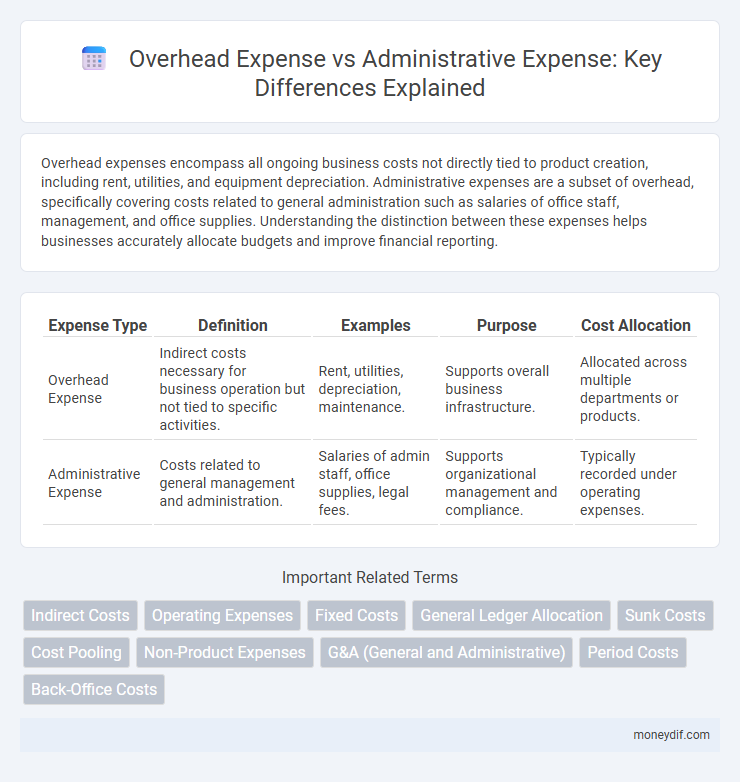

Overhead expenses encompass all ongoing business costs not directly tied to product creation, including rent, utilities, and equipment depreciation. Administrative expenses are a subset of overhead, specifically covering costs related to general administration such as salaries of office staff, management, and office supplies. Understanding the distinction between these expenses helps businesses accurately allocate budgets and improve financial reporting.

Table of Comparison

| Expense Type | Definition | Examples | Purpose | Cost Allocation |

|---|---|---|---|---|

| Overhead Expense | Indirect costs necessary for business operation but not tied to specific activities. | Rent, utilities, depreciation, maintenance. | Supports overall business infrastructure. | Allocated across multiple departments or products. |

| Administrative Expense | Costs related to general management and administration. | Salaries of admin staff, office supplies, legal fees. | Supports organizational management and compliance. | Typically recorded under operating expenses. |

Understanding Overhead and Administrative Expenses

Overhead expenses encompass all indirect costs required to run a business, such as rent, utilities, and depreciation, while administrative expenses specifically relate to the cost of general management and administration, including salaries of executive staff and office supplies. Differentiating between overhead and administrative expenses is essential for accurate financial reporting and cost control, as both impact a company's profitability and budgeting decisions. Proper classification ensures precise expense tracking and helps businesses identify areas for operational efficiency improvements.

Defining Overhead Expenses

Overhead expenses encompass all ongoing business costs not directly tied to specific products or services, such as rent, utilities, and equipment depreciation, essential for maintaining operational infrastructure. Administrative expenses, a subset of overhead, specifically cover costs related to general management and support functions, including salaries of administrative staff and office supplies. Understanding overhead expenses helps businesses accurately allocate indirect costs, ensuring precise financial analysis and budgeting.

What Are Administrative Expenses?

Administrative expenses refer to the costs incurred to manage and support the overall operations of a business, excluding direct production and sales activities. These expenses typically include salaries of administrative staff, office supplies, rent, utilities, and depreciation of office equipment. Unlike overhead expenses that may cover broader indirect costs, administrative expenses specifically relate to general management and organizational functions.

Key Differences Between Overhead and Administrative Expenses

Overhead expenses encompass all indirect costs necessary for running a business, such as rent, utilities, and maintenance, while administrative expenses specifically refer to costs related to the general administration and management functions, like salaries of administrative staff and office supplies. Overhead includes both administrative expenses and production-supporting costs, making administrative expenses a subset of overhead. Understanding the distinction helps in precise budgeting and financial analysis, ensuring accurate allocation of expenses for profitability assessment.

Examples of Overhead vs Administrative Costs

Overhead expenses include costs such as rent, utilities, and equipment depreciation that support overall business operations but are not tied to specific departments. Administrative expenses encompass salaries of executive staff, office supplies, and legal fees, reflecting costs directly related to company management. Distinguishing between overhead and administrative costs helps in precise budgeting and financial analysis for operational efficiency.

Impact on Financial Statements

Overhead expenses, including utilities and rent, are allocated to the cost of goods sold, directly influencing gross profit margins on the income statement. Administrative expenses, such as salaries of office staff and office supplies, appear as operating expenses, reducing operating income without affecting cost of goods sold. Both expense types impact net income but differ in classification, affecting financial analysis and decision-making related to operational efficiency and cost control.

