Sunk cost refers to expenses that have already been incurred and cannot be recovered, making them irrelevant to future decision-making. Opportunity cost represents the potential benefits lost when choosing one alternative over another, emphasizing the importance of considering foregone options. Understanding the distinction between sunk cost and opportunity cost helps in making rational financial decisions by ignoring irrecoverable expenses and focusing on future gains.

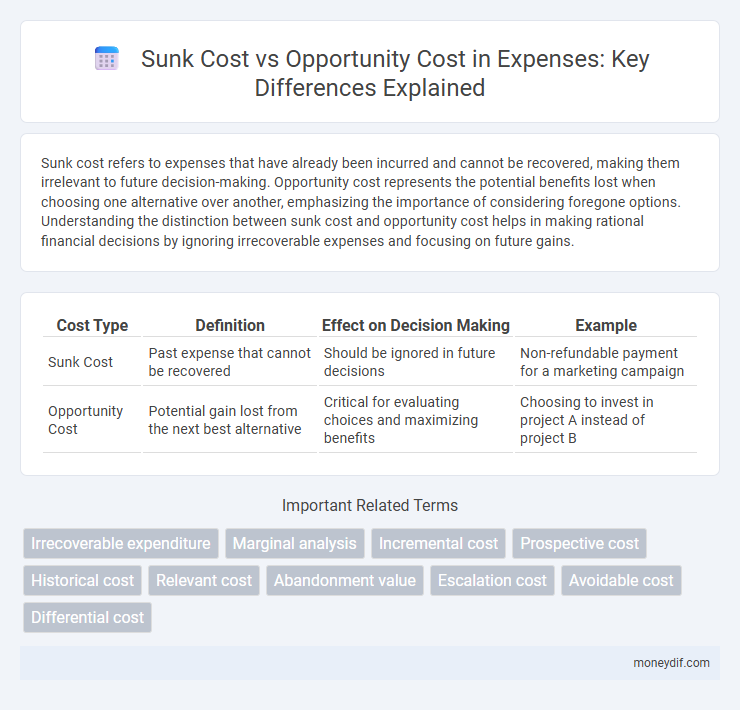

Table of Comparison

| Cost Type | Definition | Effect on Decision Making | Example |

|---|---|---|---|

| Sunk Cost | Past expense that cannot be recovered | Should be ignored in future decisions | Non-refundable payment for a marketing campaign |

| Opportunity Cost | Potential gain lost from the next best alternative | Critical for evaluating choices and maximizing benefits | Choosing to invest in project A instead of project B |

Understanding Sunk Cost and Opportunity Cost

Sunk cost refers to expenses that have already been incurred and cannot be recovered, making them irrelevant to future decision-making. Opportunity cost represents the potential benefits lost when choosing one alternative over another, emphasizing the value of the next best option foregone. Understanding these concepts is crucial for effective financial planning and avoiding irrational decisions based on past expenditures.

Defining Sunk Costs: Meaning and Examples

Sunk costs refer to expenses that have already been incurred and cannot be recovered, such as non-refundable deposits or past advertising expenditures. These costs should not influence current or future business decisions because they remain constant regardless of the outcome. Understanding sunk costs is essential to avoid the sunk cost fallacy, where decision-making is irrationally driven by unrecoverable past investments.

What Is Opportunity Cost? Key Concepts

Opportunity cost represents the potential benefits lost when choosing one alternative over another, serving as a critical factor in effective decision-making. It emphasizes the value of the next best option forgone, helping businesses and individuals allocate resources efficiently. Understanding opportunity cost enables more strategic expense management by highlighting hidden trade-offs beyond sunk costs.

The Psychological Impact of Sunk Costs

Sunk costs often create a psychological barrier, leading individuals and businesses to continue investing in unprofitable ventures to justify past expenses. This cognitive bias, known as the sunk cost fallacy, can result in inefficient resource allocation and increased financial losses. In contrast, opportunity cost requires a forward-looking mindset, emphasizing the benefits of alternative investments rather than past, irrecoverable expenditures.

Opportunity Cost in Everyday Financial Decisions

Opportunity cost plays a crucial role in everyday financial decisions, representing the value of the next best alternative foregone when choosing one option over another. Understanding opportunity cost helps individuals prioritize spending and investments, ensuring resources are allocated to maximize potential returns or benefits. Incorporating opportunity cost analysis enables more informed choices, such as comparing the benefits of saving money versus spending on immediate needs or opportunities.

How Sunk Cost Fallacy Affects Spending

Sunk cost fallacy leads individuals to continue investing in failing projects due to previously spent resources, ignoring future benefits or losses. This behavior causes inefficient spending by prioritizing past costs over potential new opportunities with higher returns. Recognizing sunk costs as irrecoverable helps optimize financial decisions and allocate resources more effectively.

