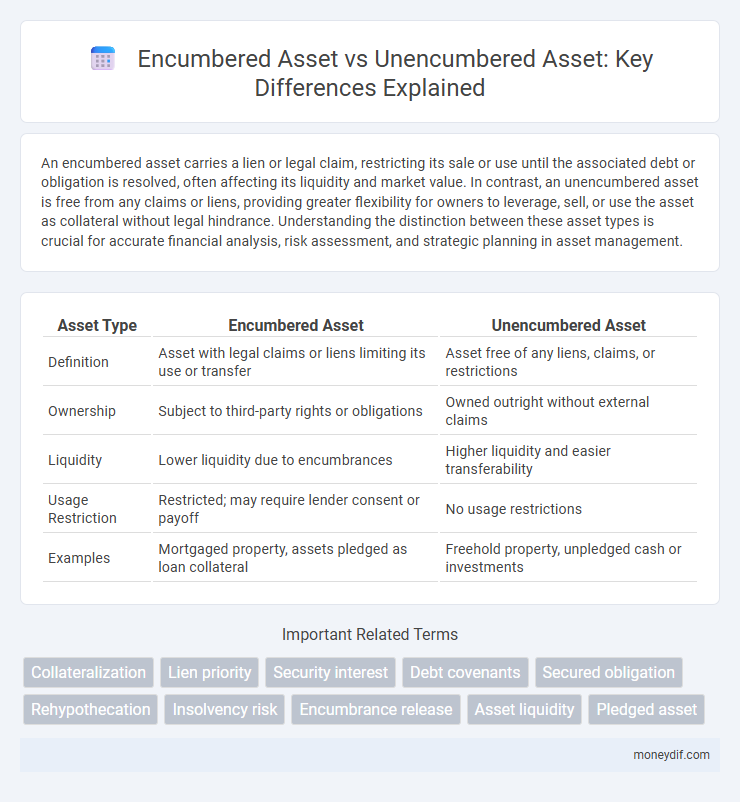

An encumbered asset carries a lien or legal claim, restricting its sale or use until the associated debt or obligation is resolved, often affecting its liquidity and market value. In contrast, an unencumbered asset is free from any claims or liens, providing greater flexibility for owners to leverage, sell, or use the asset as collateral without legal hindrance. Understanding the distinction between these asset types is crucial for accurate financial analysis, risk assessment, and strategic planning in asset management.

Table of Comparison

| Asset Type | Encumbered Asset | Unencumbered Asset |

|---|---|---|

| Definition | Asset with legal claims or liens limiting its use or transfer | Asset free of any liens, claims, or restrictions |

| Ownership | Subject to third-party rights or obligations | Owned outright without external claims |

| Liquidity | Lower liquidity due to encumbrances | Higher liquidity and easier transferability |

| Usage Restriction | Restricted; may require lender consent or payoff | No usage restrictions |

| Examples | Mortgaged property, assets pledged as loan collateral | Freehold property, unpledged cash or investments |

Definition of Encumbered Assets

Encumbered assets are assets that carry a legal claim or lien, restricting their free transfer or sale until the encumbrance is resolved. These can include collateral for loans, leases, or other financial obligations, limiting the owner's ability to fully liquidate the asset. Understanding the status of encumbered assets is crucial for assessing financial risk and collateral value in lending and investment contexts.

Definition of Unencumbered Assets

Unencumbered assets are properties or resources owned outright without any liens, loans, or claims that restrict their transfer or sale. These assets provide maximum liquidity and flexibility since they can be freely used as collateral or sold without needing creditor approval. Common examples include fully paid real estate, outright owned equipment, and cash reserves unburdened by debt obligations.

Key Differences Between Encumbered and Unencumbered Assets

Encumbered assets are tied to liabilities or legal claims, restricting their transfer or sale, while unencumbered assets remain free from any such obligations, allowing for unrestricted use or disposition. The key difference lies in encumbrance status, which affects liquidity and collateral potential; encumbered assets often serve as security for loans, reducing their availability for other uses. Unencumbered assets provide greater flexibility for borrowing, investment decisions, and financial planning due to their clear ownership and absence of third-party claims.

Importance of Asset Encumbrance in Finance

Encumbered assets have legal claims or liabilities attached, limiting their transferability and use, while unencumbered assets remain free of such restrictions, providing greater financial flexibility. Asset encumbrance is critical in finance as it influences borrowing capacity, collateral valuation, and risk assessment for lenders and investors. Proper management of encumbered and unencumbered assets ensures optimal capital allocation and enhances creditworthiness in financial transactions.

