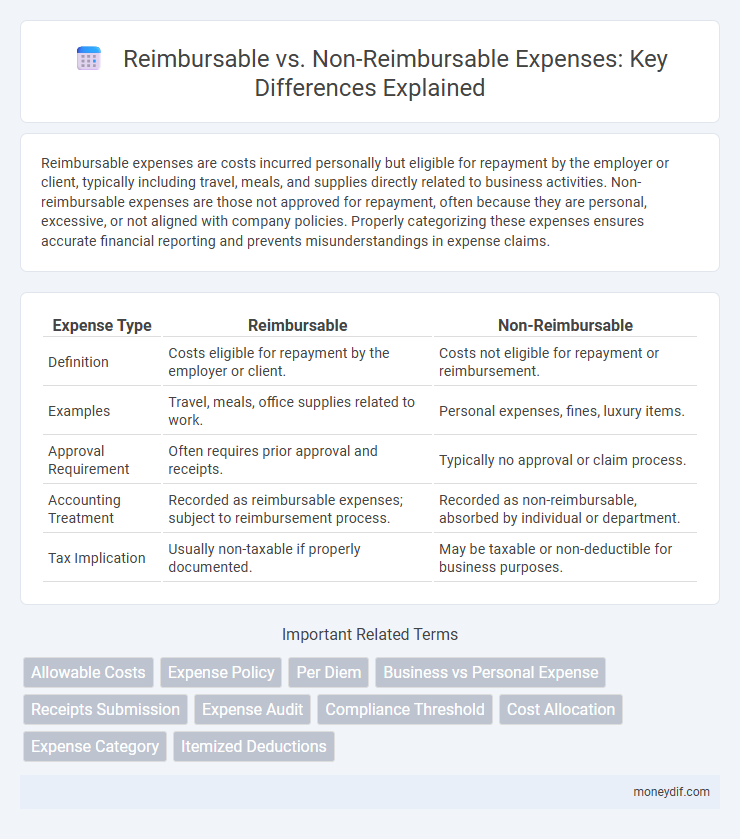

Reimbursable expenses are costs incurred personally but eligible for repayment by the employer or client, typically including travel, meals, and supplies directly related to business activities. Non-reimbursable expenses are those not approved for repayment, often because they are personal, excessive, or not aligned with company policies. Properly categorizing these expenses ensures accurate financial reporting and prevents misunderstandings in expense claims.

Table of Comparison

| Expense Type | Reimbursable | Non-Reimbursable |

|---|---|---|

| Definition | Costs eligible for repayment by the employer or client. | Costs not eligible for repayment or reimbursement. |

| Examples | Travel, meals, office supplies related to work. | Personal expenses, fines, luxury items. |

| Approval Requirement | Often requires prior approval and receipts. | Typically no approval or claim process. |

| Accounting Treatment | Recorded as reimbursable expenses; subject to reimbursement process. | Recorded as non-reimbursable, absorbed by individual or department. |

| Tax Implication | Usually non-taxable if properly documented. | May be taxable or non-deductible for business purposes. |

Understanding Reimbursable vs Non-reimbursable Expenses

Reimbursable expenses refer to costs incurred by employees or individuals that can be paid back by the employer or organization, typically involving business-related travel, meals, and supplies. Non-reimbursable expenses are personal or unrelated costs that the company does not cover, such as entertainment unrelated to work or personal items. Clear categorization and documentation of reimbursable versus non-reimbursable expenses ensure accurate financial reporting and compliance with organizational policies.

Key Differences Between Reimbursable and Non-reimbursable Costs

Reimbursable costs refer to expenses that can be repaid by an employer or client, commonly including travel, meals, and office supplies incurred during business activities. Non-reimbursable costs are expenses that employees or contractors must absorb themselves, such as personal expenses or fines unrelated to work. Key differences hinge on approval requirements, documentation needed for reimbursement, and the direct business relationship justifying the expense.

Common Examples of Reimbursable Expenses

Reimbursable expenses typically include business-related travel costs, such as airfare, lodging, and meals incurred during company trips. Office supplies and client entertainment expenses are also common examples that employees can claim for reimbursement. These expenses are directly tied to job duties and require proper documentation for approval.

Typical Non-reimbursable Expenses Explained

Typical non-reimbursable expenses include personal travel costs, entertainment unrelated to business activities, and fines or penalties incurred during work. These expenses are excluded from company reimbursements because they do not directly support business objectives or violate company policy. Understanding these categories helps employees avoid submitting ineligible claims and ensures compliance with corporate expense guidelines.

How to Determine If an Expense Is Reimbursable

Determining if an expense is reimbursable involves reviewing company policy guidelines, which typically specify eligible costs such as travel, meals, and supplies directly related to business activities. Documentation like receipts and approval from supervisors are essential to validate the expense and ensure compliance with internal controls. Expenses that do not align with the defined criteria or lack proper documentation are generally classified as non-reimbursable.

