A contingent asset is a potential asset that depends on the outcome of a future event, making its recognition uncertain until the event occurs. Realizable assets are those that can be converted into cash or cash equivalents within a short period, reflecting their liquidity and certainty. Understanding the distinction between contingent and realizable assets is crucial for accurate financial reporting and risk assessment.

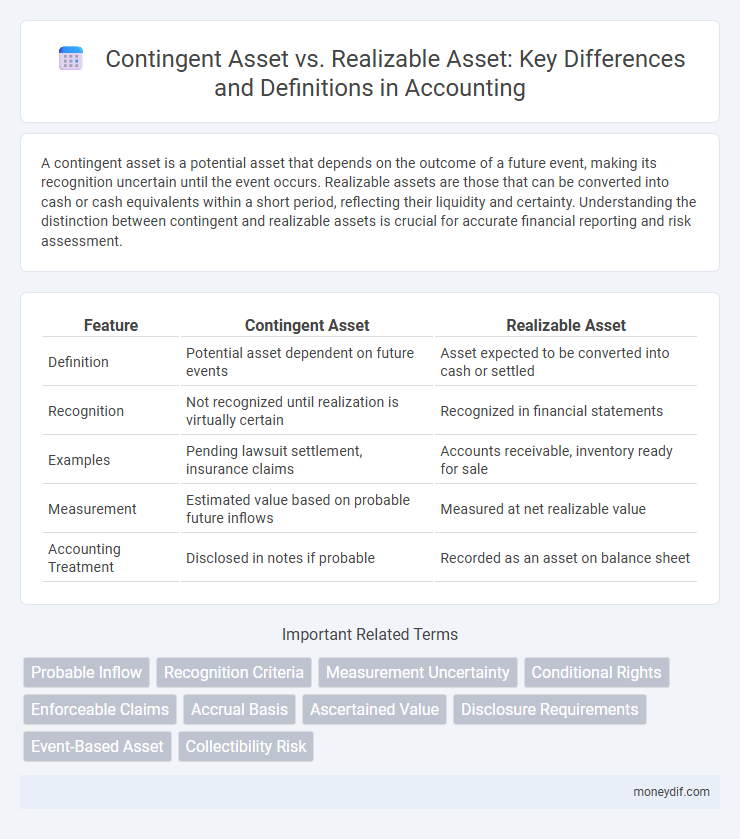

Table of Comparison

| Feature | Contingent Asset | Realizable Asset |

|---|---|---|

| Definition | Potential asset dependent on future events | Asset expected to be converted into cash or settled |

| Recognition | Not recognized until realization is virtually certain | Recognized in financial statements |

| Examples | Pending lawsuit settlement, insurance claims | Accounts receivable, inventory ready for sale |

| Measurement | Estimated value based on probable future inflows | Measured at net realizable value |

| Accounting Treatment | Disclosed in notes if probable | Recorded as an asset on balance sheet |

Introduction to Contingent and Realizable Assets

Contingent assets refer to potential economic benefits that depend on the occurrence of uncertain future events, and they are not recognized in financial statements until the realization is virtually certain. Realizable assets represent resources that can be converted into cash or cash equivalents within a specific period, such as accounts receivable or inventory. Understanding the distinction between contingent and realizable assets is crucial for accurate financial reporting and risk assessment.

Defining Contingent Assets

Contingent assets refer to potential economic benefits that may arise from uncertain future events, depending on the occurrence or non-occurrence of those events outside the control of the entity. Unlike realizable assets, which are tangible or intangible assets currently owned and can be converted into cash or equivalents, contingent assets are not recognized in financial statements until they become virtually certain. Examples include pending lawsuits where a favorable outcome may result in financial gain, but recognition is deferred due to uncertainty.

What Are Realizable Assets?

Realizable assets refer to resources or properties that a company can convert into cash or cash equivalents within a short period, typically through sale or liquidation at their fair market value. Unlike contingent assets, realizable assets have a definite value and are recognized on the balance sheet, providing liquidity to support operational needs. Examples include accounts receivable, inventory, and marketable securities, all of which contribute directly to a company's working capital and financial stability.

Key Differences: Contingent Asset vs Realizable Asset

Contingent assets are potential economic benefits that depend on uncertain future events, while realizable assets are current assets that can be converted into cash or cash equivalents within a short period. Contingent assets are not recognized in financial statements due to their uncertainty, whereas realizable assets are recorded and reported as part of company assets. The primary difference lies in recognition and certainty: realizable assets have a definite value and liquidity, whereas contingent assets require confirmation through future occurrences.

Recognition Criteria in Accounting Standards

Contingent assets are potential assets that arise from past events and whose existence will be confirmed only by the occurrence or non-occurrence of uncertain future events not wholly within the entity's control, hence they are not recognized in financial statements until realization is virtually certain. Realizable assets represent resources with measurable value that can be converted into cash or cash equivalents with reasonable certainty and are recognized in accordance with accounting standards such as IFRS and GAAP once control and future economic benefits are probable. Recognition criteria for realizable assets include the existence of reliable measurement and probable inflow of economic benefits, contrasting with contingent assets which require near certainty of realization before recognition.

