Prepaid expenses represent payments made in advance for goods or services to be received in the future, recorded as assets until the benefit is realized. Accrued expenses, on the other hand, refer to costs incurred but not yet paid, recognized as liabilities on the balance sheet. Understanding this distinction is crucial for accurate financial reporting and cash flow management.

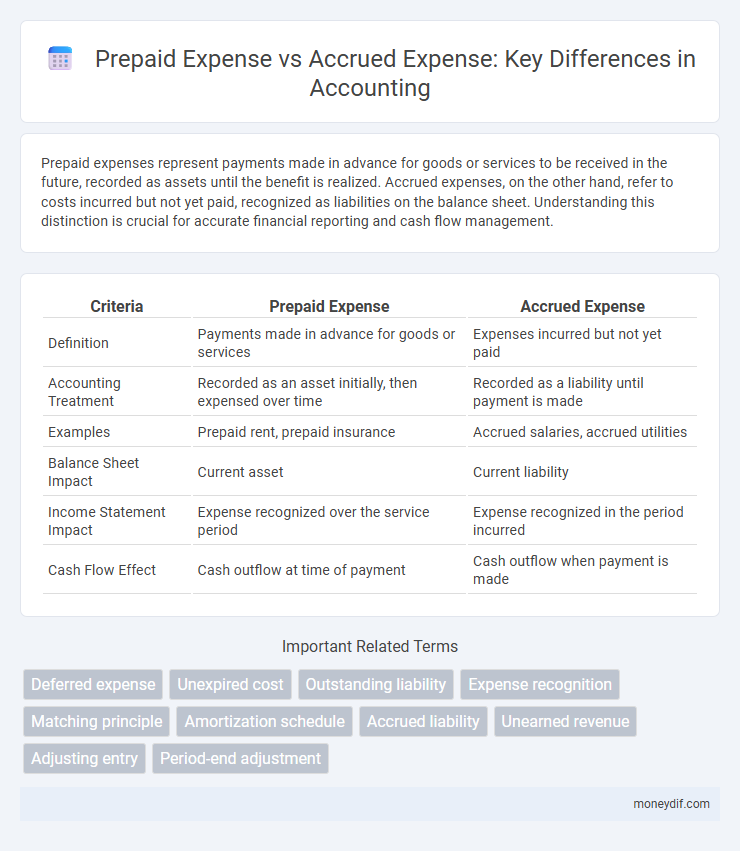

Table of Comparison

| Criteria | Prepaid Expense | Accrued Expense |

|---|---|---|

| Definition | Payments made in advance for goods or services | Expenses incurred but not yet paid |

| Accounting Treatment | Recorded as an asset initially, then expensed over time | Recorded as a liability until payment is made |

| Examples | Prepaid rent, prepaid insurance | Accrued salaries, accrued utilities |

| Balance Sheet Impact | Current asset | Current liability |

| Income Statement Impact | Expense recognized over the service period | Expense recognized in the period incurred |

| Cash Flow Effect | Cash outflow at time of payment | Cash outflow when payment is made |

Introduction to Prepaid and Accrued Expenses

Prepaid expenses represent payments made in advance for goods or services to be received in the future, creating an asset on the balance sheet until the expense is recognized. Accrued expenses arise when costs are incurred but not yet paid, requiring an adjusting entry to record the liability and expense in the appropriate accounting period. Understanding the distinction between prepaid and accrued expenses ensures accurate financial reporting and effective expense management.

Definition of Prepaid Expenses

Prepaid expenses are payments made in advance for goods or services to be received in the future, representing an asset on the balance sheet until the benefit is realized. Common examples include prepaid rent, insurance premiums, and subscriptions, which are initially recorded as current assets. As the service period progresses, these expenses are systematically recognized on the income statement to match the period they benefit.

Definition of Accrued Expenses

Accrued expenses represent liabilities for goods or services received but not yet paid by the end of an accounting period, reflecting obligations that have been incurred but remain unpaid. Common examples include accrued wages, interest expenses, and utilities, highlighting their role in matching expenses to the period in which they are incurred. Accrual accounting requires recognizing these expenses to accurately reflect financial performance and obligations in the financial statements.

Key Differences Between Prepaid and Accrued Expenses

Prepaid expenses represent payments made in advance for goods or services to be received in the future, whereas accrued expenses reflect costs incurred but not yet paid or recorded. The key distinction lies in timing: prepaid expenses are assets recorded before usage, while accrued expenses are liabilities recognized before payment. Understanding these differences is crucial for accurate financial reporting and cash flow management.

Examples of Prepaid Expenses

Prepaid expenses include payments made in advance for services or goods, such as insurance premiums, rent paid ahead of the lease period, and office supplies purchased before use. These payments are recorded as assets on the balance sheet until the benefit is realized over time. Common examples highlight how companies allocate costs to future accounting periods, improving expense matching with revenues.

Examples of Accrued Expenses

Accrued expenses include wages payable, interest payable, and utilities payable, representing costs incurred but not yet paid during the accounting period. Companies recognize these liabilities to match expenses with the period they relate to, ensuring accurate financial reporting. This practice conforms to the matching principle under accrual accounting standards like GAAP and IFRS.

