A contingent asset is a potential asset that may arise from uncertain future events, dependent on the occurrence of specific conditions beyond current control. A realized asset, in contrast, is an asset that has been acquired or completed, with full control and measurable value already established. Understanding the distinction between contingent and realized assets is crucial for accurate financial reporting and asset management.

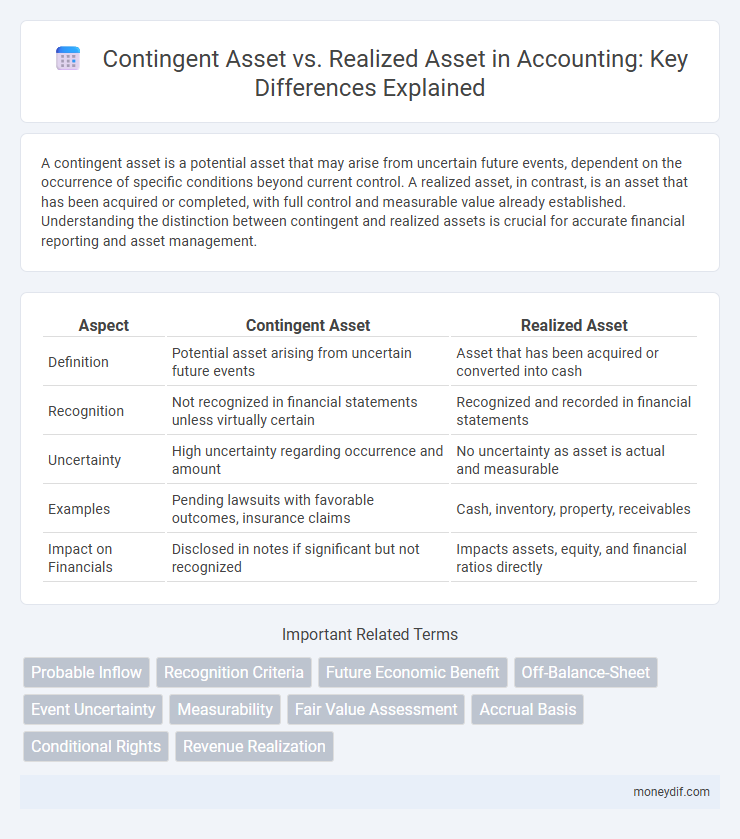

Table of Comparison

| Aspect | Contingent Asset | Realized Asset |

|---|---|---|

| Definition | Potential asset arising from uncertain future events | Asset that has been acquired or converted into cash |

| Recognition | Not recognized in financial statements unless virtually certain | Recognized and recorded in financial statements |

| Uncertainty | High uncertainty regarding occurrence and amount | No uncertainty as asset is actual and measurable |

| Examples | Pending lawsuits with favorable outcomes, insurance claims | Cash, inventory, property, receivables |

| Impact on Financials | Disclosed in notes if significant but not recognized | Impacts assets, equity, and financial ratios directly |

Understanding Contingent Assets

Contingent assets represent potential economic benefits that depend on uncertain future events beyond an entity's control, contrasting with realized assets that are already owned and controlled. These assets require careful evaluation of the likelihood of occurrence, as their recognition in financial statements is subject to the probability of inflow and reliable measurement. Effective management of contingent assets can enhance a company's financial position by anticipating resource inflows without immediate asset recognition.

What Are Realized Assets?

Realized assets refer to assets that have been converted into cash or cash equivalents through sales or other transactions, reflecting actual income rather than potential value. Unlike contingent assets, which depend on uncertain future events, realized assets represent confirmed financial gains recognized in a company's financial statements. This distinction is crucial for accurate asset valuation and financial reporting.

Key Differences Between Contingent and Realized Assets

Contingent assets represent potential economic benefits that depend on uncertain future events, making their recognition in financial statements conditional and often disclosed in notes. Realized assets are actual resources acquired or converted into cash, goods, or services, recognized on the balance sheet with measurable value. The primary difference lies in certainty and recognition: contingent assets are potential and uncertain, while realized assets are confirmed and quantified.

Recognition Criteria for Contingent Assets

Contingent assets are potential assets that arise from past events and depend on future uncertain events not wholly within the entity's control, requiring evidence that realization is probable before recognition. Unlike realized assets, which are already controlled and measurable by the entity, contingent assets must meet stringent recognition criteria based on the likelihood of inflow of economic benefits and reliable measurement. Accounting standards such as IAS 37 mandate disclosure of contingent assets only when their realization is probable, avoiding premature asset recognition on financial statements.

