Joint cost refers to expenses incurred in a single process that produces multiple products simultaneously, making it challenging to allocate costs accurately to each product. Common cost, on the other hand, represents shared expenses that support multiple departments or products but can be distinctly traced to specific cost centers. Understanding the difference between joint cost and common cost is crucial for precise cost allocation and effective financial management.

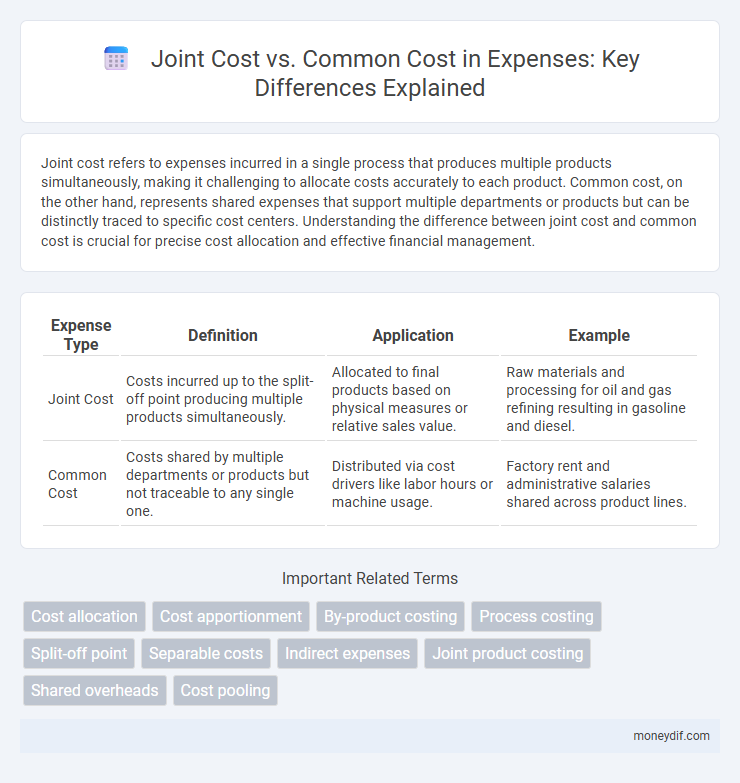

Table of Comparison

| Expense Type | Definition | Application | Example |

|---|---|---|---|

| Joint Cost | Costs incurred up to the split-off point producing multiple products simultaneously. | Allocated to final products based on physical measures or relative sales value. | Raw materials and processing for oil and gas refining resulting in gasoline and diesel. |

| Common Cost | Costs shared by multiple departments or products but not traceable to any single one. | Distributed via cost drivers like labor hours or machine usage. | Factory rent and administrative salaries shared across product lines. |

Introduction to Joint and Common Costs

Joint costs arise from a single production process that yields multiple products simultaneously, making cost allocation essential for accurate product costing. Common costs refer to expenses shared by multiple departments or products, yet they cannot be traced directly to any single output. Understanding the distinctions between joint and common costs is crucial for effective cost management and financial decision-making.

Definition of Joint Costs

Joint costs refer to expenses incurred during a production process where multiple products are simultaneously produced from a common input or raw material up to a certain split-off point. These costs cannot be directly traced to individual products because they are shared among all output products. Understanding joint costs is essential for effective cost allocation and pricing strategies in industries such as petroleum refining, meat processing, and chemical manufacturing.

Definition of Common Costs

Common costs refer to expenses incurred to support multiple products, services, or departments simultaneously without direct traceability to any single cost object. Unlike joint costs, which arise from a single production process yielding multiple outputs, common costs are shared overheads such as utilities, rent, and administrative salaries that benefit various activities collectively. Proper allocation of common costs is essential for accurate product costing, budgeting, and financial analysis.

Key Differences Between Joint and Common Costs

Joint costs arise from a single production process that simultaneously generates multiple products, making cost allocation essential for determining product profitability. Common costs refer to expenses shared across multiple departments or products but cannot be directly traced to any one product, requiring cost allocation for accurate financial analysis. The key difference lies in joint costs being linked to simultaneous production, whereas common costs are shared expenses not tied to a specific product.

Examples of Joint Costs in Business

Joint costs in business refer to expenses incurred during processes that produce multiple products simultaneously, such as the cost of raw materials and labor in dairy production where milk is processed into cream, butter, and skim milk. Another example includes the crude oil refining process, where crude oil is split into gasoline, diesel, and jet fuel, with costs shared across all outputs. Manufacturing of meat products also involves joint costs, as the slaughters and processing generate various cuts of meat and by-products like leather.

