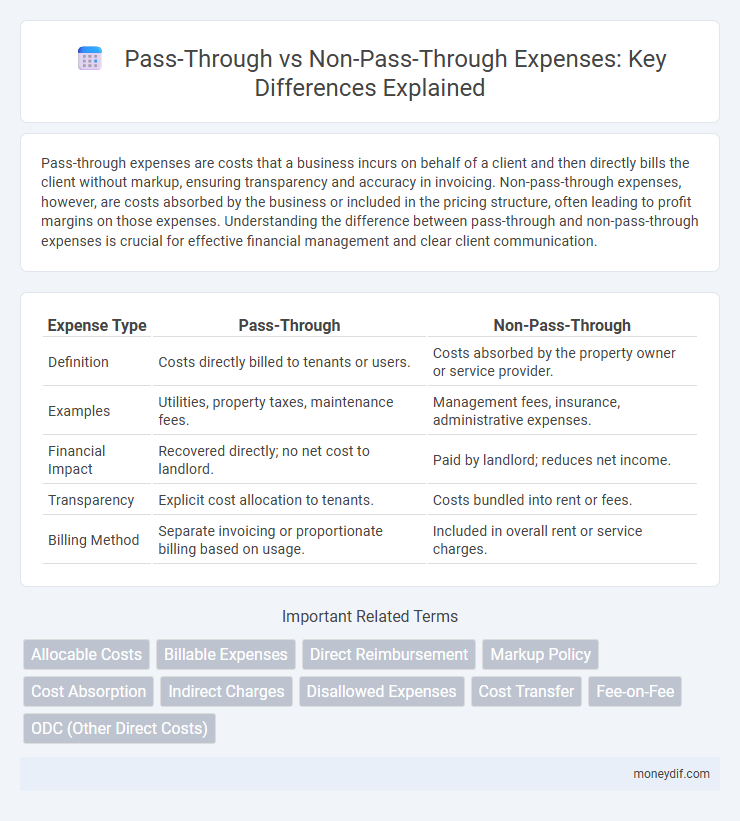

Pass-through expenses are costs that a business incurs on behalf of a client and then directly bills the client without markup, ensuring transparency and accuracy in invoicing. Non-pass-through expenses, however, are costs absorbed by the business or included in the pricing structure, often leading to profit margins on those expenses. Understanding the difference between pass-through and non-pass-through expenses is crucial for effective financial management and clear client communication.

Table of Comparison

| Expense Type | Pass-Through | Non-Pass-Through |

|---|---|---|

| Definition | Costs directly billed to tenants or users. | Costs absorbed by the property owner or service provider. |

| Examples | Utilities, property taxes, maintenance fees. | Management fees, insurance, administrative expenses. |

| Financial Impact | Recovered directly; no net cost to landlord. | Paid by landlord; reduces net income. |

| Transparency | Explicit cost allocation to tenants. | Costs bundled into rent or fees. |

| Billing Method | Separate invoicing or proportionate billing based on usage. | Included in overall rent or service charges. |

Understanding Pass-Through Expenses

Pass-through expenses refer to costs initially incurred by one party but billed directly to another without markup, commonly seen in property management and service contracts. Understanding pass-through expenses is essential for accurate budgeting and financial transparency, as these costs do not impact the service provider's profit margins. Differentiating pass-through from non-pass-through expenses helps businesses allocate funds correctly and maintain clear financial statements.

What Are Non-Pass-Through Expenses?

Non-pass-through expenses are costs incurred by a landlord that are not directly charged to tenants but absorbed as part of the property's operating expenses. These expenses typically include administrative fees, management salaries, and certain repairs or maintenance costs that benefit the property as a whole rather than individual tenants. Unlike pass-through expenses, which are billed to tenants based on their lease agreements, non-pass-through expenses impact the landlord's net operating income and overall profitability.

Key Differences Between Pass-Through and Non-Pass-Through Expenses

Pass-through expenses are costs a landlord incurs but passes directly to tenants, such as property taxes, utilities, and common area maintenance fees, while non-pass-through expenses are absorbed by the landlord, including property management fees and capital expenditures. Pass-through expenses are typically variable and tied to tenant usage or specific property costs, whereas non-pass-through expenses are usually fixed and related to the overall operation and maintenance of the property. The key difference lies in cost allocation and budgeting, with pass-through expenses impacting tenant payments directly and non-pass-through expenses influencing landlord operating costs.

Common Examples of Pass-Through Costs

Common examples of pass-through costs include utilities, subcontractor fees, and raw materials directly billed to a client without markup. These expenses are reimbursed exactly as incurred, reflecting actual third-party charges documented in invoices. Differentiating pass-through costs from non-pass-through items is crucial for accurate budget management and contract compliance.

Typical Non-Pass-Through Expense Scenarios

Typical non-pass-through expense scenarios include costs that the service provider absorbs rather than directly billing the client, such as internal administrative fees, employee benefits, and office supplies. These expenses are often embedded within the overall service pricing and lack explicit itemization on invoices, differentiating them from reimbursable, pass-through costs like travel or subcontractor fees. Non-pass-through expenses impact budget forecasting and financial reporting by requiring allocation within indirect overhead rather than direct client charges.

Impact of Pass-Through Expenses on Budgeting

Pass-through expenses directly influence budgeting by providing a transparent view of actual costs incurred, allowing for more accurate financial forecasting and allocation. These expenses are reimbursed exactly as incurred, reducing the risk of budget variances and improving accountability. Non-pass-through expenses, by contrast, often include overhead or markups, which can complicate budget precision and forecasting efforts.

