On-balance sheet assets are recorded directly on a company's balance sheet, reflecting tangible and intangible items that the company owns or controls, such as cash, inventory, and property. Off-balance sheet assets, however, are not reported on the balance sheet and typically include items like operating leases, joint ventures, or certain financial instruments used to manage risk or liabilities. Understanding the distinction between these assets is crucial for evaluating a company's true financial position and risk exposure.

Table of Comparison

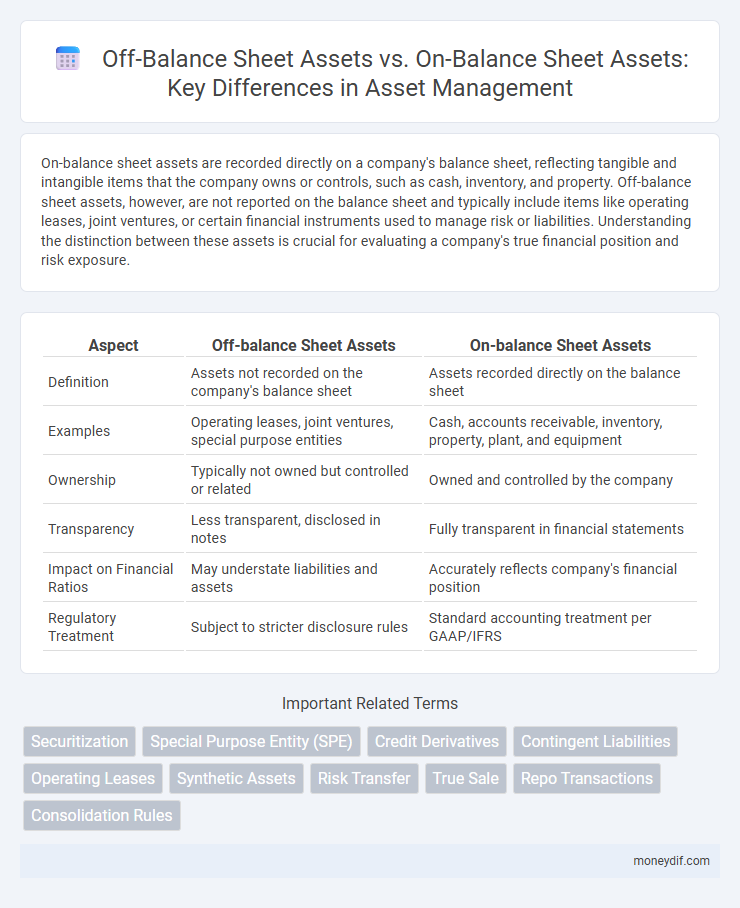

| Aspect | Off-balance Sheet Assets | On-balance Sheet Assets |

|---|---|---|

| Definition | Assets not recorded on the company's balance sheet | Assets recorded directly on the balance sheet |

| Examples | Operating leases, joint ventures, special purpose entities | Cash, accounts receivable, inventory, property, plant, and equipment |

| Ownership | Typically not owned but controlled or related | Owned and controlled by the company |

| Transparency | Less transparent, disclosed in notes | Fully transparent in financial statements |

| Impact on Financial Ratios | May understate liabilities and assets | Accurately reflects company's financial position |

| Regulatory Treatment | Subject to stricter disclosure rules | Standard accounting treatment per GAAP/IFRS |

Understanding Asset Classification: On-Balance Sheet vs Off-Balance Sheet

On-balance sheet assets are recorded directly on the company's balance sheet, reflecting ownership and control, including cash, inventory, and property. Off-balance sheet assets, such as operating leases or joint ventures, remain unrecorded on the balance sheet but can impact a company's financial health and risk exposure. Understanding the distinction between these classifications is crucial for accurate financial analysis, risk assessment, and regulatory compliance.

Key Features of On-Balance Sheet Assets

On-balance sheet assets, such as property, equipment, and inventory, are recorded directly on the company's balance sheet, providing transparency in financial reporting. These assets impact key financial ratios, including return on assets (ROA) and debt-to-asset ratio, affecting investor and creditor decisions. Their valuation follows accounting standards like GAAP or IFRS, ensuring consistency and comparability across reporting periods.

Characteristics of Off-Balance Sheet Assets

Off-balance sheet assets are financial interests or obligations not recorded directly on the company's balance sheet, typically including operating leases, joint ventures, and certain receivables. These assets allow firms to manage risk and leverage without affecting financial ratios or debt covenants, thereby maintaining a healthier balance sheet appearance. Their key characteristics include lack of direct ownership, limited disclosure requirements, and potential contingent liabilities impacting future financial assessments.

Accounting Standards Governing Asset Reporting

On-balance sheet assets are recorded directly on the balance sheet according to accounting standards such as IFRS and GAAP, reflecting ownership and control by the entity. Off-balance sheet assets involve arrangements like operating leases or joint ventures that do not meet the criteria for recognition, thus remaining disclosed in notes or supplementary schedules. These standards ensure transparency and accuracy in financial reporting by defining criteria for asset recognition, measurement, and disclosure.