Examples of Common Costs in Operations

Common costs in operations include expenses such as facility rent, utility bills, and administrative salaries that benefit multiple departments simultaneously. These costs are not directly traceable to a single product or service, making them distinct from joint costs that arise during the production of multiple products from a single process. For example, electricity used in a manufacturing plant supports various production lines, representing a typical common cost.

Importance of Cost Allocation Methods

Accurate cost allocation methods distinguish joint costs, which arise from a single process producing multiple products, from common costs shared by multiple departments or products without direct traceability. Effective allocation of joint and common costs ensures precise product costing, aids in pricing strategies, and enhances financial decision-making by reflecting true resource consumption. Implementing sophisticated methods like the physical units method or market-based allocation optimizes expense management and supports profitability analysis.

Impact on Financial Reporting and Expense Analysis

Joint costs, incurred up to the split-off point in production, require allocation among multiple products, influencing cost of goods sold and inventory valuation, which affects gross profit reporting. Common costs, shared by multiple departments or products but not directly traceable, challenge precise expense allocation and can impact the accuracy of segment reporting and profitability analysis. Effective differentiation and allocation of joint and common costs enhance financial statement transparency and support more accurate expense management decisions.

Challenges in Distinguishing Joint and Common Costs

Distinguishing joint costs from common costs presents significant challenges due to their inherent allocation complexities and overlapping characteristics in multi-product processes. Joint costs, incurred up to the split-off point in production, require precise allocation methods to accurately assign expenses to individual products, complicating cost analysis and decision-making. Common costs, shared across various departments or products without direct traceability, further obscure financial clarity, necessitating sophisticated cost accounting techniques to ensure accurate expense reporting and resource management.

Best Practices for Managing Joint and Common Costs

Effective management of joint and common costs requires detailed cost allocation methods that accurately trace expenses to specific products or departments, enhancing financial transparency. Implementing activity-based costing (ABC) helps differentiate shared expenses by assigning them according to actual resource consumption, reducing distortion in cost reporting. Regular audits and cross-functional collaboration ensure that joint and common costs are consistently monitored and allocated to support strategic decision-making and operational efficiency.

Important Terms

Cost allocation

Joint cost refers to expenses incurred up to the split-off point in a multi-product process, while common cost represents shared expenses that cannot be directly attributed to specific products or departments.

Cost apportionment

Cost apportionment distinguishes joint costs, incurred during a single process producing multiple products, from common costs, shared across different departments or products but not traceable to a single process.

By-product costing

By-product costing allocates joint costs to main products while treating common costs as shared expenses that are not directly assignable to individual products.

Process costing

Process costing allocates joint costs incurred during production to multiple products based on physical units or relative sales value, while common costs are shared expenses that cannot be traced to a specific product and require separate allocation methods.

Split-off point

The split-off point marks the stage in production where joint costs convert into separable costs, enabling allocation between joint and common costs for individual products.

Separable costs

Separable costs refer to expenses that can be directly attributed to individual products after the split-off point, unlike joint costs that are incurred up to the split-off and cannot be assigned to specific products. Common costs represent shared expenses benefiting multiple products but are not traceable to any single product, differing from separable costs which are identifiable and directly assignable.

Indirect expenses

Indirect expenses classified as joint costs are incurred for producing multiple products simultaneously and cannot be directly traced, while common costs are shared expenses allocated across different departments or products without direct association.

Joint product costing

Joint product costing involves assigning costs to multiple products generated simultaneously from a single production process, focusing on joint costs incurred up to the split-off point. Joint costs are shared expenses necessary for producing all products collectively, while common costs refer to indirect expenses not directly traceable to any specific product but supporting overall operations.

Shared overheads

Shared overheads refer to expenses incurred collectively by multiple products or departments, classified as joint costs when inseparable before allocation and as common costs when traceable but allocated across various cost objects.

Cost pooling

Cost pooling aggregates expenses shared by multiple products or services, facilitating more accurate allocation of joint costs incurred during production processes where inputs simultaneously yield multiple outputs. In contrast, common costs represent indirect expenses that cannot be directly traced to specific products or services and require allocation based on predetermined bases or cost drivers.

Joint cost vs Common cost Infographic

moneydif.com

moneydif.com