Prepaid expenses represent payments made in advance for goods or services to be received in the future, such as insurance premiums or rent, which are recorded as assets until they are recognized as expenses over time. Deferred expenses, often used interchangeably with prepaid expenses, specifically refer to costs that have been incurred but are capitalized and amortized over a period that matches the benefit derived. Understanding the distinction helps in accurately matching expenses to the correct accounting periods, ensuring precise financial reporting and analysis.

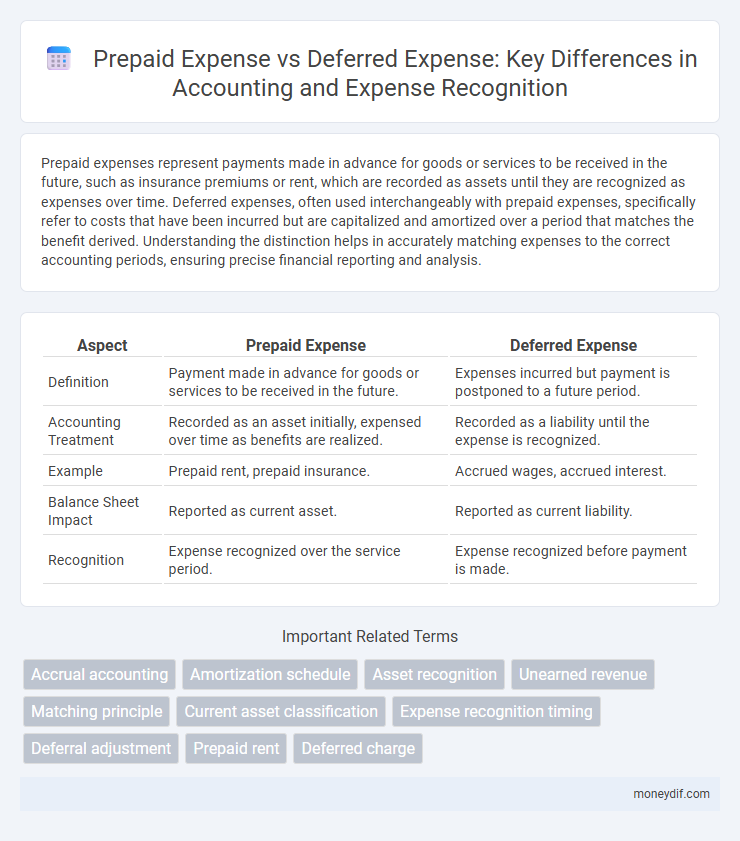

Table of Comparison

| Aspect | Prepaid Expense | Deferred Expense |

|---|---|---|

| Definition | Payment made in advance for goods or services to be received in the future. | Expenses incurred but payment is postponed to a future period. |

| Accounting Treatment | Recorded as an asset initially, expensed over time as benefits are realized. | Recorded as a liability until the expense is recognized. |

| Example | Prepaid rent, prepaid insurance. | Accrued wages, accrued interest. |

| Balance Sheet Impact | Reported as current asset. | Reported as current liability. |

| Recognition | Expense recognized over the service period. | Expense recognized before payment is made. |

Understanding Prepaid Expenses

Prepaid expenses refer to payments made in advance for goods or services to be received in the future, such as insurance premiums or rent. These expenses are recorded as assets on the balance sheet and gradually recognized as expenses over the period they benefit. Properly tracking prepaid expenses is crucial for accurate financial reporting and matching expenses to the appropriate accounting period.

What Are Deferred Expenses?

Deferred expenses, also known as prepaid expenses, represent payments made for goods or services to be received in the future, recorded as assets on the balance sheet until they are recognized as expenses. Unlike immediate expenses, deferred expenses are amortized over their useful period, matching costs with the revenues they help generate. Examples include prepaid insurance, rent, and subscriptions, which are initially recorded as assets and systematically expensed over time.

Key Differences Between Prepaid and Deferred Expenses

Prepaid expenses are payments made in advance for goods or services to be received in the future, classified as current assets on the balance sheet until they are expensed. Deferred expenses refer to costs that have been incurred but are not yet recognized as expenses since the related benefits will be realized in future periods. The key difference lies in timing and recognition: prepaid expenses represent future economic benefits paid ahead, while deferred expenses represent already incurred costs awaiting expense recognition.

Recognition in Financial Statements

Prepaid expenses are recognized as assets on the balance sheet until the related benefit is realized, at which point they are expensed on the income statement over the appropriate period. Deferred expenses represent costs that have been incurred but are not yet recognized as expenses, remaining initially recorded as liabilities or assets depending on the nature of the transaction. Accurate recognition in financial statements ensures proper matching of expenses with revenues, complying with accrual accounting principles and enhancing financial statement reliability.

Accounting Treatment: Prepaid vs. Deferred Expenses

Prepaid expenses are payments made in advance for goods or services to be received in the future and are recorded as assets until they are expensed over time, aligning with the matching principle. Deferred expenses, often similar to prepaid expenses, represent costs incurred but recognized as expenses in future periods, commonly seen in deferred charges or prepaid costs amortized systematically. The accounting treatment involves initially recording these costs as assets on the balance sheet and subsequently expensing them in the income statement when the related benefit is realized.

