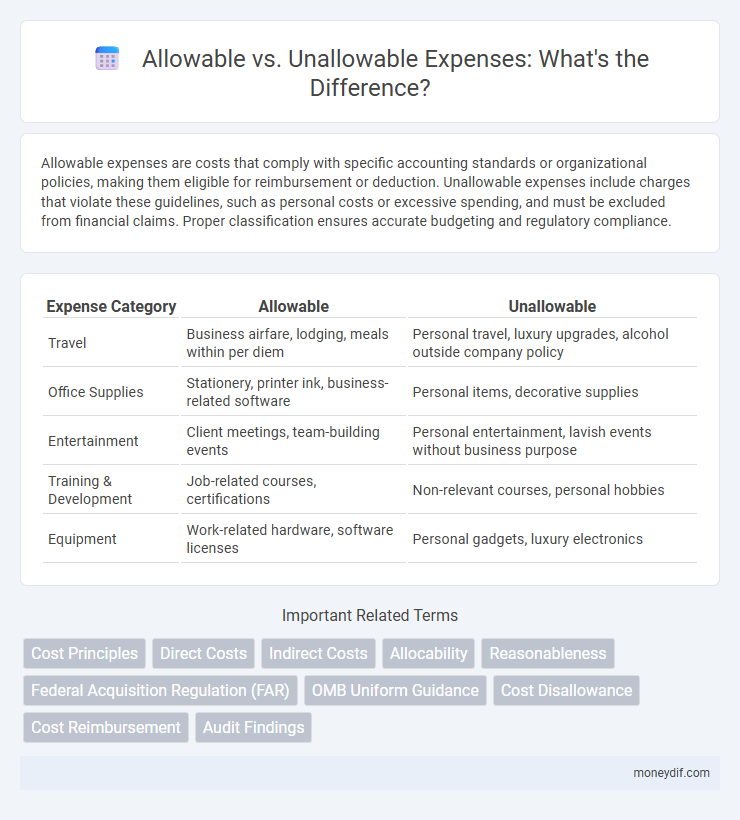

Allowable expenses are costs that comply with specific accounting standards or organizational policies, making them eligible for reimbursement or deduction. Unallowable expenses include charges that violate these guidelines, such as personal costs or excessive spending, and must be excluded from financial claims. Proper classification ensures accurate budgeting and regulatory compliance.

Table of Comparison

| Expense Category | Allowable | Unallowable |

|---|---|---|

| Travel | Business airfare, lodging, meals within per diem | Personal travel, luxury upgrades, alcohol outside company policy |

| Office Supplies | Stationery, printer ink, business-related software | Personal items, decorative supplies |

| Entertainment | Client meetings, team-building events | Personal entertainment, lavish events without business purpose |

| Training & Development | Job-related courses, certifications | Non-relevant courses, personal hobbies |

| Equipment | Work-related hardware, software licenses | Personal gadgets, luxury electronics |

Understanding Allowable and Unallowable Expenses

Understanding allowable and unallowable expenses is crucial for accurate financial reporting and compliance with regulatory standards. Allowable expenses are those costs directly related to business operations, such as office supplies, payroll, and travel expenses, which can be reimbursed or deducted for tax purposes. Unallowable expenses typically include personal costs, fines, and certain entertainment expenses that do not meet the criteria set by accounting guidelines or funding agreements.

Key Differences Between Allowable and Unallowable Expenses

Allowable expenses are costs that comply with organizational policies and regulatory guidelines, qualifying for reimbursement or deduction, such as travel expenses related to business activities and office supplies. Unallowable expenses include costs that are personal, extravagant, or non-essential, like entertainment expenses, fines, or lobbying fees, which are typically excluded from reimbursement. The key difference hinges on adherence to established criteria determining eligibility for financial claims, impacting budget management and audit compliance.

Common Examples of Allowable Expenses

Common examples of allowable expenses include office supplies, travel costs directly related to business activities, and employee salaries. These expenses are typically necessary for day-to-day operations and are deductible under IRS guidelines. Proper documentation and receipts are essential to substantiate and classify these costs as allowable.

Common Examples of Unallowable Expenses

Common examples of unallowable expenses include personal costs unrelated to business activities, entertainment expenses not directly tied to company objectives, and fines or penalties incurred due to legal violations. Expenses such as lobbying fees, political contributions, and excessive meal costs without proper documentation are also typically disallowed. These unallowable expenses must be carefully identified and excluded to ensure compliance with regulatory and financial reporting standards.

Criteria for Determining Allowable Expenses

Allowable expenses must be necessary, reasonable, and allocable to the project or business activity, complying with applicable laws, regulations, and contract terms. Expenses that align with the organization's policies, directly benefit the project, and are supported by proper documentation meet the criteria for allowability. Unallowable expenses typically involve personal costs, excessive or extravagant charges, and those not properly documented or justified within the scope of the funded activity.

Implications of Claiming Unallowable Expenses

Claiming unallowable expenses can trigger audits, result in financial penalties, and damage a company's reputation with regulatory bodies. These expenses, if not properly identified, may lead to disallowed claims during tax filings or grant reimbursements, increasing an organization's taxable income or requiring repayment. Maintaining accurate records and understanding regulatory guidelines is essential to avoid compliance risks and financial liabilities associated with unallowable costs.

