Overhead refers to the ongoing indirect expenses required to operate a business, such as rent, utilities, and administrative salaries. Burden encompasses all overhead costs plus additional expenses tied to labor, including payroll taxes and employee benefits. Understanding the distinction between overhead and burden is essential for accurate costing and financial analysis.

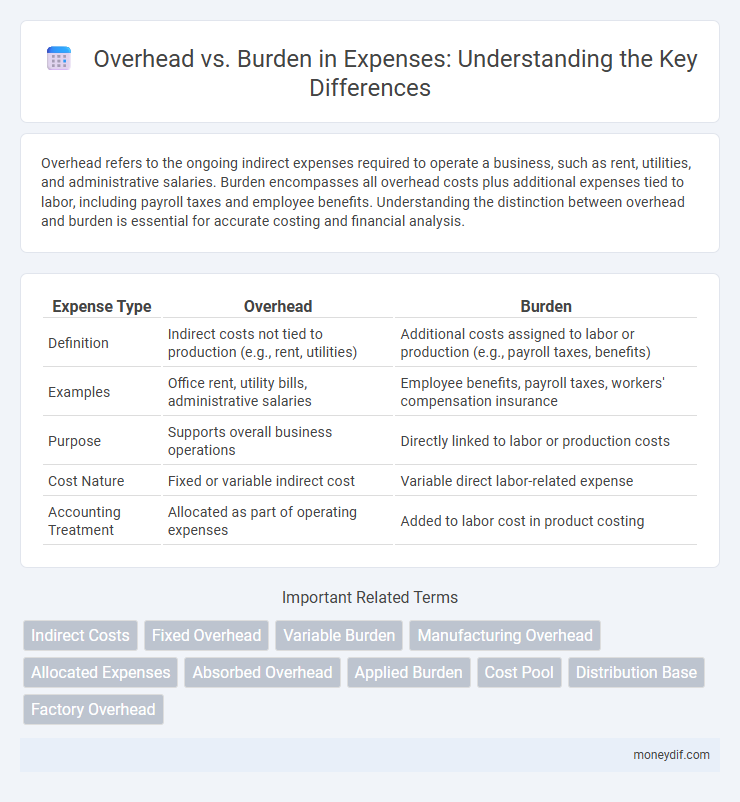

Table of Comparison

| Expense Type | Overhead | Burden |

|---|---|---|

| Definition | Indirect costs not tied to production (e.g., rent, utilities) | Additional costs assigned to labor or production (e.g., payroll taxes, benefits) |

| Examples | Office rent, utility bills, administrative salaries | Employee benefits, payroll taxes, workers' compensation insurance |

| Purpose | Supports overall business operations | Directly linked to labor or production costs |

| Cost Nature | Fixed or variable indirect cost | Variable direct labor-related expense |

| Accounting Treatment | Allocated as part of operating expenses | Added to labor cost in product costing |

Understanding Overhead in Expense Management

Overhead refers to the ongoing business expenses not directly tied to production, such as rent, utilities, and administrative salaries, crucial for accurate expense management. Properly categorizing overhead ensures transparent financial reporting and helps businesses identify cost-saving opportunities. Understanding overhead allows for better budgeting and resource allocation, driving operational efficiency.

What Is Burden in Accounting?

Burden in accounting refers to the indirect costs associated with production that are not directly tied to a specific product but are necessary for overall operations, such as utilities, maintenance, and supervisory salaries. These costs are allocated to products or departments through overhead rates to ensure accurate cost measurement and pricing. Understanding burden helps businesses manage expenses and improve profitability by identifying and controlling indirect expenditures.

Key Differences Between Overhead and Burden

Overhead refers to the ongoing business expenses not directly tied to specific products or services, such as rent, utilities, and administrative salaries. Burden includes both overhead costs and additional expenses directly related to manufacturing operations, like indirect labor and equipment depreciation. The key difference lies in burden encompassing all indirect costs, while overhead typically excludes direct production-related expenses.

Types of Overhead Expenses

Overhead expenses include fixed costs such as rent, utilities, and salaries that do not vary with production levels. Variable overhead costs consist of indirect materials, equipment maintenance, and supplies needed for manufacturing. Understanding these types helps businesses allocate overhead accurately for cost control and pricing strategies.

Classifying Burden Costs in Business

Burden costs in business refer to indirect expenses that support overall operations but are not directly tied to specific products or services. Common burden costs include utilities, rent, depreciation, administrative salaries, and maintenance expenses, all essential for maintaining business infrastructure. Proper classification of these overhead-related burden costs ensures accurate cost allocation and improved financial analysis for decision-making.

Calculating Overhead vs. Burden

Calculating overhead involves identifying all indirect costs such as rent, utilities, and administrative salaries that support business operations but are not directly tied to production. Burden cost calculation expands on overhead by including direct labor-related expenses like payroll taxes, benefits, and insurance, offering a more comprehensive view of labor costs associated with manufacturing. Accurate allocation methods, such as activity-based costing, ensure precise assignment of overhead and burden expenses to products or departments, improving cost control and pricing strategies.

