Fixed costs remain constant regardless of production levels, such as rent and salaries, providing stability in budgeting. Variable costs fluctuate directly with output, including expenses like raw materials and utility usage, impacting overall profitability. Understanding the distinction between fixed and variable costs is essential for effective financial planning and cost control.

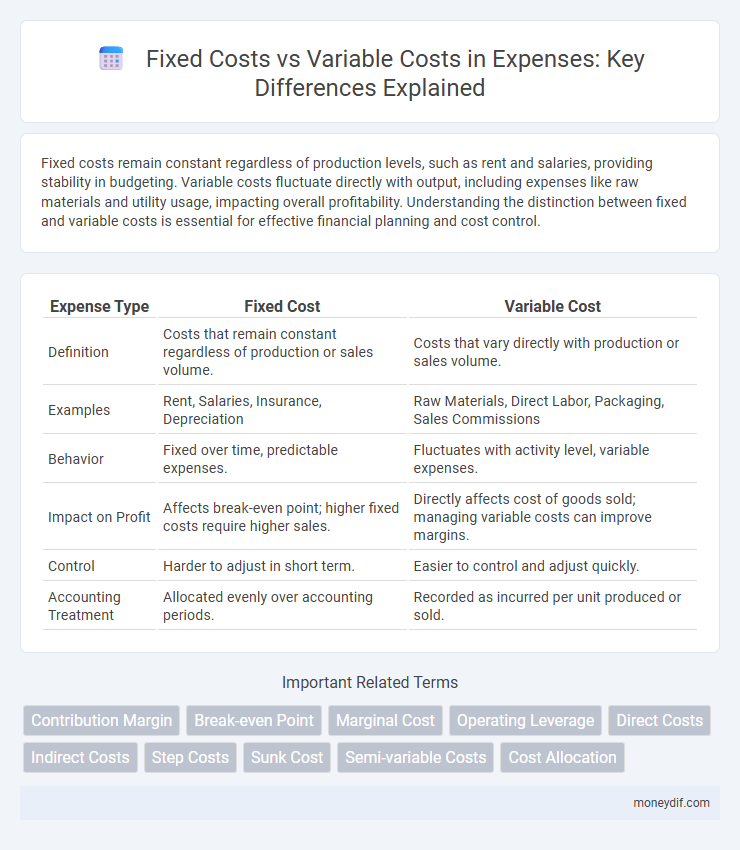

Table of Comparison

| Expense Type | Fixed Cost | Variable Cost |

|---|---|---|

| Definition | Costs that remain constant regardless of production or sales volume. | Costs that vary directly with production or sales volume. |

| Examples | Rent, Salaries, Insurance, Depreciation | Raw Materials, Direct Labor, Packaging, Sales Commissions |

| Behavior | Fixed over time, predictable expenses. | Fluctuates with activity level, variable expenses. |

| Impact on Profit | Affects break-even point; higher fixed costs require higher sales. | Directly affects cost of goods sold; managing variable costs can improve margins. |

| Control | Harder to adjust in short term. | Easier to control and adjust quickly. |

| Accounting Treatment | Allocated evenly over accounting periods. | Recorded as incurred per unit produced or sold. |

Understanding Fixed Costs in Expense Management

Fixed costs are expenses that remain constant regardless of production volume, such as rent, salaries, and insurance. Accurately identifying fixed costs is crucial for effective expense management, enabling businesses to forecast budgets and maintain profitability during sales fluctuations. Fixed costs provide a stable financial foundation, differentiating them from variable costs that fluctuate directly with production levels.

What Are Variable Costs? Key Definitions

Variable costs fluctuate directly with production volume, encompassing expenses like raw materials, direct labor, and utility usage tied to output. Unlike fixed costs, which remain constant regardless of activity levels, variable costs increase as production rises and decrease when production slows. Understanding variable costs is crucial for budgeting, pricing strategies, and profitability analysis in business operations.

Differences Between Fixed and Variable Costs

Fixed costs remain constant regardless of production levels, including expenses such as rent, salaries, and insurance. Variable costs fluctuate directly with production volume, encompassing costs like raw materials, direct labor, and utility expenses tied to manufacturing. Understanding the distinct behavior of fixed and variable costs is essential for budgeting, forecasting, and cost control in financial management.

Examples of Fixed Costs in Business

Fixed costs in business include rent, salaries, and insurance premiums, which remain consistent regardless of production levels. These expenses provide financial stability by ensuring predictable outflows, even when sales fluctuate. Understanding fixed costs is crucial for budgeting and profitability analysis.

Common Variable Costs Across Industries

Common variable costs across industries include raw materials, direct labor, and utility expenses that fluctuate with production volume, directly impacting overall expenditure. Sales commissions and shipping fees also vary proportionally with sales activity, making them crucial for budgeting in sectors like manufacturing and retail. Understanding these variable costs enables businesses to better forecast financial performance and optimize operational efficiency.

