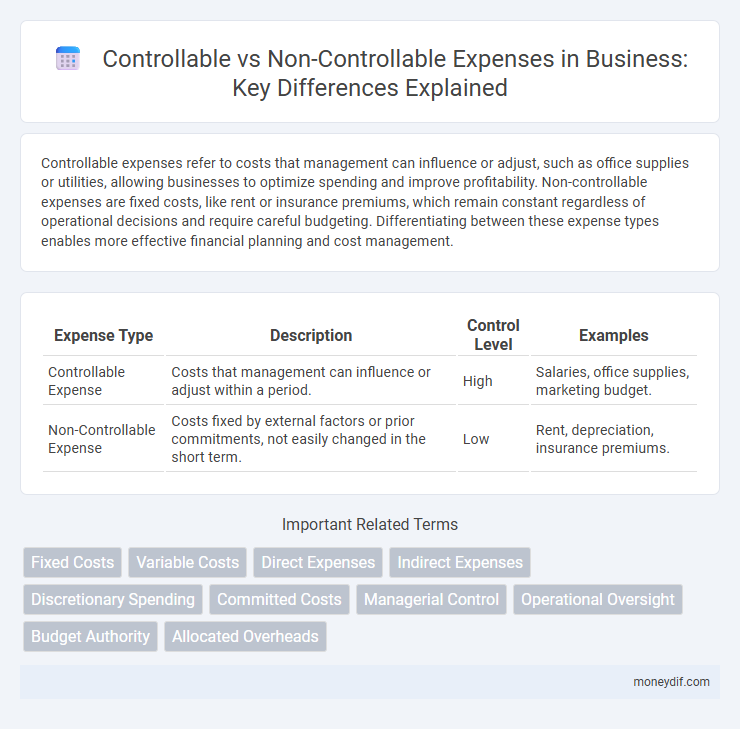

Controllable expenses refer to costs that management can influence or adjust, such as office supplies or utilities, allowing businesses to optimize spending and improve profitability. Non-controllable expenses are fixed costs, like rent or insurance premiums, which remain constant regardless of operational decisions and require careful budgeting. Differentiating between these expense types enables more effective financial planning and cost management.

Table of Comparison

| Expense Type | Description | Control Level | Examples |

|---|---|---|---|

| Controllable Expense | Costs that management can influence or adjust within a period. | High | Salaries, office supplies, marketing budget. |

| Non-Controllable Expense | Costs fixed by external factors or prior commitments, not easily changed in the short term. | Low | Rent, depreciation, insurance premiums. |

Understanding Controllable vs Non-Controllable Expenses

Understanding controllable expenses involves identifying costs that management can influence or adjust, such as marketing budgets, office supplies, and employee wages. Non-controllable expenses include fixed costs like rent, depreciation, and insurance premiums that remain constant regardless of operational decisions. Distinguishing between these expense types enables companies to effectively manage budgets and optimize financial performance.

Key Differences Between Controllable and Non-Controllable Costs

Controllable expenses are costs that managers can influence or regulate, such as labor, materials, and utility expenses, while non-controllable expenses are fixed costs like rent, depreciation, and insurance premiums that remain constant regardless of operational decisions. The key differences lie in the degree of management responsibility and flexibility; controllable costs allow for strategic adjustments during budgeting, whereas non-controllable costs require planning on a macro level. Understanding these distinctions helps businesses optimize budgeting, improve cost control measures, and enhance financial forecasting accuracy.

Examples of Controllable Expenses in Business

Controllable expenses in business include costs that management can influence or adjust, such as salaries of hourly employees, office supplies, marketing budgets, and utility expenses related to daily operations. These expenses contrast with non-controllable expenses like rent or insurance premiums, which are typically fixed and difficult to change in the short term. Effective management of controllable expenses can improve a company's profitability by identifying areas for cost reduction and efficiency improvements.

Examples of Non-Controllable Expenses Explained

Non-controllable expenses refer to costs that a business cannot influence or adjust, such as property taxes, insurance premiums, and regulatory fees. These expenses remain fixed regardless of operational decisions or budget changes, making them essential for accurate financial forecasting. Understanding non-controllable expenses helps businesses manage cash flow and differentiate between variable and fixed cost components.

Why Distinguishing Between Expense Types Matters

Distinguishing between controllable and non-controllable expenses is crucial for effective budget management and financial decision-making. Controllable expenses, such as office supplies or advertising costs, can be adjusted by management to influence profitability, while non-controllable expenses, like rent or insurance premiums, remain fixed regardless of management actions. Understanding the difference enables businesses to target cost-saving measures accurately and improve overall financial performance.

Strategies to Manage Controllable Expenses

Controllable expenses, such as advertising costs and office supplies, can be effectively managed through budgeting, negotiation with suppliers, and regular expense reviews. Implementing cost control measures like setting spending limits and encouraging employee accountability helps reduce unnecessary expenditures. Monitoring these expenses closely enables businesses to improve profitability while maintaining operational efficiency.