Impact of Overhead and Burden on Profit Margins

Overhead costs, encompassing fixed expenses like rent and utilities, directly reduce profit margins by increasing the baseline expenditure required to maintain operations. Burden, including indirect labor costs and manufacturing support expenses, further impacts profitability by allocating additional costs to product pricing or service delivery. Effective management of both overhead and burden is essential to optimize profit margins and maintain competitive pricing strategies.

Overhead vs. Burden: Examples in Practice

Overhead expenses include rent, utilities, and administrative salaries necessary to sustain business operations, while burden costs cover additional employee-related expenses such as payroll taxes, insurance, and benefits. For example, in manufacturing, overhead might entail factory rent and equipment depreciation, whereas burden encompasses workers' compensation and retirement contributions. Understanding the distinction between overhead and burden helps accurately allocate costs for budgeting and pricing strategies.

Reducing Overhead and Burden in Operations

Reducing overhead and burden in operations enhances financial efficiency by minimizing fixed costs such as rent, utilities, and administrative expenses, which do not directly contribute to production. Streamlining processes, automating routine tasks, and renegotiating supplier contracts effectively decrease both overhead and indirect labor costs, leading to improved profitability. Implementing lean management principles further cuts unnecessary expenditures, optimizing resource allocation and boosting overall operational productivity.

Best Practices for Managing Overhead and Burden

Effective management of overhead and burden requires accurate allocation methods that reflect actual resource consumption, such as activity-based costing to prevent cost distortion. Implementing regular reviews and updates to overhead rates ensures alignment with current operational expenses and improves budget accuracy. Leveraging technology for real-time expense tracking enhances transparency and supports informed decision-making in controlling indirect costs.

Important Terms

Indirect Costs

Indirect costs encompass expenses not directly tied to production, classified into overhead and burden categories; overhead includes costs like utilities, rent, and depreciation, while burden covers employee-related expenses such as taxes, insurance, and benefits. Effective accounting distinguishes overhead from burden to allocate indirect costs accurately, ensuring precise project budgeting and financial reporting.

Fixed Overhead

Fixed overhead represents the consistent indirect manufacturing costs, such as rent and salaries, that remain unchanged regardless of production volume, whereas burden encompasses all indirect costs, including both fixed and variable overhead expenses. Accurately allocating fixed overhead within burden ensures precise cost accounting and effective product pricing decisions.

Variable Burden

Variable burden refers to the fluctuating indirect costs that vary with production volume, such as utilities and consumables, distinguishing it from fixed overhead which remains constant regardless of output. It impacts cost accounting by providing a more accurate allocation of expenses to products, enhancing budgeting and financial analysis precision.

Manufacturing Overhead

Manufacturing overhead encompasses indirect production costs such as utilities, depreciation, and factory supplies that are essential for product creation but not directly traceable to specific units. Overhead differs from burden in that burden may include additional expenses like indirect labor and administrative costs allocated to product costing beyond pure manufacturing overhead.

Allocated Expenses

Allocated expenses represent the distribution of overhead costs, such as rent and utilities, across various departments or projects to accurately reflect resource consumption. Unlike burden, which specifically refers to indirect labor costs like payroll taxes and benefits, overhead encompasses all indirect expenses necessary for operations.

Absorbed Overhead

Absorbed overhead refers to the portion of factory overhead costs allocated to products based on a predetermined overhead rate, reflecting the estimated burden of indirect costs such as utilities, depreciation, and supervision. Unlike burden, which encompasses all indirect manufacturing expenses, absorbed overhead specifically denotes the overhead costs applied to production through cost accounting methods.

Applied Burden

Applied Burden represents the allocated indirect costs assigned to specific production jobs or cost objects, calculated using predetermined overhead rates based on direct labor hours or machine hours. Unlike general Overhead, which includes all indirect costs, Applied Burden quantifies the portion of overhead actually charged to products, enabling precise cost control and pricing decisions.

Cost Pool

Cost pool refers to a grouping of individual costs, typically overhead expenses, allocated collectively to various cost objects rather than assigned directly. Overhead represents indirect costs involved in production, while burden encompasses all indirect manufacturing costs including both overhead and additional expenses like employee benefits and payroll taxes.

Distribution Base

Distribution base serves as the allocation foundation for overhead costs, determining how indirect expenses like utilities, rent, and maintenance are assigned to cost objects. Unlike burden, which encompasses all indirect costs including fringe benefits, the distribution base specifically focuses on measurable activity drivers such as direct labor hours or machine hours to proportionally distribute overhead expenses.

Factory Overhead

Factory overhead encompasses indirect manufacturing costs such as utilities, depreciation, and maintenance, differing from burden which specifically refers to the sum of indirect labor and factory overhead expenses allocated to production. Understanding the distinction between overhead and burden helps optimize cost accounting, ensuring accurate product costing and improved financial management.

Overhead vs Burden Infographic

moneydif.com

moneydif.com