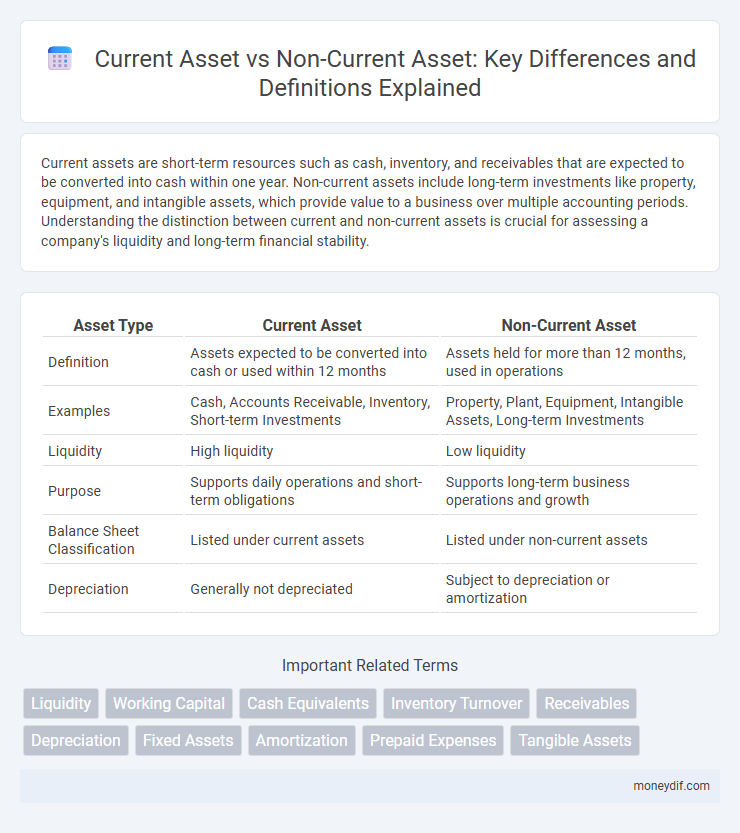

Current assets are short-term resources such as cash, inventory, and receivables that are expected to be converted into cash within one year. Non-current assets include long-term investments like property, equipment, and intangible assets, which provide value to a business over multiple accounting periods. Understanding the distinction between current and non-current assets is crucial for assessing a company's liquidity and long-term financial stability.

Table of Comparison

| Asset Type | Current Asset | Non-Current Asset |

|---|---|---|

| Definition | Assets expected to be converted into cash or used within 12 months | Assets held for more than 12 months, used in operations |

| Examples | Cash, Accounts Receivable, Inventory, Short-term Investments | Property, Plant, Equipment, Intangible Assets, Long-term Investments |

| Liquidity | High liquidity | Low liquidity |

| Purpose | Supports daily operations and short-term obligations | Supports long-term business operations and growth |

| Balance Sheet Classification | Listed under current assets | Listed under non-current assets |

| Depreciation | Generally not depreciated | Subject to depreciation or amortization |

Introduction to Asset Classification

Assets are classified into current and non-current based on their liquidity and expected usage within a business cycle. Current assets include cash, inventory, and accounts receivable, which are expected to be converted into cash within one year. Non-current assets comprise long-term investments, property, plant, and equipment, held for use beyond a year to support ongoing operations.

Defining Current Assets

Current assets are economic resources expected to be converted into cash or used up within one year or the operating cycle, whichever is longer. These include cash and cash equivalents, accounts receivable, inventory, and short-term investments, reflecting liquidity and operational efficiency. Precise classification of current assets is critical for accurate financial analysis and working capital management.

Key Features of Non-Current Assets

Non-current assets are long-term resources held by a company, typically including property, plant, equipment, and intangible assets like patents and trademarks. These assets are not intended for immediate sale and are used in business operations to generate revenue over multiple accounting periods. Their key features include long-term usage, depreciation or amortization, and a significant role in the company's capital investment structure.

Examples of Current Assets

Examples of current assets include cash and cash equivalents, accounts receivable, inventory, and short-term investments. These assets are expected to be converted into cash or used up within one year or an operating cycle. Current assets play a crucial role in maintaining a company's liquidity and operational efficiency.

Examples of Non-Current Assets

Examples of non-current assets include property, plant, and equipment (PPE), intangible assets such as patents and trademarks, and long-term investments like bonds or stocks held for several years. These assets are not expected to be converted into cash within one year, distinguishing them from current assets like inventory and receivables. Non-current assets play a critical role in a company's long-term strategy and financial stability by providing sustained value over time.

