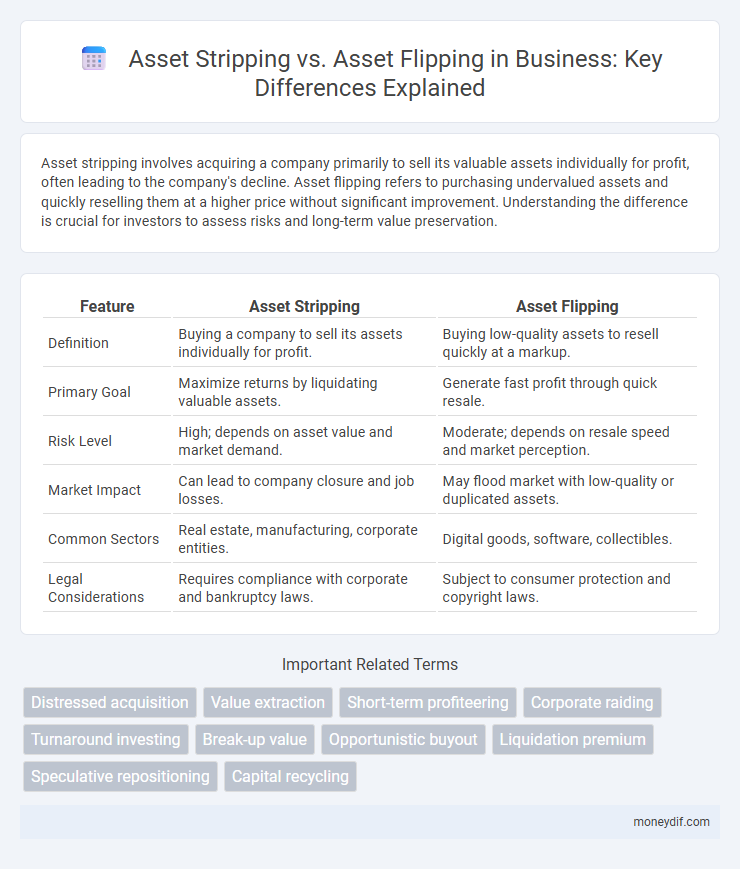

Asset stripping involves acquiring a company primarily to sell its valuable assets individually for profit, often leading to the company's decline. Asset flipping refers to purchasing undervalued assets and quickly reselling them at a higher price without significant improvement. Understanding the difference is crucial for investors to assess risks and long-term value preservation.

Table of Comparison

| Feature | Asset Stripping | Asset Flipping |

|---|---|---|

| Definition | Buying a company to sell its assets individually for profit. | Buying low-quality assets to resell quickly at a markup. |

| Primary Goal | Maximize returns by liquidating valuable assets. | Generate fast profit through quick resale. |

| Risk Level | High; depends on asset value and market demand. | Moderate; depends on resale speed and market perception. |

| Market Impact | Can lead to company closure and job losses. | May flood market with low-quality or duplicated assets. |

| Common Sectors | Real estate, manufacturing, corporate entities. | Digital goods, software, collectibles. |

| Legal Considerations | Requires compliance with corporate and bankruptcy laws. | Subject to consumer protection and copyright laws. |

Introduction to Asset Stripping and Asset Flipping

Asset stripping involves acquiring a company primarily to sell its valuable assets individually for profit, often leading to the disintegration of the original business structure. Asset flipping refers to quickly purchasing assets or properties and reselling them at a higher price with minimal or superficial improvements. Both strategies focus on capitalizing on asset value but differ significantly in execution and impact on the underlying entity.

Defining Asset Stripping: Core Principles

Asset stripping involves acquiring a company primarily to sell off its valuable assets separately, maximizing short-term financial gains often at the expense of the original business's operational continuity. Core principles include identifying undervalued assets, restructuring ownership, and prioritizing asset liquidation over long-term business development. This practice contrasts with asset flipping, which focuses on quickly buying and reselling assets for profit without fundamentally altering the asset base.

Understanding Asset Flipping: Key Concepts

Asset flipping involves acquiring existing assets, often low-cost or undervalued properties or investments, and quickly reselling them at a profit with minimal improvements. This practice contrasts with asset stripping, which focuses on breaking down an asset to sell its individual components separately for value extraction. Understanding asset flipping requires recognizing its reliance on market timing, demand forecasting, and rapid transaction capabilities to capitalize on short-term asset appreciation.

Historical Contexts of Asset Stripping and Flipping

Asset stripping emerged prominently during the 1980s corporate takeover waves, where investors targeted undervalued companies to sell off valuable assets for quick profits. Asset flipping, rooted in real estate markets, gained traction in the early 2000s, focusing on rapid buying and reselling of properties with minimal value addition. Both practices reflect strategic exploitation of market inefficiencies but differ in asset types and operational scales.

Motivations Behind Asset Stripping

Asset stripping involves acquiring a company primarily to sell off its valuable assets individually, motivated by maximizing immediate financial returns rather than long-term business growth. Investors target underperforming firms with substantial tangible assets like real estate, equipment, or intellectual property that can be liquidated for profit. This contrasts with asset flipping, where assets are quickly bought and resold at a higher price, driven by short-term capital gains instead of asset liquidation strategies.

