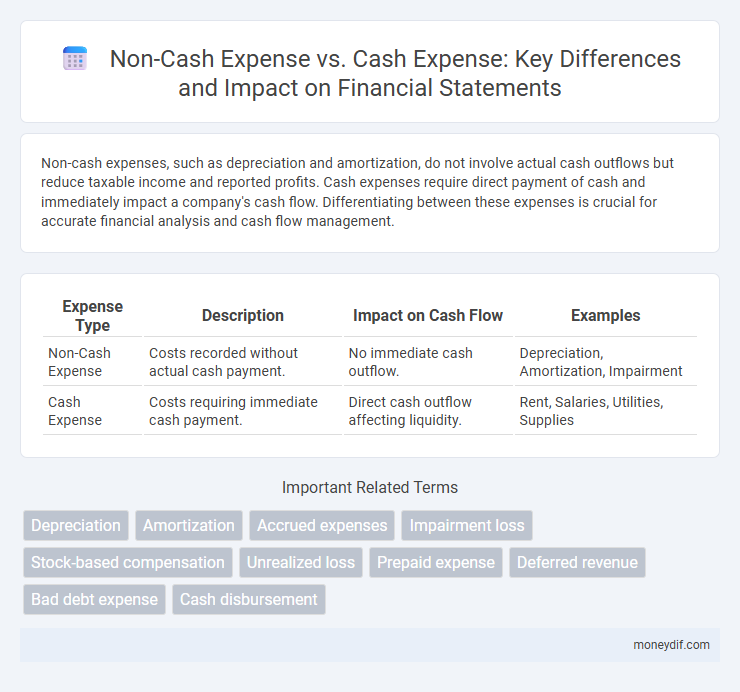

Non-cash expenses, such as depreciation and amortization, do not involve actual cash outflows but reduce taxable income and reported profits. Cash expenses require direct payment of cash and immediately impact a company's cash flow. Differentiating between these expenses is crucial for accurate financial analysis and cash flow management.

Table of Comparison

| Expense Type | Description | Impact on Cash Flow | Examples |

|---|---|---|---|

| Non-Cash Expense | Costs recorded without actual cash payment. | No immediate cash outflow. | Depreciation, Amortization, Impairment |

| Cash Expense | Costs requiring immediate cash payment. | Direct cash outflow affecting liquidity. | Rent, Salaries, Utilities, Supplies |

Definition of Cash Expenses

Cash expenses refer to outflows of actual cash or cash equivalents made by a business to cover day-to-day operational costs such as rent, utilities, salaries, and raw materials. These expenses directly impact a company's cash flow and are recorded when cash is paid out. Unlike non-cash expenses, cash expenses require immediate cash payments and influence liquidity and working capital management.

Definition of Non-Cash Expenses

Non-cash expenses refer to accounting costs recorded in financial statements that do not involve actual cash transactions, such as depreciation, amortization, and stock-based compensation. These expenses reduce taxable income and reflect the allocation of asset costs over time without impacting a company's cash flow. Understanding non-cash expenses is essential for accurate financial analysis, as they influence net income but do not affect immediate liquidity.

Key Differences Between Cash and Non-Cash Expenses

Cash expenses involve actual cash outflows such as rent, salaries, and utilities, directly impacting a company's liquidity and cash flow statements. Non-cash expenses, like depreciation and amortization, do not require cash payment but reduce taxable income by allocating the cost of assets over time. The key difference lies in cash expenses affecting immediate financial resources, while non-cash expenses adjust accounting profits without changing cash positions.

Common Examples of Cash Expenses

Common examples of cash expenses include rent payments, utility bills, payroll salaries, office supplies, and travel costs, all of which involve direct outflows of cash. Non-cash expenses, such as depreciation and amortization, do not require an immediate cash payment but reduce taxable income and accounting profits. Understanding the distinction helps businesses manage cash flow effectively and maintain accurate financial records.

Common Examples of Non-Cash Expenses

Non-cash expenses include depreciation, amortization, and stock-based compensation, which reduce reported earnings without affecting cash flow. These expenses reflect the allocation of asset costs or employee incentives over time rather than immediate outflows. Understanding non-cash expenses is crucial for accurate cash flow analysis and financial statement interpretation.

Impact on Financial Statements

Non-cash expenses such as depreciation and amortization reduce net income on the income statement without affecting cash flow, as they do not involve actual cash outflows. Cash expenses like salaries, rent, and utilities directly decrease both net income and cash flow, impacting the cash flow statement immediately. Understanding the distinction is critical for accurate cash flow analysis and evaluating a company's operational efficiency and financial health.

