Prepaid expenses represent payments made in advance for goods or services to be received in the future, such as insurance premiums or rent, and are recorded as assets on the balance sheet. Outstanding expenses, on the other hand, are liabilities reflecting amounts owed for goods or services already received but not yet paid, like utility bills or wages. Properly distinguishing between prepaid and outstanding expenses ensures accurate financial reporting and effective cash flow management.

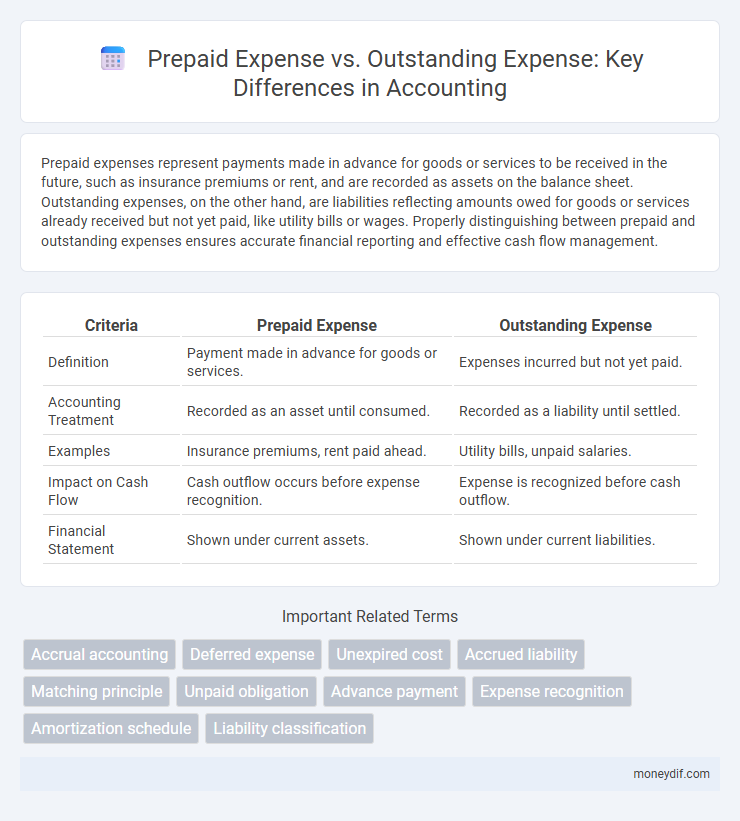

Table of Comparison

| Criteria | Prepaid Expense | Outstanding Expense |

|---|---|---|

| Definition | Payment made in advance for goods or services. | Expenses incurred but not yet paid. |

| Accounting Treatment | Recorded as an asset until consumed. | Recorded as a liability until settled. |

| Examples | Insurance premiums, rent paid ahead. | Utility bills, unpaid salaries. |

| Impact on Cash Flow | Cash outflow occurs before expense recognition. | Expense is recognized before cash outflow. |

| Financial Statement | Shown under current assets. | Shown under current liabilities. |

Understanding Prepaid and Outstanding Expenses

Prepaid expenses represent payments made in advance for goods or services to be received in the future, such as insurance premiums or rent, recorded as current assets on the balance sheet until they are expensed. Outstanding expenses, also known as accrued expenses, are costs incurred but not yet paid or recorded, including utilities or wages, which appear as current liabilities. Proper understanding of prepaid and outstanding expenses is crucial for accurate financial reporting and cash flow management.

Key Differences Between Prepaid and Outstanding Expenses

Prepaid expenses represent payments made in advance for goods or services to be received in the future, recorded as assets until consumed, while outstanding expenses are liabilities arising from incurred costs not yet paid. Prepaid expenses improve cash flow management by allocating costs over time, whereas outstanding expenses reflect current obligations that must be settled promptly. The timing and recognition of these expenses impact financial statements differently, influencing the accuracy of profit reporting and liquidity assessment.

Definition and Examples of Prepaid Expenses

Prepaid expenses are payments made in advance for goods or services to be received in the future, such as insurance premiums or rent paid upfront for several months. These expenses are recorded as assets initially and expensed over time as the benefit is realized. Unlike outstanding expenses, which represent unpaid liabilities like unpaid wages or utility bills, prepaid expenses provide future economic benefits already paid for.

Definition and Examples of Outstanding Expenses

Outstanding expenses refer to costs incurred by a business that have not yet been paid or recorded in the accounts payable. These expenses typically include utility bills, salaries, or rent that are due but remain unsettled at the end of an accounting period. Unlike prepaid expenses, which are payments made in advance for future services, outstanding expenses represent liabilities that reflect an impending cash outflow.

