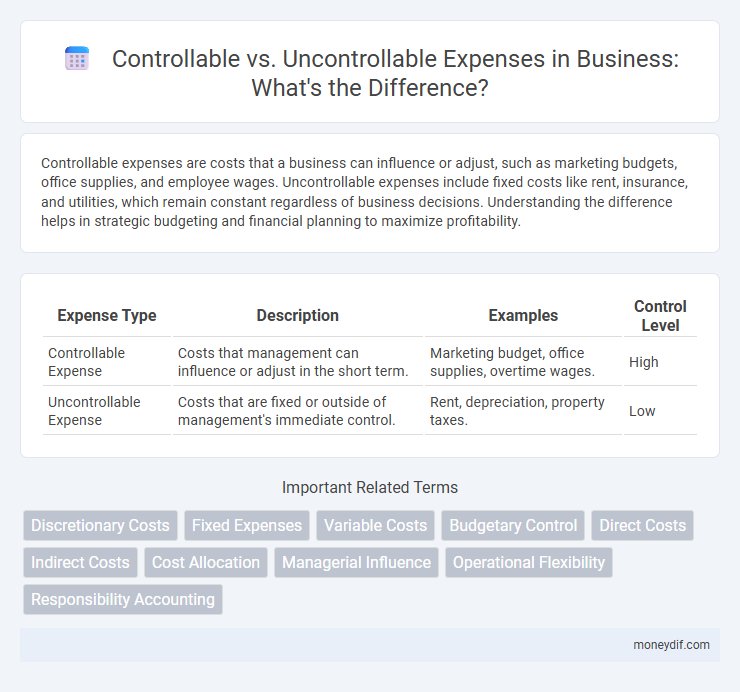

Controllable expenses are costs that a business can influence or adjust, such as marketing budgets, office supplies, and employee wages. Uncontrollable expenses include fixed costs like rent, insurance, and utilities, which remain constant regardless of business decisions. Understanding the difference helps in strategic budgeting and financial planning to maximize profitability.

Table of Comparison

| Expense Type | Description | Examples | Control Level |

|---|---|---|---|

| Controllable Expense | Costs that management can influence or adjust in the short term. | Marketing budget, office supplies, overtime wages. | High |

| Uncontrollable Expense | Costs that are fixed or outside of management's immediate control. | Rent, depreciation, property taxes. | Low |

Introduction to Controllable and Uncontrollable Expenses

Controllable expenses are costs that managers can influence or regulate, such as office supplies and employee bonuses, while uncontrollable expenses include fixed costs like rent and insurance that remain constant regardless of management decisions. Understanding the distinction between these expense types is crucial for effective budgeting and financial planning in businesses. Controllable expenses offer opportunities for cost reduction and operational efficiency, whereas uncontrollable expenses require strategic allocation and forecasting.

Defining Controllable Expenses

Controllable expenses refer to costs that a business or individual can influence or regulate through management decisions, such as office supplies, utilities, and marketing expenses. These expenses contrast with uncontrollable expenses, which are fixed costs like rent or insurance that cannot be easily altered in the short term. Effective management of controllable expenses allows for more flexible budgeting and improved financial performance.

Understanding Uncontrollable Expenses

Uncontrollable expenses refer to costs that cannot be altered or influenced by management decisions, such as taxes, rent under long-term lease agreements, and insurance premiums. These fixed expenses often remain constant regardless of business activity, making them critical for budgeting and financial planning. Understanding uncontrollable expenses helps organizations allocate resources effectively while focusing on managing controllable costs to improve overall profitability.

Key Differences Between Controllable and Uncontrollable Expenses

Controllable expenses are costs that a business can influence or regulate directly, such as salaries, utilities, and office supplies, whereas uncontrollable expenses are fixed costs like rent, depreciation, and insurance that remain unaffected by short-term decisions. Controllable expenses allow managers to implement cost-saving measures promptly, while uncontrollable expenses require long-term strategic planning due to their fixed nature. Understanding these key differences helps organizations optimize budgeting processes and enhance financial performance by distinguishing where cost management efforts are most effective.

Examples of Controllable Expenses

Controllable expenses include costs such as office supplies, utility usage, marketing budgets, and employee bonuses that management can adjust or reduce based on business needs. These expenses are typically discretionary and can be influenced by operational decisions, unlike uncontrollable expenses like rent or taxes. Monitoring controllable expenses helps companies optimize cash flow and improve overall financial performance.

Common Uncontrollable Expenses Categories

Common uncontrollable expense categories include rent, taxes, insurance premiums, and utility bills, which remain fixed or fluctuate independently of business decisions. These expenses are essential for operations but cannot be easily altered or reduced in the short term. Understanding these costs is crucial for accurate budgeting and financial forecasting in both personal and business finance.