How Non-Pass-Through Expenses Affect Financial Planning

Non-pass-through expenses directly impact a company's financial planning by requiring allocation of internal funds without reimbursement from clients, reducing available cash flow. These costs must be carefully tracked and managed within budgets to maintain profitability and accurate forecasting. Failure to effectively control non-pass-through expenses can lead to underestimated operational costs and distorted financial statements.

Pass-Through vs. Non-Pass-Through Expenses in Contracts

Pass-through expenses in contracts refer to costs incurred by one party that are directly billed to another without markup, commonly seen in service agreements where actual costs like travel or materials are reimbursed. Non-pass-through expenses include overhead or administrative fees embedded in the contract price, representing costs retained by the service provider. Clear differentiation between pass-through and non-pass-through expenses ensures transparent billing practices and accurate financial forecasting in contractual agreements.

Managing Pass-Through and Non-Pass-Through Expenses Efficiently

Efficient management of pass-through and non-pass-through expenses involves accurate classification and tracking to ensure proper billing and cost recovery. Pass-through expenses, such as subcontractor fees and permit costs, are directly reimbursed by clients without markup, while non-pass-through expenses include overhead and operational costs absorbed by the business. Implementing automated expense management systems and maintaining detailed audit trails optimize financial control and enhance profitability.

Best Practices for Tracking Expense Types

Best practices for tracking expense types emphasize clear categorization between pass-through and non-pass-through expenses to ensure accurate financial reporting and compliance. Pass-through expenses, such as reimbursable costs, should be documented separately from non-pass-through expenses, which are directly incurred by the business. Utilizing dedicated accounting software with customizable expense categories enhances visibility and streamlines auditing processes.

Important Terms

Allocable Costs

Allocable costs are expenses that can be directly attributed to a specific project or cost objective, ensuring accurate expense allocation in financial reports. In the context of pass-through versus non-pass-through funding, pass-through costs are allocated and reimbursed directly to subrecipients without markup, while non-pass-through costs are retained and managed by the primary recipient, impacting budget control and financial compliance.

Billable Expenses

Billable expenses refer to costs incurred by a service provider on behalf of a client that can be invoiced back to the client, categorized as pass-through expenses directly reimbursable without markup, or non-pass-through expenses which include handling fees or overhead added to the original cost. Understanding the distinction between pass-through and non-pass-through expenses is essential for accurate client billing, compliance with accounting standards, and maintaining transparency in expense recovery.

Direct Reimbursement

Direct Reimbursement refers to the immediate repayment mechanism where healthcare providers receive payments directly from payers without intermediaries, distinguishing pass-through reimbursement, which allows certain drugs or devices to be billed separately, from non-pass-through reimbursement, where payments are bundled into comprehensive rates. In pass-through reimbursement, specific add-on payments are made to cover high-cost items temporarily, while non-pass-through methods integrate these costs into the overall payment system, affecting provider revenue recognition and cash flow management.

Markup Policy

Markup policy distinguishes between pass-through and non-pass-through charges, where pass-through costs are directly billed to the customer without added fees, ensuring transparency and cost recovery. Non-pass-through charges include additional markups or service fees applied by the provider, impacting the final price and profit margins.

Cost Absorption

Cost absorption accounting allocates both fixed and variable manufacturing costs to products, determining inventory valuation and cost of goods sold; pass-through costs are directly charged to customers without absorbing overhead, while non-pass-through costs are absorbed into product costs, impacting pricing strategies and profitability. Understanding the distinction between pass-through and non-pass-through costs is essential for accurate financial reporting and effective management of cost recovery in industries with fluctuating expenses.

Indirect Charges

Indirect charges refer to expenses not directly tied to a specific project but necessary for general operations, often categorized as pass-through or non-pass-through costs. Pass-through charges are reimbursed directly to the entity incurring them without mark-up, while non-pass-through charges include overhead and administrative fees embedded in the indirect cost rate applied to projects.

Disallowed Expenses

Disallowed expenses refer to costs that cannot be deducted when calculating taxable income for pass-through entities, potentially increasing the individual owners' tax burden. Non-pass-through entities, like C-corporations, absorb these disallowed expenses internally, affecting corporate taxable income rather than individual shareholders directly.

Cost Transfer

Cost transfer involves reallocating expenses between accounts or projects, typically distinguishing between pass-through and non-pass-through funds based on whether expenses flow through the intermediary without modification or are retained and adjusted by the entity. Pass-through cost transfers pass funds and costs directly to the end recipient without alteration, while non-pass-through transfers involve internal cost absorption or redistribution affecting financial reporting and compliance requirements.

Fee-on-Fee

Fee-on-fee arrangements involve charging fees on top of existing fees, commonly observed in investment management where intermediary advisors apply additional fees on fund-level charges. Pass-through structures allow fees to be directly billed to clients without markup, whereas non-pass-through models incorporate additional fees, affecting the total cost and transparency for investors.

ODC (Other Direct Costs)

Other Direct Costs (ODC) refer to expenses directly attributable to a specific project or contract, such as materials, travel, or subcontractor fees. Pass-through ODCs are reimbursed exactly as paid without markup, while non-pass-through ODCs may include administrative overhead or are marked up by the service provider.

pass-through vs non-pass-through Infographic

moneydif.com

moneydif.com