Accrued expenses represent liabilities for goods or services received but not yet paid, impacting current financial statements by recognizing incurred costs in the period they occur. Deferred expenses, or prepaid expenses, are payments made in advance for benefits extending into future periods, recorded as assets until the expense is realized. Properly distinguishing accrued expenses from deferred expenses ensures accurate matching of revenues and costs, enhancing financial reporting clarity.

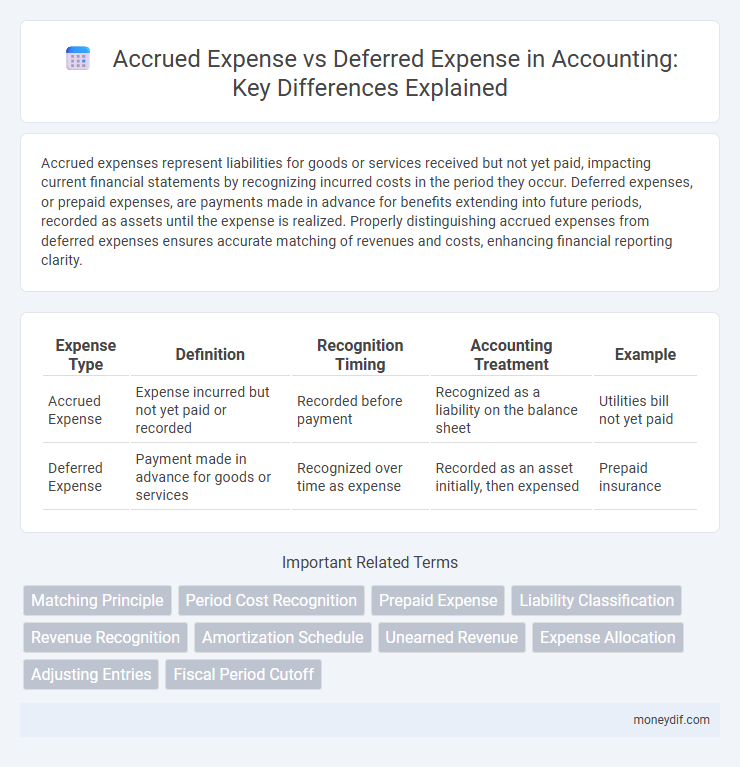

Table of Comparison

| Expense Type | Definition | Recognition Timing | Accounting Treatment | Example |

|---|---|---|---|---|

| Accrued Expense | Expense incurred but not yet paid or recorded | Recorded before payment | Recognized as a liability on the balance sheet | Utilities bill not yet paid |

| Deferred Expense | Payment made in advance for goods or services | Recognized over time as expense | Recorded as an asset initially, then expensed | Prepaid insurance |

Definition of Accrued Expense

Accrued expenses represent liabilities for goods or services received but not yet paid by the end of an accounting period, reflecting earned obligations that increase expenses and corresponding liabilities. These expenses are recorded in the period they occur to comply with the matching principle in accounting, ensuring accurate financial reporting. Examples include wages payable, interest payable, and utility bills incurred but unpaid.

Definition of Deferred Expense

Deferred expense represents a payment made for goods or services received in the future, recorded as an asset until the benefit is realized. This prepaid cost allocates expenses over multiple accounting periods, ensuring accurate matching with revenues. Common examples include prepaid rent, insurance premiums, and subscriptions.

Key Differences Between Accrued and Deferred Expenses

Accrued expenses represent costs that have been incurred but not yet paid or recorded, impacting current liabilities and reflecting obligations owed by a business. Deferred expenses, also known as prepaid expenses, involve payments made in advance for goods or services to be received in the future, recorded as assets until recognized as expenses. The key differences lie in timing and accounting treatment: accrued expenses increase liabilities before cash outflow, while deferred expenses delay expense recognition until the benefit is realized.

How Accrued Expenses Impact Financial Statements

Accrued expenses increase current liabilities on the balance sheet, reflecting obligations for goods or services received but not yet paid. They reduce net income on the income statement by recognizing expenses in the period incurred, thereby aligning expenses with revenues according to the matching principle. This adjustment improves the accuracy of financial reports and provides a clearer picture of a company's financial health.

Recording Deferred Expenses: Methods and Examples

Recording deferred expenses involves initially recognizing the payment as an asset on the balance sheet, reflecting prepaid costs such as insurance or rent. These expenses are then systematically amortized over the period benefiting from the service, aligning the expense recognition with revenue generation in accordance with accrual accounting principles. Common methods include straight-line amortization, which allocates equal expense amounts each period, and activity-based methods, which tie expense recognition to usage or output metrics.

Advantages of Tracking Accrued Expenses

Tracking accrued expenses provides a precise matching of expenses to the period in which they are incurred, enhancing the accuracy of financial statements and compliance with the accrual accounting principle. This practice enables businesses to anticipate cash flow needs by recognizing liabilities before payment is made, improving budget management and financial planning. Maintaining detailed records of accrued expenses also supports better decision-making and transparency for stakeholders and auditors.