Accounting Treatment for Realized Assets

Realized assets are recorded in accounting when economic benefits are confirmed through transactions such as sales or settlements, reflecting their recognition as actual inflows. Accounting treatment for realized assets involves debiting cash or receivables and crediting revenue or other relevant income accounts according to applicable accounting standards like IFRS or GAAP. This ensures accurate financial statements by distinguishing realized gains from contingent or unrealized assets, which are disclosed but not recognized until the contingency is resolved.

Financial Reporting of Contingent vs Realized Assets

Contingent assets are potential economic benefits that arise from past events and are uncertain until confirmed by future events, thus they are disclosed in financial statements only when the realization is probable. Realized assets represent resources controlled by an entity from past transactions, recognized on the balance sheet with measurable value and directly impacting equity through profit or loss. Financial reporting standards such as IFRS IAS 37 require careful differentiation, emphasizing that contingent assets should not be recognized as assets to avoid overstating financial position, but must be disclosed if their inflow is probable.

Implications for Balance Sheet Presentation

Contingent assets are potential economic benefits arising from uncertain future events and are disclosed in the notes rather than recognized on the balance sheet, ensuring conservative financial reporting. Realized assets represent actual economic resources controlled by the entity, recorded on the balance sheet at historical or fair value, impacting financial ratios and stakeholders' assessment. Proper differentiation affects asset valuation accuracy, regulatory compliance, and investor decision-making processes.

Impact on Financial Ratios

Contingent assets, being potential benefits dependent on future events, are not recognized on the balance sheet but are disclosed in the notes, causing no immediate impact on financial ratios like return on assets or debt-to-equity. Realized assets, recorded on the balance sheet once certain, directly improve asset base and liquidity ratios, enhancing key metrics such as current ratio and asset turnover. The distinction influences investor perception, as realized assets strengthen financial stability indicators, while contingent assets reflect potential growth without altering existing financial ratios.

Real-World Examples: Contingent Assets vs Realized Assets

Contingent assets include potential insurance claims pending settlement, whereas realized assets involve settled claims with confirmed compensation received. For example, a company awaiting a court judgment for damages holds a contingent asset, while once the court awards damages and payment is received, it becomes a realized asset. This distinction is crucial for accurate financial reporting and asset valuation under IFRS and GAAP standards.

Best Practices for Managing Asset Uncertainty

Contingent assets require proactive evaluation and documentation to assess their probable realization, ensuring clarity and compliance with accounting standards. Implementing rigorous tracking systems and regularly updating risk assessments help organizations anticipate potential benefits without overstating financial positions. Prioritizing transparent communication with stakeholders reduces uncertainty and supports informed decision-making regarding asset recognition and management.

Important Terms

Probable Inflow

Probable inflow in accounting refers to the expected future economic benefits from contingent assets that are not yet realized but are likely to occur based on available evidence. Realized assets, on the other hand, represent confirmed inflows of economic benefits that have already been obtained and recognized in the financial statements.

Recognition Criteria

Recognition criteria for a contingent asset require a high probability of future economic benefits from uncertain events, whereas realized assets are recognized when control and economic benefits are certain and measurable.

Future Economic Benefit

Future economic benefits from contingent assets depend on uncertain events outside the entity's control and are recognized only when realization is virtually certain, unlike realized assets which already provide measurable economic inflows. Contingent assets require careful assessment under accounting standards like IAS 37 before being capitalized, while realized assets reflect actual transactions that directly increase economic resources.

Off-Balance-Sheet

Off-balance-sheet items include contingent assets, which represent potential economic benefits dependent on future events and are not recorded until realization occurs. Realized assets are recognized on the balance sheet once the contingent conditions are met, transforming potential assets into actual, measurable resources.

Event Uncertainty

Event uncertainty distinguishes contingent assets, which depend on future uncertain events, from realized assets that have certain value recognized in financial statements.

Measurability

Measurability distinguishes contingent assets, which depend on uncertain future events for recognition, from realized assets that have definite value and are recorded when the asset's economic benefits are assured.

Fair Value Assessment

Fair value assessment evaluates contingent assets based on probable future economic benefits, whereas realized assets are measured by actual transactions or cash inflows.

Accrual Basis

Accrual basis accounting recognizes contingent assets only when their realization is virtually certain, while realized assets are recorded when the asset is actually obtained or earned.

Conditional Rights

Conditional rights arise from contingent assets that depend on uncertain future events, whereas realized assets represent secured rights with definite value and ownership.

Revenue Realization

Revenue realization occurs when a contingent asset, which depends on future events and is uncertain, becomes a realized asset through the confirmation of those events, allowing its value to be recorded as revenue in the financial statements. The transition from contingent to realized asset impacts financial reporting by converting potential economic benefits into recognized income under accounting standards like IFRS.

contingent asset vs realized asset Infographic

moneydif.com

moneydif.com