tolerance, investment horizon, and financial goals, often remaining stable over time. Tactical approaches require active management and timely market analysis to exploit inefficiencies, aiming to enhance portfolio performance beyond the strategic baseline.

Common Mistakes in Asset Allocation and Selection

Common mistakes in asset allocation include inadequate diversification and failure to align investments with risk tolerance, leading to suboptimal portfolio performance. In asset selection, errors often arise from overemphasizing past performance and neglecting fundamental analysis, resulting in poor investment choices. Both missteps can significantly diminish returns and increase portfolio volatility.

Tools and Methods for Effective Asset Allocation

Effective asset allocation relies on advanced tools such as mean-variance optimization, Monte Carlo simulations, and risk parity models to distribute investments across asset classes based on risk tolerance and return objectives. Portfolio management software like Bloomberg Terminal, Morningstar Direct, and MATLAB supports dynamic rebalancing and scenario analysis, enhancing decision-making precision. Employing multifactor models and machine learning algorithms improves forecasting accuracy, enabling adaptive strategies that distinguish allocation from asset selection focused on individual security evaluation.

How to Choose the Right Assets for Your Portfolio

Choosing the right assets for your portfolio involves balancing asset allocation and asset selection to optimize risk and return. Asset allocation determines the proportion of investments across major categories like stocks, bonds, and cash, providing diversification to manage market volatility. Asset selection focuses on picking specific securities within those categories based on factors such as historical performance, financial health, and growth potential to maximize portfolio growth.

Combining Asset Allocation and Asset Selection for Optimal Results

Combining asset allocation and asset selection enhances portfolio performance by balancing diversification and targeted investment choices. Strategic asset allocation determines the overall distribution across asset classes to control risk, while asset selection focuses on picking high-performing securities within those classes. Integrating both approaches leverages market opportunities and stabilizes returns, maximizing long-term investment outcomes.

Important Terms

Portfolio diversification

Portfolio diversification reduces risk by spreading investments across various asset classes, aligning with asset allocation's strategic distribution of assets to optimize risk and return. Asset selection complements this by identifying specific securities within those classes that enhance overall portfolio performance and minimize volatility.

Strategic asset mix

Strategic asset mix focuses on long-term asset allocation decisions by determining the optimal proportion of asset classes, while asset selection emphasizes choosing specific securities within those classes to maximize portfolio returns.

Tactical asset allocation

Tactical asset allocation dynamically adjusts portfolio weights based on short-term market forecasts, bridging the strategic focus of asset allocation with the security-level emphasis of asset selection to optimize risk-adjusted returns.

Security selection

Security selection focuses on choosing individual securities to maximize returns within an asset class, while asset allocation determines the optimal distribution of investments across different asset classes to manage overall portfolio risk and return.

Risk-return profile

Risk-return profiles vary significantly between asset allocation and asset selection, with asset allocation primarily influencing portfolio-level risk diversification and overall expected return through strategic distribution across asset classes. Asset selection focuses on individual securities' performance within each class, aiming to optimize return while managing risk exposure at the security level, impacting the portfolio's risk-return balance more granularly.

Benchmark comparison

Benchmark comparison in asset allocation focuses on evaluating portfolio performance against a market index to ensure optimal risk-return balance, while asset selection emphasizes choosing individual securities that outperform benchmarks within specific asset classes. Effective benchmark analysis integrates both approaches by assessing strategic allocation decisions and tactical security choices to maximize portfolio efficiency and alpha generation.

Factor investing

Factor investing enhances portfolio performance by systematically allocating assets based on underlying factors such as value, momentum, and quality, complementing traditional asset selection strategies to optimize risk-adjusted returns.

Alpha generation

Alpha generation primarily stems from superior asset selection, where investors identify mispriced securities or niches offering returns above benchmark indexes. Effective asset allocation lays the foundation by positioning portfolios within broad market segments to manage systematic risk, but persistent alpha requires active security analysis and stock-picking expertise.

Asset class weighting

Asset class weighting in asset allocation strategically balances portfolio risk and return by determining the proportion of different asset classes, unlike asset selection which focuses on choosing specific securities within those classes.

Style drift

Style drift occurs when a portfolio's asset allocation deviates from its intended investment style due to shifts in asset selection, impacting consistency and risk exposure.

Asset allocation vs Asset selection Infographic

moneydif.com

moneydif.com