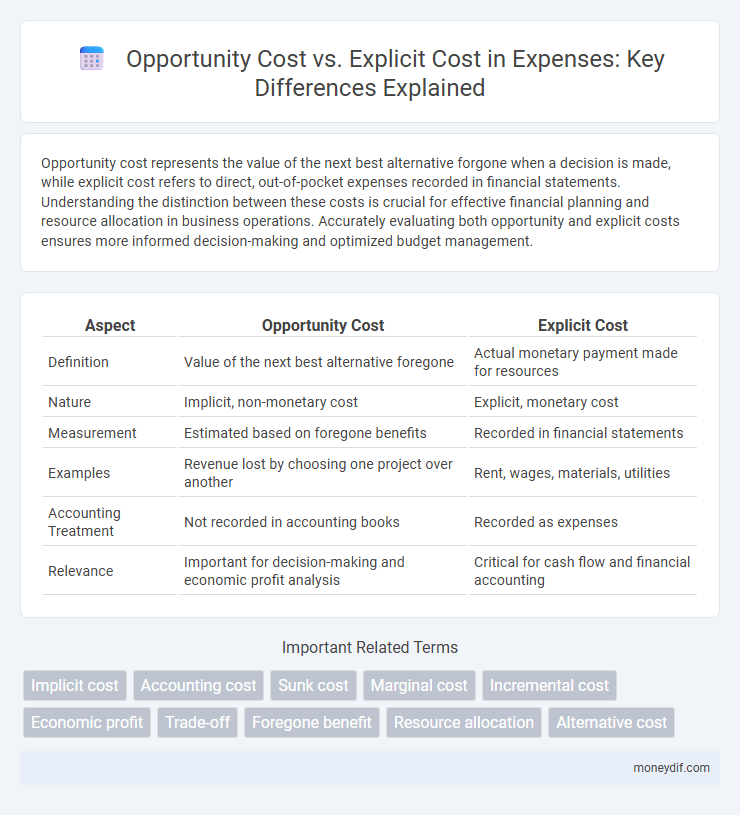

Opportunity cost represents the value of the next best alternative forgone when a decision is made, while explicit cost refers to direct, out-of-pocket expenses recorded in financial statements. Understanding the distinction between these costs is crucial for effective financial planning and resource allocation in business operations. Accurately evaluating both opportunity and explicit costs ensures more informed decision-making and optimized budget management.

Table of Comparison

| Aspect | Opportunity Cost | Explicit Cost |

|---|---|---|

| Definition | Value of the next best alternative foregone | Actual monetary payment made for resources |

| Nature | Implicit, non-monetary cost | Explicit, monetary cost |

| Measurement | Estimated based on foregone benefits | Recorded in financial statements |

| Examples | Revenue lost by choosing one project over another | Rent, wages, materials, utilities |

| Accounting Treatment | Not recorded in accounting books | Recorded as expenses |

| Relevance | Important for decision-making and economic profit analysis | Critical for cash flow and financial accounting |

Understanding Opportunity Cost in Financial Decisions

Opportunity cost represents the value of the next best alternative foregone when a financial decision is made, highlighting the potential benefits lost from not choosing that option. Explicit costs, on the other hand, involve direct monetary payments such as expenses for materials, labor, or rent. Understanding opportunity cost is crucial in financial decisions as it ensures resource allocation maximizes potential returns beyond just accounting for explicit expenditures.

Defining Explicit Cost: What You Actually Spend

Explicit cost refers to the actual monetary payments a business or individual makes for resources, such as wages, rent, and materials. These costs are recorded in accounting books and directly impact cash flow. Unlike opportunity cost, explicit costs involve tangible outflows that can be tracked and quantified.

Key Differences Between Opportunity Cost and Explicit Cost

Opportunity cost represents the value of the next best alternative foregone when a decision is made, reflecting intangible or hidden expenses, while explicit cost involves direct, out-of-pocket payments such as wages, rent, and materials. Opportunity cost is not recorded in financial statements but influences economic decision-making by highlighting potential benefits lost, whereas explicit cost is documented for accounting and tax purposes. Understanding the distinction between opportunity and explicit costs is essential for accurate budgeting, resource allocation, and evaluating true profitability in business operations.

Real-Life Examples of Opportunity and Explicit Costs

Opportunity cost in real life often manifests when choosing between working overtime or spending that time on leisure, where the forgone leisure represents the opportunity cost. Explicit costs include tangible payments like rent, utilities, and wages that a business incurs during operations. For instance, a small business owner choosing to rent office space pays explicit costs, while the potential income lost by not working a salaried job exemplifies opportunity cost.

Why Opportunity Cost Matters in Budgeting

Opportunity cost matters in budgeting because it reveals the value of forgone alternatives, helping individuals and businesses make informed financial decisions. Unlike explicit costs, which are recorded expenses, opportunity costs quantify the benefits lost by choosing one option over another. Understanding opportunity cost ensures resources are allocated efficiently, maximizing potential returns and avoiding hidden financial sacrifices.

