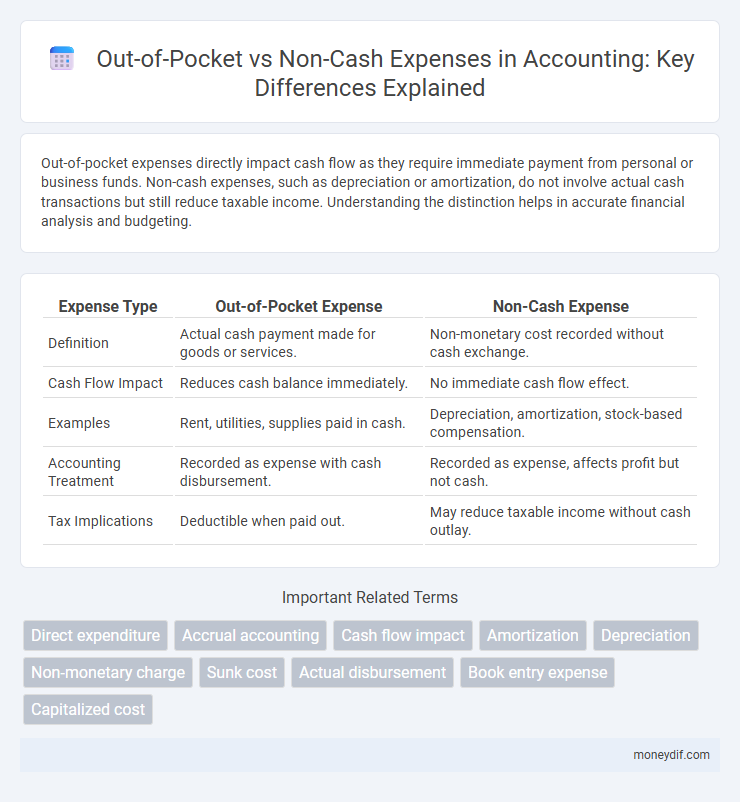

Out-of-pocket expenses directly impact cash flow as they require immediate payment from personal or business funds. Non-cash expenses, such as depreciation or amortization, do not involve actual cash transactions but still reduce taxable income. Understanding the distinction helps in accurate financial analysis and budgeting.

Table of Comparison

| Expense Type | Out-of-Pocket Expense | Non-Cash Expense |

|---|---|---|

| Definition | Actual cash payment made for goods or services. | Non-monetary cost recorded without cash exchange. |

| Cash Flow Impact | Reduces cash balance immediately. | No immediate cash flow effect. |

| Examples | Rent, utilities, supplies paid in cash. | Depreciation, amortization, stock-based compensation. |

| Accounting Treatment | Recorded as expense with cash disbursement. | Recorded as expense, affects profit but not cash. |

| Tax Implications | Deductible when paid out. | May reduce taxable income without cash outlay. |

Understanding Out-of-Pocket Expenses

Out-of-pocket expenses refer to direct payments made by individuals using their own funds for goods or services, typically including costs such as medical bills, travel, or daily necessities. These expenses are contrasted with non-cash expenses, which involve accounting entries like depreciation or amortization that do not require immediate cash outflow. Understanding out-of-pocket expenses is crucial for personal budgeting and financial planning, as they impact actual cash flow and immediate financial obligations.

Defining Non-Cash Expenses

Non-cash expenses refer to accounting costs recorded on financial statements that do not involve direct cash payments, such as depreciation and amortization. These expenses reduce reported earnings without impacting a company's cash flow, providing a clearer picture of operational profitability. Understanding non-cash expenses is essential for accurate cash flow analysis and investment decision-making.

Key Differences Between Out-of-Pocket and Non-Cash Expenses

Out-of-pocket expenses involve actual cash payments made by a business or individual, such as purchasing supplies or paying for travel costs, directly impacting cash flow. Non-cash expenses, like depreciation and amortization, represent accounting allocations that reduce reported profits without affecting cash transactions. Understanding these distinctions is crucial for accurate financial analysis and cash flow management.

Examples of Out-of-Pocket Costs

Out-of-pocket expenses include direct payments made by individuals, such as medical bills, prescription drugs, transportation fares, and meal costs during business travel. These costs are distinct from non-cash expenses like depreciation or amortization, which do not require actual cash outflows. Common out-of-pocket expenses also encompass insurance premiums, office supplies, and utility payments.

Common Types of Non-Cash Expenses

Common types of non-cash expenses include depreciation, amortization, and stock-based compensation, which do not require immediate cash outflow but reduce taxable income and reported profits. These expenses play a crucial role in accounting by allocating the cost of assets over time and reflecting the consumption of intangible assets. Understanding non-cash expenses ensures accurate financial analysis and cash flow management, distinguishing them clearly from out-of-pocket expenses that involve direct cash payments.

