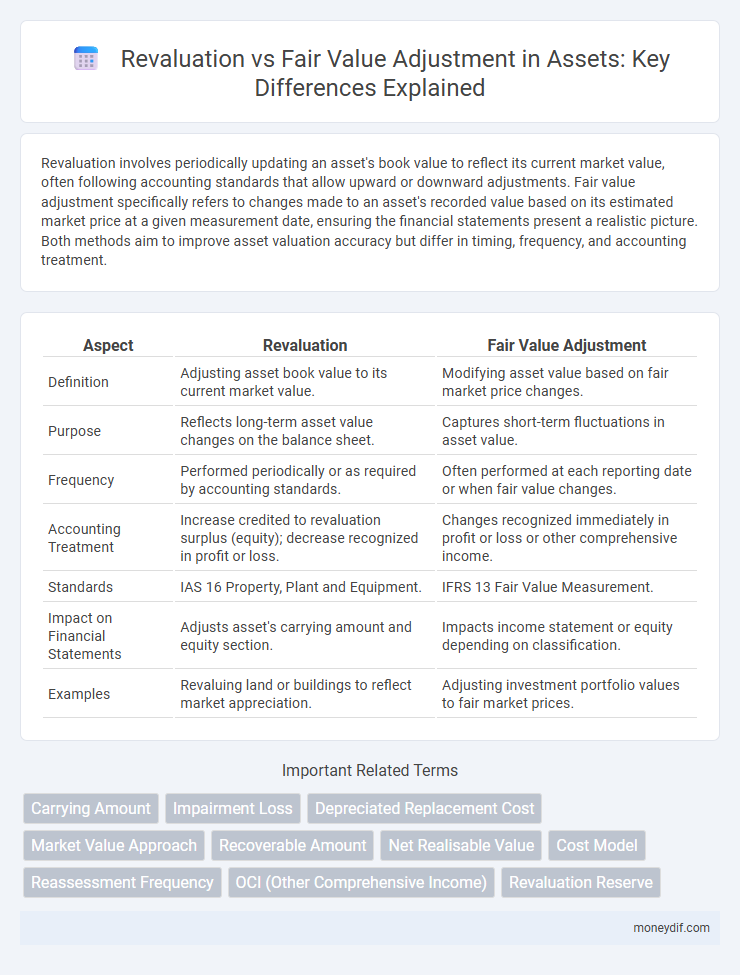

Revaluation involves periodically updating an asset's book value to reflect its current market value, often following accounting standards that allow upward or downward adjustments. Fair value adjustment specifically refers to changes made to an asset's recorded value based on its estimated market price at a given measurement date, ensuring the financial statements present a realistic picture. Both methods aim to improve asset valuation accuracy but differ in timing, frequency, and accounting treatment.

Table of Comparison

| Aspect | Revaluation | Fair Value Adjustment |

|---|---|---|

| Definition | Adjusting asset book value to its current market value. | Modifying asset value based on fair market price changes. |

| Purpose | Reflects long-term asset value changes on the balance sheet. | Captures short-term fluctuations in asset value. |

| Frequency | Performed periodically or as required by accounting standards. | Often performed at each reporting date or when fair value changes. |

| Accounting Treatment | Increase credited to revaluation surplus (equity); decrease recognized in profit or loss. | Changes recognized immediately in profit or loss or other comprehensive income. |

| Standards | IAS 16 Property, Plant and Equipment. | IFRS 13 Fair Value Measurement. |

| Impact on Financial Statements | Adjusts asset's carrying amount and equity section. | Impacts income statement or equity depending on classification. |

| Examples | Revaluing land or buildings to reflect market appreciation. | Adjusting investment portfolio values to fair market prices. |

Definition of Asset Revaluation

Asset revaluation is the process of adjusting the book value of a fixed asset to reflect its current market value, ensuring that the financial statements present a more accurate representation of the asset's worth. This accounting practice involves increasing or decreasing the asset's carrying amount based on appraisal or market data, which differs from fair value adjustment that typically applies to financial instruments and involves marking to market on an ongoing basis. Revaluation impacts the balance sheet by updating asset values and may affect depreciation and equity through revaluation surplus or deficit entries.

Understanding Fair Value Adjustment

Fair value adjustment reflects the current market value of an asset, ensuring financial statements present a realistic valuation based on observable market data or reliable valuation techniques. This method accounts for fluctuations in asset prices over time without altering the original purchase cost, unlike revaluation, which systematically updates asset values to reflect long-term changes. Understanding fair value adjustment is crucial for accurate asset reporting, investment analysis, and compliance with accounting standards like IFRS and GAAP.

Key Differences Between Revaluation and Fair Value

Revaluation involves adjusting an asset's carrying amount to its fair value at a specific date, typically for fixed assets under accounting standards like IAS 16, reflecting a more permanent update on the balance sheet. Fair value adjustment is a broader concept used to measure financial instruments, investment properties, or assets held for sale, reflecting current market conditions and often recorded through profit or loss or other comprehensive income under IFRS 13. The key difference lies in revaluation being a prescribed accounting treatment for long-term assets with intervals, while fair value adjustment is a more frequent valuation approach applied across various asset classes to present real-time market value changes.

