Securitization involves pooling various financial assets to create tradable securities that can be sold to investors, enhancing liquidity and risk distribution. Collateralization refers to using assets as security for a loan, reducing lender risk by providing a fallback in case of default. While securitization transforms assets into marketable instruments, collateralization directly backs a specific debt obligation.

Table of Comparison

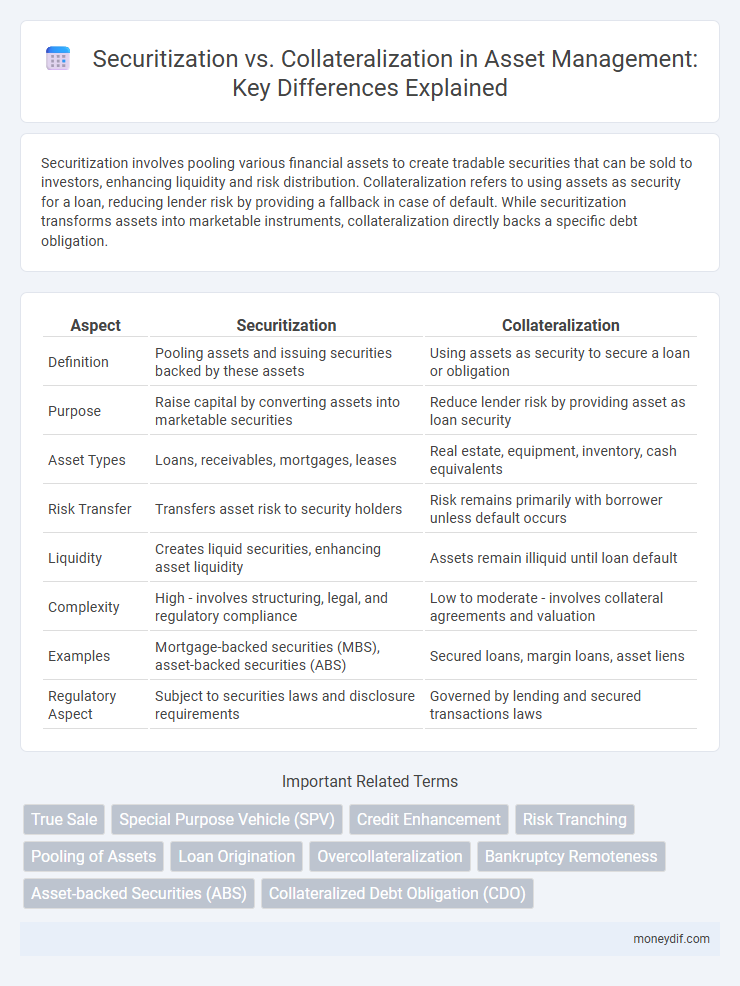

| Aspect | Securitization | Collateralization |

|---|---|---|

| Definition | Pooling assets and issuing securities backed by these assets | Using assets as security to secure a loan or obligation |

| Purpose | Raise capital by converting assets into marketable securities | Reduce lender risk by providing asset as loan security |

| Asset Types | Loans, receivables, mortgages, leases | Real estate, equipment, inventory, cash equivalents |

| Risk Transfer | Transfers asset risk to security holders | Risk remains primarily with borrower unless default occurs |

| Liquidity | Creates liquid securities, enhancing asset liquidity | Assets remain illiquid until loan default |

| Complexity | High - involves structuring, legal, and regulatory compliance | Low to moderate - involves collateral agreements and valuation |

| Examples | Mortgage-backed securities (MBS), asset-backed securities (ABS) | Secured loans, margin loans, asset liens |

| Regulatory Aspect | Subject to securities laws and disclosure requirements | Governed by lending and secured transactions laws |

Introduction to Asset Securitization and Collateralization

Asset securitization involves pooling financial assets like loans or receivables to create tradable securities, enhancing liquidity and risk distribution for originators. Collateralization refers to the use of assets as security for a loan, reducing lender risk by providing a claim on the asset if the borrower defaults. Both techniques optimize asset management, but securitization transforms assets into marketable instruments, while collateralization directly secures credit exposure.

Defining Securitization: Key Concepts and Mechanisms

Securitization involves pooling various financial assets, such as mortgages or loans, and converting them into tradable securities to enhance liquidity and transfer risk from originators to investors. Key concepts include asset-backed securities (ABS), special purpose vehicles (SPVs) that isolate assets from the originator's balance sheet, and tranching, which segments risk into different classes for tailored investor profiles. This mechanism improves capital efficiency by providing originators with immediate funding while offering investors diversified cash flow streams backed by underlying asset performance.

Understanding Collateralization: Fundamentals and Applications

Collateralization involves pledging specific assets to secure a loan or obligation, reducing lender risk by providing tangible backing. This practice enhances borrowing capacity by leveraging existing assets, such as real estate, equipment, or receivables, that can be seized if repayments fail. Unlike securitization, which pools and repackages financial assets into marketable securities, collateralization directly ties credit support to distinct asset collateral for individual debt instruments.

Main Differences between Securitization and Collateralization

Securitization involves pooling various financial assets to create new securities sold to investors, transferring risk and improving liquidity, whereas collateralization refers to using assets as a security for a loan or debt to reduce credit risk. Securitization typically results in asset-backed securities or mortgage-backed securities, while collateralization directly supports a specific obligation or loan agreement. The key difference lies in securitization transforming assets into tradeable instruments, while collateralization retains assets as security backing a debt without creating new securities.

