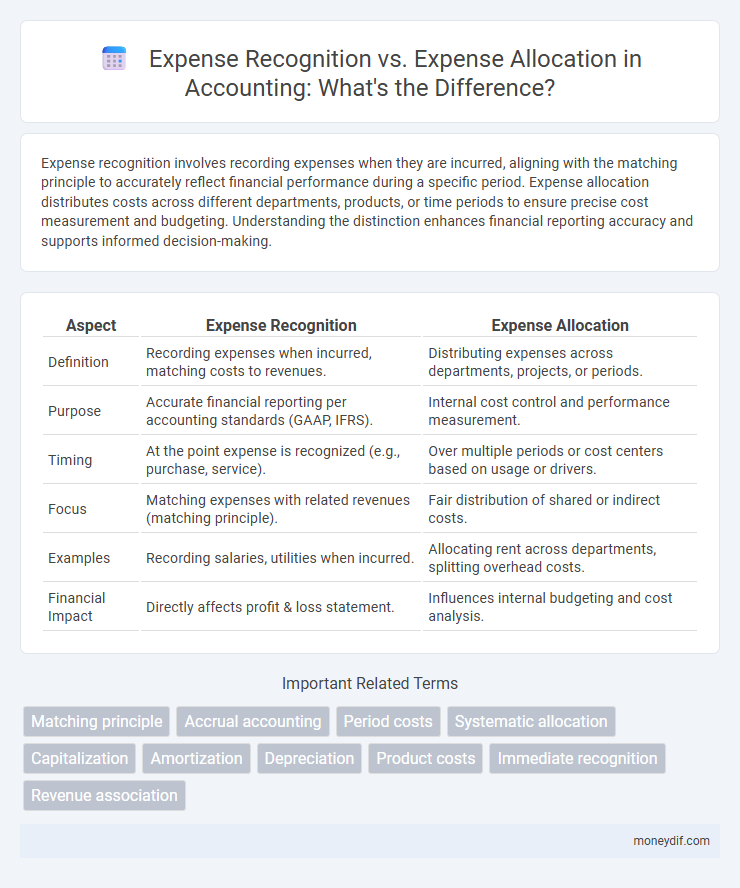

Expense recognition involves recording expenses when they are incurred, aligning with the matching principle to accurately reflect financial performance during a specific period. Expense allocation distributes costs across different departments, products, or time periods to ensure precise cost measurement and budgeting. Understanding the distinction enhances financial reporting accuracy and supports informed decision-making.

Table of Comparison

| Aspect | Expense Recognition | Expense Allocation |

|---|---|---|

| Definition | Recording expenses when incurred, matching costs to revenues. | Distributing expenses across departments, projects, or periods. |

| Purpose | Accurate financial reporting per accounting standards (GAAP, IFRS). | Internal cost control and performance measurement. |

| Timing | At the point expense is recognized (e.g., purchase, service). | Over multiple periods or cost centers based on usage or drivers. |

| Focus | Matching expenses with related revenues (matching principle). | Fair distribution of shared or indirect costs. |

| Examples | Recording salaries, utilities when incurred. | Allocating rent across departments, splitting overhead costs. |

| Financial Impact | Directly affects profit & loss statement. | Influences internal budgeting and cost analysis. |

Understanding Expense Recognition

Expense recognition involves recording expenses in the accounting period when they are incurred, ensuring accurate matching with related revenues for proper financial reporting. This principle aligns with the accrual basis of accounting, which prioritizes timely expense identification over cash flow timing. Effective expense recognition provides a clearer picture of an organization's financial performance and helps in informed decision-making.

Defining Expense Allocation

Expense allocation refers to the systematic distribution of incurred costs across different departments, projects, or accounting periods to accurately reflect resource usage and enhance financial reporting precision. It ensures expenses are matched with the revenues they help generate, supporting compliance with accounting principles like the matching concept. Proper expense allocation enables businesses to analyze profitability by segment and make informed budgeting and operational decisions.

Key Differences Between Expense Recognition and Allocation

Expense recognition records expenses when they are incurred, aligning costs with revenues in the same accounting period according to the matching principle. Expense allocation distributes incurred expenses across multiple departments, projects, or periods to accurately reflect resource usage and enhance financial analysis. The key difference lies in recognition identifying timing of expense recording, while allocation focuses on assigning costs to appropriate cost centers or time frames.

Importance of Accurate Expense Recognition

Accurate expense recognition is crucial for maintaining precise financial statements and ensuring compliance with accounting standards such as GAAP and IFRS. Proper expense recognition matches costs with the revenues they help generate, providing a clear view of a company's profitability and financial health. Misstated expenses can distort net income, mislead stakeholders, and lead to regulatory penalties, highlighting the importance of diligent expense recognition over mere expense allocation.

Methods of Expense Allocation

Expense recognition records costs when incurred, while expense allocation distributes expenses across departments or periods for accurate financial reporting. Methods of expense allocation include direct allocation, where costs are assigned directly to cost centers, step-down allocation that sequentially charges service departments, and reciprocal allocation addressing mutual services among departments. Choosing the appropriate method ensures precise matching of expenses to revenue and enhances budgeting accuracy.

