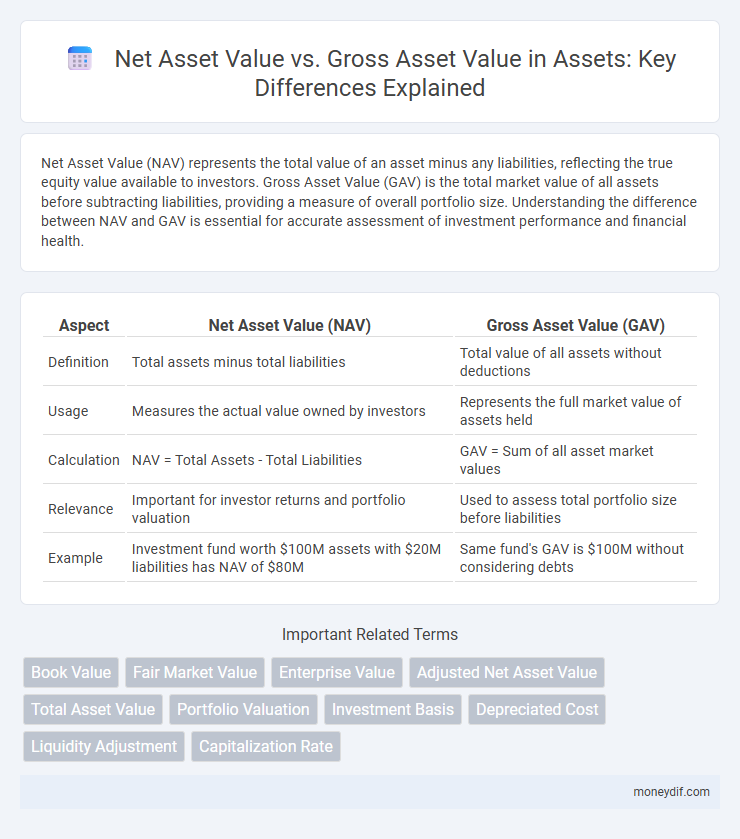

Net Asset Value (NAV) represents the total value of an asset minus any liabilities, reflecting the true equity value available to investors. Gross Asset Value (GAV) is the total market value of all assets before subtracting liabilities, providing a measure of overall portfolio size. Understanding the difference between NAV and GAV is essential for accurate assessment of investment performance and financial health.

Table of Comparison

| Aspect | Net Asset Value (NAV) | Gross Asset Value (GAV) |

|---|---|---|

| Definition | Total assets minus total liabilities | Total value of all assets without deductions |

| Usage | Measures the actual value owned by investors | Represents the full market value of assets held |

| Calculation | NAV = Total Assets - Total Liabilities | GAV = Sum of all asset market values |

| Relevance | Important for investor returns and portfolio valuation | Used to assess total portfolio size before liabilities |

| Example | Investment fund worth $100M assets with $20M liabilities has NAV of $80M | Same fund's GAV is $100M without considering debts |

Introduction to Net Asset Value (NAV) and Gross Asset Value (GAV)

Net Asset Value (NAV) represents the total value of an asset or portfolio after deducting liabilities, reflecting the actual equity value available to investors. Gross Asset Value (GAV) indicates the total market value of all assets before accounting for any debts or liabilities. Understanding the distinction between NAV and GAV is essential for accurate asset valuation and investment decision-making.

Core Definitions: Understanding NAV and GAV

Net Asset Value (NAV) represents the total value of an asset portfolio after subtracting liabilities, reflecting the true ownership value for investors. Gross Asset Value (GAV) is the sum of all asset values before any deductions, providing a comprehensive measure of total portfolio assets. Understanding NAV and GAV is crucial for accurate asset valuation, performance analysis, and investment decision-making.

Key Differences Between NAV and GAV

Net Asset Value (NAV) represents the total value of an asset or portfolio after deducting liabilities, reflecting the actual equity available to investors. Gross Asset Value (GAV) measures the sum of all asset holdings before subtracting any liabilities, providing a comprehensive picture of the asset's total market worth. Understanding the distinction between NAV and GAV is crucial for accurate asset valuation, performance assessment, and investment decision-making.

Calculating Net Asset Value: Methodology and Examples

Calculating Net Asset Value (NAV) involves subtracting total liabilities from the Gross Asset Value (GAV), which represents the sum of all assets before deductions. For example, if a fund has a GAV of $10 million and liabilities totaling $2 million, its NAV would be $8 million, reflecting the true value available to shareholders. This methodology is essential for accurate investment valuations and portfolio assessments.

Determining Gross Asset Value: Formula and Breakdown

Gross Asset Value (GAV) is determined by summing the total market value of all assets within a portfolio before deducting any liabilities. The formula for GAV is: GAV = Total Assets Market Value, which includes real estate, securities, cash, and other investments. This measure provides a comprehensive overview of the portfolio's total asset worth, serving as a baseline for calculating Net Asset Value (NAV) after liabilities are subtracted.

