Explicit costs represent direct, out-of-pocket expenses such as wages, rent, and materials, which are easily quantifiable in financial statements. Implicit costs refer to the opportunity costs of using resources owned by the business, like the owner's time or capital, which do not involve direct monetary payment but impact profitability. Understanding the distinction between explicit and implicit costs is essential for accurately assessing the true economic cost of business decisions.

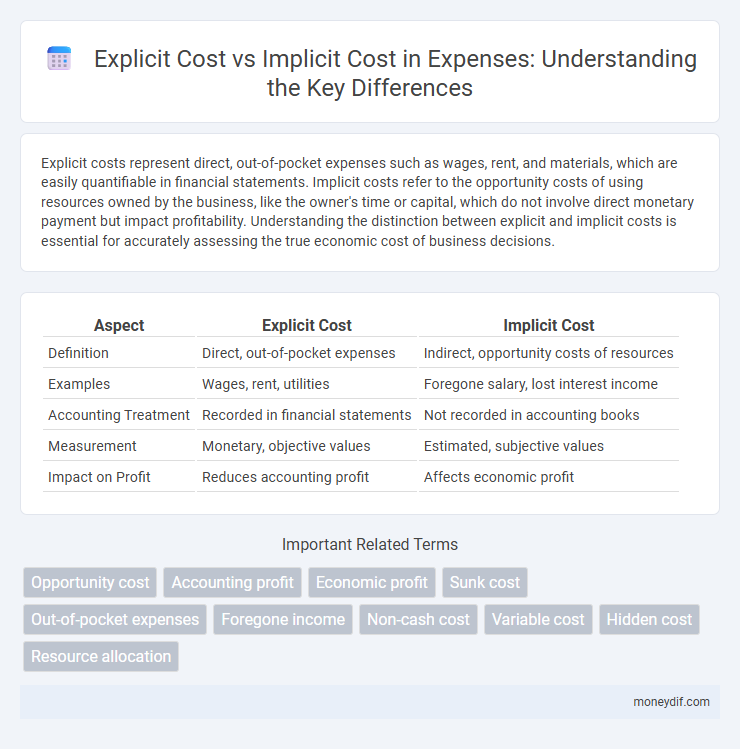

Table of Comparison

| Aspect | Explicit Cost | Implicit Cost |

|---|---|---|

| Definition | Direct, out-of-pocket expenses | Indirect, opportunity costs of resources |

| Examples | Wages, rent, utilities | Foregone salary, lost interest income |

| Accounting Treatment | Recorded in financial statements | Not recorded in accounting books |

| Measurement | Monetary, objective values | Estimated, subjective values |

| Impact on Profit | Reduces accounting profit | Affects economic profit |

Understanding Explicit Costs: Definition and Examples

Explicit costs are direct, out-of-pocket expenses incurred by a business, such as wages, rent, and raw materials. These costs are clearly recorded and easily measurable in financial statements, providing a concrete basis for calculating accounting profit. Examples include utility bills paid, salaries disbursed, and payments for supplies, distinguishing them from implicit costs which represent opportunity costs without direct monetary transactions.

What Are Implicit Costs? Key Concepts Explained

Implicit costs represent the opportunity expenses of using resources owned by the business, such as the owner's time or capital, which do not involve direct monetary payment. These costs are crucial for assessing true economic profit since they account for foregone alternatives not recorded in accounting books. Understanding implicit costs helps businesses make informed decisions by comparing real economic trade-offs beyond explicit, cash-based expenditures.

Key Differences Between Explicit and Implicit Costs

Explicit costs involve direct monetary payments such as wages, rent, and materials, which are clearly recorded in accounting books. Implicit costs represent the opportunity costs of using owner-supplied resources, like time or capital, without actual cash flow. Understanding these differences is crucial for accurate economic profit calculation and informed business decision-making.

Real-Life Examples of Explicit Costs in Business

Explicit costs in business include direct payments such as wages, rent, utilities, and raw materials essential for daily operations. For example, a restaurant paying salaries to its staff, lease payments for the dining space, and purchasing ingredients exemplifies explicit costs clearly documented in financial records. These expenses are tangible outflows that impact cash flow and are necessary for producing goods or services.

How Implicit Costs Affect Business Decision Making

Implicit costs represent the opportunity costs of using resources owned by the business, such as the owner's time or capital, which do not involve direct cash outlays but affect overall profitability. Recognizing implicit costs enables managers to evaluate true economic profit, ensuring decisions reflect the full cost of resource utilization rather than just explicit expenditures. This comprehensive cost analysis influences strategic choices like pricing, investment, and resource allocation to maximize long-term value.

Impact of Explicit and Implicit Costs on Profit Calculation

Explicit costs, such as wages and rent, directly reduce accounting profit by representing actual cash outflows. Implicit costs, including opportunity costs like foregone salary or rent, affect economic profit by accounting for non-monetary sacrifices. Incorporating both explicit and implicit costs provides a comprehensive view of true profitability and informs better business decision-making.

