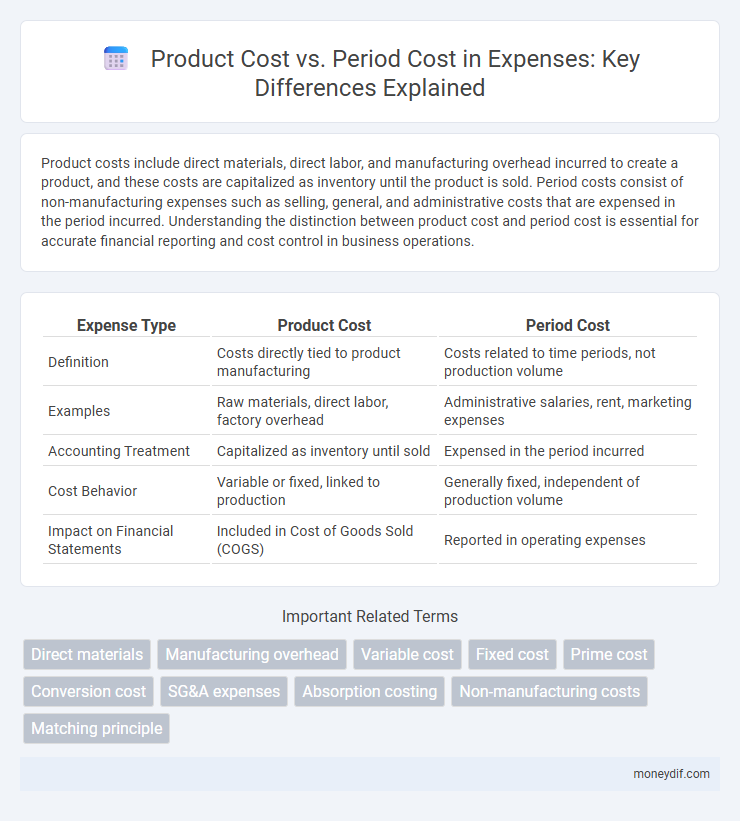

Product costs include direct materials, direct labor, and manufacturing overhead incurred to create a product, and these costs are capitalized as inventory until the product is sold. Period costs consist of non-manufacturing expenses such as selling, general, and administrative costs that are expensed in the period incurred. Understanding the distinction between product cost and period cost is essential for accurate financial reporting and cost control in business operations.

Table of Comparison

| Expense Type | Product Cost | Period Cost |

|---|---|---|

| Definition | Costs directly tied to product manufacturing | Costs related to time periods, not production volume |

| Examples | Raw materials, direct labor, factory overhead | Administrative salaries, rent, marketing expenses |

| Accounting Treatment | Capitalized as inventory until sold | Expensed in the period incurred |

| Cost Behavior | Variable or fixed, linked to production | Generally fixed, independent of production volume |

| Impact on Financial Statements | Included in Cost of Goods Sold (COGS) | Reported in operating expenses |

Understanding Product Costs and Period Costs

Product costs include all expenses directly tied to the manufacturing of goods, such as raw materials, labor, and factory overhead, which are capitalized as inventory until sold. Period costs encompass non-manufacturing expenses like selling, general, and administrative costs that are expensed in the period incurred. Understanding the distinction helps businesses accurately allocate expenses for financial reporting and cost control, ensuring precise profit measurement.

Key Differences Between Product and Period Costs

Product costs are directly tied to manufacturing and include raw materials, labor, and manufacturing overhead, becoming part of inventory valuation until the goods are sold. Period costs encompass expenses not linked to production, such as administrative salaries, rent, and marketing costs, and are expensed in the period incurred. The primary distinction lies in product costs being capitalized as inventory, while period costs are recognized immediately on the income statement.

Classification of Product Costs in Accounting

Product costs in accounting include direct materials, direct labor, and manufacturing overhead, all of which are capitalized as inventory until sold. These costs are classified as part of the cost of goods manufactured and directly traceable to the production process. Period costs, by contrast, encompass selling, general, and administrative expenses recognized in the period incurred and not tied to production activities.

What Constitutes Period Costs?

Period costs primarily include expenses that are not directly tied to the production process, such as selling, general, and administrative costs. These costs encompass salaries of office staff, marketing expenses, and rent for the company's headquarters. Unlike product costs, period costs are expensed in the period in which they are incurred rather than being assigned to inventory.

Product Cost Examples in Manufacturing

Product costs in manufacturing include direct materials, direct labor, and manufacturing overhead directly involved in producing goods. These costs are capitalized as inventory on the balance sheet until the products are sold, at which point they become cost of goods sold (COGS). Examples include raw materials like steel, wages of assembly line workers, and factory utilities.

Period Cost Examples in Business Operations

Period costs in business operations include expenses such as administrative salaries, rent, utilities, and marketing costs that are not directly tied to product manufacturing. These costs are recorded as expenses in the period they are incurred, reflecting activities that support overall operations rather than product creation. Properly distinguishing period costs from product costs is essential for accurate financial reporting and cost management.