Impact on Financial Statements

Out-of-pocket expenses directly reduce cash balance and increase expenses on the income statement, thereby lowering net income and affecting cash flow from operating activities. Non-cash expenses such as depreciation and amortization do not involve cash outflow but reduce net income by allocating the cost of assets over time, impacting the income statement and accumulated depreciation on the balance sheet. Both types influence financial ratios and profitability metrics but differ in their effect on cash flow and liquidity.

Cash Flow Implications

Out-of-pocket expenses directly reduce cash flow as they require immediate payment, impacting liquidity and available funds for operations. Non-cash expenses, such as depreciation or amortization, do not affect cash flow since they are accounting entries reflecting asset value changes without actual cash movement. Understanding the distinction helps businesses manage cash flow effectively by anticipating actual cash outlays versus non-cash accounting charges.

Importance for Budgeting and Planning

Out-of-pocket expenses directly impact cash flow and require immediate budget allocation, making them crucial for accurate financial planning and liquidity management. Non-cash expenses, such as depreciation or amortization, do not affect cash flow but influence net income and tax calculations, aiding in long-term budget forecasting and resource allocation. Proper differentiation between these expense types ensures comprehensive budgeting and effective financial control.

Tax Considerations for Each Expense Type

Out-of-pocket expenses are directly paid by individuals or businesses and are generally tax-deductible when properly documented, reducing taxable income. Non-cash expenses, such as depreciation or amortization, do not involve cash outflow but still impact tax calculations through allowable deductions. Understanding the distinct tax treatment of these expenses is crucial for accurate financial reporting and maximizing tax benefits.

Best Practices for Tracking and Reporting

Out-of-pocket expenses require meticulous recording through receipts and expense reports to ensure accurate reimbursement and budget monitoring. Non-cash expenses, such as depreciation or amortization, rely on systematic allocation schedules and accounting software for precise tracking and financial statement reporting. Employing integrated expense management tools enhances transparency and compliance by automating categorization and audit trails for both types of expenses.

Important Terms

Direct expenditure

Direct expenditure comprises out-of-pocket expenses where individuals pay cash directly for goods or services, contrasting with non-cash expenses that involve non-monetary transactions such as barter, in-kind payments, or accrued costs without immediate cash flow. Understanding these distinctions is crucial for accurately analyzing household budgets and healthcare spending patterns in economic studies.

Accrual accounting

Accrual accounting records expenses when incurred, not necessarily when paid, distinguishing out-of-pocket expenses, which involve actual cash payments, from non-cash expenses like depreciation or amortization that impact financial statements without immediate cash outflow. This method provides a more accurate representation of a company's financial performance and obligations by matching revenues with related expenses in the same period.

Cash flow impact

Out-of-pocket expenses directly reduce cash flow as they require immediate cash payments, whereas non-cash expenses, such as depreciation or amortization, affect net income without impacting actual cash flow. Understanding this distinction is crucial for accurate cash flow management and financial analysis.

Amortization

Amortization is a non-cash expense that systematically allocates the cost of intangible assets over their useful life, reducing taxable income without affecting cash flow. Unlike out-of-pocket expenses, amortization does not require an immediate cash payment, impacting financial statements by spreading the cost rather than reflecting a direct cash outflow.

Depreciation

Depreciation is a non-cash expense representing the allocation of an asset's cost over its useful life, impacting net income without affecting immediate cash flow. Unlike out-of-pocket expenses, which involve actual cash payments, depreciation reduces taxable income while preserving cash resources.

Non-monetary charge

Non-monetary charges refer to expenses recorded without an actual cash outflow, distinguishing them from out-of-pocket costs that involve direct cash payments. Non-cash expenses, such as depreciation and amortization, reduce net income while not affecting immediate cash flow, thereby providing a clearer picture of a company's operational performance.

Sunk cost

Sunk costs represent past expenditures that cannot be recovered, distinguishing them from out-of-pocket expenses, which involve actual cash outflows, and non-cash expenses, such as depreciation, which do not directly affect cash flow. Understanding the difference between sunk costs, out-of-pocket costs, and non-cash expenses is crucial for making informed financial decisions that focus on future benefits rather than irrecoverable past investments.

Actual disbursement

Actual disbursement reflects the real cash outflows incurred, distinguishing out-of-pocket expenses paid directly from funds versus non-cash expenses such as depreciation or accrued liabilities that do not require immediate cash payment. Understanding this difference is crucial for accurate financial analysis and cash flow management in business operations.

Book entry expense

Book entry expenses reflect internal accounting adjustments that do not involve actual cash outflow, distinguishing them from out-of-pocket expenses which require direct financial payment. Understanding the difference between non-cash expenses such as depreciation or amortization and cash-based out-of-pocket costs is essential for accurate financial analysis and budgeting.

Capitalized cost

Capitalized cost refers to expenses recorded as an asset on the balance sheet rather than being expensed immediately, impacting cash flow differently compared to out-of-pocket costs, which require immediate cash payment. Non-cash expenses such as depreciation relate to capitalized costs by allocating the asset's cost over its useful life without affecting current cash flow.

Out-of-pocket vs Non-cash expense Infographic

moneydif.com

moneydif.com