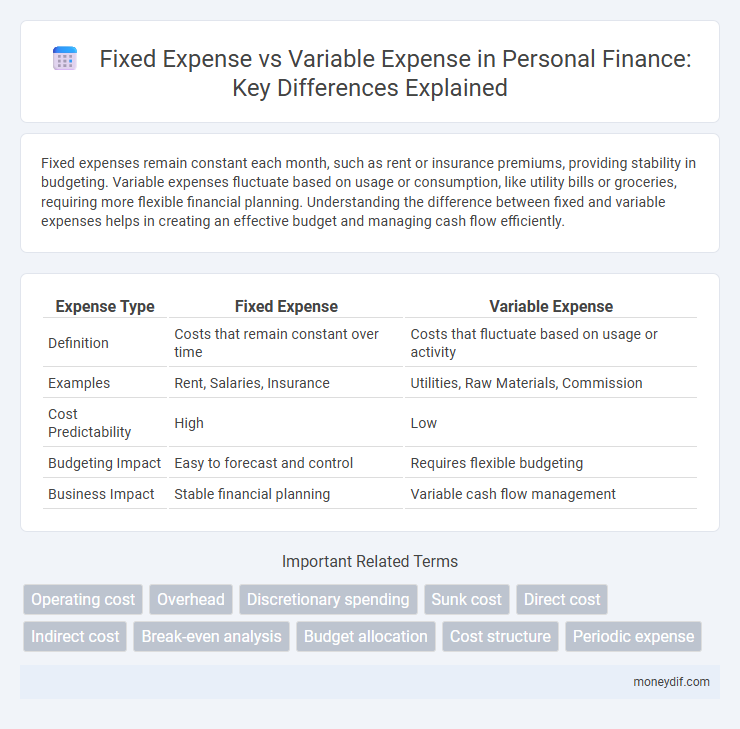

Fixed expenses remain constant each month, such as rent or insurance premiums, providing stability in budgeting. Variable expenses fluctuate based on usage or consumption, like utility bills or groceries, requiring more flexible financial planning. Understanding the difference between fixed and variable expenses helps in creating an effective budget and managing cash flow efficiently.

Table of Comparison

| Expense Type | Fixed Expense | Variable Expense |

|---|---|---|

| Definition | Costs that remain constant over time | Costs that fluctuate based on usage or activity |

| Examples | Rent, Salaries, Insurance | Utilities, Raw Materials, Commission |

| Cost Predictability | High | Low |

| Budgeting Impact | Easy to forecast and control | Requires flexible budgeting |

| Business Impact | Stable financial planning | Variable cash flow management |

Introduction to Fixed and Variable Expenses

Fixed expenses are consistent costs that remain unchanged regardless of business activity levels, such as rent, salaries, and insurance premiums. Variable expenses fluctuate directly with operational output or sales volume, including raw materials, utility costs, and commissions. Understanding the distinction between fixed and variable expenses is essential for accurate budgeting, financial forecasting, and cost management in both personal finance and business contexts.

Defining Fixed Expenses

Fixed expenses are recurring costs that remain constant over time, such as rent, insurance premiums, and loan payments. These expenses do not fluctuate with changes in business activity or production levels, providing predictable financial commitments each month. Understanding fixed expenses is essential for budgeting and financial planning because they establish the baseline costs that must be covered regardless of revenue.

Understanding Variable Expenses

Variable expenses fluctuate based on consumption or activity levels, making them essential to monitor for effective budgeting. Common examples include utility bills, groceries, and fuel costs, which vary monthly depending on usage. Understanding these expenses helps businesses and individuals adjust spending patterns to maintain financial stability and optimize cash flow management.

Key Differences Between Fixed and Variable Expenses

Fixed expenses remain constant regardless of business activity levels, such as rent, salaries, and insurance premiums. Variable expenses fluctuate directly with production volume or sales, including costs like raw materials, utility usage, and sales commissions. Understanding these key differences is essential for budgeting, forecasting, and managing cash flow effectively.

Common Examples of Fixed Expenses

Common examples of fixed expenses include rent or mortgage payments, insurance premiums, and subscription services such as streaming platforms or gym memberships. These costs remain constant each month regardless of usage or economic fluctuations. Understanding fixed expenses is crucial for budgeting as they represent recurring financial commitments that must be met consistently.

Common Examples of Variable Expenses

Common examples of variable expenses include utility bills, groceries, fuel, and dining out, as these costs fluctuate based on usage and consumption. Entertainment expenses and clothing purchases also vary monthly, reflecting changes in personal lifestyle and needs. Tracking these variable expenses helps in budgeting and managing cash flow effectively.