Importance in Cash Flow Management

Non-cash expenses such as depreciation and amortization reduce taxable income without affecting cash flow, making them critical for accurate cash flow analysis. Cash expenses involve actual outflows like salaries and rent, directly impacting liquidity and daily financial operations. Effective cash flow management requires distinguishing between these expenses to ensure sustainable budgeting and solvency.

Role in Tax Reporting

Non-cash expenses, such as depreciation and amortization, reduce taxable income without impacting cash flow, allowing businesses to lower tax liabilities while preserving cash. Cash expenses directly decrease both taxable income and cash reserves, affecting a company's liquidity. Accurate differentiation between non-cash and cash expenses is critical for tax reporting compliance and strategic financial planning.

Implications for Investors and Stakeholders

Non-cash expenses such as depreciation and amortization impact financial statements by reducing taxable income without affecting cash flow, providing investors insight into asset aging and future capital requirements. Cash expenses directly reduce company cash reserves, signaling immediate outflows that affect liquidity and operational sustainability. Understanding the distinction helps stakeholders assess true profitability and cash management effectiveness, influencing investment decisions and risk evaluations.

Best Practices for Tracking Both Types of Expenses

Accurate tracking of non-cash expenses such as depreciation and amortization alongside cash expenses like payroll and utilities is essential for precise financial reporting and budgeting. Implementing specialized accounting software that categorizes these expenses separately enhances visibility and control over cash flow and asset valuation. Regular reconciliation and detailed documentation ensure compliance with accounting standards and provide a clear audit trail for both expense types.

Important Terms

Depreciation

Depreciation is a non-cash expense that allocates the cost of a tangible asset over its useful life without directly impacting cash flow, unlike cash expenses that require immediate outlay of funds. This accounting method helps businesses accurately reflect asset value reduction while preserving operational cash for other uses.

Amortization

Amortization is a non-cash expense that systematically allocates the cost of intangible assets over their useful life, distinguishing it from cash expenses that involve actual cash outflows. This accounting treatment impacts net income without affecting the company's cash flow, providing a more accurate reflection of asset value consumption over time.

Accrued expenses

Accrued expenses represent liabilities for goods or services received but not yet paid in cash, often involving non-cash expenses like depreciation or amortization that do not require immediate cash outflow. Unlike cash expenses that involve direct payment, accrued expenses impact financial statements by recognizing obligations and affecting net income without an immediate cash transaction.

Impairment loss

Impairment loss represents a non-cash expense that reduces the carrying value of an asset on the balance sheet without affecting immediate cash flow, unlike cash expenses which involve actual outflow of cash for operations or transactions. This accounting adjustment signals asset value deterioration and impacts net income, whereas cash expenses directly influence liquidity and cash management.

Stock-based compensation

Stock-based compensation is recognized as a non-cash expense that impacts a company's income statement without affecting cash flow, reflecting the cost of equity incentives granted to employees. Unlike cash expenses, which involve actual cash outflows, stock-based compensation dilutes shareholder equity but preserves the company's liquidity.

Unrealized loss

Unrealized loss represents a non-cash expense arising from the decrease in value of assets not yet sold, impacting financial statements without affecting cash flow. In contrast, cash expenses involve actual outflows of cash, directly reducing available funds and reflecting real-time operational costs.

Prepaid expense

Prepaid expenses represent payments made in advance for goods or services, classified as non-cash expenses when amortized over time, reflecting the consumption of the prepaid asset without immediate cash outflow. Unlike cash expenses, prepaid expenses initially impact balance sheet accounts and only affect the income statement as the expense is recognized during the relevant accounting periods.

Deferred revenue

Deferred revenue represents cash received before services are delivered or goods are provided, classified as a liability on the balance sheet, whereas non-cash expenses like depreciation affect net income without impacting cash flow. Cash expenses involve actual cash outflows, directly reducing cash balances, in contrast to deferred revenue which reflects customer prepayments and impacts revenue recognition timing rather than immediate cash movement.

Bad debt expense

Bad debt expense represents a non-cash expense that reflects estimated uncollectible accounts receivable, impacting net income without affecting actual cash flow. This contrasts with cash expenses, which involve direct outflows of cash, highlighting bad debt's role solely in accounting adjustments rather than immediate cash transactions.

Cash disbursement

Cash disbursement involves actual outflow of funds, distinguishing it from non-cash expenses like depreciation, which affect financial statements without impacting cash flow. Understanding this difference is crucial for accurate cash flow management and financial analysis in business operations.

Non-cash expense vs Cash expense Infographic

moneydif.com

moneydif.com