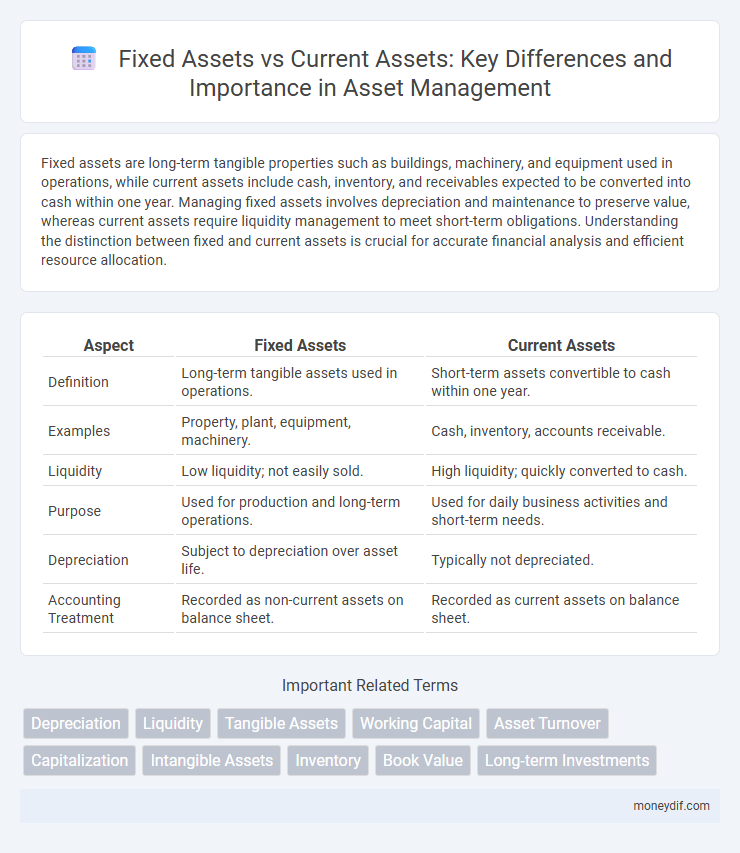

Fixed assets are long-term tangible properties such as buildings, machinery, and equipment used in operations, while current assets include cash, inventory, and receivables expected to be converted into cash within one year. Managing fixed assets involves depreciation and maintenance to preserve value, whereas current assets require liquidity management to meet short-term obligations. Understanding the distinction between fixed and current assets is crucial for accurate financial analysis and efficient resource allocation.

Table of Comparison

| Aspect | Fixed Assets | Current Assets |

|---|---|---|

| Definition | Long-term tangible assets used in operations. | Short-term assets convertible to cash within one year. |

| Examples | Property, plant, equipment, machinery. | Cash, inventory, accounts receivable. |

| Liquidity | Low liquidity; not easily sold. | High liquidity; quickly converted to cash. |

| Purpose | Used for production and long-term operations. | Used for daily business activities and short-term needs. |

| Depreciation | Subject to depreciation over asset life. | Typically not depreciated. |

| Accounting Treatment | Recorded as non-current assets on balance sheet. | Recorded as current assets on balance sheet. |

Definition of Fixed Assets

Fixed assets are tangible long-term resources owned by a company, such as buildings, machinery, and land, used in operations to generate revenue over multiple accounting periods. Unlike current assets, fixed assets are not intended for sale or conversion into cash within a year. These assets depreciate over time, reflecting their gradual loss of value through usage and wear.

Definition of Current Assets

Current assets refer to assets expected to be converted into cash, sold, or consumed within one fiscal year or operating cycle, whichever is longer. These include cash and cash equivalents, accounts receivable, inventory, and short-term investments. Current assets are crucial for managing a company's liquidity and operational efficiency.

Key Differences Between Fixed and Current Assets

Fixed assets are long-term tangible assets like machinery, buildings, and land used in operations, while current assets include cash, inventory, and accounts receivable intended for short-term conversion into cash. Fixed assets are non-liquid and depreciate over time, whereas current assets are highly liquid and consumed or converted within one accounting cycle. The key differences lie in their usage duration, liquidity, and impact on company operations and financial statements.

Examples of Fixed Assets

Fixed assets include tangible items such as buildings, machinery, vehicles, and land that a company uses for long-term operations. These assets are not intended for sale in the regular course of business and are depreciated over their useful life. Examples contrast with current assets like inventory and cash, which are expected to be converted into cash within one year.

