Depreciable expense refers to the allocation of the cost of tangible fixed assets, such as machinery or buildings, over their useful life to reflect wear and tear. Amortized expense applies to intangible assets, like patents or copyrights, spreading their cost systematically over their estimated useful life. Both methods ensure proper matching of expenses with revenues, enhancing accurate financial reporting.

Table of Comparison

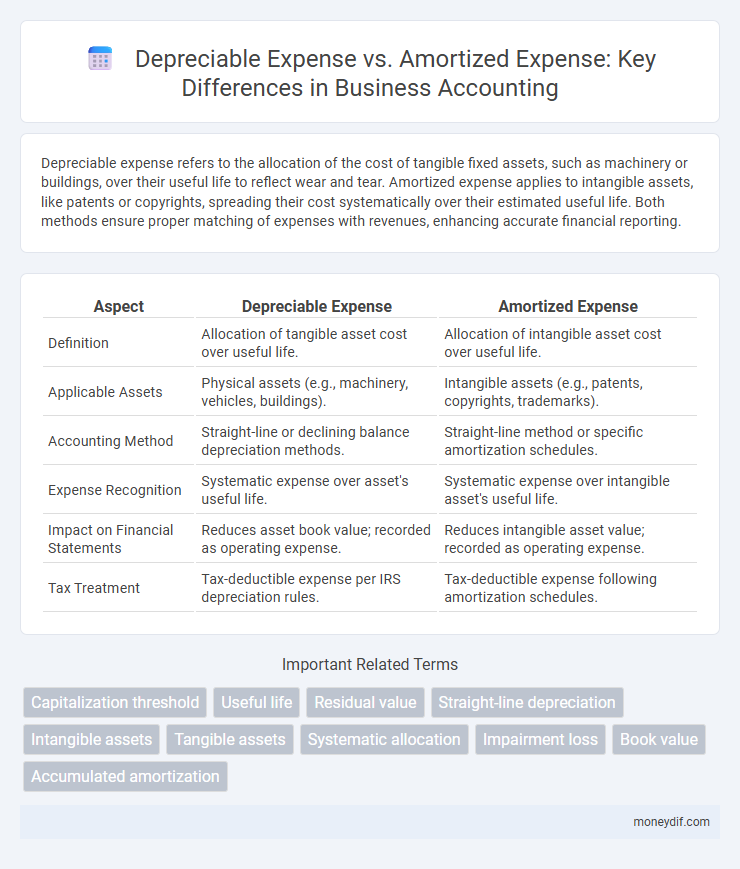

| Aspect | Depreciable Expense | Amortized Expense |

|---|---|---|

| Definition | Allocation of tangible asset cost over useful life. | Allocation of intangible asset cost over useful life. |

| Applicable Assets | Physical assets (e.g., machinery, vehicles, buildings). | Intangible assets (e.g., patents, copyrights, trademarks). |

| Accounting Method | Straight-line or declining balance depreciation methods. | Straight-line method or specific amortization schedules. |

| Expense Recognition | Systematic expense over asset's useful life. | Systematic expense over intangible asset's useful life. |

| Impact on Financial Statements | Reduces asset book value; recorded as operating expense. | Reduces intangible asset value; recorded as operating expense. |

| Tax Treatment | Tax-deductible expense per IRS depreciation rules. | Tax-deductible expense following amortization schedules. |

Understanding Depreciable vs. Amortized Expenses

Depreciable expenses refer to the allocation of the cost of tangible fixed assets, such as machinery and buildings, over their useful lives to match the expense with revenue generated. Amortized expenses involve spreading out the cost of intangible assets, like patents or trademarks, over a specific period to reflect usage and obsolescence. Understanding the distinction ensures accurate financial reporting and proper tax treatment in asset management.

Key Definitions: Depreciation and Amortization

Depreciation refers to the systematic allocation of the cost of a tangible fixed asset over its useful life, reflecting wear and tear or obsolescence. Amortization involves the gradual write-off of intangible assets such as patents or trademarks, spreading their expense over the asset's expected economic benefit period. Both methods are essential for accurately matching the cost of assets with the revenue they generate, ensuring precise financial reporting.

Types of Assets: Depreciable vs. Amortizable

Depreciable expenses apply to tangible assets like machinery, buildings, and vehicles that wear out over time, whereas amortized expenses relate to intangible assets such as patents, copyrights, and trademarks. Depreciation systematically allocates the cost of physical assets over their useful lives using methods like straight-line or declining balance. Amortization spreads the cost of intangible assets evenly over their legal or useful life, reflecting the consumption of their economic benefits.

Calculation Methods for Depreciable Expenses

Depreciable expense calculation methods include the straight-line method, which evenly allocates the asset's cost over its useful life, and the declining balance method, which applies a fixed percentage to the asset's remaining book value annually. Another common approach is the units-of-production method, where expenses correspond to the asset's actual usage or production levels. Accurate calculation of depreciable expenses ensures precise matching of costs with revenue generation for tangible assets.

How Amortized Expenses Are Calculated

Amortized expenses are calculated by spreading the cost of intangible assets, such as patents or copyrights, evenly over their useful life using the straight-line method. This involves dividing the total capitalized cost by the estimated useful life to determine the periodic amortization expense. Unlike depreciable expenses that apply to tangible assets, amortization focuses exclusively on intangible asset costs.