How Non-Controllable Expenses Impact Budgets

Non-controllable expenses, such as rent, utilities, and insurance premiums, directly affect budget stability by imposing fixed costs that cannot be reduced or eliminated in the short term. These expenses create financial constraints, limiting the flexibility to allocate funds toward variable or discretionary spending categories. Effective budget management requires accounting for non-controllable expenses to ensure sufficient cash flow and avoid deficits.

Role of Management in Expense Control

Management plays a crucial role in controlling controllable expenses by implementing budgeting processes, monitoring spending, and making strategic decisions to optimize resource allocation. Non-controllable expenses, such as taxes and regulatory fees, require management to focus on forecasting and compliance to minimize financial impact. Effective expense control hinges on management's ability to analyze expense drivers and enforce policies that balance cost efficiency with operational needs.

Reporting and Tracking Expense Categories

Controllable expenses, such as marketing and utility costs, can be directly influenced by management decisions and require detailed tracking for budget adjustments and performance evaluation. Non-controllable expenses, including rent and depreciation, are fixed or predetermined costs that must be reported accurately to reflect true financial obligations without manipulating operational strategies. Effective reporting and categorization of these expense types enable precise financial analysis, budget planning, and resource allocation aligning with organizational goals.

Best Practices for Expense Optimization

Prioritize tracking controllable expenses such as utilities, office supplies, and labor costs to identify reduction opportunities without impacting core business functions. Implement automated expense management tools to monitor spending patterns and enforce budget compliance on both controllable and non-controllable costs like rent and taxes. Regularly review vendor contracts and renegotiate terms to optimize non-controllable expenses, ensuring overall financial efficiency and sustainability.

Important Terms

Fixed Costs

Fixed costs include controllable expenses such as salaries and office supplies, which management can influence through budgeting decisions, and non-controllable expenses like property taxes and insurance premiums, which remain constant regardless of operational changes. Understanding the distinction between these expenses aids in effective cost management and financial forecasting by identifying which fixed costs can be adjusted to optimize profitability.

Variable Costs

Variable costs fluctuate directly with production volume, often categorized into controllable expenses such as direct materials and labor, which managers can influence, and non-controllable expenses like utility rates that vary with usage but are less subject to managerial control. Understanding the distinction helps businesses optimize operational efficiency by focusing on controllable variable costs while monitoring non-controllable expenses for budgeting accuracy.

Direct Expenses

Direct expenses are costs directly attributable to the production of goods or services, often categorized into controllable expenses, such as labor and raw materials, which managers can influence, and non-controllable expenses, like depreciation or rent, which remain fixed regardless of operational decisions. Understanding the distinction between controllable and non-controllable expenses is crucial for accurate budgeting, cost control, and performance evaluation within an organization.

Indirect Expenses

Indirect expenses include both controllable expenses, which managers can influence through operational decisions such as utility costs and office supplies, and non-controllable expenses, which remain fixed regardless of managerial actions, like property taxes and depreciation. Differentiating these expenses enables accurate budgeting and performance evaluation by identifying areas where cost management efforts can effectively reduce overall spending.

Discretionary Spending

Discretionary spending refers to expenses that are flexible and can be adjusted based on budget priorities, categorized primarily as controllable expenses like entertainment and dining, while non-controllable expenses include fixed obligations such as rent or utilities that must be paid regardless of changes in budget. Understanding the distinction between these spending types helps individuals and organizations effectively manage financial resources and optimize budgeting strategies.

Committed Costs

Committed costs represent fixed obligations that a business must pay regardless of its level of activity, often categorized into controllable and non-controllable expenses based on management's ability to influence them. Controllable expenses, such as direct labor and variable overheads, can be adjusted by managerial decisions, whereas non-controllable expenses, including depreciation and property taxes, remain fixed and outside managerial control in the short term.

Managerial Control

Managerial control focuses on distinguishing controllable expenses, which managers can influence or regulate, from non-controllable expenses, which are fixed or externally mandated costs beyond their authority. Effective management of controllable expenses, such as labor or materials costs, optimizes budget adherence and operational efficiency, while understanding non-controllable expenses like rent or taxes aids in accurate financial forecasting and performance evaluation.

Operational Oversight

Operational oversight ensures strict monitoring of controllable expenses such as labor costs, supplies, and utilities that managers can directly influence, while non-controllable expenses, including rent, taxes, and insurance, fall outside managerial control. Effective differentiation between these expense types allows organizations to implement targeted cost reduction strategies and optimize budget management for improved financial performance.

Budget Authority

Budget authority defines the legal power to obligate funds, distinguishing controllable expenses, which managers can influence or adjust within their departments, from non-controllable expenses, typically fixed costs like rent or utilities that are mandated and beyond managerial discretion. Effective budget management requires identifying these expenses to optimize resource allocation and maintain financial accountability.

Allocated Overheads

Allocated overheads represent indirect costs assigned to specific departments or products, with controllable expenses being those overheads managers can influence, such as utilities or supplies, while non-controllable expenses include fixed allocations like rent or depreciation that remain constant regardless of managerial actions. Understanding the distinction between controllable and non-controllable allocated overheads is essential for accurate budgeting, performance evaluation, and cost control in managerial accounting.

Controllable expense vs Non-controllable expense Infographic

moneydif.com

moneydif.com