Types of Assets Used in Securitization vs Collateralization

Securitization primarily involves pooling financial assets such as mortgages, auto loans, and credit card receivables into marketable securities, enabling diversified investor exposure and risk distribution. Collateralization typically uses tangible or fixed assets like real estate, equipment, or cash equivalents to secure loans, directly reducing lender risk through asset-backed guarantees. Understanding the types of assets utilized highlights securitization's focus on receivables and future cash flows versus collateralization's reliance on physical or liquid asset backing.

Benefits of Securitization for Asset Management

Securitization enhances asset management by converting illiquid assets into tradable securities, thereby improving liquidity and enabling better capital allocation. It diversifies risk by pooling heterogeneous assets, reducing exposure to individual asset defaults and enhancing portfolio stability. This process also facilitates access to broader capital markets, lowering funding costs and increasing financial flexibility for asset managers.

Advantages of Collateralization in Risk Mitigation

Collateralization reduces credit risk by securing loans with tangible assets, providing creditors with a safety net if borrowers default. It enhances lender confidence and lowers financing costs due to the presence of pledged collateral, which can be quickly liquidated. Compared to securitization, collateralization offers more direct control over asset-related risks, improving overall loan performance stability.

Potential Risks and Challenges in Securitization and Collateralization

Securitization involves pooling financial assets and issuing securities backed by these assets, which introduces risks such as credit risk from underlying assets, liquidity risk in secondary markets, and complex legal structures that may lead to opacity. Collateralization carries challenges including valuation risk of the collateral, operational risk in managing and liquidating collateral, and the potential for margin calls that can exacerbate financial stress during market volatility. Both processes require rigorous risk assessment and management to mitigate exposure to default, market fluctuations, and regulatory compliance issues.

Regulatory Frameworks Impacting Securitization and Collateralization

Regulatory frameworks such as Basel III and the Dodd-Frank Act significantly shape securitization and collateralization by imposing capital requirements and risk retention rules that influence asset-backed securities and collateral management. These regulations enhance transparency and risk mitigation, demanding adherence to stringent disclosure standards and credit quality assessments. Compliance with these frameworks ensures financial institutions maintain stability while optimizing asset liquidity through structured financial products.

Choosing the Right Strategy: Securitization vs Collateralization

Choosing between securitization and collateralization hinges on the desired liquidity and risk distribution of assets. Securitization transforms illiquid assets into marketable securities, enhancing capital flow and mitigating default risk via asset-backed securities issuance. Collateralization involves pledging assets to secure debt, providing creditor protection but potentially limiting asset flexibility and affecting balance sheet leverage.

Important Terms

True Sale

True Sale securitization involves the complete transfer of assets' legal ownership from the originator to a special purpose vehicle (SPV), ensuring that these assets are isolated from the originator's bankruptcy risk. In contrast, collateralization typically retains ownership with the originator while using the assets as security, exposing investors to greater counterparty risk compared to the bankruptcy-remote structure of a true sale.

Special Purpose Vehicle (SPV)

Special Purpose Vehicle (SPV) in securitization facilitates the isolation and transfer of financial assets into marketable securities, enhancing liquidity and reducing risk for originators by segregating the assets from the parent company's balance sheet. In collateralization, SPVs hold specific collateral to back debt instruments, providing investors with security interests and improving creditworthiness through asset-backed guarantee structures.

Credit Enhancement

Credit enhancement improves the creditworthiness of securitized assets by reducing the risk to investors, often through overcollateralization, reserve funds, or guarantees. Compared to collateralization, which secures debt with specific assets, credit enhancement focuses on boosting the overall credit profile to achieve better financing terms and lower interest rates.

Risk Tranching

Risk tranching segments securitized assets into prioritized layers of credit risk, enhancing collateralization by distributing potential losses among investors based on asset-backed securities' credit quality.

Pooling of Assets

Pooling of assets in securitization involves aggregating diverse financial assets to create a new security, spreading risk among investors through structured tranches. In collateralization, assets serve as direct backing for a loan or obligation, providing a safeguard for lenders without transforming the asset into tradeable securities.

Loan Origination

Loan origination involves creating new loans that can be enhanced through securitization, which pools multiple loans into tradable securities, increasing liquidity and risk distribution. Collateralization, in contrast, secures individual loans by pledging assets as collateral, directly mitigating lender risk but without bundling multiple loans for market trading.

Overcollateralization

Overcollateralization involves securing a securitized asset pool with collateral exceeding the principal value to enhance credit quality and reduce default risk, a practice distinct from simple collateralization which only requires asset backing equal to loan amounts. In securitization, this excess collateral supports higher credit ratings and investor confidence by providing a buffer against losses, whereas collateralization primarily ensures repayment but without the structural risk mitigation seen in overcollateralization.

Bankruptcy Remoteness

Bankruptcy remoteness is a key feature in securitization structures that isolates assets from the originator's bankruptcy risk, enhancing investor protection by ensuring asset-backed securities remain unaffected by the originator's insolvency. In contrast, collateralization involves securing debt with specific assets but does not inherently provide the same level of bankruptcy insulation, making bankruptcy remoteness a crucial advantage in securitization transactions.

Asset-backed Securities (ABS)

Asset-backed securities (ABS) are financial instruments created through securitization by pooling underlying assets as collateral to generate tradable securities.

Collateralized Debt Obligation (CDO)

Collateralized Debt Obligation (CDO) is a complex financial instrument that pools various debt assets, such as loans and bonds, into tranches sold to investors, representing a securitization process that transforms illiquid debts into marketable securities. Unlike direct collateralization where assets secure a specific loan, CDOs rely on the credit performance of pooled assets, distributing risk through structured finance and enhancing liquidity in debt markets.

securitization vs collateralization Infographic

moneydif.com

moneydif.com