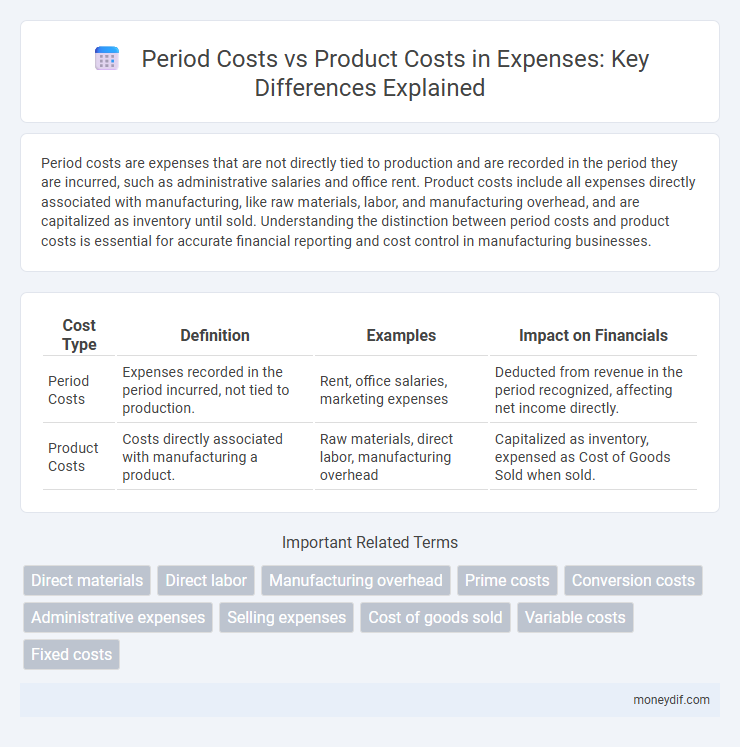

Period costs are expenses that are not directly tied to production and are recorded in the period they are incurred, such as administrative salaries and office rent. Product costs include all expenses directly associated with manufacturing, like raw materials, labor, and manufacturing overhead, and are capitalized as inventory until sold. Understanding the distinction between period costs and product costs is essential for accurate financial reporting and cost control in manufacturing businesses.

Table of Comparison

| Cost Type | Definition | Examples | Impact on Financials |

|---|---|---|---|

| Period Costs | Expenses recorded in the period incurred, not tied to production. | Rent, office salaries, marketing expenses | Deducted from revenue in the period recognized, affecting net income directly. |

| Product Costs | Costs directly associated with manufacturing a product. | Raw materials, direct labor, manufacturing overhead | Capitalized as inventory, expensed as Cost of Goods Sold when sold. |

Understanding Period Costs and Product Costs

Period costs are expenses not directly tied to the production process, including selling, general, and administrative costs, and are expensed in the period incurred. Product costs encompass direct materials, direct labor, and manufacturing overhead, which are capitalized as inventory and expensed when goods are sold. Distinguishing these costs is essential for accurate financial reporting and cost control in managerial accounting.

Key Differences Between Period Costs and Product Costs

Period costs are expenses not directly tied to manufacturing and are expensed in the period incurred, such as selling and administrative costs, whereas product costs include direct materials, direct labor, and manufacturing overhead, which are capitalized as inventory until sold. Product costs impact the cost of goods sold and inventory valuation, affecting gross profit, while period costs influence operating expenses and net income immediately. Understanding these distinctions is crucial for accurate financial reporting and cost control in managerial accounting.

Classification Criteria for Expenses

Period costs are expenses classified based on the time period in which they are incurred, such as selling, general, and administrative expenses that do not directly contribute to inventory production. Product costs, in contrast, include direct materials, direct labor, and manufacturing overhead expenses directly linked to the creation of finished goods and are capitalized as inventory until sold. Classification criteria hinge on whether costs are tied to production activities (product costs) or operational time periods unrelated to manufacturing (period costs).

Examples of Typical Period Costs

Typical period costs include administrative salaries, rent for office space, and marketing expenses, which are incurred regardless of production levels. These expenses are recorded on the income statement in the period they occur rather than being tied to inventory valuation. Unlike product costs, period costs do not directly contribute to the manufacturing process but are essential for overall business operations.