Examples of Contingent Assets

Examples of contingent assets include pending lawsuits with a probable favorable outcome, possible insurance claims awaiting settlement, and expected government grants not yet approved. These assets are not recorded on the balance sheet until their realization becomes virtually certain, contrasting with realizable assets like accounts receivable and inventory that are already measurable and collectible. Recognizing contingent assets can affect financial decision-making but requires careful assessment of the likelihood and timing of future economic benefits.

Examples of Realizable Assets

Realizable assets include cash, accounts receivable, and inventory that can be quickly converted into cash within a short period. Examples of realizable assets are marketable securities, prepaid expenses, and short-term investments that a company expects to liquidate or use within one year. These assets differ from contingent assets, which depend on future events for recognition and realization.

Financial Reporting and Disclosure Requirements

Contingent assets require disclosure in financial statements only when their realization is probable, ensuring transparency without recognizing uncertain gains, whereas realizable assets are recorded on the balance sheet at their net realizable value, reflecting a measurable economic benefit. Financial reporting standards mandate that contingent assets must be presented in notes, highlighting potential future inflows without inflating current asset figures. Accurate disclosure of both asset types is crucial for stakeholders to assess the entity's true financial position and potential liquidity.

Impact on Financial Statements and Decision Making

Contingent assets are potential resources arising from uncertain future events, not recognized on the balance sheet but disclosed in notes, affecting management's cautious optimism in financial decision-making. Realizable assets represent current resources convertible into cash or equivalents, directly influencing asset valuation and liquidity ratios, crucial for accurate financial analysis and investor confidence. Understanding the distinction aids stakeholders in evaluating risk exposure and the reliability of reported financial positions.

Practical Considerations for Businesses

Contingent assets represent potential economic benefits dependent on future events beyond a company's control, requiring cautious recognition in financial statements until realization is probable. Realizable assets, meanwhile, are existing resources already owned by the business that can be converted into cash or equivalents with reasonable certainty. Businesses prioritize realizable assets for liquidity assessment and operational planning, while contingent assets are disclosed in notes to manage expectations and comply with accounting standards such as IFRS or GAAP.

Important Terms

Probable Inflow

Probable inflow refers to the expected economic benefits from contingent assets that are more likely than not to occur but are not yet realizable assets until the conditions for recognition are met.

Recognition Criteria

Recognition criteria for contingent assets require the asset to be probable and reliably measurable, whereas realizable assets must be both measurable and currently convertible into cash or equivalents.

Measurement Uncertainty

Measurement uncertainty in contingent assets arises from unpredictable future events affecting cash inflows, whereas realizable assets have more reliable valuation due to existing market conditions or contractual agreements. The degree of uncertainty impacts financial reporting and recognition criteria, with contingent assets requiring cautious disclosure to avoid overstating asset value.

Conditional Rights

Conditional rights refer to entitlements dependent on specific events or conditions being met before recognition, often associated with contingent assets which represent potential economic benefits uncertain in timing or amount. Realizable assets, by contrast, are recognized when the asset's existence and value are confirmed and expected to result in probable future economic inflows, reflecting a more concrete and measurable benefit than conditional rights.

Enforceable Claims

Enforceable claims refer to rights recognized by law that can be legally asserted to recover a specific amount or asset, distinguishing them from contingent assets that depend on uncertain future events and are not recognized until realization is probable. Realizable assets, in contrast, are those with a measurable value that can be converted into cash or other benefits, making enforceable claims a subset of realizable assets due to their legal certainty and recoverability.

Accrual Basis

Accrual basis accounting recognizes contingent assets only when their realization is virtually certain, whereas realizable assets are recorded when they are expected to generate probable economic benefits. Contingent assets represent potential future gains dependent on uncertain events, while realizable assets have established value and are measurable for financial reporting under accrual principles.

Ascertained Value

Ascertained value refers to the determined monetary worth of an asset based on tangible evidence, distinguishing it from contingent assets that depend on uncertain future events, while realizable assets represent those readily convertible to cash under current market conditions. Accurate valuation of ascertained assets is crucial for financial reporting, ensuring clarity between potential gains from contingent assets and the liquidity of realizable assets.

Disclosure Requirements

Disclosure requirements mandate that contingent assets must be disclosed in the financial statements only when the inflow of economic benefits is probable, whereas realizable assets are recognized and measured based on their recoverable amounts.

Event-Based Asset

Event-based assets arise from specific occurrences that create a potential right or advantage, often differentiated from contingent assets, which depend on uncertain future events and are not recognized until realization is probable. Realizable assets, in contrast, represent resources that can be converted into cash or equivalents, emphasizing availability over potentiality inherent in contingent or event-based assets.

Collectibility Risk

Collectibility risk arises when contingent assets depend on uncertain future events, making their realization less assured compared to realizable assets with established, measurable values.

Contingent Asset vs Realizable Asset Infographic

moneydif.com

moneydif.com