Accounting Treatment for Prepaid Expenses

Prepaid expenses are recorded as assets on the balance sheet because they represent payments made for goods or services to be received in the future. During the accounting period, these amounts are gradually expensed through systematic allocation, typically via adjusting entries that debit expense accounts and credit prepaid expense accounts. This process aligns with the matching principle, ensuring expenses are recognized in the period when the related benefits are consumed.

Accounting Treatment for Accrued Expenses

Accrued expenses are recorded as liabilities on the balance sheet until paid, reflecting incurred costs not yet settled. The accounting treatment requires recognizing the expense in the period it occurs to match revenues and expenses accurately under the accrual basis. Common examples include accrued salaries, interest payable, and utilities, which are adjusted through journal entries at the end of the accounting period.

Impact on Financial Statements

Prepaid expenses appear as current assets on the balance sheet, reducing cash but increasing assets until the expense is recognized over time, which then impacts the income statement by increasing expenses. Accrued expenses are recorded as current liabilities on the balance sheet because the expense has been incurred but not yet paid, leading to an increase in expenses on the income statement before cash outflow. Properly accounting for prepaid and accrued expenses ensures accurate matching of expenses with revenues, maintaining the integrity of financial reports.

Importance in Expense Management

Prepaid expenses represent payments made in advance for goods or services, allowing companies to allocate costs accurately over future periods and improve cash flow visibility. Accrued expenses, recorded as liabilities before payment, ensure that expenses are matched with the corresponding revenue, providing a more precise picture of financial performance. Effective management of prepaid and accrued expenses enhances budgeting accuracy, financial reporting, and compliance with accounting standards such as GAAP and IFRS.

Important Terms

Deferred expense

Deferred expense, also known as prepaid expense, represents payments made in advance for goods or services to be received in the future, recorded as assets until they are incurred. In contrast, accrued expenses refer to costs that have been incurred but not yet paid, recognized as liabilities on the balance sheet.

Unexpired cost

Unexpired cost refers to expenses paid or incurred that have not yet been consumed, such as prepaid expenses which are payments made in advance for goods or services to be received in the future. In contrast, accrued expenses represent costs that have been incurred but not yet paid, reflecting obligations to settle these liabilities in upcoming periods.

Outstanding liability

Outstanding liability related to prepaid expenses arises when payments are made in advance for goods or services yet to be received, representing an asset until the benefit is realized, whereas accrued expenses reflect liabilities for costs incurred but not yet paid, impacting the company's balance sheet by increasing current liabilities. Effective management of these accounts ensures accurate financial reporting and cash flow forecasting by distinguishing prepaid advances from obligations that require settlement.

Expense recognition

Expense recognition dictates matching expenses to the period they help generate revenue, distinguishing prepaid expenses--payments made in advance recorded as assets--and accrued expenses--incurred costs recorded as liabilities before payment. Prepaid expenses are gradually expensed over time, whereas accrued expenses recognize obligations before cash outflow, ensuring accurate financial reporting under the matching principle.

Matching principle

The matching principle requires expenses to be recorded in the same period as the revenues they help generate, making prepaid expenses recorded as assets and then expensed over time, while accrued expenses are recognized as liabilities before cash payment. Accurately applying this principle ensures financial statements reflect true financial performance by matching costs with related revenues.

Amortization schedule

An amortization schedule systematically allocates prepaid expenses over their useful periods, ensuring accurate expense recognition aligned with revenue generation. In contrast, accrued expenses are recorded based on incurred obligations, with no upfront payments, emphasizing the matching principle for proper financial reporting.

Accrued liability

Accrued liability represents expenses recognized before payment, typically associated with accrued expenses like wages owed or utilities used but not yet billed, whereas prepaid expenses involve payments made in advance for future benefits, such as prepaid rent or insurance. Understanding the distinction aids in accurate financial statement preparation, with accrued liabilities increasing current liabilities and prepaid expenses recorded as assets until they are incurred.

Unearned revenue

Unearned revenue represents cash received before services are performed, contrasting with prepaid expenses which are outflows paid in advance for future benefits; accrued expenses, by comparison, reflect incurred costs not yet paid. Effective accounting requires distinguishing unearned revenue liabilities from prepaid assets and accrued liabilities to accurately match revenue recognition and expense reporting periods.

Adjusting entry

Adjusting entries for prepaid expenses involve debiting an expense account and crediting an asset account to recognize the portion of the prepaid amount used during the period, while accrued expenses require debiting an expense account and crediting a liability account to record expenses incurred but not yet paid. These adjustments ensure accurate financial reporting by matching expenses to the period in which they are incurred, following accrual accounting principles.

Period-end adjustment

Period-end adjustment for prepaid expenses involves allocating the unexpired portion of payments as assets on the balance sheet, ensuring only the consumed expenses appear in the income statement. In contrast, accrued expenses require recording liabilities for incurred but unpaid costs, matching expenses to the period in which they occur to comply with the matching principle.

prepaid expense vs accrued expense Infographic

moneydif.com

moneydif.com