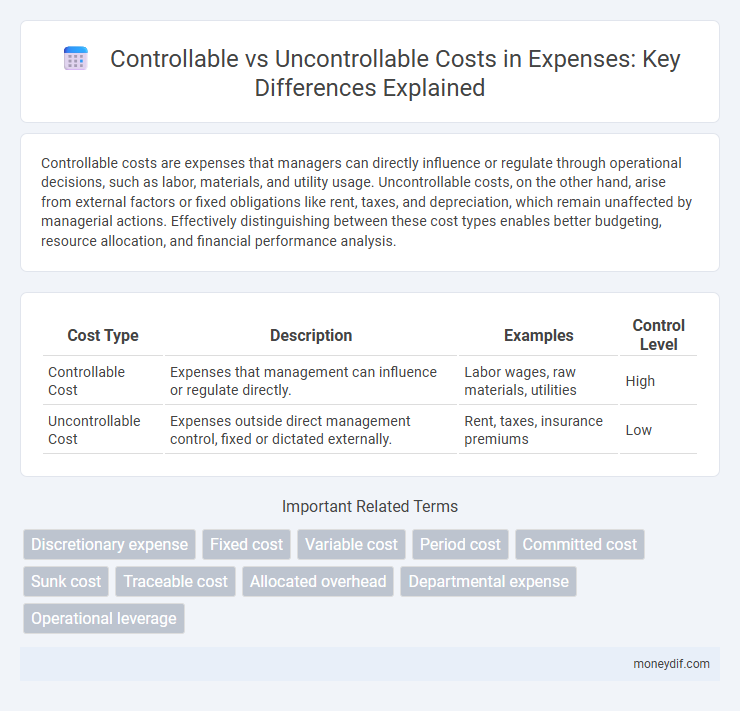

Controllable costs are expenses that managers can directly influence or regulate through operational decisions, such as labor, materials, and utility usage. Uncontrollable costs, on the other hand, arise from external factors or fixed obligations like rent, taxes, and depreciation, which remain unaffected by managerial actions. Effectively distinguishing between these cost types enables better budgeting, resource allocation, and financial performance analysis.

Table of Comparison

| Cost Type | Description | Examples | Control Level |

|---|---|---|---|

| Controllable Cost | Expenses that management can influence or regulate directly. | Labor wages, raw materials, utilities | High |

| Uncontrollable Cost | Expenses outside direct management control, fixed or dictated externally. | Rent, taxes, insurance premiums | Low |

Understanding Controllable and Uncontrollable Costs

Controllable costs are expenses that managers can influence or regulate within a specific period, such as labor, materials, and utility expenses. Uncontrollable costs, including allocated overhead and fixed depreciation, remain unaffected by managerial decisions in the short term. Distinguishing between these costs enables effective budgeting, performance evaluation, and strategic resource allocation.

Key Differences Between Controllable and Uncontrollable Costs

Controllable costs are expenses that managers can influence or regulate, such as labor, materials, and utility expenses, directly tied to operational decisions. Uncontrollable costs, including rent, depreciation, and allocated overhead, remain fixed regardless of managerial actions, often predetermined by external factors or long-term contracts. Understanding the distinction helps businesses optimize budgeting, improve cost management strategies, and enhance overall financial performance.

Examples of Controllable Costs in Business

Controllable costs in business include expenses such as direct materials, labor costs, and utility bills that managers can influence through operational decisions. Examples also extend to advertising budgets, office supplies, and employee training programs, which can be adjusted to align with financial goals. These costs contrast with uncontrollable expenses like rent or taxes, which remain fixed regardless of managerial actions.

Examples of Uncontrollable Costs in Business

Uncontrollable costs in business include expenses such as property taxes, insurance premiums, and contractual lease payments that remain fixed regardless of operational decisions. These costs are often predetermined by external factors or long-term agreements, limiting managerial influence over their fluctuation. Understanding uncontrollable expenses is essential for accurate budgeting and financial forecasting within an organization.

Importance of Identifying Controllable Costs

Identifying controllable costs is essential for effective expense management and operational efficiency. Controllable costs, such as direct labor and materials, can be adjusted or eliminated by management decisions, directly impacting the company's profitability. Differentiating controllable from uncontrollable costs enables precise budgeting and resource allocation, improving financial control and strategic planning.

