Variable costs fluctuate directly with production volume, increasing as output rises and decreasing when production slows. Fixed costs remain constant regardless of production levels, covering expenses like rent, salaries, and insurance. Understanding the distinction between variable and fixed costs is crucial for budgeting, forecasting, and optimizing business profitability.

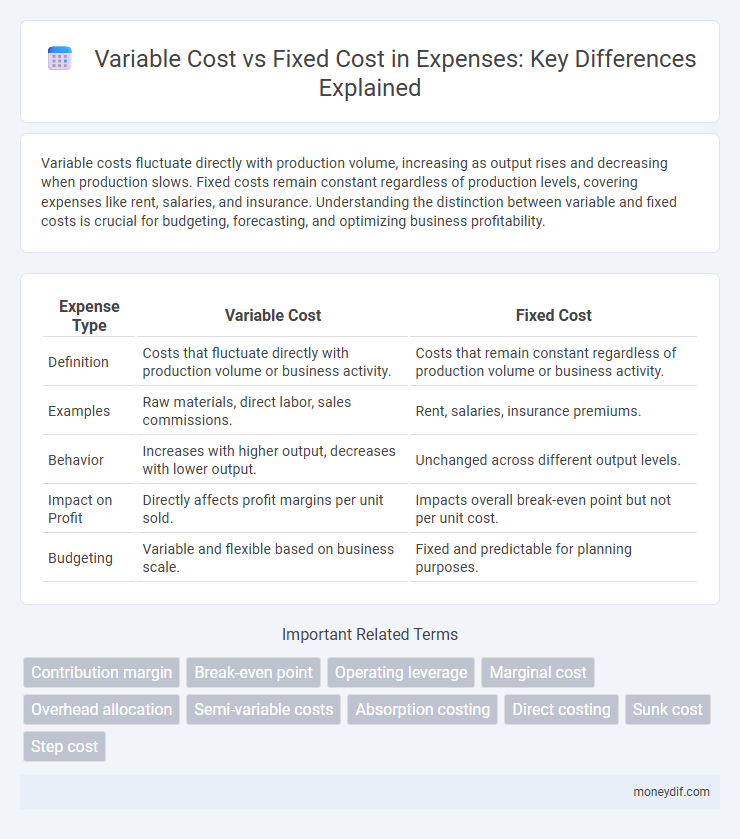

Table of Comparison

| Expense Type | Variable Cost | Fixed Cost |

|---|---|---|

| Definition | Costs that fluctuate directly with production volume or business activity. | Costs that remain constant regardless of production volume or business activity. |

| Examples | Raw materials, direct labor, sales commissions. | Rent, salaries, insurance premiums. |

| Behavior | Increases with higher output, decreases with lower output. | Unchanged across different output levels. |

| Impact on Profit | Directly affects profit margins per unit sold. | Impacts overall break-even point but not per unit cost. |

| Budgeting | Variable and flexible based on business scale. | Fixed and predictable for planning purposes. |

Understanding Variable and Fixed Costs

Variable costs fluctuate directly with production volume, including expenses like raw materials and direct labor, which increase as output rises. Fixed costs, such as rent, salaries, and insurance, remain constant regardless of production levels, providing a stable financial baseline. Understanding the distinction between variable and fixed costs is essential for budgeting, cost control, and pricing strategies in managing overall business expenses.

Key Differences Between Variable and Fixed Costs

Variable costs fluctuate directly with production volume, such as raw materials and direct labor expenses, while fixed costs remain constant regardless of output, including rent and salaried wages. Variable costs impact profit margins per unit, making them critical for budgeting in scalable operations, whereas fixed costs influence overall financial stability and break-even analysis. Understanding these distinctions aids in accurate forecasting, pricing strategies, and cost control measures essential for effective expense management.

Examples of Variable Costs in Business

Variable costs in business fluctuate directly with production volume, making them essential for cost management and profitability analysis. Common examples include raw materials, direct labor costs, sales commissions, shipping expenses, and utility costs tied to production. Understanding these variable costs helps businesses optimize operations and forecast expenses accurately.

Common Fixed Costs in Organizations

Common fixed costs in organizations remain constant regardless of production volume, including expenses like rent, salaries, and insurance. These costs do not fluctuate with business activity and are crucial for budgeting and financial planning. Understanding the distinction between fixed and variable costs helps organizations manage expenses and allocate resources efficiently.

Impact of Variable and Fixed Costs on Profitability

Variable costs fluctuate directly with production volume, influencing gross profit margins as they increase or decrease with output. Fixed costs remain constant regardless of sales levels, impacting operating leverage and the break-even point. Managing the balance between variable and fixed costs is crucial for optimizing profitability and maintaining financial stability during demand fluctuations.

