Deferred expenses represent costs paid in advance and recorded as assets until they are consumed or expired, ensuring accurate matching with revenue periods. Incurred expenses, on the other hand, are costs that have been recognized during a specific accounting period, reflecting obligations already incurred regardless of payment status. Understanding the timing and recognition difference between deferred and incurred expenses is crucial for precise financial reporting and expense management.

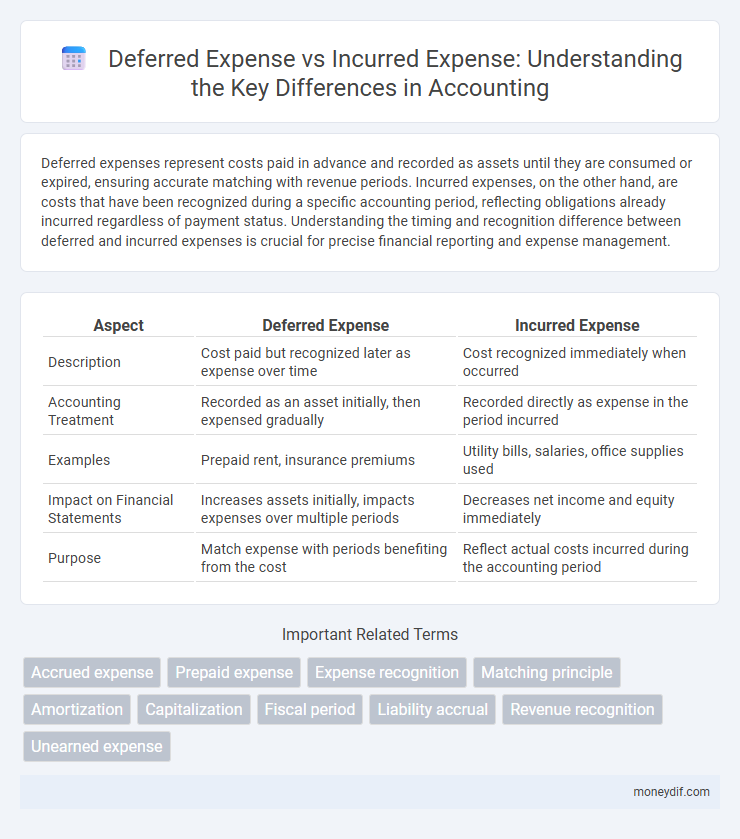

Table of Comparison

| Aspect | Deferred Expense | Incurred Expense |

|---|---|---|

| Description | Cost paid but recognized later as expense over time | Cost recognized immediately when occurred |

| Accounting Treatment | Recorded as an asset initially, then expensed gradually | Recorded directly as expense in the period incurred |

| Examples | Prepaid rent, insurance premiums | Utility bills, salaries, office supplies used |

| Impact on Financial Statements | Increases assets initially, impacts expenses over multiple periods | Decreases net income and equity immediately |

| Purpose | Match expense with periods benefiting from the cost | Reflect actual costs incurred during the accounting period |

Understanding Deferred vs Incurred Expenses

Deferred expenses represent costs that have been paid but not yet incurred, recorded as assets on the balance sheet until the related benefits are realized. Incurred expenses are costs that have been recognized on the income statement because the goods or services have been received or consumed. Differentiating between deferred and incurred expenses is essential for accurate financial reporting and matching expenses to the appropriate accounting periods.

Key Differences Between Deferred and Incurred Expenses

Deferred expenses represent payments made for goods or services to be received in the future, recorded as assets on the balance sheet until they are realized. Incurred expenses, by contrast, refer to costs that have been consumed or accrued during the accounting period, directly impacting the income statement as liabilities or expenses. The key distinction lies in timing: deferred expenses are prepayments benefiting future periods, whereas incurred expenses reflect obligations or consumed resources within the current period.

Definition and Examples of Deferred Expenses

Deferred expenses, also known as prepaid expenses, are costs that a company pays in advance for goods or services to be received or consumed in the future, such as prepaid rent, insurance premiums, or subscriptions. These expenses are recorded as assets on the balance sheet until the related benefit is realized over time, at which point they are recognized as incurred expenses on the income statement. For example, a company paying $12,000 upfront for a one-year insurance policy records this amount as a deferred expense, then allocates $1,000 monthly as an incurred expense throughout the year.

Definition and Examples of Incurred Expenses

Incurred expenses refer to costs that a business has become obligated to pay, regardless of whether the payment has been made, such as salaries earned by employees during the accounting period or utility bills received for services already consumed. These expenses directly impact the income statement in the period they are incurred, reflecting the true cost of operations within that timeframe. Unlike deferred expenses, which are prepaid and recorded as assets until utilized, incurred expenses represent actual liabilities that reduce net income when recognized.

Recognition Criteria for Deferred and Incurred Expenses

Deferred expenses are recognized on the balance sheet when payments are made for goods or services that will benefit future periods, adhering to the matching principle by allocating costs over the relevant accounting periods. Incurred expenses are recorded on the income statement when the obligation arises, reflecting the consumption of resources in the current period regardless of cash payment timing. Recognition criteria for deferred expenses require future economic benefits and probable realization, while incurred expenses necessitate a present obligation and measurable cost related to current operations.