Managing Uncontrollable Costs Effectively

Managing uncontrollable costs effectively requires precise monitoring and strategic allocation of resources to minimize financial impact despite limited control over these expenses. Implementing predictive analytics and real-time data tracking enables businesses to anticipate fluctuations in uncontrollable costs like regulatory fees or market-driven price changes. Optimizing operational efficiency and negotiating with suppliers can also help mitigate the effects of uncontrollable costs on overall expense management.

Impact of Controllable vs. Uncontrollable Costs on Budgeting

Controllable costs directly influence budget management since they can be adjusted by operational decisions, allowing businesses to optimize expenses and improve profitability. Uncontrollable costs, such as regulatory fees or fixed contractual payments, impose constraints on the budget, necessitating careful forecasting and contingency planning. Effective budgeting requires distinguishing between these cost types to allocate resources efficiently and mitigate financial risks.

Strategies for Reducing Controllable Costs

Implementing effective budgeting and monitoring systems allows organizations to identify and reduce controllable costs such as labor, materials, and utilities. Negotiating better supplier contracts and adopting energy-efficient technologies directly lowers operational expenses. Regular performance reviews and employee training promote cost-conscious behaviors that further minimize controllable expenses.

Role of Managers in Controlling Costs

Managers play a critical role in controlling controllable costs, such as labor, materials, and overhead, directly influencing these expenses through budgeting and operational decisions. Uncontrollable costs, like rent and taxes, remain outside their direct influence but require strategic planning to manage their impact on overall expenses. Effective cost control hinges on managers' ability to differentiate these costs, implement efficient resource allocation, and monitor performance to optimize financial outcomes.

Controllable vs. Uncontrollable Costs: Best Practices for Financial Management

Controllable costs, such as direct labor and raw materials, allow managers to influence spending through operational decisions, whereas uncontrollable costs, like rent and taxes, remain fixed regardless of managerial actions. Effective financial management emphasizes identifying and monitoring controllable costs to optimize budgeting, improve cost efficiency, and drive profitability. Implementing variance analysis and regular cost reviews helps distinguish controllable expenses from uncontrollable ones, enabling informed decision-making and strategic resource allocation.

Important Terms

Discretionary expense

Discretionary expenses are controllable costs that managers can adjust or eliminate based on business needs, unlike uncontrollable costs which remain fixed regardless of management decisions. Examples of discretionary expenses include advertising and training budgets, while uncontrollable costs often comprise rent or depreciation.

Fixed cost

Fixed costs are often classified as uncontrollable costs because they remain constant regardless of production levels, while some fixed costs may be considered controllable if management can influence them within a specific period.

Variable cost

Variable costs fluctuate directly with production volume, categorizing controllable costs as those management can influence and uncontrollable costs as those fixed expenses beyond managerial control.

Period cost

Period costs include both controllable costs, which managers can influence or regulate within a given time frame, and uncontrollable costs, which remain unaffected by managerial decisions in the short term. Understanding the distinction aids in effective budgeting and performance evaluation by isolating costs that can be managed from those that must be absorbed.

Committed cost

Committed costs are long-term, fixed expenses typically uncontrollable by management, whereas controllable costs are short-term expenses that managers can influence or adjust.

Sunk cost

Sunk costs are past expenses that cannot be recovered and are typically uncontrollable, whereas controllable costs can be influenced or altered by management decisions.

Traceable cost

Traceable costs are expenses directly linked to a specific segment and can be controlled or influenced, whereas uncontrollable costs cannot be altered by management decisions within that segment.

Allocated overhead

Allocated overhead refers to the portion of indirect costs assigned to specific cost centers or products, which can be classified as either controllable or uncontrollable costs. Controllable costs are those overhead expenses that managers can influence or regulate, such as utilities or supplies, while uncontrollable costs include fixed overhead items like depreciation or property taxes that remain unaffected by managerial decisions.

Departmental expense

Departmental expenses are classified into controllable costs, which managers can influence, and uncontrollable costs, which remain unaffected by managerial decisions.

Operational leverage

Operational leverage measures the impact of controllable fixed costs versus uncontrollable variable costs on a company's profitability and risk profile.

Controllable cost vs Uncontrollable cost Infographic

moneydif.com

moneydif.com