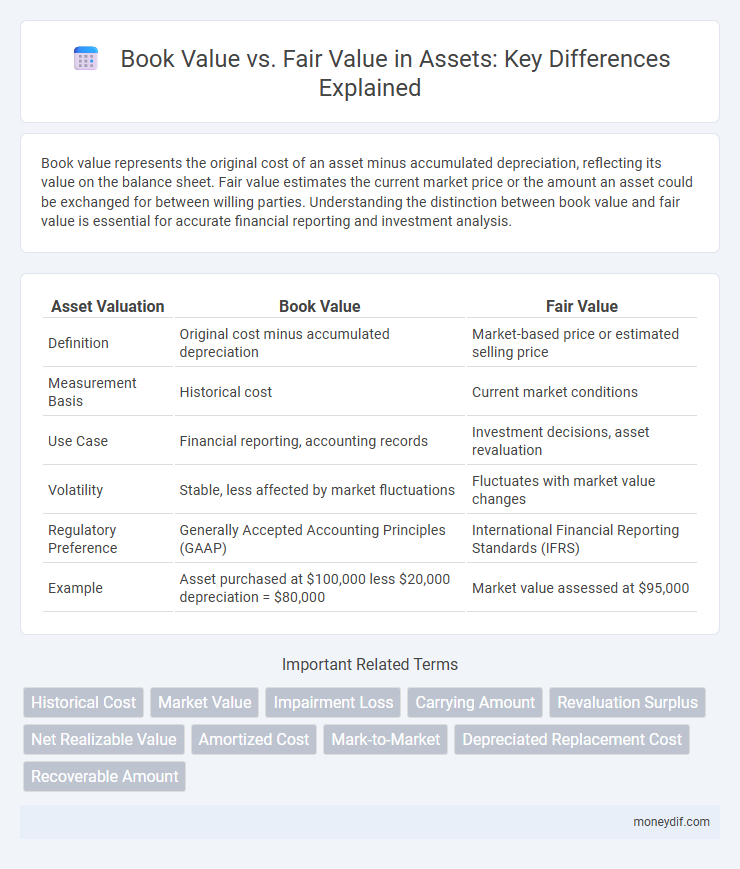

Book value represents the original cost of an asset minus accumulated depreciation, reflecting its value on the balance sheet. Fair value estimates the current market price or the amount an asset could be exchanged for between willing parties. Understanding the distinction between book value and fair value is essential for accurate financial reporting and investment analysis.

Table of Comparison

| Asset Valuation | Book Value | Fair Value |

|---|---|---|

| Definition | Original cost minus accumulated depreciation | Market-based price or estimated selling price |

| Measurement Basis | Historical cost | Current market conditions |

| Use Case | Financial reporting, accounting records | Investment decisions, asset revaluation |

| Volatility | Stable, less affected by market fluctuations | Fluctuates with market value changes |

| Regulatory Preference | Generally Accepted Accounting Principles (GAAP) | International Financial Reporting Standards (IFRS) |

| Example | Asset purchased at $100,000 less $20,000 depreciation = $80,000 | Market value assessed at $95,000 |

Introduction to Book Value and Fair Value

Book value represents the original cost of an asset minus accumulated depreciation, reflecting its accounting-based value on the balance sheet. Fair value estimates the price an asset could fetch in an orderly market transaction between knowledgeable parties at the measurement date. Understanding the distinction between book value and fair value is crucial for accurate asset valuation and informed financial decision-making.

Defining Asset Book Value

Asset book value represents the original cost of an asset minus accumulated depreciation, amortization, or impairment costs recorded on the balance sheet. It reflects the historical value of the asset as recorded in financial statements, providing a conservative estimate of the asset's worth. Book value differs from fair value, which is the estimated market price an asset could fetch in an arm's length transaction.

Defining Asset Fair Value

Asset fair value represents the price at which an asset could be exchanged between knowledgeable, willing parties in an orderly transaction. It reflects current market conditions and excludes transaction costs, providing a more accurate measure than book value, which is based on historical cost minus depreciation. Fair value is essential for financial reporting, ensuring assets are reported at amounts that correspond to their true market worth.

Key Differences Between Book Value and Fair Value

Book value represents an asset's original cost minus accumulated depreciation, reflecting historical cost on the balance sheet. Fair value measures the current market price an asset could fetch in an orderly transaction between willing parties. Unlike book value, fair value fluctuates with market conditions, offering a more accurate snapshot of an asset's real-time economic worth.