Allocation Methods for Overhead and Administrative Expenses

Overhead expenses are allocated using methods such as activity-based costing, direct labor hours, or machine hours to accurately assign indirect costs to products or departments. Administrative expenses allocation often relies on proportionate metrics like departmental headcount, revenue generation, or floor space to distribute costs related to management and general operations. Precise allocation methods improve cost control, ensure accurate financial reporting, and support strategic decision-making in budgeting and performance analysis.

Importance in Budget Planning

Overhead expenses and administrative expenses are critical components in budget planning, directly influencing the accuracy of financial forecasts. Proper classification and analysis of these costs enable businesses to allocate resources efficiently and identify potential areas for cost reduction. Understanding the distinction between fixed overhead costs and flexible administrative expenses supports strategic decision-making and enhances overall financial control.

Strategies to Manage Overhead and Administrative Costs

Effective strategies to manage overhead and administrative expenses include implementing strict budget controls, automating routine administrative tasks, and regularly analyzing expense reports for cost-saving opportunities. Leveraging technology such as cloud-based accounting software reduces manual labor and improves accuracy, while renegotiating vendor contracts and consolidating office space can decrease overhead costs. Prioritizing these approaches enhances operational efficiency and contributes to sustainable financial management.

Overhead vs Administrative Expenses: Common Misconceptions

Overhead expenses encompass all ongoing costs required to operate a business, including rent, utilities, and maintenance, while administrative expenses specifically relate to costs associated with managing the company, such as salaries of executives and office supplies. A common misconception is that all overhead expenses are administrative, but overhead also covers production-related indirect costs like factory rent and equipment depreciation. Understanding the distinction helps businesses accurately allocate expenses for financial reporting and cost control.

Important Terms

Indirect Costs

Indirect costs encompass overhead expenses such as rent, utilities, and equipment maintenance that support overall business operations but are not directly tied to specific projects, while administrative expenses include salaries of management personnel, office supplies, and other costs associated with general administration and organizational management. Differentiating overhead from administrative expenses is essential for accurate cost allocation and financial reporting in budgeting and project cost control.

Operating Expenses

Operating expenses include both overhead and administrative expenses, where overhead expenses cover indirect costs like rent, utilities, and maintenance essential for daily business functions. Administrative expenses specifically relate to costs associated with the general management and support services, such as salaries of administrative staff, office supplies, and legal fees.

Fixed Costs

Fixed costs include overhead expenses such as rent and utilities that support overall business operations, while administrative expenses encompass salaries and office supplies related to management and general administration. Both overhead and administrative expenses remain constant regardless of production levels, directly impacting the company's fixed cost structure.

General Ledger Allocation

General Ledger Allocation involves distributing overhead expenses, such as utilities and rent, to various cost centers based on predetermined drivers, ensuring accurate expense tracking and cost control. Administrative expenses, including salaries of management and office supplies, are allocated separately to reflect non-production-related costs for precise financial reporting and budgeting.

Sunk Costs

Sunk costs are past expenses that cannot be recovered and should not influence future financial decisions, often associated with overhead expenses such as rent or utilities that remain fixed regardless of administrative activities. Administrative expenses, while part of overhead, include costs directly tied to managing the business, like salaries of office staff, and should be evaluated separately when considering sunk costs in budgeting and cost control.

Cost Pooling

Cost pooling groups overhead expenses, such as utilities and maintenance, separately from administrative expenses like managerial salaries and office supplies to enhance cost allocation accuracy. Differentiating between these cost pools enables more precise tracking and management of organizational costs for budgeting and financial analysis.

Non-Product Expenses

Non-product expenses encompass costs not directly tied to production, primarily including overhead expenses such as utilities, rent, and maintenance, alongside administrative expenses covering salaries, office supplies, and management costs. Overhead expenses support the overall operational infrastructure, while administrative expenses focus specifically on the organizational and executive activities required for company management.

G&A (General and Administrative)

G&A (General and Administrative expenses) encompass both overhead and administrative costs, where overhead typically includes indirect expenses such as rent, utilities, and office supplies, while administrative expenses cover salaries of management, accounting, and human resources personnel. Distinguishing between overhead and administrative expenses enables precise budgeting and financial analysis, crucial for optimizing operational efficiency and cost control.

Period Costs

Period costs include overhead expenses and administrative expenses, both recorded as operating expenses in the income statement and not assigned to product costs. Overhead expenses primarily involve indirect manufacturing costs such as factory rent and utilities, while administrative expenses encompass general business costs like office salaries and office supplies.

Back-Office Costs

Back-office costs primarily encompass administrative expenses, which include salaries, office supplies, and utilities necessary to support internal operations, whereas overhead expenses refer to ongoing business costs not directly tied to specific projects, such as rent, depreciation, and insurance. Distinguishing between overhead and administrative expenses helps optimize financial management by accurately allocating indirect costs and improving overall budget control.

overhead expense vs administrative expense Infographic

moneydif.com

moneydif.com