Asset swaps involve exchanging one asset for another, often to adjust portfolio risk or improve liquidity without changing the total value. Asset sales refer to selling assets outright to generate cash or exit an investment, which can impact balance sheets and trigger tax consequences. Understanding these approaches helps businesses optimize financial outcomes and align with strategic goals.

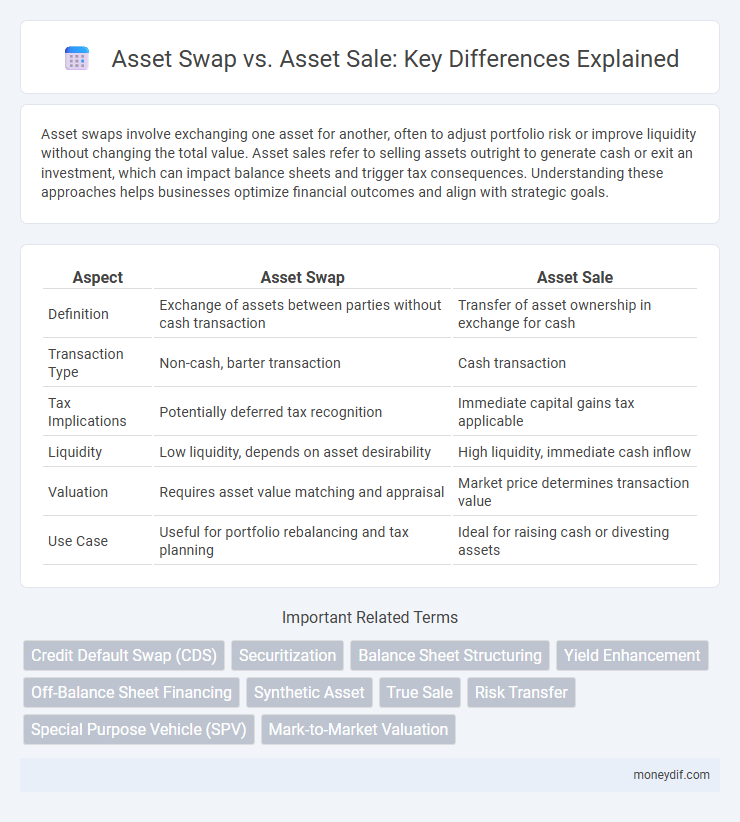

Table of Comparison

| Aspect | Asset Swap | Asset Sale |

|---|---|---|

| Definition | Exchange of assets between parties without cash transaction | Transfer of asset ownership in exchange for cash |

| Transaction Type | Non-cash, barter transaction | Cash transaction |

| Tax Implications | Potentially deferred tax recognition | Immediate capital gains tax applicable |

| Liquidity | Low liquidity, depends on asset desirability | High liquidity, immediate cash inflow |

| Valuation | Requires asset value matching and appraisal | Market price determines transaction value |

| Use Case | Useful for portfolio rebalancing and tax planning | Ideal for raising cash or divesting assets |

Introduction to Asset Swap and Asset Sale

An asset swap involves exchanging one asset for another, often to optimize portfolio performance or manage risk without liquidating holdings, while an asset sale refers to the outright sale of an asset to monetize investment or reallocate capital. Asset swaps are common in fixed income markets where investors trade bonds to adjust duration or credit exposure, whereas asset sales typically occur in real estate, businesses, or financial instruments to generate immediate cash flow. Understanding the strategic implications of asset swaps and asset sales aids in effective asset management and investment decision-making.

Key Differences Between Asset Swap and Asset Sale

An asset swap involves exchanging financial assets, such as bonds or loans, between parties to optimize portfolio characteristics or manage risk, without transferring ownership of the underlying assets. In contrast, an asset sale entails a complete transfer of ownership rights of tangible or intangible assets from the seller to the buyer, often involving legal title and associated liabilities. Key differences include the nature of the transaction--swap is typically a derivative contract without transferring the actual asset, whereas a sale results in full ownership change and possible tax implications.

Advantages of Asset Swap

Asset swaps offer significant advantages, including tax efficiency by deferring capital gains taxes compared to immediate asset sales. They enable portfolio diversification without liquidating assets, preserving market positions and reducing transaction costs. Furthermore, asset swaps facilitate tailored risk management by aligning asset classes more closely with investment objectives.

Benefits of Asset Sale

An asset sale allows buyers to selectively acquire specific assets and liabilities, minimizing exposure to unknown or contingent liabilities, which can reduce risk significantly. Sellers benefit from potential tax advantages, as gains from asset sales may be allocated across various asset classes, possibly resulting in favorable tax treatment. This structure also provides clearer title transfer and greater flexibility in negotiating terms related to included assets, enhancing transaction clarity and control.

Legal Considerations in Asset Swap vs Asset Sale

Legal considerations in an asset swap involve complex transfer agreements, regulatory compliance for both parties, and potential tax implications related to the exchange of assets without cash involvement. In contrast, an asset sale typically requires clear title transfers, adherence to local sales laws, and may trigger immediate tax liabilities due to the sale proceeds. Both transactions demand thorough due diligence to assess liabilities, warranties, and the enforceability of contractual terms under jurisdiction-specific regulations.

