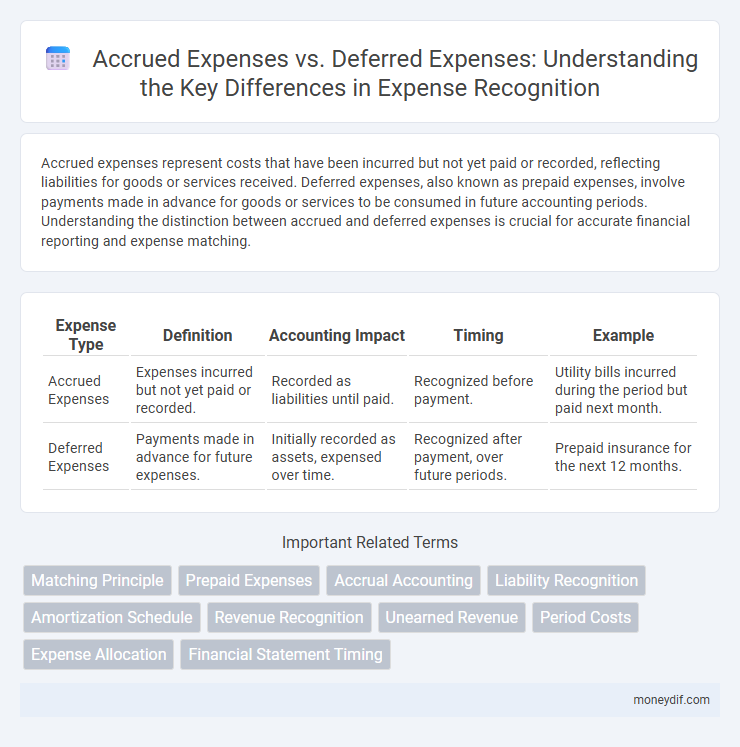

Accrued expenses represent costs that have been incurred but not yet paid or recorded, reflecting liabilities for goods or services received. Deferred expenses, also known as prepaid expenses, involve payments made in advance for goods or services to be consumed in future accounting periods. Understanding the distinction between accrued and deferred expenses is crucial for accurate financial reporting and expense matching.

Table of Comparison

| Expense Type | Definition | Accounting Impact | Timing | Example |

|---|---|---|---|---|

| Accrued Expenses | Expenses incurred but not yet paid or recorded. | Recorded as liabilities until paid. | Recognized before payment. | Utility bills incurred during the period but paid next month. |

| Deferred Expenses | Payments made in advance for future expenses. | Initially recorded as assets, expensed over time. | Recognized after payment, over future periods. | Prepaid insurance for the next 12 months. |

Understanding Accrued Expenses: Definition and Examples

Accrued expenses represent costs that a company has incurred but not yet paid by the balance sheet date, such as salaries, utilities, and interest expenses. These liabilities are recorded to comply with the matching principle, ensuring expenses are recognized in the same period as the related revenues. For example, wages earned by employees in December but paid in January are recorded as accrued expenses on the December financial statements.

What Are Deferred Expenses? Key Concepts Explained

Deferred expenses represent payments made for goods or services that benefit future accounting periods, requiring their costs to be allocated over time rather than recognized immediately. Key concepts include prepaid expenses such as rent or insurance, which are initially recorded as assets and expensed gradually as the benefit is realized. This practice aligns with the matching principle, ensuring expenses correspond to the periods in which related revenues are earned.

Accrued vs Deferred Expenses: Core Differences

Accrued expenses represent liabilities for goods or services received but not yet paid, reflecting obligations incurred during the current accounting period. Deferred expenses, or prepaid expenses, are payments made in advance for benefits to be received in future periods, recorded as assets until they are expensed. The core difference lies in timing: accrued expenses recognize incurred costs before payment, while deferred expenses recognize payments before costs are incurred.

The Accounting Treatment of Accrued Expenses

Accrued expenses are recognized in the accounting period when they are incurred, regardless of when cash payment occurs, using the accrual basis of accounting. These expenses are recorded as liabilities on the balance sheet and corresponding expenses on the income statement to match expenses with the revenues they help generate. Common examples include wages payable, interest payable, and utilities payable, ensuring accurate financial reporting and compliance with GAAP standards.

Recognizing Deferred Expenses in Financial Statements

Deferred expenses are recorded as assets on the balance sheet until the related benefit is realized, ensuring expenses are matched with the appropriate accounting period. Recognition occurs when prepaid costs, such as insurance or rent, gradually convert into expenses over time through systematic allocation. Proper disclosure of deferred expenses aids in accurate financial analysis and adherence to the matching principle in accounting.