Examples of Encumbered Assets

Encumbered assets include properties under mortgage liens, vehicles with outstanding auto loans, and equipment pledged as collateral for business loans. These assets have legal claims against them, limiting their transferability or sale until debts are settled. Real estate with tax liens and inventory held as security for financing also represent common examples of encumbered assets.

Examples of Unencumbered Assets

Unencumbered assets include cash reserves, marketable securities, and fully owned real estate properties that are free of liens or mortgages. These assets can be quickly liquidated or leveraged without restrictions, providing financial flexibility to individuals or businesses. Examples also include equipment owned outright and vehicles with no outstanding loans, ensuring immediate availability for collateral or sale.

Impact of Encumbrance on Asset Liquidity

Encumbered assets have restrictions or liens that limit their sale or transfer, significantly reducing their liquidity compared to unencumbered assets, which are free of such claims and can be readily sold or leveraged. The presence of encumbrances increases transaction complexity and potential costs, deterring buyers and lenders, thus impairing the asset's marketability and cash conversion potential. Unencumbered assets offer greater financial flexibility and faster access to capital due to their clear ownership and absence of legal obligations.

Role of Encumbered Assets in Collateral Agreements

Encumbered assets serve as collateral in secured lending agreements, limiting an owner's ability to freely transfer or dispose of those assets until the associated debt is repaid. These assets create a legal claim for lenders, reducing their risk and often enabling borrowers to access more favorable financing terms. In contrast, unencumbered assets remain free of liens or claims, providing greater flexibility for owners but typically offering less security for creditors in collateral agreements.

Legal and Regulatory Considerations

Encumbered assets have legal restrictions or claims, such as liens or mortgages, affecting their transferability and requiring compliance with regulatory frameworks governing secured transactions. Unencumbered assets are free from such claims, enabling more straightforward legal ownership transfer and fewer regulatory hurdles. Understanding the distinction is crucial for due diligence, risk assessment, and ensuring adherence to financial and property laws.

Managing and Reporting Asset Encumbrance

Managing asset encumbrance involves tracking liabilities tied to specific assets to assess the organization's financial flexibility accurately. Reporting encumbered assets separately from unencumbered assets enhances transparency, facilitating more precise risk management and creditworthiness evaluation. Effective systems integrate real-time data on encumbrances, optimizing decision-making and regulatory compliance in asset management.

Important Terms

Collateralization

Collateralization involves using assets as security for a loan, distinguishing between encumbered assets, which are pledged and restricted for specific obligations, and unencumbered assets, which remain free from claims and can be leveraged or sold without creditor consent. Understanding this distinction is crucial for assessing an entity's liquidity, credit risk, and borrowing capacity in financial analysis and risk management.

Lien priority

Lien priority determines the order of claims on an encumbered asset, whereas unencumbered assets remain free of liens, ensuring clear ownership and easier transferability.

Security interest

A security interest legally encumbers an asset by granting a creditor a claim or lien, whereas an unencumbered asset remains free of such claims, allowing the owner full control and the ability to use it as collateral.

Debt covenants

Debt covenants often restrict a borrower's ability to encumber assets, requiring key assets to remain unencumbered as collateral to maintain financial flexibility and satisfy lender conditions. Unencumbered assets are critical in debt agreements because they provide assurance to creditors that sufficient untapped collateral exists, whereas encumbered assets are already pledged, limiting further borrowing capacity.

Secured obligation

A secured obligation is a debt or liability backed by an encumbered asset, which serves as collateral to reduce the lender's risk. Unencumbered assets are free from liens or claims, allowing the borrower to sell or leverage them without restrictions tied to secured obligations.

Rehypothecation

Rehypothecation involves using encumbered assets as collateral for securing new loans, whereas unencumbered assets remain free from such claims and provide greater liquidity and flexibility for financial transactions.

Insolvency risk

Insolvency risk increases when a company holds a higher proportion of encumbered assets compared to unencumbered assets, limiting its ability to secure additional financing or meet debt obligations.

Encumbrance release

Encumbrance release frees an encumbered asset from legal claims, restoring its status to unencumbered and available for unrestricted use or transfer.

Asset liquidity

Encumbered assets are restricted by legal claims or liens limiting their liquidity, while unencumbered assets are free of such claims and offer higher liquidity for financing or sale.

Pledged asset

A pledged asset is a type of encumbered asset used as collateral to secure a loan, whereas an unencumbered asset is free of any legal claims or liens and can be freely sold or pledged.

Encumbered asset vs Unencumbered asset Infographic

moneydif.com

moneydif.com