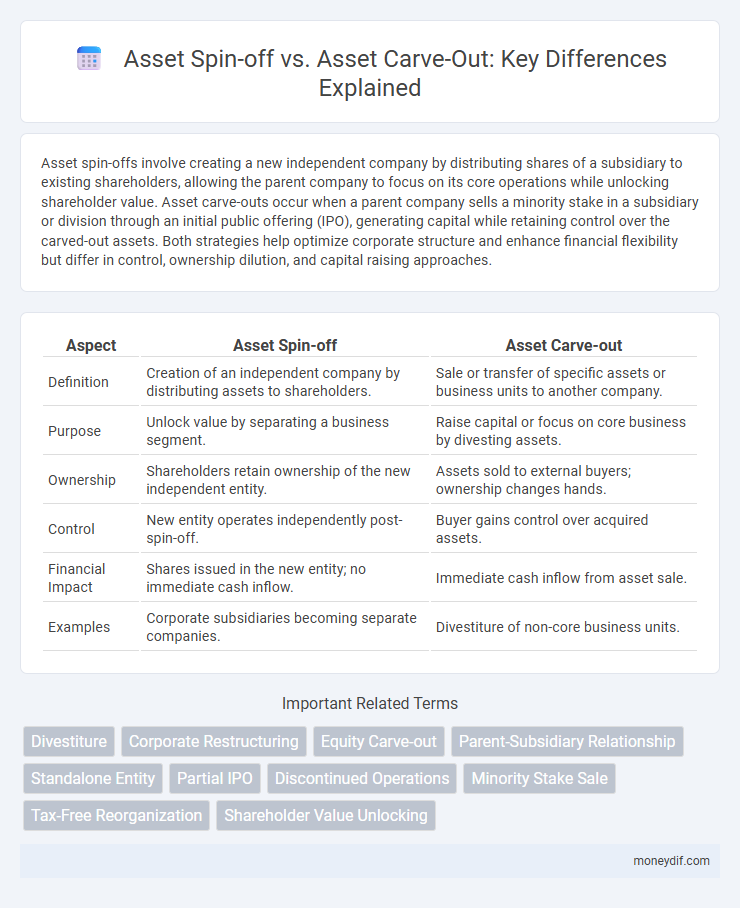

Asset spin-offs involve creating a new independent company by distributing shares of a subsidiary to existing shareholders, allowing the parent company to focus on its core operations while unlocking shareholder value. Asset carve-outs occur when a parent company sells a minority stake in a subsidiary or division through an initial public offering (IPO), generating capital while retaining control over the carved-out assets. Both strategies help optimize corporate structure and enhance financial flexibility but differ in control, ownership dilution, and capital raising approaches.

Table of Comparison

| Aspect | Asset Spin-off | Asset Carve-out |

|---|---|---|

| Definition | Creation of an independent company by distributing assets to shareholders. | Sale or transfer of specific assets or business units to another company. |

| Purpose | Unlock value by separating a business segment. | Raise capital or focus on core business by divesting assets. |

| Ownership | Shareholders retain ownership of the new independent entity. | Assets sold to external buyers; ownership changes hands. |

| Control | New entity operates independently post-spin-off. | Buyer gains control over acquired assets. |

| Financial Impact | Shares issued in the new entity; no immediate cash inflow. | Immediate cash inflow from asset sale. |

| Examples | Corporate subsidiaries becoming separate companies. | Divestiture of non-core business units. |

Introduction to Asset Spin-off and Asset Carve-out

Asset spin-offs involve creating an independent company by distributing shares of a subsidiary to existing shareholders, enabling focused management and unlocking value. Asset carve-outs refer to the partial sale of a business unit or assets, often through an initial public offering (IPO), while maintaining parent company ownership to raise capital. Both strategies optimize asset portfolios but differ in ownership transfer and financial structuring.

Defining Asset Spin-off: Key Features and Processes

An asset spin-off involves creating a new independent company by separating specific assets and liabilities from the parent company, allowing shareholders to receive shares in the newly formed entity. This process typically includes transferring selected assets, employees, and operational responsibilities while maintaining ongoing support or agreements between the parent and the spin-off. Key features include strategic realignment, enhanced focus on core business areas, and potential tax advantages depending on the jurisdiction and structure of the transaction.

Understanding Asset Carve-out: Core Concepts and Steps

Asset carve-out involves separating a specific business unit or asset from a parent company while retaining partial operational integration, allowing for focused management and financial clarity. Key steps include identifying the carve-out scope, restructuring financial statements to isolate assets and liabilities, and establishing standalone operational systems. This approach differs from spin-offs by maintaining some affiliation with the parent entity, enabling strategic flexibility and smoother transition.

Strategic Motivations for Asset Spin-off vs Carve-out

Asset spin-offs strategically enable companies to unlock shareholder value by creating independent entities focused on core competencies, often resulting in improved operational efficiency and market valuation. Carve-outs are motivated by the desire to monetize non-core assets through partial sales while retaining some ownership, providing liquidity without full divestiture. Both approaches aim to enhance strategic focus, but spin-offs prioritize long-term autonomy and growth potential, whereas carve-outs focus on immediate capital generation and risk management.

Impact on Shareholder Value: Spin-off vs Carve-out

Asset spin-offs typically unlock greater shareholder value by creating independent entities with distinct market valuations, leading to clearer strategic focus and enhanced capital allocation. Asset carve-outs may generate immediate cash inflows and partial ownership retention but often result in smaller value realization due to potential market confusion and diluted control. Empirical studies indicate spin-offs generally outperform carve-outs in shareholder returns and long-term value creation.

