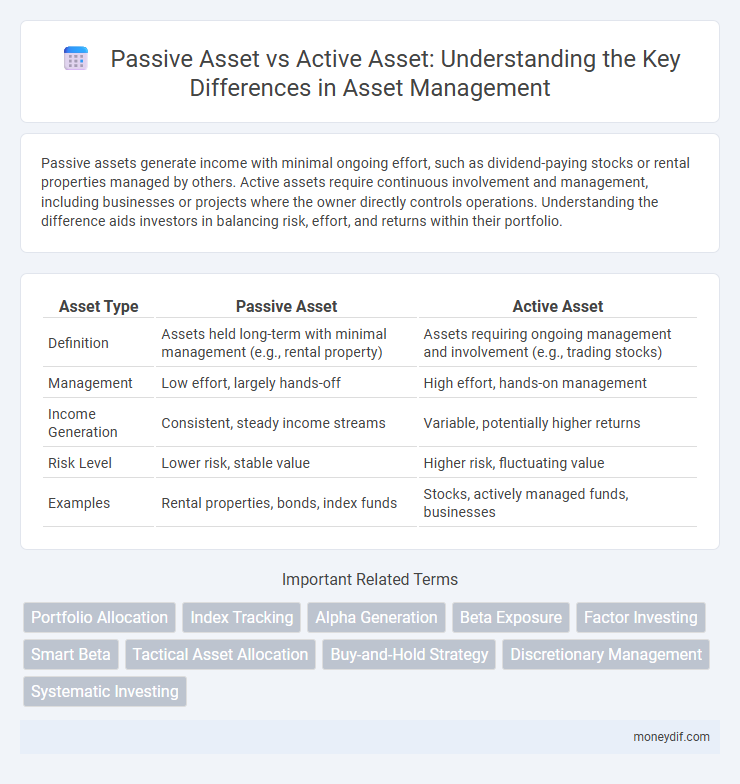

Passive assets generate income with minimal ongoing effort, such as dividend-paying stocks or rental properties managed by others. Active assets require continuous involvement and management, including businesses or projects where the owner directly controls operations. Understanding the difference aids investors in balancing risk, effort, and returns within their portfolio.

Table of Comparison

| Asset Type | Passive Asset | Active Asset |

|---|---|---|

| Definition | Assets held long-term with minimal management (e.g., rental property) | Assets requiring ongoing management and involvement (e.g., trading stocks) |

| Management | Low effort, largely hands-off | High effort, hands-on management |

| Income Generation | Consistent, steady income streams | Variable, potentially higher returns |

| Risk Level | Lower risk, stable value | Higher risk, fluctuating value |

| Examples | Rental properties, bonds, index funds | Stocks, actively managed funds, businesses |

Understanding Passive Assets vs Active Assets

Passive assets generate income with minimal effort, such as rental properties or dividend-paying stocks, providing steady cash flow over time. Active assets require ongoing management and involvement, like a business you operate or real estate you actively rent and maintain. Understanding the distinction helps investors balance workload and risk while optimizing portfolio performance through diversification.

Key Characteristics of Passive Assets

Passive assets typically include investments such as index funds, bonds, and rental properties that generate steady income with minimal management effort. These assets exhibit lower risk and volatility compared to active assets because they follow a predefined strategy or market trends without frequent trading or active decision-making. Their key characteristics include consistent cash flow, reduced operational involvement, and stable long-term appreciation potential.

Key Characteristics of Active Assets

Active assets are characterized by their ability to generate continuous income or capital appreciation through active management and strategic decision-making. These assets often require regular oversight, such as stocks, real estate properties, or businesses, where performance can be influenced by market conditions and managerial actions. Their liquidity and growth potential typically exceed those of passive assets, making them central to dynamic portfolio strategies.

Risk and Return: Comparing Passive and Active Assets

Passive assets typically offer lower risk due to broad market exposure and minimal management, delivering returns that closely track market indices. Active assets involve higher risk as portfolio managers make targeted investments aiming to outperform the market, which can result in higher returns or greater losses. The trade-off between risk and return in active versus passive assets depends on market conditions, management skill, and investment costs.

Cost Efficiency: Management Fees and Expenses

Passive assets typically incur lower management fees and operational expenses due to their automated, index-tracking nature. Active assets often involve higher costs from portfolio managers' research, trading, and frequent rebalancing activities. Investors seeking cost efficiency generally favor passive assets to minimize fees and maximize net returns.