Impact of Product and Period Costs on Financial Statements

Product costs, including direct materials, direct labor, and manufacturing overhead, are capitalized as inventory on the balance sheet and recognized as expenses when goods are sold, directly affecting the cost of goods sold and net income. Period costs, such as selling, general, and administrative expenses, are expensed in the period incurred, reducing operating income on the income statement without impacting inventory valuation. The distinction between product and period costs influences financial reporting by determining how costs are matched with revenues, affecting profitability analysis and inventory valuation.

Cost Allocation: Assigning Product vs Period Costs

Product costs directly relate to manufacturing expenses such as raw materials, labor, and factory overhead, which are capitalized as inventory costs and expensed when goods are sold. Period costs include selling, general, and administrative expenses that are expensed in the period incurred, regardless of production volume. Accurate cost allocation requires distinguishing product costs for inventory valuation and period costs for operational expense reporting, ensuring precise financial analysis and decision-making.

Importance of Distinguishing Product and Period Costs

Accurately distinguishing product costs from period costs is crucial for precise financial reporting and effective cost management. Product costs, including direct materials, direct labor, and manufacturing overhead, are capitalized as inventory and expensed when goods are sold, directly affecting gross profit. Period costs, such as selling, general, and administrative expenses, are expensed in the period incurred, impacting operating profit and aiding in clearer budget control and performance analysis.

Product Cost vs Period Cost: Strategic Management Insights

Product costs include direct materials, direct labor, and manufacturing overhead directly tied to production, impacting inventory valuation and gross profit margins. Period costs encompass selling, general, and administrative expenses incurred during a specific time frame, influencing net income and cash flow management. Strategic management requires differentiating these costs to optimize pricing, budgeting, and profitability analysis for informed decision-making.

Important Terms

Direct materials

Direct materials are classified as product costs because they are integral components directly traceable to the production of finished goods, forming part of inventory valuation on the balance sheet. In contrast, period costs, such as selling and administrative expenses, are not tied to production and are expensed in the period incurred without being included in product cost.

Manufacturing overhead

Manufacturing overhead includes indirect production expenses such as utilities, maintenance, and factory supplies, directly contributing to product costs by being allocated to inventory. Period costs, in contrast, encompass non-manufacturing expenses like administrative salaries and marketing, which are expensed in the period incurred and do not affect product cost valuation.

Variable cost

Variable cost directly fluctuates with production volume and is a key component of product costs, encompassing expenses like raw materials and direct labor. In contrast, period costs, such as administrative salaries and rent, remain fixed regardless of output and are expensed in the period incurred.

Fixed cost

Fixed costs remain constant regardless of production volume and are classified as product costs when they are directly tied to manufacturing, such as factory rent or equipment depreciation. When fixed costs are related to non-manufacturing activities, like administrative salaries or office rent, they are treated as period costs and expensed within the reporting period.

Prime cost

Prime cost consists of direct materials and direct labor expenses directly tied to product manufacturing, distinguishing it from period costs, which include overhead and administrative expenses not linked to production. Understanding the difference between product costs (prime cost plus manufacturing overhead) and period costs is crucial for accurate cost allocation and financial reporting.

Conversion cost

Conversion cost refers to the expenses incurred to transform raw materials into finished products, including direct labor and manufacturing overhead. Unlike period costs, which are expensed in the period incurred, conversion costs are capitalized as part of product costs and included in inventory valuation until the goods are sold.

SG&A expenses

SG&A expenses, classified as period costs, are not directly included in product costs but are essential for operating the business, covering selling, general, and administrative functions. Product costs encompass direct materials, direct labor, and manufacturing overhead, which are capitalized as inventory and expensed during cost of goods sold.

Absorption costing

Absorption costing allocates all manufacturing costs, including direct materials, direct labor, and both variable and fixed manufacturing overhead, to product costs, thereby capitalizing these expenses as inventory until sold. Period costs, such as selling and administrative expenses, are expensed in the period incurred and are not included in product costs under absorption costing.

Non-manufacturing costs

Non-manufacturing costs, including selling, general, and administrative expenses, are classified as period costs because they are not directly tied to the production process and are expensed in the period incurred. These costs differ from product costs, which encompass direct materials, direct labor, and manufacturing overhead, all capitalized as inventory until the goods are sold.

Matching principle

The matching principle requires expenses to be recorded in the same period as the revenues they help generate, ensuring accurate financial reporting by aligning product costs--direct materials, labor, and manufacturing overhead--with inventory and cost of goods sold. Period costs, such as selling and administrative expenses, are expensed in the period incurred because they do not directly relate to production, distinguishing them clearly from product costs in financial statements.

Product cost vs Period cost Infographic

moneydif.com

moneydif.com