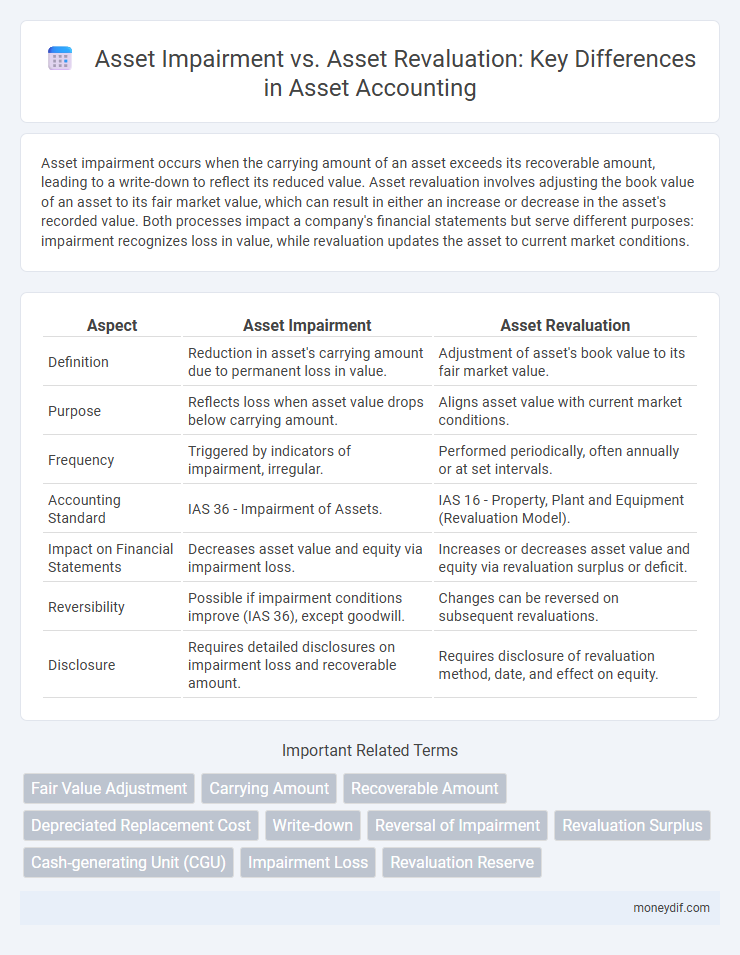

Asset impairment occurs when the carrying amount of an asset exceeds its recoverable amount, leading to a write-down to reflect its reduced value. Asset revaluation involves adjusting the book value of an asset to its fair market value, which can result in either an increase or decrease in the asset's recorded value. Both processes impact a company's financial statements but serve different purposes: impairment recognizes loss in value, while revaluation updates the asset to current market conditions.

Table of Comparison

| Aspect | Asset Impairment | Asset Revaluation |

|---|---|---|

| Definition | Reduction in asset's carrying amount due to permanent loss in value. | Adjustment of asset's book value to its fair market value. |

| Purpose | Reflects loss when asset value drops below carrying amount. | Aligns asset value with current market conditions. |

| Frequency | Triggered by indicators of impairment, irregular. | Performed periodically, often annually or at set intervals. |

| Accounting Standard | IAS 36 - Impairment of Assets. | IAS 16 - Property, Plant and Equipment (Revaluation Model). |

| Impact on Financial Statements | Decreases asset value and equity via impairment loss. | Increases or decreases asset value and equity via revaluation surplus or deficit. |

| Reversibility | Possible if impairment conditions improve (IAS 36), except goodwill. | Changes can be reversed on subsequent revaluations. |

| Disclosure | Requires detailed disclosures on impairment loss and recoverable amount. | Requires disclosure of revaluation method, date, and effect on equity. |

Understanding Asset Impairment

Asset impairment occurs when the carrying amount of an asset exceeds its recoverable amount, indicating a significant decline in value not attributable to normal depreciation. This reduction requires immediate recognition of a loss in financial statements to accurately reflect the asset's diminished economic benefits. Understanding asset impairment is crucial for maintaining transparent and reliable financial reporting, contrasting with asset revaluation, which adjusts asset values upward based on market conditions.

Fundamentals of Asset Revaluation

Asset revaluation fundamentally involves adjusting the carrying value of an asset to reflect its current fair market value, ensuring the balance sheet presents more accurate and up-to-date information. Unlike asset impairment, which records a reduction in asset value due to a decrease in recoverable amount, revaluation can result in an increase or decrease, depending on market conditions. This process requires adherence to accounting standards such as IAS 16, emphasizing regular assessments and maintaining consistency in valuation methods to provide transparency and reliability in financial reporting.

Key Differences: Impairment vs Revaluation

Asset impairment reflects a permanent decline in the recoverable value of an asset below its carrying amount, requiring a write-down to reflect this loss in financial statements. Asset revaluation involves adjusting the carrying amount of an asset to its current fair market value, which can result in an increase or decrease in the asset's book value. The key difference lies in impairment recognizing a loss due to decreased value, while revaluation updates asset values to reflect fair value changes without necessarily indicating a loss.

Recognition Criteria for Asset Impairment

Asset impairment is recognized when the carrying amount of an asset exceeds its recoverable amount, indicating a permanent decline in value. The recognition criteria require evidence such as significant asset damage, adverse market conditions, or underperformance relative to expected returns. Asset revaluation, in contrast, involves adjusting an asset's carrying amount to its fair value without necessarily indicating impairment.