The Role of Explicit and Implicit Costs in Opportunity Cost

Explicit costs represent direct monetary payments made for resources, such as wages, rent, and materials, while implicit costs reflect the value of foregone opportunities, including the owner's time and capital invested elsewhere. Both explicit and implicit costs are crucial in calculating opportunity cost, which measures the true economic expense of choosing one option over another. Understanding these costs ensures accurate financial decision-making by capturing both actual expenditures and hidden sacrifices.

Why Both Costs Matter in Economic Analysis

Explicit cost represents the tangible monetary payments a business makes, such as wages, rent, and materials, while implicit cost reflects the opportunity costs of using resources owned by the firm, like the owner's time or capital. Both costs matter in economic analysis because considering only explicit costs can lead to an incomplete assessment of profitability, ignoring the value of foregone alternatives. Incorporating both explicit and implicit costs ensures a comprehensive evaluation of economic profit, guiding more informed business decisions and resource allocations.

Benefits and Limitations of Tracking Explicit vs Implicit Costs

Tracking explicit costs offers clear financial visibility by recording direct payments like wages and materials, enabling precise budgeting and financial reporting. Implicit costs capture opportunity costs such as forgone income or alternative resource uses, providing a fuller picture of economic decision-making beyond visible expenditures. However, explicit cost tracking may overlook hidden expenses, while implicit costs are often difficult to quantify and require estimations, limiting their accuracy in financial statements.

Practical Tips for Identifying Explicit and Implicit Costs

Explicit costs include direct, out-of-pocket expenses such as wages, rent, and materials that are easily recorded in financial statements. Implicit costs represent the opportunity costs of using resources owned by the business, like owner's time or foregone rental income from own properties. To identify these costs effectively, maintain detailed financial records for explicit expenses and estimate the economic value of resources devoted to the business but not directly paid for, enabling a comprehensive understanding of total costs.

Important Terms

Opportunity cost

Opportunity cost represents the value of the next best alternative foregone when a decision is made, combining both explicit costs--direct monetary payments--and implicit costs, which include the opportunity value of resources owned by the firm. Understanding the distinction between explicit cost, such as wages and materials, and implicit cost, like foregone rental income or personal time, is essential for accurate economic decision-making and profit calculation.

Accounting profit

Accounting profit is calculated by subtracting explicit costs, which are direct monetary payments for inputs like wages and materials, from total revenue, excluding implicit costs such as opportunity costs of owner-supplied resources. This metric focuses solely on observable cash outflows, providing a clear but potentially incomplete picture of a firm's financial performance compared to economic profit.

Economic profit

Economic profit measures the difference between total revenue and the sum of explicit costs (direct, out-of-pocket expenses) and implicit costs (opportunity costs of resources owned by the firm). Unlike accounting profit, it accounts for both visible expenses and the value of foregone alternatives.

Sunk cost

Sunk cost refers to expenses that have already been incurred and cannot be recovered, distinguishing it from explicit costs, which are direct, out-of-pocket payments, and implicit costs, which represent the opportunity costs of resources owned by the firm. Understanding sunk costs helps businesses ignore these irrecoverable expenses in future decision-making, focusing instead on relevant explicit and implicit costs.

Out-of-pocket expenses

Out-of-pocket expenses refer to explicit costs that involve direct monetary payments for goods or services, such as rent, wages, and materials. Implicit costs represent the opportunity costs of using owned resources without direct payment, like foregone income from personal labor or capital invested in the business.

Foregone income

Foregone income represents implicit costs, reflecting the potential earnings an individual or business sacrifices by choosing one option over another, unlike explicit costs, which are direct, out-of-pocket expenses paid in the course of business operations. Understanding the distinction between explicit costs, such as wages and rent, and implicit costs, like foregone income from alternative uses of resources, is essential for accurate economic decision-making and evaluating true opportunity costs.

Non-cash cost

Non-cash costs, such as depreciation and amortization, represent explicit costs recorded in accounting yet do not involve actual cash outflows, distinguishing them from implicit costs that reflect opportunity costs without direct monetary transactions. Understanding the difference between explicit non-cash costs and implicit costs is essential for accurate financial analysis and decision-making.

Variable cost

Variable costs directly change with production output and represent explicit costs such as raw materials and labor wages, clearly recorded in accounting statements. Implicit costs, on the other hand, include opportunity costs like the foregone salary of an entrepreneur, which do not appear as explicit financial transactions but are crucial for economic decision-making.

Hidden cost

Hidden costs often arise from implicit costs, which represent the opportunity costs of resources used in a business but not directly paid for, unlike explicit costs that involve clear, monetary expenditures. These hidden costs can significantly impact profitability by including factors such as foregone income, unpaid labor, or depreciated asset value that are easily overlooked in financial analysis.

Resource allocation

Resource allocation decisions require careful evaluation of explicit costs, such as direct monetary payments for labor and materials, against implicit costs, which represent the opportunity costs of using resources in their next best alternative. Efficient allocation maximizes economic profit by considering both explicit expenses and the potential income foregone, ensuring optimal utilization of scarce resources.

explicit cost vs implicit cost Infographic

moneydif.com

moneydif.com