Recordkeeping for Allowable vs Unallowable Expenses

Accurate recordkeeping for allowable expenses requires detailed documentation such as receipts, invoices, and approved purchase orders to ensure compliance with financial policies and auditing standards. For unallowable expenses, maintaining clear records including justifications for why charges are disallowed helps prevent improper reimbursement and facilitates internal reviews. Consistent categorization and timely reconciliation of these records enhance transparency and accountability in expense reporting.

Regulatory Guidelines on Expense Allowability

Regulatory guidelines on expense allowability distinguish between allowable and unallowable costs to ensure compliance with federal and organizational standards. Allowable expenses typically include those directly related to business operations and adequately documented, while unallowable expenses often encompass personal costs, entertainment, and excessive or unreasonable charges. Strict adherence to regulations such as the Federal Acquisition Regulation (FAR) or the Office of Management and Budget (OMB) Uniform Guidance is essential for accurate expense classification and audit readiness.

Best Practices for Expense Compliance

Best practices for expense compliance emphasize clear differentiation between allowable and unallowable expenses to ensure accurate reporting and adherence to company policies. Implementing detailed expense categories, regular training, and audit trails strengthens internal controls and prevents misuse. Consistent documentation and timely submission of receipts further support transparent and compliant expense management.

Consequences of Misclassifying Expenses

Misclassifying expenses can lead to inaccurate financial statements, resulting in potential tax penalties and increased scrutiny from auditors. Unallowable expenses wrongly classified as allowable could trigger disallowed deductions, creating unexpected liabilities for the business. Consistent misclassification undermines compliance with regulatory standards and jeopardizes eligibility for grants or reimbursements.

Important Terms

Cost Principles

Cost principles define criteria for determining allowable versus unallowable expenses under government contracts, ensuring compliance with the Federal Acquisition Regulation (FAR) and Office of Management and Budget (OMB) guidelines. Allowable costs must be reasonable, allocable, and conform to contract terms, while unallowable costs include those that are expressly prohibited, such as entertainment or alcohol expenses, which cannot be charged to the government.

Direct Costs

Direct costs refer to expenses that can be specifically identified with a particular project or activity, such as salaries of project staff or materials used exclusively for the project; allowable direct costs comply with regulations set forth by funding agencies, while unallowable direct costs include expenses like entertainment or personal use that are explicitly excluded by these guidelines. Proper classification ensures compliance with financial regulations and maximizes the efficiency of budget management in grant administration.

Indirect Costs

Indirect costs include expenses not directly attributable to a specific project but necessary for overall operations, such as administrative salaries and facility maintenance. Allowable indirect costs comply with regulatory guidelines and can be charged to federally funded projects, while unallowable costs, like entertainment or lobbying expenses, must be excluded from budget claims.

Allocability

Allocability determines whether a cost can be properly assigned to a specific project or activity, based on its direct benefit and relevance. Allowable costs are allocable and meet regulatory criteria, whereas unallowable costs fail to satisfy these conditions and cannot be charged to the project.

Reasonableness

Reasonableness criteria play a crucial role in distinguishing allowable costs from unallowable expenses within regulatory and contractual frameworks. Determining whether a cost is reasonable involves assessing its necessity, market value alignment, and adherence to established guidelines to ensure compliance and fiscal responsibility.

Federal Acquisition Regulation (FAR)

The Federal Acquisition Regulation (FAR) outlines specific cost principles that distinguish allowable from unallowable costs in federal contracts, ensuring compliance with government standards for cost reimbursement and billing. Allowable costs must be reasonable, allocable, and comply with accounting standards, while unallowable costs include expenses such as alcohol, entertainment, and certain lobbying activities, which are expressly prohibited from reimbursement.

OMB Uniform Guidance

OMB Uniform Guidance delineates clear criteria for allowable versus unallowable costs under federal grants, emphasizing compliance with cost principles outlined in 2 CFR Part 200. Allowable costs must be necessary, reasonable, allocable, and consistently treated, whereas unallowable costs include lobbying, entertainment, and alcohol expenses.

Cost Disallowance

Cost disallowance occurs when expenses claimed are deemed unallowable according to regulatory guidelines such as the Federal Acquisition Regulation (FAR), resulting in their exclusion from reimbursable costs. Differentiating allowable costs, which comply with cost principles and contract terms, from unallowable costs, including those that are unreasonable, illegal, or unsupported, is essential for accurate financial reporting and compliance.

Cost Reimbursement

Cost reimbursement contracts require reimbursement for allowable costs defined under federal regulations such as the Federal Acquisition Regulation (FAR), while unallowable costs like entertainment expenses, alcohol, and certain fines are excluded from reimbursement. Accurate identification and documentation of allowable versus unallowable costs are essential for compliance and audit readiness in government contracting.

Audit Findings

Audit findings often reveal discrepancies between allowable and unallowable expenses, highlighting non-compliance with regulatory or contractual guidelines. Identifying these unallowable costs is critical to ensure accurate financial reporting and prevent potential penalties or disallowed reimbursements.

allowable vs unallowable Infographic

moneydif.com

moneydif.com