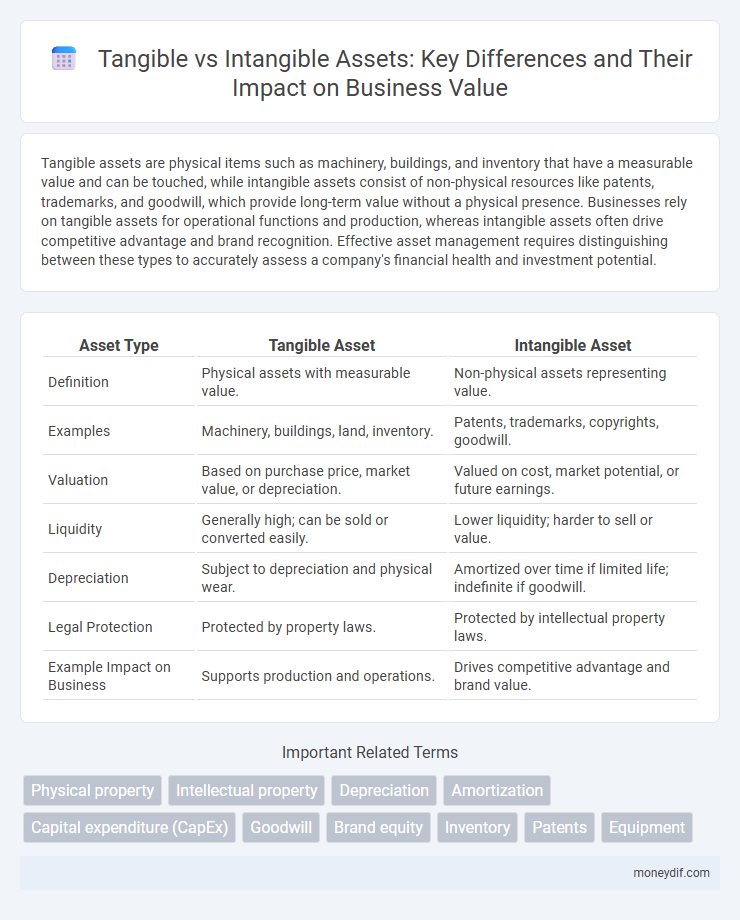

Tangible assets are physical items such as machinery, buildings, and inventory that have a measurable value and can be touched, while intangible assets consist of non-physical resources like patents, trademarks, and goodwill, which provide long-term value without a physical presence. Businesses rely on tangible assets for operational functions and production, whereas intangible assets often drive competitive advantage and brand recognition. Effective asset management requires distinguishing between these types to accurately assess a company's financial health and investment potential.

Table of Comparison

| Asset Type | Tangible Asset | Intangible Asset |

|---|---|---|

| Definition | Physical assets with measurable value. | Non-physical assets representing value. |

| Examples | Machinery, buildings, land, inventory. | Patents, trademarks, copyrights, goodwill. |

| Valuation | Based on purchase price, market value, or depreciation. | Valued on cost, market potential, or future earnings. |

| Liquidity | Generally high; can be sold or converted easily. | Lower liquidity; harder to sell or value. |

| Depreciation | Subject to depreciation and physical wear. | Amortized over time if limited life; indefinite if goodwill. |

| Legal Protection | Protected by property laws. | Protected by intellectual property laws. |

| Example Impact on Business | Supports production and operations. | Drives competitive advantage and brand value. |

Definition of Tangible and Intangible Assets

Tangible assets are physical items owned by a company, such as machinery, buildings, and inventory, that have measurable value and can be touched or seen. Intangible assets, in contrast, represent non-physical resources, including patents, trademarks, copyrights, and goodwill, which contribute value through legal rights or competitive advantages. Both asset types are critical for financial reporting and strategic management, with tangible assets often recorded at historical cost and intangible assets recognized based on acquisition or development costs.

Key Differences Between Tangible and Intangible Assets

Tangible assets are physical items such as machinery, buildings, and inventory that have measurable value and can be touched, while intangible assets include non-physical items like patents, trademarks, and goodwill that represent legal rights or competitive advantages. Tangible assets depreciate over time due to wear and tear, whereas intangible assets amortize based on their useful life or remain indefinite if classified as goodwill. Financial reporting differentiates these assets clearly, affecting balance sheet classification and impacting company valuation and investment decisions.

Examples of Tangible Assets

Examples of tangible assets include physical items such as machinery, buildings, land, vehicles, and inventory, all of which have a concrete physical form and can be touched or seen. These assets are vital for operational activities and are recorded on the balance sheet at historical cost minus any depreciation. Unlike intangible assets like patents or trademarks, tangible assets provide collateral value and are crucial for securing loans and financing.

Examples of Intangible Assets

Intangible assets include non-physical resources such as patents, trademarks, copyrights, brand recognition, and goodwill that provide long-term value to a company. Unlike tangible assets like machinery or buildings, intangible assets often represent intellectual property or contractual rights crucial for competitive advantage. Companies invest in intangible assets to enhance innovation, protect proprietary technology, and strengthen market position.