Common Examples of On-Balance Sheet Assets

Common examples of on-balance sheet assets include cash and cash equivalents, accounts receivable, inventory, property, plant, and equipment (PP&E), and intangible assets like patents and trademarks. These assets are recorded directly on the company's balance sheet, reflecting ownership and control, which impact financial ratios and borrowing capacity. Accurately reporting on-balance sheet assets ensures transparency in financial statements and compliance with accounting standards such as GAAP or IFRS.

Typical Off-Balance Sheet Assets in Practice

Typical off-balance sheet assets in practice include operating leases, joint ventures, and special purpose entities (SPEs) that companies use to manage risk and improve financial ratios without reflecting these assets directly on the balance sheet. These assets help firms maintain lower reported debt levels and improve return metrics, although they expose the company to contingent liabilities and potential risks not immediately visible to investors. Common examples are leased equipment, unconsolidated subsidiaries, and certain receivables transferred through securitization arrangements.

Risk Implications of Off-Balance Sheet Assets

Off-balance sheet assets, such as operating leases, joint ventures, and special purpose entities, pose significant risk implications by obscuring a company's true financial liabilities and leverage, potentially misleading investors and creditors. These assets can lead to underestimation of a firm's risk exposure, increasing the likelihood of liquidity crises during economic downturns. Transparent disclosure and rigorous risk assessment practices are crucial to mitigate hidden risks associated with off-balance sheet assets.

Impact on Financial Ratios and Performance Metrics

Off-balance sheet assets, such as operating leases and joint ventures, are excluded from the balance sheet, potentially understating a company's liabilities and assets, which can distort key financial ratios like debt-to-equity and return on assets (ROA). On-balance sheet assets are fully accounted for, providing a more transparent view of company resources and liabilities, leading to more accurate evaluation of liquidity, leverage, and profitability ratios. The exclusion of off-balance sheet assets may result in misleading performance metrics, affecting investor and creditor decisions.

Regulatory Considerations for Asset Disclosure

Regulatory frameworks require transparent disclosure of both off-balance sheet assets, such as leased equipment and special purpose entities, and on-balance sheet assets like cash, receivables, and property. Compliance with standards like IFRS 7 and ASC 842 mandates detailed reporting to prevent understatement of liabilities and ensure accurate risk assessment. Financial institutions face stringent scrutiny to disclose off-balance sheet exposures that could impact capital adequacy and solvency ratios.

Best Practices for Transparent Asset Management

Best practices for transparent asset management require clear differentiation between off-balance sheet assets, such as leases or special purpose entities, and on-balance sheet assets recorded directly on the company's financial statements. Maintaining detailed disclosures and thorough documentation ensures stakeholders accurately assess the company's asset base and associated risks. Implementing robust internal controls and adhering to accounting standards like IFRS 16 or ASC 842 enhances the reliability and transparency of asset reporting.

Important Terms

Securitization

Securitization transforms on-balance sheet assets, such as loans and receivables, into off-balance sheet assets by packaging and selling them as securities to investors, thereby improving liquidity and reducing credit risk exposure for financial institutions. This process shifts assets from the balance sheet, enhancing capital adequacy ratios and enabling better risk management without affecting the company's reported debt levels.

Special Purpose Entity (SPE)

Special Purpose Entities (SPEs) enable companies to keep certain assets and liabilities off-balance sheet, thereby improving financial ratios by isolating off-balance sheet assets separate from on-balance sheet assets subject to consolidated financial reporting.

Credit Derivatives

Credit derivatives enable risk transfer of credit exposures from on-balance sheet assets to off-balance sheet assets, enhancing risk management and capital efficiency for financial institutions.

Contingent Liabilities

Contingent liabilities are potential obligations that may arise from off-balance sheet items, such as guarantees or pending lawsuits, which are not recorded as on-balance sheet assets but must be disclosed in financial statements. On-balance sheet assets, unlike off-balance sheet assets, are recognized within the balance sheet and directly impact a company's financial position, while contingent liabilities linked to off-balance sheet arrangements require careful monitoring due to their uncertain nature and potential financial impact.

Operating Leases

Operating leases classify leased assets as off-balance sheet items, whereas finance leases require recognition of leased assets and liabilities on the balance sheet.

Synthetic Assets

Synthetic assets often function as off-balance sheet instruments by replicating the economic benefits of on-balance sheet assets without appearing in the company's official financial statements.

Risk Transfer

Risk transfer involves shifting financial exposure from on-balance sheet assets, which directly impact a company's financial statements, to off-balance sheet assets that remain hidden from immediate accounting but still carry contingent liabilities. Off-balance sheet arrangements enable firms to manage risk and improve financial ratios without increasing reported debt, though they require careful disclosure to avoid hidden vulnerabilities.

True Sale

True sale transactions transfer assets off-balance sheet by legally separating them from the seller's entity, thereby removing associated risks and liabilities from the seller's financial statements.

Repo Transactions

Repo transactions temporarily shift securities from on-balance sheet assets to off-balance sheet assets by acting as secured loans without transferring asset ownership.

Consolidation Rules

Consolidation rules require including on-balance sheet assets of subsidiaries while off-balance sheet assets are disclosed separately to ensure transparent financial reporting.

Off-balance Sheet Assets vs On-balance Sheet Assets Infographic

moneydif.com

moneydif.com