Examples of Current Assets

Current assets include cash, accounts receivable, inventory, and short-term investments, all of which are expected to be converted into cash within one year. Unlike fixed assets such as machinery, buildings, or land, current assets facilitate day-to-day operational liquidity and financial flexibility. Managing these assets efficiently ensures a company can meet its short-term obligations and maintain smooth business operations.

Importance of Asset Classification in Accounting

Proper classification of assets into fixed assets and current assets is crucial in accounting as it directly impacts financial reporting accuracy and liquidity analysis. Fixed assets, such as buildings and machinery, provide long-term value and are depreciated over time, while current assets, including cash and inventory, are essential for daily operations and short-term financial health assessment. Accurate asset classification enables better decision-making, enhances balance sheet transparency, and supports compliance with accounting standards like GAAP and IFRS.

Depreciation and Valuation of Fixed Assets

Fixed assets, such as machinery and buildings, undergo depreciation, which systematically reduces their book value over time to reflect wear and obsolescence. Current assets, including inventory and accounts receivable, are valued at their short-term realizable amounts without depreciation. Accurate valuation of fixed assets requires consistent application of depreciation methods like straight-line or declining balance to ensure financial statements present true asset worth.

Liquidity and Role of Current Assets

Current assets possess higher liquidity compared to fixed assets, as they include cash, accounts receivable, and inventory, which can be quickly converted into cash to meet short-term obligations. Fixed assets, such as property, plant, and equipment, provide long-term value but lack immediate liquidity. The critical role of current assets lies in maintaining operational efficiency and ensuring a company's ability to cover its short-term liabilities without disrupting business activities.

Impact on Financial Statements

Fixed assets, such as property, plant, and equipment, appear on the balance sheet under non-current assets and are depreciated over their useful lives, affecting both the asset value and expense recognition on the income statement. Current assets, including cash, inventory, and accounts receivable, impact liquidity ratios and working capital management, directly influencing short-term financial health and operational efficiency. The distinction between fixed and current assets shapes asset valuation, profitability metrics, and financial stability analysis in financial statements.

Best Practices for Managing Fixed and Current Assets

Effective asset management involves regularly assessing fixed assets such as machinery, buildings, and equipment for depreciation and maintenance schedules to maximize their lifespan and value. Current assets like cash, inventory, and accounts receivable require frequent monitoring to ensure liquidity and operational efficiency. Implementing integrated asset tracking systems and accurate financial reporting enhances decision-making and compliance with accounting standards.

Important Terms

Depreciation

Depreciation applies to fixed assets by systematically allocating their cost over useful life, while current assets are not depreciated as they are expected to be converted into cash within one year.

Liquidity

Liquidity is higher in current assets due to their quick convertibility to cash compared to fixed assets, which are long-term and less liquid investments.

Tangible Assets

Tangible assets include fixed assets like buildings and machinery, which provide long-term value, and current assets such as inventory and cash, which support short-term operational needs.

Working Capital

Working capital represents the difference between current assets, such as cash, inventory, and receivables, and current liabilities, reflecting a company's short-term liquidity and operational efficiency. Unlike fixed assets, which are long-term investments in property and equipment, current assets are liquid resources crucial for managing day-to-day business expenses and maintaining smooth operations.

Asset Turnover

Asset turnover measures how efficiently a company uses fixed assets and current assets to generate sales revenue, with fixed asset turnover focusing on long-term asset productivity and total asset turnover including current assets for overall operational efficiency.

Capitalization

Capitalization of expenses increases fixed assets on the balance sheet by recording costs as long-term investments, while current assets consist of short-term resources expected to be converted into cash within one year.

Intangible Assets

Intangible assets, unlike fixed assets which are tangible and long-term, lack physical substance but provide lasting value, whereas current assets are short-term resources expected to be converted into cash within a fiscal year.

Inventory

Inventory is classified as a current asset because it is expected to be sold or used within one business cycle, while fixed assets refer to long-term tangible items like machinery and buildings used in operations. Effective inventory management optimizes working capital, whereas fixed asset management focuses on depreciation and maintaining asset value over time.

Book Value

Book value represents the net value of an asset recorded on the balance sheet, calculated as the original cost minus accumulated depreciation for fixed assets such as machinery and buildings. For current assets like inventory and receivables, book value typically equals the purchase cost or net realizable value, reflecting their short-term liquidity and turnover.

Long-term Investments

Long-term investments are classified separately from fixed assets and current assets due to their extended holding period and liquidity characteristics.

Fixed Assets vs Current Assets Infographic

moneydif.com

moneydif.com