Impact on Financial Statements

Expense recognition directly affects the timing of expenses recorded on the income statement, influencing net income and taxable income for the period. Expense allocation distributes costs across multiple periods or departments, impacting asset valuation and profitability metrics by matching expenses with related revenues. Accurate recognition and allocation are essential for reliable financial statements, ensuring compliance with accounting standards such as GAAP or IFRS.

Common Challenges in Expense Recognition

Expense recognition often faces challenges such as accurately determining the timing of expenses according to the matching principle, which requires aligning expenses with related revenues within the correct accounting period. Complexities arise in identifying when costs directly contribute to revenue generation versus when they serve multiple periods, complicating the recognition process. Misclassification or delays in recording expenses can lead to misstated financial statements and affect overall financial analysis and decision-making.

Best Practices for Expense Allocation

Effective expense allocation ensures accurate financial reporting by assigning costs directly to the departments or projects that incurred them. Best practices include using a consistent, transparent allocation method based on measurable drivers such as headcount, usage, or square footage. Regular reviews and adjustments improve precision in expense distribution, supporting better budget control and decision-making.

Expense Recognition: Compliance and Standards

Expense recognition ensures that costs are recorded in the accounting period when they are incurred, adhering to the matching principle under GAAP and IFRS standards. Compliance with these accounting standards requires companies to recognize expenses systematically and rationally to present a true and fair view of financial performance. Accurate expense recognition affects financial statements, tax reporting, and regulatory compliance, preventing misstatements and ensuring transparency for stakeholders.

Improving Financial Reporting Through Effective Expense Management

Expense recognition records costs when incurred to accurately match revenues and expenses within the same accounting period, enhancing financial statement accuracy. Expense allocation distributes expenses across departments or projects based on usage or benefit to provide a clearer view of cost drivers and profitability. Effective expense management combines precise recognition and strategic allocation to improve financial reporting transparency and enable more informed decision-making.

Important Terms

Matching principle

The Matching Principle ensures that expenses are recognized in the same period as the revenues they help generate, aligning expense recognition with income measurement; expense allocation, however, involves systematically distributing costs across multiple periods to reflect their usage accurately. This principle is fundamental in accrual accounting to provide an accurate depiction of financial performance by matching expenses to related revenues rather than simply recording expenses when cash is paid.

Accrual accounting

Accrual accounting recognizes expenses when they are incurred, matching them to the related revenues within the same accounting period to provide an accurate financial picture. Expense allocation involves systematically distributing expenses across multiple periods or departments to reflect their actual consumption or usage in financial statements.

Period costs

Period costs are expenses recognized entirely in the accounting period in which they are incurred, reflecting immediate expense recognition for costs not tied to production. Expense allocation, in contrast, involves distributing costs over multiple periods, matching expenses with the revenues they help generate according to the matching principle.

Systematic allocation

Systematic allocation involves distributing expenses over multiple periods based on a consistent, rational method, in contrast to expense recognition, which records expenses when they are incurred or matched directly with related revenues. This approach ensures accurate financial reporting by aligning costs, such as depreciation or prepaid expenses, with the periods benefiting from the associated assets or services.

Capitalization

Expense recognition requires capitalizing expenditures only when future economic benefits are expected, while expense allocation spreads recognized costs over multiple periods to match revenues accurately. Capitalization impacts financial statements by deferring expenses and enhancing asset values, contrasting with immediate expense allocation that affects profit and loss immediately.

Amortization

Amortization involves expense recognition by systematically matching the cost of intangible assets to revenue generated over their useful life, ensuring accurate financial reporting. Expense allocation, in contrast, spreads costs across multiple periods or projects without directly linking them to specific revenue streams, allowing for budget management and cost control.

Depreciation

Depreciation involves expense recognition by systematically matching the cost of a tangible asset to the periods benefiting from its use, while expense allocation refers to distributing the asset's cost across its useful life. This accounting method ensures accurate financial reporting by aligning expenses with revenue generation, reflecting true asset consumption over time.

Product costs

Product costs include direct materials, direct labor, and manufacturing overhead, which are initially capitalized as inventory on the balance sheet and recognized as expenses through cost of goods sold upon sale. Expense recognition matches costs to the revenue they generate, while expense allocation involves systematically assigning indirect costs to products or periods based on rational and consistent methods.

Immediate recognition

Immediate recognition records expenses at the moment they are incurred, reflecting real-time financial impact, while expense allocation spreads costs over multiple periods to match revenues and adhere to accrual accounting principles. This distinction affects financial statement accuracy, tax reporting, and managerial decision-making by ensuring expenses correspond to the proper accounting periods.

Revenue association

Revenue association ensures that expenses are recognized in the same period as the revenues they help generate, maintaining accurate matching for financial reporting. Expense recognition records costs when they are incurred, while expense allocation distributes costs systematically across multiple periods or departments for precise financial analysis.

Expense recognition vs Expense allocation Infographic

moneydif.com

moneydif.com