How to Identify Fixed vs Variable Expenses

Identifying fixed versus variable expenses requires analyzing whether costs remain constant regardless of production or activity levels; fixed expenses such as rent, salaries, and insurance incur the same amount monthly, while variable expenses like raw materials, utilities, and sales commissions fluctuate with business output. Businesses often track historical financial data to categorize expenses accurately and use cost behavior analysis to predict how changes in operations will impact total costs. Proper identification aids in budgeting, forecasting, and improving profit margins by controlling cost variances effectively.

The Role of Fixed and Variable Costs in Budgeting

Fixed costs, such as rent and salaries, remain constant regardless of production levels, providing budget stability and predictability for long-term financial planning. Variable costs, including raw materials and direct labor, fluctuate with production volume, requiring dynamic budget adjustments to maintain cost control. Effective budgeting balances fixed and variable costs to optimize resource allocation and support strategic decision-making.

Impact of Cost Structure on Profit Margins

Fixed costs, such as rent and salaries, remain constant regardless of production levels, creating a steady expense baseline that influences profit margins. Variable costs fluctuate directly with production volume, impacting profitability by increasing expenses as output rises. A higher proportion of fixed costs in the cost structure can lead to greater profit margin volatility, especially during demand fluctuations, while a dominant variable cost structure offers more flexibility to manage expenses in response to sales changes.

Managing Fixed and Variable Costs Effectively

Managing fixed costs, such as rent and salaries, requires careful budget planning to ensure consistent cash flow regardless of production levels. Variable costs, including raw materials and utilities, fluctuate with output, so monitoring these expenses helps optimize profit margins. Implementing cost-control strategies that balance fixed and variable expenses enhances overall financial stability and operational efficiency.

Why Differentiating Costs Matters for Financial Planning

Differentiating fixed costs, such as rent and salaries, from variable costs like raw materials and production supplies is crucial for accurate financial planning and budgeting. Understanding these distinctions allows businesses to predict how expenses will change with fluctuating production levels and informs strategic decisions on cost control and pricing. Accurate cost categorization enhances cash flow management, profitability analysis, and risk assessment.

Important Terms

Contribution Margin

Contribution Margin represents the amount remaining from sales revenue after variable costs are deducted, directly impacting the coverage of fixed costs and profitability. A higher contribution margin indicates greater efficiency in covering fixed costs and generating profit, highlighting the importance of managing variable costs to optimize financial performance.

Break-even Point

The break-even point is the sales volume at which total revenue equals total costs, encompassing both fixed costs, which remain constant regardless of production level, and variable costs, which fluctuate with output. Understanding the interplay between fixed and variable costs is essential for accurately calculating the break-even point to determine the minimum sales required to avoid losses.

Marginal Cost

Marginal cost represents the additional expense incurred by producing one more unit of output, primarily influenced by variable costs rather than fixed costs, as fixed costs remain constant regardless of production volume. Understanding the distinction between fixed and variable costs is crucial for accurately calculating marginal cost, which aids businesses in optimizing production levels and pricing strategies.

Operating Leverage

Operating leverage measures a company's fixed costs relative to its variable costs, indicating how changes in sales volume affect operating income. High operating leverage occurs when fixed costs dominate, leading to greater profit sensitivity from sales fluctuations, while low operating leverage reflects a cost structure with higher variable costs that buffer profit impact.

Direct Costs

Direct costs consist of expenses directly tied to production, including both fixed costs such as equipment depreciation and variable costs like raw materials. Understanding the distinction between fixed and variable direct costs is essential for accurate budgeting and cost control in manufacturing processes.

Indirect Costs

Indirect costs include overhead expenses not directly traceable to a product, often encompassing fixed costs like rent and salaries, which remain constant regardless of production volume. Variable indirect costs fluctuate with production levels, such as utilities or maintenance, making accurate cost allocation essential for precise financial analysis.

Step Costs

Step costs remain constant over specific activity ranges but increase abruptly once the activity exceeds a threshold, differentiating them from fixed costs, which remain constant regardless of activity, and variable costs, which fluctuate proportionally with activity levels. Businesses must carefully analyze step costs to optimize budgeting and cost control, particularly when scaling operations or adjusting production capacity.

Sunk Cost

Sunk costs are expenses that have already been incurred and cannot be recovered, often mistaken as fixed costs but distinct because fixed costs, such as rent or salaries, persist regardless of production levels. Variable costs fluctuate with output, whereas sunk costs remain irrelevant to future decisions, emphasizing the importance of ignoring sunk costs when evaluating ongoing projects or investments.

Semi-variable Costs

Semi-variable costs combine fixed cost components that remain constant regardless of production volume with variable cost elements that fluctuate based on activity levels, such as utility bills with a base charge plus usage fees. Understanding the distinction between fixed, variable, and semi-variable costs is essential for accurate budgeting, cost control, and break-even analysis in financial management.

Cost Allocation

Cost allocation involves distributing fixed costs, which remain constant regardless of production levels, and variable costs, which fluctuate based on output, to accurately assess product or service profitability. Properly allocating these costs enables businesses to identify cost drivers, improve budgeting accuracy, and optimize pricing strategies for enhanced financial performance.

fixed cost vs variable cost Infographic

moneydif.com

moneydif.com