Accounting Standards Governing Asset Revaluation

Accounting standards governing asset revaluation, such as IAS 16 and IFRS 13, require assets to be recorded at fair value when revalued, reflecting current market conditions. Asset impairment, governed by IAS 36, mandates recognition of an impairment loss when the recoverable amount of an asset falls below its carrying amount, ensuring assets are not overstated on the balance sheet. Revaluation increases are credited to other comprehensive income unless reversing previous impairment losses charged to profit or loss, maintaining accurate financial reporting.

Impact on Financial Statements

Asset impairment reduces the carrying amount of an asset to its recoverable value, leading to an immediate expense that decreases net income and total assets on the balance sheet. Asset revaluation adjusts the asset's carrying amount to its fair market value, which can increase or decrease the asset's value and is reflected in other comprehensive income, affecting equity rather than net income directly. Both processes impact depreciation expenses and future profitability projections but differ in their accounting treatment and timing of financial statement effects.

Reversal of Impairment Losses

Reversal of impairment losses occurs when the recoverable amount of an asset increases after a previous impairment recognition, allowing the asset's carrying amount to be adjusted up to its revised recoverable value, but never exceeding the original carrying amount before impairment. In contrast, asset revaluation involves a systematic upward or downward adjustment of an asset's carrying amount based on fair value assessments, typically conducted at regular intervals. Accounting standards like IAS 36 restrict reversals of impairment losses to prevent overstating asset values, while asset revaluations under IAS 16 ensure that asset records reflect fair market conditions.

Frequency and Timing of Revaluations

Asset impairment assessments are conducted whenever indicators suggest a decline in the recoverable amount, often triggered by market changes or operational issues, requiring immediate recognition of loss. Asset revaluation occurs at systematic intervals, typically annually or every few years, to reflect fair value adjustments under accounting standards like IAS 16. The timing of revaluations is predetermined, whereas impairment tests are event-driven and can happen at any time during the reporting period.

Disclosure Requirements for Impairment and Revaluation

Disclosure requirements for asset impairment include detailing the events or changes in circumstances leading to impairment, the amount of impairment loss recognized or reversed, and the effect on the entity's financial position and performance. For asset revaluation, entities must disclose the effective date of the revaluation, whether an independent valuer was involved, the methods and significant assumptions applied, and the carrying amount of revalued assets. Both impairment and revaluation disclosures ensure transparency in financial reporting, enabling users to assess the impact on asset values and the entity's financial health.

Strategic Implications for Asset Management

Asset impairment impacts strategic asset management by signaling a decline in asset value that necessitates immediate financial reassessment, potentially triggering write-downs and affecting investment decisions. In contrast, asset revaluation provides updated market values that can enhance balance sheet accuracy and support more informed long-term capital allocation strategies. Integrating impairment indicators with periodic revaluations ensures dynamic asset management aligned with evolving market conditions and organizational goals.

Important Terms

Fair Value Adjustment

Fair Value Adjustment distinguishes asset impairment, reflecting a decline below carrying amount, from asset revaluation, which updates asset value to current fair market price.

Carrying Amount

The carrying amount of an asset is adjusted downward to its recoverable amount during asset impairment, while asset revaluation updates the carrying amount to a fair value, which can increase or decrease the asset's book value based on market conditions.

Recoverable Amount

The recoverable amount represents the higher of an asset's fair value less costs to sell and its value in use, serving as a critical benchmark to determine impairment losses or justify asset revaluation adjustments.

Depreciated Replacement Cost

Depreciated Replacement Cost is a valuation method used primarily in asset impairment assessments to estimate the current cost to replace an asset minus accumulated depreciation, whereas asset revaluation adjusts the asset's carrying amount to its fair market value without considering replacement cost.

Write-down

Write-down reduces an asset's book value to its impaired carrying amount reflecting loss in value, whereas asset revaluation adjusts the asset's carrying amount to fair market value for accurate financial reporting.

Reversal of Impairment

Reversal of impairment refers to restoring the carrying amount of an impaired asset to its recoverable amount, contrasting with asset revaluation which adjusts asset value based on fair market value without necessarily reflecting prior impairments.

Revaluation Surplus

Revaluation surplus arises when an asset's carrying amount is increased during revaluation, contrasting with asset impairment which requires a write-down when the asset's recoverable amount falls below its carrying value.

Cash-generating Unit (CGU)

Cash-generating Unit (CGU) assessment determines asset impairment by comparing the CGU's carrying amount to its recoverable amount, whereas asset revaluation adjusts the asset's carrying amount to its fair value without necessarily indicating impairment.

Impairment Loss

Impairment loss occurs when the carrying amount of an asset exceeds its recoverable amount, contrasting with asset revaluation, which adjusts the asset's carrying value to its fair market value without necessarily indicating a permanent decline.

Revaluation Reserve

Revaluation Reserve reflects changes in an asset's carrying amount following asset revaluation, capturing increases in fair value without affecting profit or loss, whereas asset impairment results in a reduction of asset value recognized directly in profit or loss, decreasing the asset's carrying amount and impacting financial performance. The Revaluation Reserve is a component of equity that increases with upward revaluations but is not affected by impairment losses, which require immediate expense recognition.

Asset impairment vs Asset revaluation Infographic

moneydif.com

moneydif.com