Methodologies for Calculating Book Value

Book value is calculated using historical cost accounting, where the asset's original purchase price minus accumulated depreciation determines its net value on the balance sheet. Depreciation methods such as straight-line, declining balance, or units of production are applied to allocate the asset's cost over its useful life. This approach contrasts with fair value measurement, which reflects current market conditions rather than historical costs.

Approaches to Determine Fair Value

Approaches to determine fair value of assets include the market approach, income approach, and cost approach, each providing a distinct valuation perspective. The market approach compares the asset to similar items recently sold in an active market, reflecting current market conditions. The income approach discounts expected future cash flows to present value, while the cost approach estimates the replacement cost of the asset, accounting for depreciation and obsolescence.

Impact of Market Conditions on Fair Value

Market conditions critically influence the fair value of assets by reflecting current supply and demand dynamics, which can cause significant fluctuations in valuation compared to book value. Unlike book value, which is based on historical cost minus depreciation, fair value adjusts in real-time to market sentiments, economic shifts, and regulatory changes. This dynamic ensures fair value provides a more accurate representation of an asset's current worth under prevailing market conditions.

Book Value vs Fair Value in Financial Reporting

Book value in financial reporting represents the original cost of an asset minus accumulated depreciation, reflecting its historical cost on the balance sheet. Fair value measures the asset's current market price or its estimated exit price, providing a more accurate and timely valuation that aligns with market conditions. Differences between book value and fair value impact financial statements, affecting asset impairment assessments and investment decision-making.

Implications for Investors and Stakeholders

Book value represents an asset's original cost minus depreciation, offering a conservative estimate of its worth on financial statements. Fair value reflects the current market price or an estimate based on market conditions, providing a more accurate and timely assessment of an asset's true value. Investors and stakeholders rely on fair value for informed decision-making, as it better captures potential gains or losses, whereas book value may understate the asset's economic benefit.

Practical Examples of Book Value vs Fair Value

Book value of an asset represents its original cost minus accumulated depreciation, reflecting the historical accounting value recorded on the balance sheet. Fair value, determined through market-based inputs such as recent sale prices or appraisals, indicates the current market price an asset could fetch in an orderly transaction. For example, a machinery purchased for $100,000 with $40,000 accumulated depreciation has a book value of $60,000, but if similar machinery sells in the market for $80,000, its fair value is higher, influencing financial reporting and decision-making.

Important Terms

Historical Cost

Historical cost represents the original purchase price of an asset, providing a stable, verifiable measure for book value that does not fluctuate with market conditions. Fair value reflects the current market price, offering a more dynamic but subjective assessment that adjusts an asset's value to present economic realities.

Market Value

Market value reflects the price at which an asset trades publicly, often differing from book value, which represents historical cost, and fair value, calculated using current market assumptions to estimate an asset's true worth.

Impairment Loss

Impairment loss occurs when the book value of an asset exceeds its recoverable fair value, requiring a write-down to reflect the asset's diminished worth.

Carrying Amount

Carrying Amount represents the value of an asset recorded on the balance sheet, often equated to Book Value but can differ from Fair Value, which reflects the asset's current market price.

Revaluation Surplus

Revaluation surplus arises when an asset's fair value exceeds its book value, reflecting the increase in the asset's carrying amount on the balance sheet. This surplus is recorded in equity under other comprehensive income and does not affect profit or loss until the asset is disposed of or impaired.

Net Realizable Value

Net Realizable Value represents the estimated selling price of an asset minus any costs to complete and sell, often differing from Book Value which reflects historical cost, and Fair Value which represents the asset's current market value.

Amortized Cost

Amortized cost represents an asset's initial book value adjusted for principal repayments and amortization of premiums or discounts, reflecting historical cost less any impairment, whereas fair value indicates the current market price that could be received to sell the asset, providing a more timely and relevant measurement. The comparison between amortized cost and fair value is crucial in financial reporting, influencing impairment assessments and fair value disclosures under IFRS and GAAP frameworks.

Mark-to-Market

Mark-to-Market accounting records assets and liabilities at their current fair value rather than historical book value, providing a more accurate reflection of real-time financial conditions. This method enhances transparency by aligning financial statements with market fluctuations, contrasting with book value which represents original cost minus depreciation.

Depreciated Replacement Cost

Depreciated Replacement Cost measures an asset's value based on the current cost to replace it minus depreciation, providing a method to assess Book Value when Fair Value is not reliably available.

Recoverable Amount

Recoverable amount represents the higher value between an asset's fair value less costs of disposal and its value in use, ensuring accurate impairment assessment against the book value. When the book value exceeds the recoverable amount, an impairment loss must be recognized to align the carrying amount with the asset's true economic benefit.

Book Value vs Fair Value Infographic

moneydif.com

moneydif.com