Liquidity Differences: Current vs. Non-Current Assets

Current assets, such as cash, accounts receivable, and inventory, are highly liquid and expected to be converted into cash within one year, making them essential for managing short-term financial obligations. Non-current assets, including property, plant, and equipment, possess lower liquidity due to their long-term usage and slower conversion into cash. The liquidity difference between current and non-current assets directly impacts working capital management and financial stability assessments in corporate finance.

Impact on Financial Statements

Current assets, such as cash, accounts receivable, and inventory, directly influence a company's short-term liquidity and working capital, reflected prominently on the balance sheet and impacting the current ratio. Non-current assets, including property, plant, and equipment, affect long-term financial health by contributing to depreciation expenses on the income statement and shaping the asset base for future growth. The classification between current and non-current assets determines financial statement analysis, influencing key metrics like solvency, profitability, and capital structure.

Importance in Financial Analysis

Current assets, including cash, receivables, and inventory, are crucial for assessing a company's liquidity and short-term financial health, ensuring it can meet immediate obligations. Non-current assets, such as property, equipment, and long-term investments, provide insight into the firm's long-term stability and capacity for growth. Analyzing both asset types enables investors and analysts to evaluate operational efficiency, solvency, and the overall financial position comprehensively.

Asset Management Strategies

Effective asset management strategies differentiate between current assets, such as cash, inventory, and receivables, which are vital for maintaining liquidity and operational efficiency, and non-current assets like property, equipment, and intangible assets, which require long-term investment planning and depreciation management. Optimizing the balance between current and non-current assets enhances cash flow control and capital allocation, supporting sustainable growth and financial stability. Leveraging technology in asset tracking and valuation can improve decision-making processes and asset utilization over time.

Conclusion: Choosing the Right Asset Mix

Selecting the right asset mix depends on balancing liquidity and long-term financial stability to meet business goals effectively. Current assets, such as cash and inventory, provide immediate operational support, while non-current assets like property and equipment contribute to sustained growth and capital investment. Strategically optimizing both asset types enhances overall asset management and maximizes return on investment.

Important Terms

Liquidity

Liquidity measures a company's ability to meet short-term obligations using current assets, which are cash or assets easily convertible to cash within one year, such as inventory and receivables. Non-current assets, including property, plant, and equipment, are less liquid as they are intended for long-term use and cannot be quickly converted into cash to cover immediate liabilities.

Working Capital

Working capital measures a company's operational liquidity by subtracting current liabilities from current assets, excluding non-current assets which are not readily convertible to cash within a year.

Cash Equivalents

Cash equivalents, including treasury bills and money market funds, are classified as current assets due to their high liquidity and short-term maturity, distinguishing them from non-current assets that have longer-term usage or investment horizons.

Inventory Turnover

Inventory turnover measures how efficiently a company manages its inventory by calculating the number of times inventory is sold and replaced over a period, directly impacting current assets since inventory is a key component of current assets. Non-current assets do not influence inventory turnover ratios as they represent long-term investments and fixed assets unrelated to inventory management or sales cycles.

Receivables

Receivables classified as current assets are expected to be collected within one year, while non-current receivables extend beyond one year and impact long-term financial planning.

Depreciation

Depreciation primarily affects non-current assets by systematically allocating their cost over useful life, while current assets are not depreciated due to their short-term nature.

Fixed Assets

Fixed assets, classified as non-current assets, represent long-term tangible property such as buildings, machinery, and equipment used in business operations, contrasting with current assets like cash, inventory, and receivables, which are expected to be liquidated or consumed within one year. The distinction impacts financial analysis by highlighting fixed assets' role in production capacity and long-term investment versus current assets' function in short-term liquidity and operational efficiency.

Amortization

Amortization is the systematic allocation of the cost of intangible non-current assets, such as patents or trademarks, over their useful life, reflecting their consumption in generating revenue. Current assets, like inventory or receivables, are not amortized since they are expected to be converted into cash within one year and do not have a depreciable lifespan.

Prepaid Expenses

Prepaid expenses classified as current assets represent payments made for goods or services to be received within one year, directly impacting short-term liquidity and working capital management. When prepaid expenses extend beyond one year, they are recorded as non-current assets, reflecting long-term resource allocation and deferred expenses affecting financial planning and asset management.

Tangible Assets

Tangible assets classified as current assets include inventory, cash, and accounts receivable, which are expected to be converted into cash or used within one year. Non-current tangible assets consist of property, plant, and equipment, which provide long-term value and are not intended for sale within the normal business cycle.

Current Asset vs Non-Current Asset Infographic

moneydif.com

moneydif.com