Comparing Sunk Cost vs Opportunity Cost in Business

Sunk costs represent past expenditures that cannot be recovered and should not influence current business decisions, while opportunity costs measure the potential benefits lost when choosing one alternative over another. In business, recognizing sunk costs prevents throwing good money after bad, whereas evaluating opportunity costs ensures resources are allocated to the most profitable ventures. Strategic decision-making hinges on ignoring sunk costs and carefully analyzing opportunity costs to maximize returns and optimize resource utilization.

Real-life Scenarios: Sunk Cost vs Opportunity Cost

In real-life scenarios, sunk costs represent expenses already incurred and cannot be recovered, such as non-refundable tickets or obsolete equipment, making them irrelevant for future decisions. Opportunity cost reflects the potential benefits lost when choosing one alternative over another, like investing time and money in a failing project instead of pursuing a more profitable venture. Understanding the distinction helps businesses and individuals avoid irrational decisions by focusing on future gains rather than past expenditures.

Strategies to Minimize Sunk Cost Traps

Minimizing sunk cost traps involves rigorous evaluation of current investments against potential future gains without emotional attachment to past expenses. Implementing decision frameworks that prioritize opportunity cost analysis helps in reallocating resources to more beneficial uses. Regularly reviewing project viability and setting clear exit criteria prevent overcommitment to unproductive expenses.

Making Smarter Choices: Focusing on Opportunity Cost

Focusing on opportunity cost enables smarter financial decisions by highlighting the potential benefits of alternative choices rather than dwelling on sunk costs that cannot be recovered. Evaluating opportunity cost helps prioritize investments and expenses that maximize value and future returns, ensuring resources are allocated efficiently. By ignoring past expenses, individuals and businesses can avoid the fallacy of sunk cost and concentrate on actions with the highest potential gain.

Important Terms

Irrecoverable expenditure

Irrecoverable expenditure, commonly known as sunk cost, refers to expenses that cannot be recovered once incurred, contrasting with opportunity cost which represents the potential benefits lost when choosing one alternative over another. Understanding the distinction between sunk cost and opportunity cost is essential for effective decision-making, as sunk costs should be ignored in future strategy while opportunity costs inform the trade-offs between different business options.

Marginal analysis

Marginal analysis evaluates the additional benefits and costs of a decision, emphasizing opportunity cost as the true economic sacrifice rather than sunk costs, which are past expenses that cannot be recovered and should not influence future choices. By focusing on incremental changes, marginal analysis ensures resources are allocated efficiently, ignoring irrelevant sunk costs and prioritizing the highest-valued alternative foregone.

Incremental cost

Incremental cost refers to the additional expense incurred when choosing one option over another and is distinct from sunk cost, which represents past expenses that cannot be recovered. Unlike opportunity cost, which measures the value of the foregone alternative, incremental cost focuses solely on the actual increase in expenditure directly associated with a decision.

Prospective cost

Prospective cost refers to future expenses that influence decision-making, distinct from sunk costs which are past, irrecoverable expenditures. Opportunity cost represents the potential benefits lost when choosing one alternative over another, emphasizing the value of the best foregone option in prospective cost analysis.

Historical cost

Historical cost refers to the original monetary value of an asset recorded at the time of acquisition, which remains relevant in accounting despite potential market fluctuations. Unlike sunk costs that represent past expenses irrecoverable in decision-making, opportunity costs measure the value of foregone alternatives, emphasizing future economic trade-offs rather than past transactions.

Relevant cost

Relevant cost represents future expenses directly affected by a specific decision, excluding sunk costs which are past expenses that cannot be recovered and should not influence current decisions. Opportunity cost reflects the potential benefits lost when choosing one alternative over another and is critical for evaluating the true impact of business choices.

Abandonment value

Abandonment value represents the recoverable amount from an asset or project if it is terminated early, influencing decisions where sunk costs--irrecoverable past expenses--should be disregarded while opportunity costs--the benefits of the next best alternative--must be evaluated to optimize resource allocation. Properly assessing abandonment value ensures that decision-making focuses on future potential returns rather than past expenditures, aligning investments with opportunity costs to maximize economic efficiency.

Escalation cost

Escalation cost refers to additional expenses incurred beyond the original budget due to project delays or scope changes, often complicating sunk cost decisions where previous investments cannot be recovered. Evaluating escalation cost against opportunity cost helps determine if continuing the project justifies foregoing potentially more profitable alternatives.

Avoidable cost

Avoidable costs are expenses that can be eliminated if a particular decision is made, contrasting with sunk costs, which are past expenses that cannot be recovered and should not influence future choices. Opportunity costs represent the potential benefits lost when choosing one alternative over another, highlighting the importance of considering avoidable costs to optimize resource allocation.

Differential cost

Differential cost represents the difference in total cost between two alternatives and excludes sunk costs, which are past expenses that cannot be recovered, ensuring decisions focus on future financial impact. Opportunity cost captures the value of the next best alternative foregone, emphasizing the benefits sacrificed when choosing one option over another in cost analysis.

Sunk cost vs Opportunity cost Infographic

moneydif.com

moneydif.com