Impact of Accrued Expenses on Profit and Loss

Accrued expenses increase the liabilities on the balance sheet while simultaneously reducing net income on the profit and loss statement, reflecting costs incurred but not yet paid. These expenses ensure matching of costs to the period in which they occur, providing a more accurate representation of financial performance. Failure to record accrued expenses can overstate profits, leading to misleading financial analysis and decision-making.

Deferred Expenses: Effects on Cash Flow and Reporting

Deferred expenses represent payments made for goods or services to be received in the future, impacting cash flow by reducing immediate cash outflow despite expenses being recognized later. This timing difference causes deferred expenses to appear as assets on the balance sheet until the corresponding benefit is realized, aligning expense recognition with the matching principle in accounting. Properly reporting deferred expenses improves financial statement accuracy by reflecting the true timing of expense utilization and preserving cash flow stability.

Why Accurate Timing Matters: Accrual vs Deferral

Accurate timing in accounting ensures that accrued expenses, which represent liabilities for goods or services received but not yet paid, are recorded in the period they occur, matching expenses to revenues. Deferred expenses involve costs paid in advance, recognized over time as the service or benefit is realized, preventing premature expense recognition. Precise handling of accruals and deferrals maintains financial statement integrity, supports compliance with GAAP, and improves decision-making by reflecting true financial performance.

Best Practices for Recording Accrued and Deferred Expenses

Accurately recording accrued expenses requires recognizing liabilities for expenses incurred but not yet paid, ensuring precise matching of expenses to the reporting period for reliable financial statements. Deferred expenses demand careful tracking as prepaid costs that must be allocated over future periods, supporting accurate revenue and expense recognition in compliance with GAAP. Implementing a robust accounting system with timely reconciliations and clear documentation improves accuracy and consistency in managing both accrued and deferred expenses.

Common Mistakes in Managing Accrued and Deferred Expenses

Common mistakes in managing accrued and deferred expenses include misclassifying expenses on financial statements, leading to inaccurate profit reporting and cash flow analysis. Failing to regularly update accrued expenses can cause underestimating liabilities, while neglecting periodic review of deferred expenses may result in delayed recognition of expenses affecting budgeting accuracy. Properly distinguishing between these expense types ensures compliance with accounting standards like GAAP and improves financial decision-making.

Important Terms

Matching Principle

The Matching Principle requires recognizing accrued expenses when incurred and deferred expenses as prepaid costs to accurately align expenses with related revenues in the same accounting period.

Prepaid Expenses

Prepaid expenses represent payments made in advance for goods or services, classified as deferred expenses, whereas accrued expenses reflect incurred costs not yet paid, highlighting the key difference between deferred and accrued expenses in accounting.

Accrual Accounting

Accrual accounting recognizes expenses when they are incurred, leading to accrued expenses that represent liabilities for goods or services received but not yet paid, while deferred expenses are costs paid in advance and recorded as assets until they are recognized as expenses over time. This method ensures accurate matching of revenues and expenses within the appropriate accounting periods, improving financial statement reliability.

Liability Recognition

Liability recognition occurs when accrued expenses represent obligations for incurred costs not yet paid, while deferred expenses reflect payments made in advance for future liabilities.

Amortization Schedule

An amortization schedule outlines the systematic allocation of accrued expenses as liabilities incurred but not yet paid and deferred expenses as prepaid costs gradually recognized over time.

Revenue Recognition

Revenue recognition impacts accrued and deferred expenses by dictating the timing of revenue and matching related expenses to ensure accurate financial reporting and compliance with accounting standards.

Unearned Revenue

Unearned revenue is a deferred expense representing cash received before services are rendered, contrasting with accrued expenses which record incurred costs not yet paid.

Period Costs

Period costs include accrued expenses, which are liabilities for incurred but unpaid costs, and deferred expenses, which are prepaid costs recorded as assets until recognized as expenses.

Expense Allocation

Expense allocation distinguishes accrued expenses as incurred but unpaid costs from deferred expenses as payments made in advance for future periods.

Financial Statement Timing

Accrued expenses represent liabilities recognized before cash payment, while deferred expenses involve prepaid costs recorded as assets until incurred, both affecting the timing of financial statement recognition.

Accrued expenses vs Deferred expenses Infographic

moneydif.com

moneydif.com