Company Policies on Expense Reimbursement

Company policies on expense reimbursement clearly define reimbursable expenses as those directly related to business activities, such as travel, meals, and supplies necessary for work. Non-reimbursable expenses typically include personal purchases, fines, and entertainment unrelated to company objectives. Adherence to these guidelines ensures transparent financial management and prevents disputes in expense claims.

Documentation Required for Reimbursable Expenses

Reimbursable expenses require detailed documentation such as original receipts, invoices, and proof of payment to ensure accurate processing and compliance with company policies. Expense reports must include clear descriptions, dates, and the business purpose to validate the legitimacy of claims. Maintaining organized records helps prevent delays and supports audit trails for reimbursable expenditures.

Tax Implications of Reimbursable vs Non-reimbursable Expenses

Reimbursable expenses are typically excluded from taxable income since employees are merely reimbursed for work-related costs, whereas non-reimbursable expenses may affect taxable income if the employee is not fully reimbursed. The IRS requires clear documentation for reimbursable expenses to avoid their classification as taxable income, impacting tax reporting and deductions. Understanding the distinction between reimbursable and non-reimbursable expenses is crucial for accurate tax compliance and minimizing potential liabilities for both employees and employers.

Best Practices for Managing Expense Reports

Clear categorization between reimbursable and non-reimbursable expenses streamlines approval processes and ensures accurate financial tracking. Implementing detailed guidelines and training employees on eligible expenses reduces submission errors and prevents fraud. Digital expense management tools enhance real-time expense monitoring, simplifying audits and improving compliance.

Avoiding Mistakes: Tips to Prevent Non-reimbursable Claims

To prevent non-reimbursable claims, meticulously review company expense policies and ensure all submitted receipts align with approved categories. Document expenses with clear, detailed descriptions and avoid personal or unrelated costs that violate reimbursement rules. Regular audits and employee training on reimbursable versus non-reimbursable criteria significantly reduce costly errors and streamline expense reporting.

Important Terms

Allowable Costs

Allowable costs are expenses that comply with specific guidelines and can be charged to a contract or grant, with reimbursable costs being those approved for repayment by the funding agency. Non-reimbursable costs do not meet these criteria and must be absorbed by the organization without reimbursement.

Expense Policy

Expense policies clearly define reimbursable expenses as those necessary and reasonable costs incurred during business activities, such as travel, meals, and supplies, which can be claimed back by employees. Non-reimbursable expenses typically include personal costs, fines, and luxury items that fall outside company guidelines and are not eligible for reimbursement.

Per Diem

Per diem refers to a daily allowance provided to employees to cover expenses incurred during business travel, categorized as reimbursable when employees submit receipts and non-reimbursable when the allowance is a fixed amount not requiring expense reports. Distinguishing reimbursable per diem ensures accurate accounting and tax compliance, while non-reimbursable per diem simplifies expense management by providing a predetermined sum regardless of actual costs.

Business vs Personal Expense

Business expenses are costs incurred for work-related activities and are typically reimbursable by employers, while personal expenses are individual costs that are non-reimbursable. Distinguishing between reimbursable business expenses and non-reimbursable personal expenses is essential for accurate accounting and tax compliance.

Receipts Submission

Receipts submission is essential for distinguishing reimbursable expenses, which are eligible for reimbursement, from non-reimbursable costs that must be personally absorbed. Accurate documentation of receipts ensures compliance with company policies and facilitates efficient expense tracking and financial auditing.

Expense Audit

Expense audit meticulously distinguishes reimbursable expenses, such as travel and business meals, from non-reimbursable costs like personal items or unauthorized purchases to ensure accurate financial reporting and compliance. This differentiation enables organizations to enforce policy adherence, prevent fraud, and optimize reimbursements within corporate budgets.

Compliance Threshold

Compliance threshold defines the minimum criteria for expenses to qualify as reimbursable versus non-reimbursable, ensuring alignment with organizational policies and contractual obligations. Clear differentiation at this threshold optimizes financial accountability and prevents unauthorized cost claims, enhancing regulatory adherence and budget management.

Cost Allocation

Cost allocation involves distributing expenses to specific projects or departments, distinguishing between reimbursable costs that clients or funding sources will repay and non-reimbursable costs absorbed by the organization. Accurate tracking and documentation of reimbursable versus non-reimbursable expenses ensure compliance with contract terms and optimize financial reporting efficiency.

Expense Category

Expense categories define whether costs are reimbursable or non-reimbursable based on company policies, with reimbursable expenses typically including travel, meals, and supplies incurred on behalf of the organization. Non-reimbursable expenses often cover personal costs or items not aligned with business activities and therefore cannot be claimed for compensation.

Itemized Deductions

Itemized deductions may include expenses that are non-reimbursable by an employer, such as unreimbursed employee business expenses, which qualify for potential tax deductions under certain conditions. Reimbursable expenses, typically covered under an accountable plan, do not qualify for itemized deductions as they are effectively excluded from taxable income.

Reimbursable vs Non-reimbursable Infographic

moneydif.com

moneydif.com