Importance of NAV and GAV in Asset Management

Net Asset Value (NAV) and Gross Asset Value (GAV) serve as critical metrics in asset management, with NAV representing the market value of assets minus liabilities, offering a clear picture of an investment's true worth. GAV reflects the total market value of a portfolio's assets before subtracting any liabilities, providing a broad scope of asset valuation. Understanding NAV and GAV is essential for accurately assessing fund performance, making informed investment decisions, and maintaining transparent financial reporting.

Impacts of Liabilities on NAV Versus GAV

Net Asset Value (NAV) reflects the true value of assets after subtracting liabilities, providing a more accurate measure of an entity's financial health compared to Gross Asset Value (GAV), which ignores liabilities. Liabilities directly reduce NAV, impacting investment decisions and risk assessments by revealing the actual net worth available to shareholders or investors. In contrast, GAV can overstate an entity's financial position since it does not account for obligations that diminish asset value.

NAV vs GAV: Relevance for Investors

Net Asset Value (NAV) represents the total value of a fund's assets minus its liabilities, providing investors with a clear picture of the fund's actual worth. Gross Asset Value (GAV) reflects the total market value of all assets before any liabilities are deducted, offering insight into the overall size and scale of the asset portfolio. Investors prioritize NAV over GAV for assessing fund performance and making investment decisions because NAV accounts for debts, delivering a more accurate measure of profitability and fund health.

Common Mistakes in Evaluating Asset Values

Common mistakes in evaluating asset values often arise from confusing Net Asset Value (NAV) with Gross Asset Value (GAV), where NAV excludes liabilities while GAV does not. Overlooking liabilities can inflate perceived asset performance, leading to misguided investment decisions. Accurate assessment requires clearly distinguishing between total asset holdings and net assets after deducting obligations to avoid valuation errors.

Conclusion: Choosing the Right Metric for Asset Analysis

Net Asset Value (NAV) offers a clearer picture of an asset's true value by deducting liabilities, making it essential for precise investment decisions. Gross Asset Value (GAV) highlights the total value of assets without liabilities, useful for assessing overall portfolio size. Selecting between NAV and GAV depends on whether the focus is on net worth or total asset evaluation, with NAV preferred for detailed financial analysis.

Important Terms

Book Value

Book value represents a company's net asset value, calculated as gross asset value minus liabilities, reflecting the shareholders' equity on the balance sheet.

Fair Market Value

Fair Market Value (FMV) represents the price at which an asset would trade in a competitive and open market, reflecting its current worth without discounts for liabilities. Net Asset Value (NAV) subtracts total liabilities from Gross Asset Value (GAV), providing a more accurate measure of an asset's intrinsic value by accounting for debts, whereas GAV totals all asset valuations before liabilities.

Enterprise Value

Enterprise Value (EV) reflects a company's total value by incorporating market capitalization, debt, and cash, providing a comprehensive measure beyond Net Asset Value (NAV), which represents total assets minus liabilities. In contrast, Gross Asset Value (GAV) considers the total market value of all assets without deducting liabilities, making EV a more accurate indicator of a firm's financial health and investment potential.

Adjusted Net Asset Value

Adjusted Net Asset Value refines Net Asset Value by incorporating liabilities and off-balance-sheet items, providing a more precise valuation than Gross Asset Value alone.

Total Asset Value

Total Asset Value represents the gross asset value before deducting liabilities, whereas Net Asset Value equals total assets minus total liabilities, reflecting the company's true equity worth.

Portfolio Valuation

Portfolio valuation hinges on accurately calculating Net Asset Value (NAV), which represents the total assets minus total liabilities of the portfolio, providing a realistic measure of its true worth. Gross Asset Value (GAV), encompassing the total market value of all portfolio assets before liabilities, offers insight into the overall size and investment exposure without accounting for debts or obligations.

Investment Basis

Investment basis reflects the original capital invested and is crucial for calculating returns relative to net asset value (NAV), which represents assets minus liabilities, whereas gross asset value (GAV) includes total asset value before deducting liabilities. Investors analyze NAV to understand the actual equity value of an investment, while GAV provides insight into the total market value of all assets under management.

Depreciated Cost

Depreciated cost is a valuation method that adjusts the gross asset value by deducting accumulated depreciation to reflect the net asset value, providing a more accurate measure of an asset's current worth. This approach ensures that the net asset value accounts for wear and tear, obsolescence, and usage, contrasting with the gross asset value that represents the historical cost without depreciation adjustments.

Liquidity Adjustment

Liquidity adjustment reflects the difference between net asset value (NAV) and gross asset value (GAV) by accounting for the impact of asset liquidity on portfolio valuation.

Capitalization Rate

Capitalization Rate (Cap Rate) measures the ratio of net operating income to the property's value, often derived using Net Asset Value (NAV) to reflect true profitability after liabilities, unlike Gross Asset Value (GAV), which represents the total market value before deductions. Utilizing NAV in Cap Rate calculations provides a more accurate assessment of return on investment by accounting for debt and operational costs, whereas GAV-based Cap Rates may overestimate property performance by ignoring financial obligations.

net asset value vs gross asset value Infographic

moneydif.com

moneydif.com