How to Calculate Variable and Fixed Costs

To calculate variable costs, multiply the variable cost per unit by the total number of units produced or sold, capturing expenses that fluctuate with production volume. Fixed costs remain constant regardless of output, calculated by summing all expenses such as rent, salaries, and insurance that do not change with production levels. Accurately distinguishing between variable and fixed costs is essential for budgeting, forecasting, and determining breakeven points.

Variable vs Fixed Costs: Budgeting Strategies

Variable costs fluctuate directly with production volume, impacting cash flow and requiring flexible budgeting approaches, while fixed costs remain constant regardless of output, enabling predictable expense planning. Effective budgeting strategies involve analyzing variable costs such as raw materials and labor to adjust spending in response to sales trends, alongside maintaining control over fixed costs like rent and salaries to ensure financial stability. Balancing these costs through detailed forecasting and variance analysis optimizes resource allocation and enhances overall budget accuracy.

Managing Expenses: Optimizing Variable and Fixed Costs

Effective expense management hinges on optimizing variable and fixed costs to enhance profitability. Variable costs fluctuate with production levels, allowing for flexibility in budgeting, while fixed costs remain constant, requiring strategic control to prevent overspending. Implementing cost analysis and monitoring systems can ensure balanced expense management, maximizing operational efficiency.

Role of Variable and Fixed Costs in Pricing Decisions

Variable costs directly influence pricing decisions by fluctuating with production volume, allowing businesses to adjust prices based on cost changes for each unit produced. Fixed costs remain constant regardless of output, requiring pricing strategies to cover these expenses over time to ensure profitability. Understanding the balance between variable and fixed costs enables companies to set prices that maximize margins while remaining competitive in the market.

Variable and Fixed Costs in Financial Planning

Variable costs fluctuate directly with production volume, such as raw materials and direct labor, making them essential for budgeting accuracy in financial planning. Fixed costs, including rent, salaries, and insurance, remain constant regardless of output, providing stability in long-term financial forecasts. Understanding the balance between variable and fixed costs enables businesses to optimize resource allocation and improve profit margin analysis.

Important Terms

Contribution margin

Contribution margin represents the difference between sales revenue and variable costs, highlighting how much revenue contributes to covering fixed costs and generating profit. Variable costs fluctuate with production levels, while fixed costs remain constant regardless of output, making the contribution margin crucial for break-even analysis and decision-making.

Break-even point

The break-even point occurs where total revenues equal the sum of fixed costs and variable costs, allowing a business to cover all expenses without profit or loss. Understanding the relationship between variable costs per unit and fixed costs is crucial for calculating the exact sales volume needed to reach this financial equilibrium.

Operating leverage

Operating leverage measures how changes in sales volume impact operating income, largely influenced by the proportion of fixed costs versus variable costs in a company's cost structure. Higher fixed costs relative to variable costs increase operating leverage, amplifying profit volatility as sales fluctuate.

Marginal cost

Marginal cost represents the increase in total cost resulting from producing one additional unit, primarily driven by variable costs such as materials and labor, while fixed costs like rent and salaries remain constant regardless of output. Understanding the distinction between variable and fixed costs is crucial for accurately calculating marginal cost and optimizing production decisions.

Overhead allocation

Overhead allocation assigns indirect costs to products or departments, distinguishing between variable overhead, which fluctuates with production volume, and fixed overhead, which remains constant regardless of output. Accurate allocation improves cost control and pricing by linking variable costs to activity levels and spreading fixed costs evenly across units.

Semi-variable costs

Semi-variable costs combine fixed and variable cost elements, remaining constant up to a certain production level before increasing with additional output. These costs, such as utility bills with a base fee plus usage charges, differ from purely fixed costs, which do not change with production volume, and purely variable costs, which fluctuate directly with output.

Absorption costing

Absorption costing allocates both fixed manufacturing overhead and variable production costs to product units, ensuring total production costs are included in inventory valuation. This contrasts with variable costing, which assigns only variable manufacturing costs to products while treating fixed overhead as a period expense.

Direct costing

Direct costing assigns only variable costs, such as materials and labor, to product costs, treating fixed costs like rent and salaries as period expenses. This method enhances cost control and decision-making by clearly distinguishing between variable costs that fluctuate with production and fixed costs that remain constant regardless of output.

Sunk cost

Sunk costs are expenses already incurred and cannot be recovered, making them irrelevant to future business decisions focused on variable and fixed costs. Unlike fixed costs, which remain constant regardless of production levels, variable costs fluctuate with output, but sunk costs should not influence cost analysis or pricing strategies.

Step cost

Step cost is a type of cost that remains fixed over a range of activity but increases or decreases in discrete steps as the activity level changes, blending characteristics of both fixed and variable costs. Unlike variable costs that change continuously with production volume and fixed costs that remain constant regardless of activity, step costs shift only when specific thresholds are crossed, such as hiring additional staff or adding equipment.

variable cost vs fixed cost Infographic

moneydif.com

moneydif.com