Common Examples in Business

Prepaid expenses commonly include insurance premiums, rent, and subscriptions paid in advance, while deferred expenses often consist of costs related to advertising campaigns, research and development, and software development fees recognized over time. Businesses categorize prepaid expenses as assets on the balance sheet until the benefit is realized, contrasting with deferred expenses that delay recognition of costs to match revenue generation periods. Accurate accounting for these expenses ensures compliance with accrual accounting principles and improves financial reporting transparency.

Importance in Managing Cash Flow

Prepaid expenses represent payments made in advance for goods or services, directly impacting cash flow by reducing available cash upfront while ensuring future benefits. Deferred expenses, recorded as liabilities until recognized as expenses over time, help smooth out cash flow by aligning costs with revenue periods. Effectively managing both prepaid and deferred expenses is crucial for maintaining accurate financial statements and optimizing cash flow stability.

Impact on Profit and Loss

Prepaid expenses represent payments made in advance for goods or services, recorded as assets and expensed over time, leading to a gradual impact on profit and loss as the benefit is realized. Deferred expenses involve costs incurred but not yet recognized in the profit and loss statement, delaying the expense recognition to match revenue periods and improve income statement accuracy. Proper classification of prepaid and deferred expenses ensures precise matching of expenses with revenues, directly affecting net income and financial performance reporting.

Best Practices for Recording Expenses

Prepaid expenses, such as insurance premiums or rent paid in advance, should be recorded as assets initially and expensed systematically over the benefit period to match revenue recognition accurately. Deferred expenses require clear documentation and periodic review to ensure timely amortization aligns with the incurred economic benefits, preventing misstated financial statements. Best practices include maintaining detailed schedules, applying consistent amortization methods, and ensuring compliance with relevant accounting standards like GAAP or IFRS.

Frequently Asked Questions (FAQs)

Prepaid expenses refer to payments made in advance for goods or services to be received in the future, such as prepaid insurance or rent, and are recorded as assets until consumed. Deferred expenses, often used interchangeably with prepaid expenses, specifically highlight costs allocated over time on the income statement rather than immediately expensed, reflecting the matching principle. Common FAQs address the timing differences in recognition, proper accounting treatment, examples, and impact on financial statements.

Important Terms

Accrual accounting

Accrual accounting records prepaid expenses as assets on the balance sheet until the associated benefits are realized, ensuring expenses are matched with the corresponding revenue period. Deferred expenses represent costs paid in advance that are initially recorded as assets and systematically expensed over time to reflect consumption or usage.

Amortization schedule

An amortization schedule systematically allocates prepaid expenses, such as insurance premiums, over their useful period, ensuring accurate expense recognition aligned with revenue generation. Deferred expenses, recorded as liabilities, are gradually amortized on the schedule to match accounting periods when the related benefits are consumed, enhancing financial statement accuracy.

Asset recognition

Asset recognition involves identifying and recording prepaid expenses as current assets on the balance sheet, reflecting payments made in advance for goods or services to be received in the future. Deferred expenses represent costs that are capitalized and expensed over multiple accounting periods, ensuring accurate matching of expenses with related revenues to comply with accrual accounting principles.

Unearned revenue

Unearned revenue represents funds received before delivering goods or services, contrasting with prepaid expenses, which involve payments made in advance for future benefits, and deferred expenses, costs recognized later than when they were incurred. Both prepaid and deferred expenses are asset accounts that reflect timing differences in expense recognition, while unearned revenue is a liability indicating obligations owed to customers.

Matching principle

The matching principle requires expenses to be recorded in the same accounting period as the revenues they help generate, which affects the treatment of prepaid expenses by recognizing them as assets initially and expensing them over time. Deferred expenses, a type of prepaid expense, are allocated gradually to match the periods benefiting from the expense, ensuring accurate financial reporting and compliance with accrual accounting.

Current asset classification

Current asset classification includes prepaid expenses, which represent payments made in advance for goods or services to be received within one year, whereas deferred expenses are costs that are capitalized and expensed over multiple periods, often classified under long-term assets. Prepaid expenses directly reduce current liabilities as they are consumed, while deferred expenses impact financial statements gradually through amortization or allocation.

Expense recognition timing

Expense recognition timing differentiates prepaid expenses, where costs are paid in advance and recognized as expenses over time as the benefits are realized, from deferred expenses, which involve costs incurred but not yet recognized as expenses until future periods. Accurate timing ensures compliance with the matching principle and improves financial statement reliability by aligning expenses with corresponding revenue periods.

Deferral adjustment

Deferral adjustment involves shifting expenses to future periods to match revenues, where prepaid expenses represent payments made in advance for services or goods, recorded as assets initially; deferred expenses refer to costs recognized as expenses over time as the related benefits are realized. Accurate deferral adjustments ensure prepaid expenses are amortized properly while deferred expenses reflect the correct accounting period, maintaining financial statement integrity.

Prepaid rent

Prepaid rent is classified as a prepaid expense, representing an advance payment for occupying a leased property before the rental period begins, while deferred expenses refer more broadly to costs that are capitalized and expensed over time, such as insurance or advertising. Recording prepaid rent as an asset on the balance sheet ensures accurate matching of rental costs to the appropriate accounting periods, distinguishing it from other deferred expenses that may have different recognition timelines.

Deferred charge

Deferred charge refers to payments recorded as assets because the company expects to receive future benefits, distinguishing it from prepaid expenses, which are advance payments for services or goods consumed within a short period. Deferred expenses are ongoing costs capitalized on the balance sheet and amortized over time, whereas prepaid expenses are expensed as incurred typically within one year.

Prepaid expense vs Deferred expense Infographic

moneydif.com

moneydif.com