Goals and Strategies in Asset Flipping

Asset flipping involves acquiring undervalued or underutilized assets with the goal of quickly improving and reselling them for profit, utilizing strategies such as rapid renovation, rebranding, or repackaging to increase market appeal. The emphasis in asset flipping is on short-term value maximization through strategic enhancements rather than long-term value extraction seen in asset stripping. Key tactics include leveraging market trends, optimizing asset visibility, and implementing cost-effective improvements to accelerate turnover and maximize return on investment.

Impact on Stakeholders: Employees, Shareholders, and Communities

Asset stripping often leads to significant job losses and diminished morale among employees, while shareholders may experience short-term financial gains at the expense of long-term value. Communities suffer from reduced economic activity and social instability due to the closure or downsizing of local operations. In contrast, asset flipping can create mixed outcomes by quickly reallocating resources, sometimes preserving jobs and shareholder value but risking community disruption if done without strategic consideration.

Legal and Ethical Dimensions

Asset stripping involves the legal acquisition and subsequent selling of a company's valuable assets, often leading to the original business's decline, raising ethical concerns about shareholder and employee harm. Asset flipping, commonly seen in real estate or digital domains, entails rapid resale of assets at inflated prices with minimal improvement, triggering legal scrutiny for potential fraud or misrepresentation. Both practices require careful navigation of contract law, fiduciary duties, and regulatory frameworks to avoid violations and uphold ethical standards in asset management.

Economic Consequences and Market Perceptions

Asset stripping often leads to short-term financial gains by selling off valuable components, which can result in long-term economic decline and reduced company value. Asset flipping tends to generate rapid transactional profits but risks harming market perceptions due to perceived lack of sustainable business practices. Both strategies impact investor confidence and can destabilize market valuations through altered asset integrity and operational performance.

Asset Stripping vs. Asset Flipping: Key Differences and Future Trends

Asset stripping involves acquiring companies primarily to sell off valuable assets for profit, often leading to workforce reductions and diminished company value, while asset flipping focuses on quickly reselling assets, typically real estate or digital assets, for short-term gains without long-term investment. Key differences lie in the strategic intent and operational impact, with asset stripping causing significant structural changes versus asset flipping's transactional nature. Future trends indicate increased regulatory scrutiny on asset stripping practices, whereas asset flipping is poised to grow with emerging markets and digital asset platforms.

Important Terms

Distressed acquisition

Distressed acquisition often involves asset stripping, where valuable assets are sold off to repay creditors, while asset flipping focuses on quickly reselling acquired assets at a profit without significant operational changes.

Value extraction

Value extraction involves maximizing returns by selectively acquiring and monetizing assets, where asset stripping focuses on dismantling and selling valuable components, while asset flipping entails quickly reselling assets at a profit without significant alteration.

Short-term profiteering

Short-term profiteering through asset stripping involves rapidly selling off valuable company assets for immediate gain, whereas asset flipping focuses on quickly buying and reselling assets at a higher price for fast profit.

Corporate raiding

Corporate raiding involves acquiring a company primarily to extract value through methods such as asset stripping, which entails selling off valuable assets to repay debts or profit at the expense of long-term growth, whereas asset flipping focuses on rapidly buying and selling companies or assets to capitalize on short-term market opportunities without substantial operational changes. Both practices can significantly impact shareholder value and corporate stability, with asset stripping often leading to workforce reductions and diminished company infrastructure.

Turnaround investing

Turnaround investing focuses on revitalizing financially distressed companies by restructuring operations and improving cash flow, contrasting with asset stripping which involves selling off valuable company assets for immediate profit. Unlike asset flipping, where assets are quickly bought and resold for short-term gains, turnaround investing aims for sustainable long-term value creation through strategic business recovery.

Break-up value

Break-up value in asset stripping refers to the total resale value of a company's individual assets when sold separately, often exceeding the firm's market value, whereas asset flipping involves quickly reselling acquired assets for a profit with minimal modification.

Opportunistic buyout

Opportunistic buyouts exploit undervalued companies through aggressive asset stripping, rapidly selling off valuable assets to maximize short-term gains. In contrast, asset flipping involves acquiring businesses to quickly resell them at a profit without significantly dismantling core assets, focusing on market timing and valuation arbitrage.

Liquidation premium

Liquidation premium reflects the additional value investors may pay for acquiring undervalued assets during asset stripping, contrasting with asset flipping where quick resale aims at short-term profit without significant asset value enhancement.

Speculative repositioning

Speculative repositioning involves acquiring undervalued properties for asset flipping by rapidly upgrading and reselling, whereas asset stripping focuses on dismantling and selling individual components to maximize short-term gains.

Capital recycling

Capital recycling involves strategically selling underperforming or non-core assets to generate funds for reinvestment, contrasting with asset stripping, which focuses on extracting maximum value by liquidating asset components often leading to long-term decline. Unlike asset flipping that quickly sells assets for profit with minimal value addition, capital recycling emphasizes sustainable portfolio optimization and improved capital efficiency.

Asset stripping vs Asset flipping Infographic

moneydif.com

moneydif.com