Financial Reporting Differences: Spin-off and Carve-out

Asset spin-offs require separate financial statements for the new entity, allowing for independent reporting and clear distinction of asset ownership and liabilities. Asset carve-outs involve creating stand-alone financial reports based on extracted assets and operations, usually necessitating significant adjustments to allocate shared costs and liabilities accurately. Financial reporting in spin-offs aims at regulatory compliance with distinct entity disclosures, while carve-outs focus on presenting a segmented view of the parent company's operations for potential divestiture or investment analysis.

Tax Implications: Spin-off vs Carve-out

Asset spin-offs typically qualify for tax-free treatment under Internal Revenue Code Section 355, allowing shareholders to receive new shares without immediate tax liability. In contrast, asset carve-outs often trigger taxable events due to the sale of assets or equity, resulting in recognized gains and potential corporate-level taxes. Understanding the distinct tax implications is crucial for structuring transactions to optimize tax efficiency and shareholder value.

Regulatory Considerations in Spin-off and Carve-out

Regulatory considerations in asset spin-offs primarily involve compliance with securities laws and disclosure requirements to protect shareholder interests during the distribution of new entity shares. Asset carve-outs require adherence to antitrust regulations and may necessitate regulatory approvals, especially if the carve-out targets a competitive segment within an industry. Both structures demand thorough due diligence to ensure conformity with financial reporting standards and minimize regulatory risks in compliance frameworks.

Risks and Challenges: Comparing Spin-off and Carve-out

Asset spin-offs often carry risks related to market perception and shareholder value dilution due to the creation of a separate entity, while asset carve-outs involve complexities in segregating operations, financial reporting, and potential regulatory hurdles. Spin-offs may face challenges in establishing independent management and systems, whereas carve-outs require detailed negotiations on asset allocation and transitional service agreements. Both strategies can trigger operational disruptions and investor uncertainty, requiring careful planning to mitigate risks associated with valuation, integration, and compliance.

Case Studies: Successful Asset Spin-offs and Carve-outs

Case studies of successful asset spin-offs demonstrate significant value creation by enabling companies to unlock hidden assets and improve strategic focus, as seen in PayPal's spin-off from eBay which enhanced market agility and growth potential. In contrast, asset carve-outs, such as Hewlett-Packard's separation of HP Enterprise from HP Inc., highlight how divesting a distinct business unit can streamline operations and attract specialized investors. Both strategies effectively realign corporate portfolios, but spin-offs often generate higher shareholder returns by creating standalone entities with targeted business models.

Important Terms

Divestiture

Divestiture through an asset spin-off involves creating a new independent company by transferring specific assets and liabilities, allowing the parent company to streamline operations while retaining partial ownership. In contrast, an asset carve-out sells a portion of a company's assets as a separate business unit, typically to external buyers, enabling immediate capital generation without forming a new standalone entity.

Corporate Restructuring

Asset spin-offs separate a business unit into a new independent company by distributing shares to existing shareholders, while asset carve-outs involve selling a portion of assets or operations, often through a partial IPO, to raise capital and streamline corporate focus.

Equity Carve-out

Equity carve-out involves a parent company selling a minority stake in a subsidiary to the public, creating a separate publicly traded entity while retaining control, contrasting with asset spin-offs where specific assets are separated to form an independent company, and asset carve-outs where selected assets are sold off but do not result in a new publicly listed entity. This strategy enables liquidity generation and market valuation of the carved-out business segment without fully divesting ownership.

Parent-Subsidiary Relationship

A parent-subsidiary relationship involves a parent company owning controlling interest in a subsidiary, enabling strategic asset realignment through methods such as asset spin-offs or asset carve-outs. An asset spin-off creates an independent company by distributing shares of a business unit to existing shareholders, while an asset carve-out sells a segment or assets outright, typically retaining partial ownership and capital infusion from external investors.

Standalone Entity

Standalone entities created through asset spin-offs or asset carve-outs differ in that spin-offs distribute shares of a subsidiary to existing shareholders creating a fully independent company, whereas carve-outs involve selling a portion of a business typically via an IPO while retaining partial ownership.

Partial IPO

Partial IPO involves offering shares of a spun-off subsidiary to the public, distinguishing it from an asset carve-out where a business unit's assets are sold or restructured without creating a separately listed entity.

Discontinued Operations

Discontinued operations typically arise from asset spin-offs or asset carve-outs, where spin-offs involve creating an independent company by distributing a subsidiary's shares to existing shareholders, while carve-outs sell a portion of assets or business units, both requiring separate financial reporting to isolate discontinued results.

Minority Stake Sale

Minority stake sales often accompany asset spin-offs, separating specific business units as independent entities to attract targeted investors, whereas asset carve-outs involve selling a portion of assets or business segments directly, providing immediate liquidity without full operational separation.

Tax-Free Reorganization

A Tax-Free Reorganization involving an Asset Spin-off allows a parent company to distribute a subsidiary's assets to shareholders tax-free, whereas an Asset Carve-out typically involves selling or divesting part of a business for cash or stock and may trigger taxable events.

Shareholder Value Unlocking

Shareholder value unlocking through asset spin-offs typically results in higher market valuation by creating focused, independent entities that attract specialized investors and improve operational efficiencies. In contrast, asset carve-outs involve partial divestitures maintaining some parent control, which may limit value realization but provide liquidity and strategic flexibility.

Asset Spin-off vs Asset Carve-out Infographic

moneydif.com

moneydif.com