Accounting for Explicit Costs in Business Operations

Explicit costs in business operations refer to direct monetary payments made for resources such as wages, rent, and materials, which are recorded in accounting books to reflect actual cash outflows. Unlike opportunity costs, which represent forgone alternatives and are not typically logged in financial statements, explicit costs impact profit calculations and tax reporting. Accurate accounting for explicit costs ensures precise financial analysis and effective cost management necessary for strategic decision-making.

Hidden Impacts of Opportunity Cost on Investment Choices

Opportunity cost represents the latent value of foregone alternatives when capital is allocated to a particular investment, influencing long-term profitability and strategic decision-making. Unlike explicit costs, which are tangible expenses recorded in financial statements, opportunity costs encompass intangible sacrifices such as missed growth prospects or alternative resource deployments. Recognizing these hidden impacts enables investors to optimize portfolio performance by evaluating both direct expenditures and the implicit consequences of their investment choices.

Balancing Opportunity and Explicit Costs for Optimal Spending

Balancing opportunity cost and explicit cost is essential for optimal spending decisions, as explicit costs represent tangible expenditures while opportunity costs reflect the value of foregone alternatives. Assessing both types of costs enables individuals and businesses to allocate resources more effectively, maximizing potential benefits. Strategic evaluation of these costs ensures that every dollar spent contributes to the highest overall economic value.

Role of Explicit Cost in Financial Reporting

Explicit costs are direct, out-of-pocket expenses recorded in financial statements, crucial for accurate profit calculation and tax reporting. These costs include wages, rent, and utilities, providing a clear measure of business expenditures. Explicit cost reporting ensures transparency and compliance with accounting standards, enabling stakeholders to assess the company's financial health effectively.

Strategies to Minimize Opportunity Cost in Personal Finance

Opportunity cost, the value of the next best alternative foregone, differs from explicit cost, which involves direct monetary expenditure. Strategies to minimize opportunity cost in personal finance include allocating resources toward high-return investments, prioritizing spending on essential needs over non-essential wants, and conducting regular budget reviews to identify and eliminate low-value expenses. Effective time management and leveraging financial tools like budgeting apps can further reduce missed opportunities by ensuring resources are optimally utilized.

Important Terms

Implicit cost

Implicit cost represents the opportunity cost of using resources owned by a firm, reflecting the income foregone by not employing these resources elsewhere, while explicit cost involves direct monetary payments made for inputs. Understanding the distinction highlights how implicit costs capture non-monetary sacrifice in decision-making compared to explicit costs, which are recorded as actual expenses.

Accounting cost

Accounting cost represents the total explicit costs incurred by a business, including direct payments such as wages, rent, and materials. Unlike opportunity cost, which accounts for the value of foregone alternatives, accounting cost strictly captures the monetary outflows recorded in financial statements.

Sunk cost

Sunk cost refers to expenses already incurred and unrecoverable, making them irrelevant to future economic decisions when evaluating opportunity cost, which represents potential benefits lost by choosing one alternative over another. Unlike explicit costs, which are direct, out-of-pocket payments, sunk costs should not influence incremental decision-making since they do not vary with future outcomes.

Marginal cost

Marginal cost represents the additional expense incurred by producing one more unit, closely linked to opportunity cost, which accounts for the value of foregone alternatives, while explicit cost refers to direct, out-of-pocket expenditures. Understanding marginal cost requires integrating opportunity cost to capture both explicit and implicit trade-offs in decision-making.

Incremental cost

Incremental cost represents the additional expenses incurred when choosing a specific option, directly impacting decision-making by comparing the extra outlay against potential benefits. Unlike explicit cost, which involves clear monetary payments, opportunity cost reflects the value of foregone alternatives, making incremental cost crucial for evaluating trade-offs between explicit expenditures and unrealized gains.

Economic profit

Economic profit accounts for both explicit costs, such as wages and materials, and opportunity costs, representing the value of the next best alternative foregone. This comprehensive measure differs from accounting profit by incorporating opportunity cost to reflect true profitability.

Trade-off

Trade-off in economics involves choosing between options where opportunity cost represents the value of the next best alternative foregone, while explicit cost refers to direct, out-of-pocket expenses incurred. Understanding this distinction helps businesses and individuals make informed decisions by comparing tangible expenditures against potential benefits lost.

Foregone benefit

Foregone benefit represents the implicit cost associated with the next best alternative foregone when a decision is made, highlighting the concept of opportunity cost rather than explicit cost, which involves direct monetary payments. Opportunity cost captures both foregone benefits and explicit costs, providing a more comprehensive measure of economic trade-offs in resource allocation.

Resource allocation

Resource allocation involves choosing how to best assign limited resources among competing needs, where opportunity cost reflects the value of the next best alternative foregone, while explicit cost represents direct monetary expenses incurred. Understanding both opportunity cost and explicit cost is essential for efficient decision-making in economics, as it ensures resources are used to maximize returns and minimize wasted expenditure.

Alternative cost

Alternative cost, often synonymous with opportunity cost, represents the value of the next best alternative forgone when a decision is made, highlighting the benefits missed compared to explicit cost, which refers to direct, out-of-pocket expenses paid in monetary terms. Understanding the distinction between opportunity cost and explicit cost is crucial for making informed economic choices and resource allocation.

Opportunity cost vs Explicit cost Infographic

moneydif.com

moneydif.com