Valuation Methods for Tangible vs Intangible Assets

Valuation methods for tangible assets typically rely on cost approaches, market comparisons, and income generation forecasts, emphasizing physical existence and resale value, such as machinery or real estate appraisals. Intangible assets valuation involves methods like relief-from-royalty, multi-period excess earnings, and discounted cash flow analysis, focusing on intellectual property, brand value, patents, or goodwill without physical form. Accurate asset valuation integrates market data, income potential, and asset-specific characteristics to reflect proper financial reporting and investment decisions.

Depreciation and Amortization: Tangible vs Intangible

Tangible assets, such as machinery and buildings, undergo depreciation to allocate their cost over their useful life, reflecting physical wear and tear. Intangible assets, including patents and trademarks, are amortized, systematically expensing their cost over their estimated economic life without physical deterioration. Depreciation affects asset valuation for tangible property, while amortization applies to intangible assets, impacting financial statements and tax calculations differently.

The Role of Assets in Business Operations

Tangible assets such as machinery, buildings, and inventory play a critical role in business operations by providing physical resources essential for production and service delivery. Intangible assets, including patents, trademarks, and goodwill, drive competitive advantage and innovation through intellectual property and brand value. Both asset types contribute to a company's financial stability and operational efficiency, enabling growth and market positioning.

Financial Reporting for Tangible and Intangible Assets

Financial reporting for tangible assets requires recognition at historical cost and subsequent measurement at cost less accumulated depreciation and impairment losses. Intangible assets are recognized only if they are identifiable, controlled, and expected to generate future economic benefits, with initial recognition at cost and subsequent measurement either at cost less amortization and impairment or at revalued amounts if an active market exists. Disclosures for both asset types include valuation methods, useful lives, amortization or depreciation policies, and impairment considerations to ensure transparency and comparability in financial statements.

Impact on Investment and Funding Decisions

Tangible assets, such as property and equipment, provide collateral value that can enhance a company's borrowing capacity and reduce the cost of capital. Intangible assets, including patents, trademarks, and goodwill, often complicate valuation but drive long-term growth potential and investor confidence. Investment decisions weigh the liquidity and depreciation of tangible assets against the innovation and competitive advantage linked to intangible assets.

Legal Considerations and Protection of Assets

Tangible assets, such as real estate and machinery, require physical security measures and clear ownership documentation to ensure legal protection and prevent unauthorized use or theft. Intangible assets, including intellectual property like patents, trademarks, and copyrights, demand robust legal frameworks such as registration, licensing agreements, and enforcement of rights to safeguard their value. Effective asset protection strategies combine contract law, property law, and regulatory compliance to mitigate risks and enhance the enforceability of ownership claims.

Important Terms

Physical property

Physical properties such as size, shape, and material composition distinguish tangible assets from intangible assets, which lack a physical form but hold value through rights or intellectual property.

Intellectual property

Intellectual property, classified as an intangible asset, represents legally protected creations of the mind, contrasting with tangible assets like physical property or equipment.

Depreciation

Depreciation applies to tangible assets by allocating their cost over useful life, while intangible assets undergo amortization reflecting their consumption or expiration.

Amortization

Amortization applies to intangible assets by systematically expensing their cost over useful life, while tangible assets undergo depreciation to allocate cost based on physical wear and tear.

Capital expenditure (CapEx)

Capital expenditure (CapEx) involves investing in tangible assets like machinery, buildings, and equipment that have a physical presence and long-term utility. In contrast, CapEx for intangible assets includes costs related to acquiring patents, trademarks, software, or licenses, which provide value through intellectual property rather than physical form.

Goodwill

Goodwill is an intangible asset that arises when a company acquires another business for more than the fair value of its net identifiable tangible and intangible assets. Unlike tangible assets such as machinery or buildings, goodwill represents non-physical elements like brand reputation, customer relationships, and intellectual capital.

Brand equity

Brand equity, as an intangible asset, often surpasses the value of tangible assets by driving customer loyalty, premium pricing, and long-term competitive advantage.

Inventory

Inventory is classified as a tangible asset because it consists of physical goods available for sale or production, unlike intangible assets which include non-physical items such as patents, trademarks, or goodwill. Proper management of inventory impacts a company's working capital and liquidity, distinguishing it from intangible assets that primarily influence long-term value and intellectual property.

Patents

Patents are classified as intangible assets because they grant exclusive legal rights to inventions without physical substance, unlike tangible assets such as machinery or buildings that have a physical form. The valuation of patents on the balance sheet reflects their potential to generate future economic benefits through licensing, manufacturing, or litigation advantages.

Equipment

Equipment is classified as a tangible asset because it has physical substance and can be touched, unlike intangible assets which lack physical form and include items such as patents and trademarks.

Tangible asset vs Intangible asset Infographic

moneydif.com

moneydif.com