How Fixed and Variable Expenses Impact Budgeting

Fixed expenses, such as rent and insurance premiums, provide stability by ensuring predictable monthly costs, allowing for more accurate budget planning. Variable expenses, including utilities and groceries, fluctuate monthly, requiring flexible allocation and careful monitoring to avoid overspending. Balancing fixed and variable expenses is essential for creating a realistic budget that accommodates both steady obligations and changing financial needs.

Strategies for Managing Fixed Expenses

Implementing budget caps and negotiating long-term contracts can effectively manage fixed expenses, stabilizing monthly financial commitments such as rent, insurance, and subscriptions. Regularly auditing these costs helps identify opportunities to switch providers or eliminate unnecessary services, optimizing overall expenditure. Automating fixed payments ensures timely settlements, reducing the risk of late fees and enhancing credit management for consistent expense control.

Tips to Control Variable Expenses

Managing variable expenses requires consistent tracking of spending patterns and setting realistic budget limits based on historical data. Prioritizing essential costs, using expense tracking apps, and reviewing monthly statements can help identify unnecessary expenditures for elimination or reduction. Implementing strategies such as meal planning, limiting impulse purchases, and negotiating bills effectively reduces fluctuations and enhances financial stability.

Importance of Tracking Both Expense Types

Tracking both fixed and variable expenses is crucial for accurate budgeting and financial planning. Fixed expenses such as rent, insurance, and loan payments provide a stable baseline cost, while variable expenses like groceries, utilities, and entertainment fluctuate monthly and impact cash flow. Monitoring these expense types enables better expense control, identification of potential savings, and informs strategic financial decisions.

Important Terms

Operating cost

Operating cost comprises fixed expenses, such as rent, salaries, and insurance, which remain constant regardless of production volume, and variable expenses like raw materials, utilities, and direct labor, which fluctuate with business activity levels. Understanding the balance between fixed and variable expenses is crucial for budgeting, financial forecasting, and optimizing profit margins in operational management.

Overhead

Overhead costs encompass both fixed expenses, such as rent and salaries that remain constant regardless of production levels, and variable expenses like utilities and raw materials that fluctuate with operational activity. Understanding the distinction between fixed and variable overhead is crucial for accurate budgeting, cost control, and pricing strategies in business management.

Discretionary spending

Discretionary spending refers to non-essential expenses that can fluctuate depending on personal choices, contrasting with fixed expenses like rent or mortgage that remain constant each month; variable expenses such as entertainment or dining out fall under discretionary spending because they vary in amount and frequency. Managing discretionary spending effectively helps balance overall budgeting by allowing adjustments beyond obligatory fixed and variable costs.

Sunk cost

Sunk costs are past expenditures that cannot be recovered and should not influence future business decisions, whereas fixed expenses remain constant regardless of production levels, and variable expenses fluctuate proportionally with output. Understanding the distinction between sunk costs and ongoing fixed or variable expenses is crucial for accurate cost management and strategic planning.

Direct cost

Direct costs are expenses directly attributable to production, often classified into fixed expenses like equipment depreciation and variable expenses such as raw materials varying with output. Understanding the distinction between fixed and variable direct costs is essential for accurate budgeting, cost control, and profitability analysis in manufacturing and service industries.

Indirect cost

Indirect costs encompass both fixed expenses, such as rent and salaries, which remain constant regardless of production levels, and variable expenses, like utility bills and maintenance, which fluctuate with operational activity. Understanding the distinction helps businesses accurately allocate overhead, optimize budgeting, and improve cost management strategies.

Break-even analysis

Break-even analysis determines the sales volume at which total revenues equal total costs, distinguishing between fixed expenses, which remain constant regardless of production output, and variable expenses, which fluctuate directly with sales levels. Understanding the relationship between fixed expenses like rent and salaries, and variable expenses such as raw materials and direct labor, is crucial for accurately calculating the break-even point and making informed financial decisions.

Budget allocation

Budget allocation requires distinguishing fixed expenses such as rent, salaries, and insurance, which remain constant monthly, from variable expenses like utilities, raw materials, and marketing costs that fluctuate based on business activity. Optimizing budget allocation involves accurately forecasting fixed commitments to ensure stability while managing variable expenses dynamically to maximize cash flow and operational flexibility.

Cost structure

Cost structure comprises fixed expenses, which remain constant regardless of production volume, and variable expenses, which fluctuate directly with output levels. Understanding the balance between fixed and variable costs is crucial for effective budgeting, pricing strategies, and profitability analysis.

Periodic expense

Periodic expenses occur at regular intervals and can be classified as fixed or variable expenses; fixed periodic expenses maintain a consistent cost such as rent or insurance premiums, while variable periodic expenses fluctuate based on usage or activity levels, like utility bills or maintenance costs. Understanding the distinction between fixed and variable periodic expenses aids in budgeting accuracy and financial forecasting for businesses and individuals.

Fixed expense vs Variable expense Infographic

moneydif.com

moneydif.com