Accounting Treatment for Prepaid Expenses

Prepaid expenses are recorded as assets on the balance sheet because the payment is made in advance for goods or services to be received in the future. Accounting treatment involves initially debiting the prepaid expense account and crediting cash or accounts payable, then systematically expensing the prepaid amount over the relevant periods as the benefits are realized. Unlike outstanding expenses, which are liabilities recorded when expenses are incurred but not yet paid, prepaid expenses represent payments made upfront and recognized gradually.

Accounting Treatment for Outstanding Expenses

Outstanding expenses, also known as accrued expenses, represent costs incurred but not yet paid or recorded in the accounts. The accounting treatment requires recognition of these expenses in the period they are incurred by creating a liability account called "Accrued Expenses" or "Outstanding Expenses" on the balance sheet and an associated expense entry on the income statement. This ensures adherence to the matching principle, aligning expenses with the revenues they help generate for accurate financial reporting.

Impact on Financial Statements

Prepaid expenses are recorded as assets on the balance sheet and gradually expensed over time, improving current asset liquidity while reducing net income when amortized. Outstanding expenses, or accrued expenses, appear as liabilities, increasing current liabilities and decreasing net income until they are paid. Both impact cash flow timing and profitability, with prepaid expenses affecting future periods and outstanding expenses reflecting current obligations.

Practical Scenarios: Prepaid vs Outstanding Expenses

Prepaid expenses, such as insurance premiums paid in advance, represent costs already incurred but allocated to future accounting periods, ensuring accurate matching of expenses to revenue. Outstanding expenses, like unpaid utility bills at month-end, reflect incurred costs that have yet to be paid, requiring accrual to present a true financial position. Practical scenarios include prepaid rent covering the upcoming quarter versus outstanding salaries owed to employees, both critical for precise expense recognition and financial reporting.

Importance in Expense Management

Effective expense management requires distinguishing between prepaid expenses and outstanding expenses to ensure accurate financial reporting and cash flow monitoring. Prepaid expenses represent payments made in advance for goods or services, which must be allocated over time to match the expense with the related revenue period. Outstanding expenses, on the other hand, refer to incurred costs not yet paid, highlighting liabilities that impact budgeting and cash flow forecasting.

Common Mistakes in Classifying Expenses

Confusing prepaid expenses with outstanding expenses often leads to misclassification, where prepaid expenses are mistakenly recorded as current period expenses instead of assets. Outstanding expenses, which represent liabilities for expenses incurred but not yet paid, are sometimes incorrectly treated as prepaid or neglected altogether. Proper distinction ensures accurate financial statements by recognizing prepaid expenses as deferred costs and outstanding expenses as accrued liabilities.

Important Terms

Accrual accounting

Accrual accounting records prepaid expenses as assets and outstanding expenses as liabilities to accurately match expenses to the period they incur.

Deferred expense

Deferred expense, also known as prepaid expense, represents payments made in advance for goods or services to be received in the future, whereas outstanding expense refers to incurred liabilities not yet paid.

Unexpired cost

Unexpired cost represents prepaid expenses recorded as assets until consumption, while outstanding expenses are liabilities reflecting costs incurred but not yet paid.

Accrued liability

Accrued liabilities represent expenses incurred but not yet paid, contrasting with prepaid expenses which are payments made in advance for future benefits.

Matching principle

The matching principle ensures that prepaid expenses, such as insurance or rent paid in advance, are recorded as assets and expensed over the periods they benefit, while outstanding expenses, like unpaid utilities or salaries, are recognized as liabilities and recorded as expenses in the period incurred. This principle aligns expenses with the related revenues to provide accurate financial statements.

Unpaid obligation

Unpaid obligations differ from prepaid expenses as they represent outstanding expenses incurred but not yet paid, whereas prepaid expenses are payments made in advance for future services or goods.

Advance payment

Advance payments are recorded as prepaid expenses when paid before goods or services are received, while outstanding expenses represent liabilities for goods or services already incurred but not yet paid.

Expense recognition

Expense recognition requires matching prepaid expenses as assets and systematically expensing them over time, while outstanding expenses represent incurred liabilities yet to be paid and must be recorded in the current period's financial statements.

Amortization schedule

An amortization schedule systematically allocates prepaid expenses over their useful period while distinguishing them from outstanding expenses that represent unpaid liabilities yet to be expensed.

Liability classification

Liability classification distinguishes outstanding expenses as current liabilities since they represent unpaid obligations, whereas prepaid expenses are recorded as current assets because they reflect payments made in advance for future benefits. Accurate classification ensures proper financial statement presentation, affecting liquidity and operational assessment.

Prepaid expense vs Outstanding expense Infographic

moneydif.com

moneydif.com