Tax Implications of Asset Swap and Asset Sale

Tax implications of an asset swap often involve deferred capital gains taxes due to the exchange's qualifying like-kind property status, allowing asset owners to postpone tax recognition. In contrast, an asset sale typically triggers immediate tax liabilities, including capital gains and ordinary income taxes based on the sale proceeds and asset basis. Careful consideration of depreciation recapture rules and local tax regulations is essential to optimize tax outcomes in both asset swaps and sales.

Asset Valuation Strategies

Asset valuation strategies differ significantly between asset swaps and asset sales, with swaps requiring comparative market analysis to assess relative value equivalence, while sales depend on absolute valuation metrics such as discounted cash flow or appraised market value. Accurate valuation in asset swaps hinges on aligning the fair market value of exchanged assets to ensure equitable transaction terms without direct monetary exchange. In asset sales, prioritizing liquidity, future income potential, and market trends are critical to maximizing sale proceeds and optimizing financial outcomes.

Risk Assessment in Asset Transactions

Risk assessment in asset swap transactions requires analyzing the potential volatility and valuation discrepancies between exchanged assets, as parties must account for market fluctuations and liquidity risks. In asset sales, the primary risk centers on accurately determining the asset's fair market value and potential liabilities, including hidden defects or encumbrances that may affect the sale price. Both transactions demand thorough due diligence, but asset swaps typically involve higher complexity in risk evaluation due to the simultaneous exchange of differing asset types.

When to Choose Asset Swap Over Asset Sale

Choose an asset swap over an asset sale when the goal is to restructure investment portfolios without incurring significant capital gains taxes or liquidity events. Asset swaps are ideal for maintaining asset control while achieving diversification or liability matching in fixed income portfolios. This approach suits institutional investors seeking tax efficiency and strategic portfolio realignment without the immediate cash flow demands of a sale.

Case Studies: Real-World Examples of Asset Swap and Asset Sale

Asset swap case studies often highlight financial institutions exchanging loan portfolios to optimize balance sheets and manage risk exposure, as seen in Barclays' strategic swaps in 2020, enhancing capital efficiency without asset liquidation. In contrast, asset sale examples such as General Electric's 2018 disposal of its biopharma unit illustrate how companies monetize non-core assets to streamline operations and raise cash for debt reduction or reinvestment. Real-world scenarios demonstrate that asset swaps are preferred for maintaining operational continuity, while asset sales provide immediate liquidity and simplification of business focus.

Important Terms

Credit Default Swap (CDS)

Credit Default Swaps (CDS) serve as financial derivatives that provide protection against credit risk, often used in asset swaps to hedge or transfer the credit exposure of fixed-income securities without the sale of the underlying asset. Unlike asset sales, which involve outright transfer of ownership, asset swaps combined with CDS enable investors to isolate and manage credit risk while retaining the underlying bond, enhancing liquidity and risk management flexibility.

Securitization

Securitization involves transforming financial assets into marketable securities, where asset swaps exchange cash flow characteristics without transferring ownership, whereas asset sales transfer ownership by selling the underlying assets outright. Asset swaps optimize risk and return profiles through synthetic adjustments, while asset sales provide liquidity and remove assets from the balance sheet.

Balance Sheet Structuring

Balance Sheet structuring optimizes financial stability by comparing Asset Swaps, which adjust asset compositions while maintaining ownership, versus Asset Sales that convert assets to cash and reduce balance sheet size.

Yield Enhancement

Yield enhancement through asset swaps involves exchanging fixed-income securities to capture better interest rate spreads without altering the asset's ownership, while asset sales directly generate cash by transferring the asset, potentially realizing capital gains or losses. Asset swaps offer flexibility and ongoing yield management, whereas asset sales provide immediate liquidity but eliminate future yield potential from the sold asset.

Off-Balance Sheet Financing

Off-balance sheet financing enables companies to keep certain assets and liabilities off their balance sheets through methods like asset swaps, which involve exchanging assets without impacting reported debt levels, unlike asset sales that transfer ownership and recognize the transaction on the balance sheet. Asset swaps help maintain financial ratios by avoiding immediate capital gains or losses, whereas asset sales provide liquidity but directly affect the company's financial statements and debt metrics.

Synthetic Asset

Synthetic assets replicate the risk and return profile of underlying assets through derivatives, enabling asset swaps to exchange financial risks without transferring ownership, unlike asset sales which involve the actual transfer of asset ownership.

True Sale

A true sale legally transfers asset ownership, distinguishing it from an asset swap where assets are exchanged but ownership rights remain unaffected.

Risk Transfer

Risk transfer in asset swaps involves exchanging cash flow risks without changing asset ownership, whereas asset sales transfer both ownership and associated risks to the buyer.

Special Purpose Vehicle (SPV)

A Special Purpose Vehicle (SPV) serves as a legal entity created to isolate financial risk and facilitate transactions such as asset swaps or asset sales by holding specific assets or liabilities. In an asset swap, the SPV enables parties to exchange cash flows or asset exposures without transferring ownership outright, while in an asset sale, the SPV manages the transfer of ownership and associated legal rights of the assets to the buyer.

Mark-to-Market Valuation

Mark-to-Market Valuation assesses the current market value of financial assets or liabilities, providing real-time pricing that reflects market conditions. In an Asset Swap, this valuation method helps determine the fair value exchanged between parties, whereas in an Asset Sale, it establishes the accurate sale price based on prevailing market rates.

Asset Swap vs Asset Sale Infographic

moneydif.com

moneydif.com