Accounting Treatment: Deferred vs Incurred Expenses

Deferred expenses are recorded as assets on the balance sheet and recognized as expenses over time when the related benefit is realized, following the matching principle in accrual accounting. Incurred expenses are immediately recorded as liabilities or expenses on the income statement when the obligation occurs, reflecting actual consumption of resources. Proper accounting treatment ensures accurate financial reporting by distinguishing costs that provide future economic benefits from those already consumed.

Impact on Financial Statements

Deferred expenses represent payments made for future benefits and are recorded as assets on the balance sheet, reducing current period expenses and inflating net income. Incurred expenses are recognized immediately on the income statement, reflecting the actual cost of goods or services consumed during the period and decreasing net income. The distinction impacts financial statements by affecting asset values, expense recognition timing, and profitability metrics.

Common Mistakes in Expense Classification

Misclassifying deferred expenses as incurred expenses can distort financial statements by overstating current period costs and understating future expenses. Businesses often mistake prepaid items, such as insurance or rent, as expenses when they should be recognized over time according to the matching principle. Accurate classification requires aligning expense recognition with the period in which the related benefit is received to ensure compliant financial reporting and decision-making.

Importance in Financial Reporting and Compliance

Deferred expense represents payments made for goods or services to be received in future periods, impacting asset recognition and ensuring expenses are matched with corresponding revenues in financial reporting. Incurred expense reflects costs that are recognized immediately as liabilities, crucial for accurate profit measurement and compliance with accounting standards such as GAAP or IFRS. Proper distinction and timely recording between deferred and incurred expenses enhance transparency, support regulatory compliance, and improve financial statement reliability.

Best Practices for Managing Business Expenses

Effective management of deferred expenses involves accurately recording prepaid costs and systematically allocating them over relevant accounting periods to match revenues, ensuring precise financial reporting. For incurred expenses, prompt recognition and documentation are essential to maintain up-to-date financial records and facilitate cash flow analysis. Implementing robust tracking systems and regular reconciliations enhances visibility, optimizes budget adherence, and supports strategic financial decision-making.

Important Terms

Accrued expense

Accrued expenses represent liabilities for costs that have been incurred but not yet paid, distinguishing them from deferred expenses which are payments made in advance for future benefits. Incurred expenses are recognized when the obligation arises, aligning with the accrual accounting principle, while deferred expenses are recorded as assets until the associated benefits are realized.

Prepaid expense

Prepaid expenses represent costs paid in advance and recorded as assets until they are incurred, while deferred expenses refer to those costs capitalized on the balance sheet but recognized as expenses over time. Incurred expenses, in contrast, are costs that have been realized or consumed during the accounting period and are immediately recognized on the income statement.

Expense recognition

Deferred expense represents payments made for goods or services to be received in the future, recorded as assets until the benefit is realized, while incurred expense reflects costs that have already been consumed or used up during the accounting period, recognized immediately on the income statement. Accurate expense recognition ensures proper matching of costs with revenues, supporting compliance with accrual accounting principles and enhancing financial reporting reliability.

Matching principle

The matching principle requires expenses to be recorded in the same period as the revenues they help generate, which distinguishes deferred expenses--paid in advance but recognized over time--from incurred expenses that are recorded immediately when consumed. Accurate application ensures financial statements reflect true profitability by aligning costs with the related income within the appropriate accounting period.

Amortization

Amortization systematically allocates the cost of a deferred expense, such as prepaid insurance or rent, over its useful period to match expense recognition with the related revenue. Incurred expenses are recorded immediately in the accounting period they occur, whereas deferred expenses are capitalized and gradually amortized to expense on the income statement.

Capitalization

Capitalization of deferred expenses involves recording costs as assets on the balance sheet, reflecting future economic benefits, whereas incurred expenses are immediately recognized on the income statement, reducing net income for the current period. Understanding the distinction ensures accurate financial reporting and compliance with accounting standards such as GAAP or IFRS.

Fiscal period

A fiscal period is the specific timeframe businesses use to report financial performance, during which deferred expenses are recognized as assets on the balance sheet until they are incurred and expensed in the matching period. Incurred expenses are costs that have already been consumed or used up within the fiscal period, directly affecting the income statement and reducing net income.

Liability accrual

Liability accrual involves recognizing expenses incurred but not yet paid, often linked to deferred expenses which represent prepaid costs allocated over future periods, unlike incurred expenses that are recognized immediately when a service or good is received. Accrued liabilities ensure accurate matching of expenses to the period they relate to, contrasting with deferred expenses that defer recognition to align with revenue generation.

Revenue recognition

Revenue recognition hinges on matching incurred expenses with the corresponding earned revenue, while deferred expenses represent costs paid but not yet incurred, requiring allocation over future periods. Proper differentiation ensures accurate financial reporting by aligning revenues with the expenses truly associated with generating them.

Unearned expense

Unearned expense, often confused with deferred expense, represents payments made for goods or services not yet received, whereas deferred expenses are costs capitalized on the balance sheet to be expensed over future periods. Incurred expenses, by contrast, are costs that have been recognized in the accounting records as liabilities once the goods or services have been received, regardless of payment timing.

Deferred expense vs Incurred expense Infographic

moneydif.com

moneydif.com