Importance of Monitoring Controllable Expenses

Monitoring controllable expenses is crucial for effective financial management, as these costs can be adjusted or reduced to improve profitability and maintain budget discipline. Businesses gain strategic flexibility by regularly tracking controllable expenses such as labor, utilities, and supplies, enabling timely decision-making and cost optimization. Neglecting this oversight risks financial inefficiency and undermines the ability to respond to market changes or unexpected challenges.

Strategies to Manage Uncontrollable Expenses

Implementing strategies such as negotiating contracts, leveraging bulk purchasing, and adopting energy-efficient technologies can significantly reduce uncontrollable expenses like utilities and supplier costs. Monitoring market trends and exploring alternative vendors allows businesses to mitigate price fluctuations and maintain budget stability. Establishing contingency funds and regularly reviewing expense reports further enhance financial resilience against unforeseen uncontrollable costs.

Impact of Expense Types on Budget Planning

Controllable expenses, such as office supplies and utility costs, offer flexibility for budget adjustments and immediate cost-saving measures. Uncontrollable expenses, including rent and insurance premiums, impose fixed financial obligations that limit short-term budget responsiveness. Effective budget planning requires distinguishing between these expense types to optimize resource allocation and maintain financial stability.

Best Practices for Balancing Both Expense Types

Effective management of controllable expenses, such as labor and utilities, involves regular monitoring, budgeting, and employee training to reduce unnecessary costs without sacrificing quality. Uncontrollable expenses like rent and taxes require strategic planning, including long-term contracts and tax optimization strategies, to minimize their impact on overall finances. Balancing both expense types demands integrating data analytics for predictive budgeting and fostering collaboration between departments to ensure financial flexibility and operational efficiency.

Important Terms

Discretionary Costs

Discretionary costs are expenses that management can adjust or eliminate in the short term, making them primarily controllable expenses, unlike uncontrollable costs which are fixed and unavoidable. Examples include advertising budgets and employee training programs, which can be modified to manage a company's financial performance.

Fixed Expenses

Fixed expenses such as rent, salaries, and insurance premiums often fall under controllable expenses when management can adjust staffing levels or negotiate lease terms, while uncontrollable fixed expenses include property taxes or contractual loan payments that remain constant regardless of business decisions. Understanding the distinction between controllable and uncontrollable fixed expenses enables businesses to implement effective budget control and forecast cash flow accurately.

Variable Costs

Variable costs fluctuate directly with production volume, making them largely controllable by management decisions such as labor allocation and raw material usage. Uncontrollable expenses, in contrast, remain fixed regardless of output levels and are not influenced by short-term operational choices.

Budgetary Control

Budgetary control involves monitoring and managing controllable expenses, such as labor and raw materials, while identifying uncontrollable expenses like rent and taxes that cannot be altered in the short term. Effective budgetary control ensures that controllable costs are kept within approved limits to enhance financial performance and operational efficiency.

Direct Costs

Direct costs include expenses directly tied to production, such as raw materials and labor, which are generally controllable by management through operational decisions. Uncontrollable expenses, however, like certain utility fees or regulatory costs, fall outside management's ability to influence despite being directly associated with the production process.

Indirect Costs

Indirect costs include both controllable and uncontrollable expenses, where controllable expenses can be influenced or managed by the organization, such as utility costs or administrative salaries. Uncontrollable indirect costs, like insurance premiums or property taxes, are fixed and cannot be altered by management decisions in the short term.

Cost Allocation

Cost allocation differentiates between controllable expenses, which managers can influence or adjust, and uncontrollable expenses, which remain fixed regardless of managerial decisions. Accurately assigning costs enhances budgeting, performance evaluation, and decision-making by highlighting areas where cost control is feasible.

Managerial Influence

Managerial influence primarily affects controllable expenses, where decisions such as budgeting, resource allocation, and operational efficiencies can directly reduce costs. Uncontrollable expenses, including fixed costs like rent or depreciation, remain unaffected by managerial actions and require strategic long-term planning to manage.

Operational Flexibility

Operational flexibility enhances a company's ability to adjust controllable expenses such as labor and materials in response to market changes while managing uncontrollable expenses like rent and taxes effectively. Optimizing the balance between these expense types enables agile financial planning and sustained profitability.

Responsibility Accounting

Responsibility accounting distinguishes between controllable expenses, which managers can influence through operational decisions, and uncontrollable expenses, which remain outside their control due to external factors or higher-level management directives. This differentiation helps in evaluating managerial performance by assigning accountability only for costs within their direct control.

controllable vs uncontrollable expense Infographic

moneydif.com

moneydif.com