When to Apply Revaluation Accounting

Revaluation accounting should be applied when an asset's fair value can be reliably measured and there is a significant and sustained change in its market value compared to its carrying amount. This approach is typically used for property, plant, and equipment to reflect a more accurate value on the balance sheet. Entities must conduct revaluations regularly to ensure the reported asset values remain current and relevant for financial reporting purposes.

Scenarios for Fair Value Adjustment

Fair value adjustment scenarios include market fluctuations, asset impairment, or changes in use that impact an asset's recoverable amount. These adjustments ensure financial statements reflect current market conditions, improving asset valuation accuracy. Unlike revaluation that may be periodic, fair value adjustments often occur more frequently to capture timely economic realities.

Impact on Financial Statements

Revaluation increases an asset's carrying amount on the balance sheet, reflecting updated fair values and leading to adjustments in equity through revaluation reserves. Fair value adjustments impact both the income statement and balance sheet, with gains or losses recognized directly in profit or loss, affecting net income. These differences influence financial ratios, investor perceptions, and regulatory compliance, necessitating careful consideration in asset reporting.

Advantages and Limitations of Asset Revaluation

Asset revaluation provides updated asset values on the balance sheet, reflecting current market conditions and enhancing the accuracy of financial statements. This process improves stakeholders' confidence by presenting a more realistic asset worth, which can facilitate better investment decisions and loan negotiations. However, revaluation may lead to increased volatility in reported profits due to fluctuations in asset values and can incur significant costs related to professional valuations and compliance with accounting standards.

Pros and Cons of Fair Value Adjustment

Fair value adjustment provides up-to-date asset valuation reflecting current market conditions, enhancing financial statement transparency and relevance. It can introduce volatility due to frequent market fluctuations, complicating earnings predictability and financial planning. However, fair value adjustment offers a more accurate economic picture compared to historical cost or arbitrary revaluation methods, aiding better investment and management decisions.

Regulatory and Reporting Standards

Revaluation and fair value adjustment of assets are governed by specific regulatory frameworks such as IFRS and US GAAP, which dictate recognition, measurement, and disclosure requirements. Revaluation often involves periodic asset value updates within financial statements to reflect fair market value, primarily under IAS 16, while fair value adjustments under IFRS 13 emphasize current market conditions and exit prices. Compliance with these standards ensures transparent reporting, accurate financial representation, and adherence to audit and regulatory scrutiny.

Strategic Considerations for Asset Valuation

Strategic considerations for asset valuation emphasize choosing between revaluation and fair value adjustment based on the asset's purpose and market dynamics. Revaluation provides a systematic approach aligned with accounting standards to reflect substantial changes in asset value, enhancing balance sheet accuracy. Fair value adjustment offers more frequent, market-driven valuations, supporting responsive decision-making in dynamic environments and investment assessments.

Important Terms

Carrying Amount

Carrying amount represents the value at which an asset is recognized on the balance sheet, reflecting historical cost less accumulated depreciation or impairment. Revaluation adjustments increase or decrease the carrying amount to reflect fair value changes, whereas fair value adjustments specifically adjust asset values to current market conditions without altering historical cost basis.

Impairment Loss

Impairment loss occurs when the carrying amount of an asset exceeds its recoverable amount, contrasting with revaluation which adjusts asset value based on market conditions, while fair value adjustment reflects the current market price without considering impairment.

Depreciated Replacement Cost

Depreciated Replacement Cost measures asset value by estimating current replacement cost minus depreciation, contrasting with fair value adjustment that reflects market-based asset price changes.

Market Value Approach

The Market Value Approach assesses asset worth by comparing recent sales data to determine fair value adjustments during revaluation, ensuring accurate reflection of current market conditions.

Recoverable Amount

Recoverable amount is the higher of an asset's fair value less costs of disposal and its value in use, used to assess impairment under accounting standards like IFRS IAS 36. Revaluation adjustments affect the asset's carrying amount to reflect fair value changes, while fair value adjustments specifically align asset values to current market conditions, both impacting recoverable amount assessments and financial reporting.

Net Realisable Value

Net Realisable Value (NRV) represents the estimated selling price of an asset minus any costs necessary to complete and sell it, serving as a conservative valuation measure in inventory accounting. Unlike fair value adjustments, which reflect current market conditions and may increase or decrease asset values, revaluation typically updates asset carrying amounts to fair value without impacting NRV directly, ensuring asset values do not exceed recoverable amounts.

Cost Model

Cost model accounting records assets at historical cost less accumulated depreciation, while revaluation adjusts asset values to fair value reflecting current market conditions.

Reassessment Frequency

Reassessment frequency for revaluation requires systematic intervals, typically annually or every five years, whereas fair value adjustments must be updated at each reporting date to reflect current market conditions.

OCI (Other Comprehensive Income)

Other Comprehensive Income (OCI) includes unrealized gains and losses from revaluation surplus and fair value adjustments on assets, reflecting changes in equity that bypass net income under IFRS and US GAAP.

Revaluation Reserve

Revaluation Reserve arises from upward adjustments of asset values recorded during revaluation under IAS 16, capturing changes in an asset's carrying amount rather than gains or losses from fair value fluctuations recognized in profit or loss. Unlike fair value adjustments under IFRS 13, which reflect current market conditions and impact profit or loss immediately, Revaluation Reserve specifically reflects historical increments in asset value that are retained in equity until realized.

revaluation vs fair value adjustment Infographic

moneydif.com

moneydif.com