Accounting Treatment and Journal Entries

Depreciable expenses refer to the systematic allocation of the cost of tangible fixed assets over their useful life, recorded as depreciation expense in accounting, with journal entries debiting Depreciation Expense and crediting Accumulated Depreciation. Amortized expenses involve intangible assets, where the asset's cost is gradually expensed over its estimated useful life, reflected by debiting Amortization Expense and crediting Accumulated Amortization. Both accounting treatments follow the matching principle, ensuring expenses are recognized in the same period as the revenue generated from the related asset.

Tax Implications: Depreciation vs. Amortization

Depreciable expenses allow businesses to deduct the cost of tangible assets over their useful life, reducing taxable income gradually according to IRS depreciation schedules. Amortized expenses pertain to intangible assets and are typically deducted evenly over a specific period, influencing tax reporting through Section 197 of the Internal Revenue Code. Understanding these distinctions is critical for optimizing tax benefits and ensuring compliance with tax regulations governing asset cost recovery.

Examples of Depreciable and Amortized Assets

Depreciable assets typically include tangible items such as machinery, vehicles, buildings, and equipment that lose value over time due to wear and tear. Amortized assets refer to intangible assets like patents, copyrights, trademarks, and goodwill, which are expensed over their useful life. Understanding these examples helps businesses categorize expenses correctly for financial reporting and tax purposes.

Impact on Financial Statements

Depreciable expenses reduce the value of tangible fixed assets on the balance sheet, spreading the cost over their useful life and directly decreasing net income on the income statement. Amortized expenses apply to intangible assets, similarly allocating the expense across periods, which lowers reported earnings while reflecting the consumption of asset value. Both methods affect cash flow statements indirectly by impacting net income, but they do not involve cash outflows during the expense recognition period.

Choosing the Right Expense Method for Your Business

Choosing between depreciable expense and amortized expense depends on the nature of your business assets. Depreciable expenses apply to tangible fixed assets like machinery and equipment, spreading the cost over their useful life to match revenue generation. Amortized expenses relate to intangible assets such as patents and copyrights, allowing businesses to systematically allocate the asset's cost over its effective legal or useful life for accurate financial reporting.

Important Terms

Capitalization threshold

Capitalization threshold defines the minimum asset cost required for capitalization, impacting whether expenses are recorded as depreciable assets or immediately amortized expenses. Assets above the capitalization threshold are capitalized and depreciated over their useful life, while costs below the threshold are expensed immediately, typically as amortized expenses.

Useful life

Useful life determines the period over which an asset's cost is systematically allocated as depreciable expense for tangible assets or amortized expense for intangible assets. This allocation matches the asset's consumption or obsolescence, ensuring accurate financial reporting and expense recognition over time.

Residual value

Residual value directly impacts the calculation of depreciable expense by determining the portion of an asset's cost that will be allocated over its useful life, whereas amortized expense applies to intangible assets and does not typically involve residual value considerations. Depreciable expense equals the asset cost minus residual value divided by useful life, ensuring more accurate matching of expenses with revenue generation.

Straight-line depreciation

Straight-line depreciation allocates the depreciable expense evenly over an asset's useful life, reflecting the consistent wear and tear of tangible fixed assets like machinery or buildings. In contrast, amortized expense applies to intangible assets such as patents or copyrights, spreading the cost systematically while recognizing their finite economic benefits.

Intangible assets

Intangible assets are subject to amortized expense, which systematically allocates their cost over their useful life, unlike tangible assets that incur depreciable expense due to physical wear and tear. Amortization applies to assets like patents, copyrights, and trademarks, reflecting the consumption of their economic benefits without physical degradation.

Tangible assets

Tangible assets such as machinery, buildings, and equipment incur depreciable expenses reflecting their loss of value over time due to wear and tear. In contrast, amortized expenses apply to intangible assets like patents and copyrights, systematically allocating their cost over the asset's useful life.

Systematic allocation

Systematic allocation of depreciable expense spreads the cost of tangible assets, such as machinery or buildings, over their useful life, reflecting wear and tear or obsolescence. In contrast, amortized expense applies to intangible assets like patents or copyrights, allocating their cost evenly over the estimated period of economic benefit.

Impairment loss

Impairment loss reduces the carrying amount of an asset below its depreciable or amortizable base, affecting the expense recognized in financial statements. Depreciable expenses relate to tangible assets, while amortized expenses apply to intangible assets, both reflecting systematic cost allocation over the asset's useful life before impairment is considered.

Book value

Book value reflects the net asset value after deducting accumulated depreciation for tangible assets and accumulated amortization for intangible assets. Depreciable expense reduces the book value of physical assets over time, while amortized expense systematically allocates costs of intangible assets, both impacting financial statements and asset valuation.

Accumulated amortization

Accumulated amortization reflects the total amount of amortized expense recognized over time for intangible assets, whereas depreciable expense pertains to the allocation of cost for tangible fixed assets. Both accumulated amortization and accumulated depreciation serve to systematically reduce the asset's book value, aligning expense recognition with asset usage.

depreciable expense vs amortized expense Infographic

moneydif.com

moneydif.com