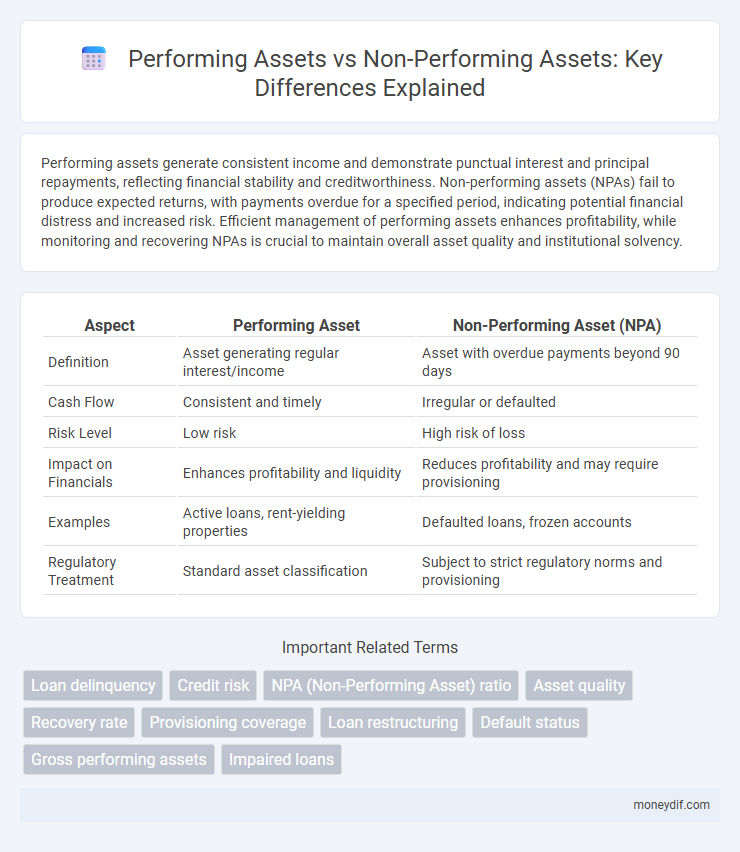

Performing assets generate consistent income and demonstrate punctual interest and principal repayments, reflecting financial stability and creditworthiness. Non-performing assets (NPAs) fail to produce expected returns, with payments overdue for a specified period, indicating potential financial distress and increased risk. Efficient management of performing assets enhances profitability, while monitoring and recovering NPAs is crucial to maintain overall asset quality and institutional solvency.

Table of Comparison

| Aspect | Performing Asset | Non-Performing Asset (NPA) |

|---|---|---|

| Definition | Asset generating regular interest/income | Asset with overdue payments beyond 90 days |

| Cash Flow | Consistent and timely | Irregular or defaulted |

| Risk Level | Low risk | High risk of loss |

| Impact on Financials | Enhances profitability and liquidity | Reduces profitability and may require provisioning |

| Examples | Active loans, rent-yielding properties | Defaulted loans, frozen accounts |

| Regulatory Treatment | Standard asset classification | Subject to strict regulatory norms and provisioning |

Definition of Performing and Non-performing Assets

Performing assets refer to loans or advances on which the borrower is making timely principal and interest payments as per the agreed schedule, indicating the asset is generating expected income. Non-performing assets (NPAs) are loans or advances where the borrower has failed to make scheduled payments for a specified period, typically 90 days or more, leading to a loss of income and increased credit risk for the lender. Banks and financial institutions monitor NPAs closely to assess asset quality and maintain financial stability.

Key Differences Between Performing and Non-performing Assets

Performing assets generate regular income or interest payments, reflecting healthy cash flow and borrower reliability. Non-performing assets (NPAs) fail to produce expected returns for over 90 days, indicating potential loan defaults and increased financial risk. Key differences include asset quality, risk assessment, and impact on banking profitability and capital adequacy ratios.

Importance of Asset Performance in Financial Markets

Asset performance critically influences liquidity and risk management in financial markets, distinguishing performing assets, which generate steady returns, from non-performing assets (NPAs) that pose credit risk and reduce capital efficiency. Monitoring asset quality ensures financial institutions maintain solvency and investor confidence by minimizing defaults and optimizing portfolio value. Effective asset performance assessment supports market stability, strategic investment decisions, and regulatory compliance.

Criteria for Classifying Assets as Performing or Non-performing

Assets are classified as performing or non-performing based on specific criteria such as timely repayment of principal and interest, the frequency of payment defaults, and the overdue period of installments. Performing assets demonstrate regular cash flows without significant delays, whereas non-performing assets (NPAs) typically show persistent defaults exceeding 90 days or more, indicating impaired credit quality. Key indicators include credit risk assessments, borrower's financial health, and recovery prospects that determine asset categorization in financial portfolios.