Examples of Common Product Costs

Common product costs include direct materials like raw components, direct labor involved in manufacturing, and manufacturing overhead such as factory utilities, depreciation on production equipment, and maintenance expenses. These costs are integral to creating finished goods and are capitalized as inventory until the goods are sold. Product costs contrast with period costs, which are expensed in the period incurred and include selling, general, and administrative expenses.

Impact on Financial Statements

Period costs, such as administrative and selling expenses, are expensed immediately on the income statement, reducing net income for the period incurred. Product costs, including direct materials, direct labor, and manufacturing overhead, are initially recorded as inventory on the balance sheet and expensed as cost of goods sold when the product is sold. The timing difference between expensing period costs and capitalizing product costs directly affects gross profit, net income, and inventory valuation on financial statements.

Period Costs vs Product Costs in Manufacturing

Period costs in manufacturing refer to expenses that are not directly tied to the production process, such as administrative salaries, rent, and utilities, and are expensed in the period incurred. Product costs include direct materials, direct labor, and manufacturing overhead, which are capitalized as inventory and only expensed as cost of goods sold when the finished products are sold. Proper classification between period and product costs is crucial for accurate inventory valuation, cost control, and financial reporting in manufacturing operations.

Implications for Managerial Decision-Making

Period costs, such as administrative and marketing expenses, are expensed immediately and impact short-term profitability analysis, while product costs, including direct materials and manufacturing overhead, are capitalized as inventory and only expensed when goods are sold. Understanding this distinction enables managers to make informed decisions about pricing, budgeting, and cost control by aligning cost behavior with production and sales cycles. Accurate classification enhances performance evaluation, cost-volume-profit analysis, and strategic planning by reflecting true production costs versus operational expenses.

How Costs Influence Pricing Strategies

Period costs, such as selling, general, and administrative expenses, directly impact a company's pricing strategies by increasing the overall overhead that must be recovered through sales prices. Product costs, including direct materials, direct labor, and manufacturing overhead, form the baseline for setting minimum prices to ensure profitability. Pricing strategies integrate both cost types to balance competitive pricing while maintaining healthy profit margins, influencing decisions like cost-plus pricing or value-based pricing.

Accounting Standards for Cost Allocation

Period costs, such as selling, general, and administrative expenses, are expensed in the period incurred and do not attach to product inventory. Product costs, including direct materials, direct labor, and manufacturing overhead, are capitalized as inventory according to IFRS and US GAAP until the related goods are sold. Accurate allocation between period and product costs ensures compliance with accounting standards and affects financial statements' accuracy and cost management decisions.

Important Terms

Direct materials

Direct materials are classified as product costs because they are directly traceable to the production of goods, whereas period costs, such as selling and administrative expenses, are not directly tied to production.

Direct labor

Direct labor is classified as a product cost because it is directly traceable to manufacturing, whereas period costs include indirect expenses unrelated to production.

Manufacturing overhead

Manufacturing overhead includes indirect production costs allocated as product costs, while period costs encompass non-manufacturing expenses incurred outside the production process.

Prime costs

Prime costs include direct materials and direct labor, classified as product costs, while period costs consist of non-manufacturing expenses such as selling and administrative costs.

Conversion costs

Conversion costs, comprising direct labor and manufacturing overhead, are classified as product costs because they are directly tied to the production process, unlike period costs which are expensed in the period incurred and unrelated to production.

Administrative expenses

Administrative expenses are classified as period costs because they are not directly tied to the production process, unlike product costs which include direct materials, direct labor, and manufacturing overhead.

Selling expenses

Selling expenses are classified as period costs because they are incurred during a specific time frame and are not directly traceable to the production of goods. Unlike product costs, which include direct materials, direct labor, and manufacturing overhead tied to inventory, selling expenses cover activities such as advertising, sales commissions, and distribution, impacting the income statement within the reporting period.

Cost of goods sold

Cost of goods sold primarily includes product costs such as direct materials, direct labor, and manufacturing overhead, while period costs like selling and administrative expenses are excluded and expensed in the period incurred.

Variable costs

Variable costs fluctuate with production volume and are classified as product costs when directly tied to manufacturing, whereas period costs remain fixed and are expensed within the accounting period regardless of production levels.

Fixed costs

Fixed costs classified as period costs include expenses like administrative salaries and rent, while fixed costs recognized as product costs involve manufacturing overhead such as depreciation on factory equipment.

Period costs vs Product costs Infographic

moneydif.com

moneydif.com