Performance Trends: Historical Perspectives

Passive assets typically exhibit steady, long-term growth with lower volatility, reflecting broad market index performance over time. Active assets aim to outperform benchmarks by leveraging market timing and asset selection, often resulting in higher short-term variability but potential for superior returns. Historical data reveals passive assets have consistently delivered competitive risk-adjusted returns, while active management performance varies significantly across market cycles.

Liquidity Factors in Asset Types

Passive assets typically exhibit lower liquidity due to their long-term nature and limited marketability, often including investments like real estate or machinery. Active assets, such as cash or marketable securities, possess high liquidity, enabling quick conversion to cash without significant value loss. Understanding liquidity factors is crucial for asset management, as it influences an organization's ability to meet short-term financial obligations efficiently.

Suitability for Different Investor Profiles

Passive assets such as index funds and ETFs suit risk-averse investors seeking low-maintenance, long-term growth with minimal fees and volatility. Active assets, including individual stocks and managed portfolios, appeal to aggressive investors willing to accept higher risk for potential above-market returns through active decision-making. Financial advisors recommend blending both asset types to match diverse investor profiles and optimize portfolio balance.

Tax Implications of Passive vs Active Assets

Passive assets, such as rental properties or dividend-paying stocks, often generate income subject to lower tax rates, including qualified dividends and long-term capital gains, providing potential tax advantages. Active assets, like business equipment or inventory, typically produce ordinary income taxed at higher rates due to active involvement and depreciation recapture rules. Understanding these tax implications helps investors optimize portfolio strategies by balancing the benefits of passive income tax preferences against the operational tax considerations of active assets.

Choosing the Right Asset Strategy for Your Portfolio

Passive assets, such as index funds and bonds, offer steady growth with lower risk and minimal management effort, making them ideal for long-term, hands-off investors. Active assets, including individual stocks and real estate, require ongoing analysis and decision-making but provide opportunities for higher returns and portfolio customization. Balancing passive and active assets aligns risk tolerance and financial goals, optimizing diversification and overall portfolio performance.

Important Terms

Portfolio Allocation

Effective portfolio allocation balances passive assets for broad market exposure and active assets for targeted growth potential.

Index Tracking

Index tracking involves passive asset management by replicating a market index, contrasting with active asset management where portfolio managers make strategic investment decisions to outperform the market.

Alpha Generation

Alpha Generation relies on active asset management strategies to outperform passive asset approaches by leveraging market inefficiencies and skillful stock selection.

Beta Exposure

Beta exposure measures the sensitivity of a portfolio's returns to market movements, with passive assets typically exhibiting a beta close to 1, reflecting broad market tracking. Active assets aim to deviate from this benchmark beta to generate alpha, resulting in beta values significantly different from 1 based on the manager's investment strategy.

Factor Investing

Factor investing strategically targets specific drivers of returns such as value, momentum, or quality, offering a middle ground between purely passive asset allocation and active asset management. Compared to passive asset strategies that track broad market indices, factor investing enhances portfolio efficiency by systematically capturing risk premia, while providing a more transparent and rules-based approach than traditional active asset management.

Smart Beta

Smart Beta strategies blend passive asset management's rules-based approach with select active asset management factors, aiming to enhance returns and reduce risk compared to traditional market-cap weighted passive funds. By systematically targeting factors like value, momentum, and low volatility, Smart Beta seeks to outperform standard passive portfolios while maintaining lower costs than fully active management.

Tactical Asset Allocation

Tactical Asset Allocation strategically adjusts portfolio weightings between passive and active assets to optimize returns while managing risk based on market conditions.

Buy-and-Hold Strategy

The Buy-and-Hold Strategy involves purchasing assets and maintaining ownership over an extended period, minimizing transaction costs and capitalizing on long-term growth, which aligns closely with passive asset management characterized by low portfolio turnover and cost-efficiency. In contrast, active asset management frequently entails frequent trading and market timing to outperform benchmarks, often resulting in higher fees and increased risk relative to the steady, disciplined approach of buy-and-hold investors.

Discretionary Management

Discretionary management involves actively selecting and adjusting passive and active assets to optimize portfolio performance based on client goals and market conditions.

Systematic Investing

Systematic investing leverages disciplined contributions into passive assets such as index funds to minimize fees and market timing risks, while active asset management seeks to outperform benchmarks through strategic asset selection and market timing. Comparing passive assets, which track market indices with lower costs, to active assets emphasizes the trade-off between lower expenses and the potential for higher returns driven by expert analysis and portfolio adjustments.

Passive asset vs Active asset Infographic

moneydif.com

moneydif.com