Causes of Asset Non-performance

Asset non-performance primarily stems from poor credit assessment, leading to high default rates on loans. Economic downturns and sector-specific challenges undermine borrower repayment capacity, causing assets to become non-performing. Inadequate monitoring and inefficient recovery processes further exacerbate the accumulation of non-performing assets in financial institutions.

Impact of Non-performing Assets on Financial Institutions

Non-performing assets (NPAs) significantly impair the profitability and liquidity of financial institutions by reducing interest income and increasing provisioning requirements. Elevated levels of NPAs erode capital adequacy ratios, restrict lending capacity, and amplify credit risk exposure. Persistent NPAs undermine investor confidence and hamper overall economic growth by constraining the financial sector's ability to allocate resources efficiently.

Strategies for Managing and Reducing Non-performing Assets

Effective strategies for managing non-performing assets (NPAs) include early identification through comprehensive credit monitoring systems and proactive restructuring of stressed loans. Implementing robust recovery mechanisms such as asset reconstruction companies, legal action, and strategic asset sales can significantly reduce NPAs. Enhancing risk assessment frameworks and strengthening due diligence in credit appraisal further prevent asset deterioration.

Regulatory Framework and Reporting Standards for Assets

Regulatory frameworks such as Basel III establish specific criteria for classifying performing and non-performing assets, emphasizing timely interest and principal repayments. Reporting standards under IFRS 9 require financial institutions to recognize expected credit losses on non-performing assets, impacting provisions and capital adequacy. Accurate classification according to these regulations ensures transparency and stability in financial reporting and risk management.

Role of Asset Quality in Investment Decisions

Asset quality significantly influences investment decisions by distinguishing performing assets that generate consistent returns from non-performing assets that pose financial risks. High-quality assets contribute to portfolio stability and enhanced capital allocation, while non-performing assets increase default risk and potential losses. Investors prioritize thorough asset quality assessments to optimize risk-adjusted returns and ensure sustained financial performance.

Case Studies: Successful Asset Performance Management

Case studies on successful asset performance management reveal that companies leveraging real-time monitoring and predictive maintenance achieve up to 30% reduction in downtime and a 25% increase in asset lifespan. Organizations utilizing advanced analytics platforms like IBM Maximo and SAP EAM have demonstrated significant improvements in turning non-performing assets into productive resources. Effective implementation of condition-based maintenance strategies correlates with enhanced return on asset investment and operational efficiency.

Important Terms

Loan delinquency

Loan delinquency occurs when borrowers fail to make scheduled loan payments, causing the loan to transition from a performing asset, which generates expected cash flows, to a non-performing asset (NPA) where repayments become overdue beyond a specified period, typically 90 days. Non-performing assets signal increased credit risk and reduced asset quality in financial institutions, leading to potential losses and stricter regulatory scrutiny.

Credit risk

Credit risk increases significantly when performing assets deteriorate into non-performing assets, reflecting the borrower's inability to meet payment obligations and impacting financial stability.

NPA (Non-Performing Asset) ratio

The NPA ratio measures the proportion of non-performing assets to the total performing and non-performing assets, indicating the percentage of loans that are in default or close to default.

Asset quality

Asset quality measures the financial health of assets, focusing on the proportion of performing assets--those generating expected returns--versus non-performing assets (NPAs) that show payment defaults or delays. High asset quality is indicated by a greater ratio of performing assets to NPAs, minimizing credit risk and enhancing a financial institution's stability.

Recovery rate

The recovery rate measures the proportion of funds recovered from performing assets versus non-performing assets, reflecting the efficiency of asset management and credit risk mitigation. Higher recovery rates on non-performing assets indicate effective restructuring or collateral realization, while performing assets typically exhibit near-complete recovery through timely payments.

Provisioning coverage

Provisioning coverage ratio measures the adequacy of reserves set aside to cover potential losses from non-performing assets compared to performing assets.

Loan restructuring

Loan restructuring improves recovery by converting non-performing assets into performing assets through modified repayment terms and conditions.

Default status

Default status indicates a borrower's failure to meet debt repayment obligations, directly impacting asset classification between performing assets and non-performing assets (NPAs). Performing assets generate timely interest and principal payments, while non-performing assets are characterized by overdue payments exceeding 90 days, signaling default risk and potential financial loss.

Gross performing assets

Gross performing assets represent the total value of loans and advances that are generating income without any default, serving as a key indicator of a bank's credit quality. Performing assets differ from non-performing assets, as the latter consist of loans that have stopped generating income due to defaults or delays beyond 90 days, impacting asset quality and financial stability.

Impaired loans

Impaired loans are classified as non-performing assets when principal or interest payments are overdue for 90 days or more, whereas performing assets generate timely payments without significant credit risk.

Performing asset vs Non-performing asset Infographic

moneydif.com

moneydif.com