Common Examples of Accrued vs. Deferred Expenses

Accrued expenses include salaries payable, utility bills, and interest expenses that have been incurred but not yet paid by the end of an accounting period. Deferred expenses typically involve prepaid insurance, rent, and subscription fees that are paid in advance and expensed over time. Understanding these common examples helps differentiate the timing of expense recognition under accrual accounting principles.

Importance in Financial Reporting and Compliance

Accrued expenses ensure liabilities are recognized in the correct accounting period, providing an accurate reflection of obligations and enhancing financial statement reliability. Deferred expenses allow for proper matching of costs to revenues by allocating payments over multiple periods, crucial for compliance with accrual accounting principles. Accurate recording of both accrued and deferred expenses supports regulatory adherence and prevents misstated financial results in reporting.

Accrued and Deferred Expenses in Cash vs. Accrual Accounting

Accrued expenses represent liabilities for goods or services received but not yet paid, recognized in accrual accounting to match expenses with revenues in the period incurred. Deferred expenses, or prepaid expenses, are payments made in advance, recorded as assets until the related benefit is realized, distinguishing cash flow timing in cash accounting. Understanding the timing and recognition of accrued versus deferred expenses is crucial for accurate financial reporting and cash flow management.

Best Practices for Managing Accrued and Deferred Expenses

Implementing best practices for managing accrued and deferred expenses involves accurate and timely recording to ensure financial statements reflect true obligations and future benefits. Utilizing automated accounting software can enhance precision in tracking accruals and deferrals, reducing errors and improving compliance with GAAP standards. Regular reconciliation of accrued and deferred expense accounts helps maintain transparency and supports effective cash flow management.

Important Terms

Matching Principle

The matching principle requires that expenses be recognized in the same period as the revenues they help generate, leading to accrued expenses being recorded when costs are incurred but not yet paid, and deferred expenses being allocated to future periods when the related benefits are realized. Accurate application of this principle ensures financial statements reflect true profitability by matching accrued expenses such as utilities or wages payable, and deferred expenses like prepaid insurance or rent, to their corresponding revenue periods.

Period Cost Recognition

Period cost recognition involves recording expenses in the period they are incurred, distinguishing accrued expenses, which are recognized before payment due to incurred obligations, from deferred expenses, which represent payments made in advance and are expensed over future periods. Accurate matching of costs and revenues ensures financial statements reflect the true economic activity of the reporting period.

Prepaid Expense

Prepaid expense represents payments made in advance for goods or services to be received in the future, classified as deferred expenses since costs are recognized over time as benefits accrue. Accrued expenses, in contrast, involve liabilities for expenses incurred but not yet paid, reflecting obligations that increase expenses before cash outflow occurs.

Liability Classification

Liability classification distinguishes accrued expenses as current liabilities representing amounts owed for goods or services received but not yet paid, while deferred expenses are recorded as assets until the related expense is incurred. Accrued expenses increase liabilities immediately, reflecting obligations incurred, whereas deferred expenses reflect prepaid costs awaiting future expense recognition.

Revenue Recognition

Revenue recognition involves recording revenue when earned, while accrued expenses represent costs incurred but not yet paid, affecting net income by matching expenses to the correct period, and deferred expenses are payments made in advance that are expensed over time, impacting asset accounts until recognized. Properly distinguishing accrued expenses and deferred expenses ensures accurate matching of revenue and expenses consistent with the revenue recognition principle under GAAP or IFRS.

Amortization Schedule

An amortization schedule systematically allocates the cost of accrued expenses, such as interest or wages owed but not yet paid, across future periods to match the expense with the related revenue, while deferred expenses represent prepayments recorded as assets and gradually expensed over time. Properly distinguishing accrued expenses versus deferred expenses within the schedule ensures accurate financial reporting and compliance with matching principles under GAAP or IFRS.

Unearned Revenue

Unearned revenue represents payments received before goods or services are delivered, contrasting with accrued expenses that involve costs incurred but not yet paid and deferred expenses which are prepaid costs recognized over time. Managing unearned revenue accurately impacts financial statements by matching revenues with periods earned, while accrued and deferred expenses ensure expenses are recognized in the appropriate accounting periods.

Expense Allocation

Expense allocation involves assigning costs to specific periods, where accrued expenses represent costs incurred but not yet paid, and deferred expenses refer to payments made in advance for future expenses. Proper management of accrued and deferred expenses ensures accurate financial reporting and compliance with matching principles in accounting.

Adjusting Entries

Accrued expenses represent costs incurred but not yet paid or recorded, requiring adjusting entries to recognize liabilities and expenses in the correct accounting period. Deferred expenses involve payments made in advance, necessitating adjusting entries to allocate the prepaid amounts as expenses over the periods benefiting from the payment.

Fiscal Period Cutoff

Fiscal period cutoff ensures accurate financial reporting by recognizing accrued expenses as liabilities for costs incurred but not yet paid within the period, while deferred expenses are recorded as assets representing payments made for benefits extending beyond the current period. Proper cutoff application distinguishes between period-specific expenses and prepayments, maintaining compliance with accrual accounting principles.

accrued expense vs deferred expense Infographic

moneydif.com

moneydif.com